|

Strategic

Management MGT603

VU

Lesson

29

GRAND

STRATEGY MATRIX

Learning

objective

Grand

strategy matrix is a last

matrix of matching strategy

formulation framework. It same as

important

as

BCG, IE and other matrices.

This chapter enables you to

understand the preparation of GS

matrix.

This

chapter also enables you to

understand the last stage

(decision stage) of strategy

formulation frame

work

and also explain that how it

is prepared

Grand

Strategy Matrix

This

is also an important matrix of

strategy formulation frame

work. Grand strategy matrix

it is popular

tool

for formulating alternative strategies.

In this matrix all organization divides

into four quadrants.

Any

organization should be placed in any one

of four quadrants. Appropriate

strategies for an

organization

to consider are listed in

sequential order of attractiveness in

each quadrant of the matrix.

It

is based two major

dimensions

1.

Market growth

2.

Competitive position

All

quadrant contain all possible

strategies

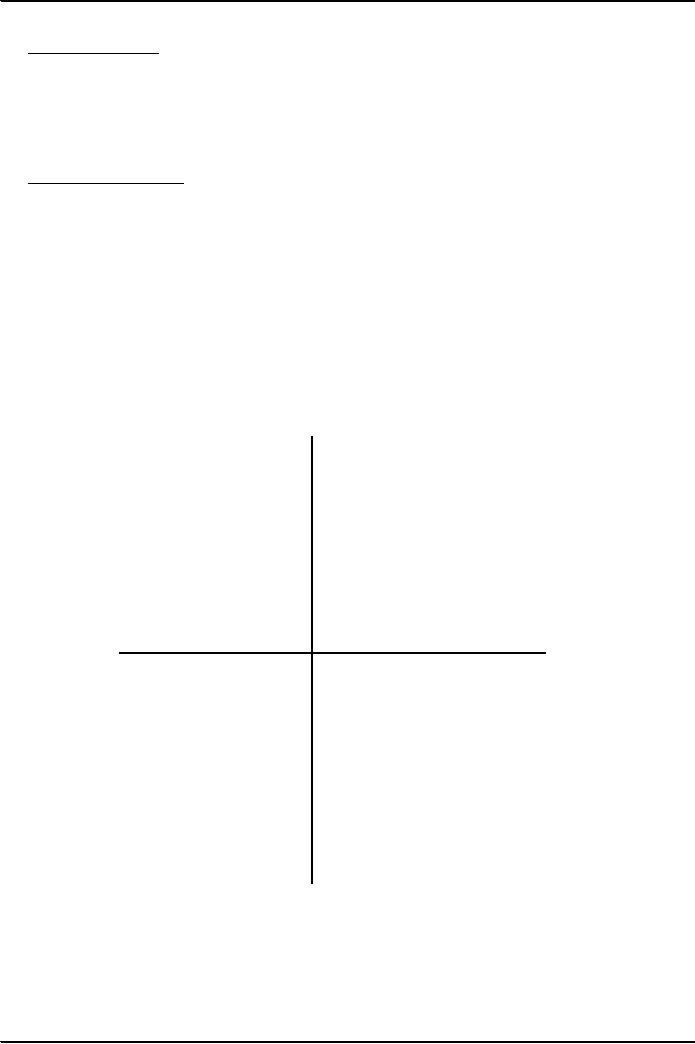

RAPID

MARKET GROWTH

Quadrant

I

Quadrant

II

Market

development

Market

development

Market

penetration

Market

penetration

Product

development

Product

development

Forward

integration

Horizontal

integration

Backward

integration

Divestiture

Horizontal

integration

Liquidation

Concentric

diversification

WEAK

STRONG

COMPETITIVE

COMPETITIVE

POSITION

POSITION

Quadrant

IV

Quadrant

III

Concentric

diversification

Retrenchment

Horizontal

diversification

Concentric

diversification

Conglomerate

diversification

Horizontal

diversification

Joint

ventures

Conglomerate

diversification

Liquidation

SLOW

MARKET GROWTH

Qurdant-1

contains

that company's strong having competitive

situation and rapid market

growth.

Firms

located in Quadrant I of the Grand

Strategy Matrix are in an

excellent strategic position.

These

firms

must focus on current market

and appropriate to follow market

penetration, market development

and

products development are appropriate

strategies.

107

Strategic

Management MGT603

VU

Qurdant-2

contains

that company's having weak

competitive situation and

rapid market growth.

Firms

positioned

in Quadrant II need to evaluate their

present approach to the marketplace

seriously.

Although

their industry is growing, they are

unable to compete effectively,

and they need to determine

why

the firm's current approach is ineffectual and

how the company can best

change to improve its

competitiveness.

Because Quadrant II firms are in a

rapid-market-growth industry, an intensive

strategy

(as

opposed to integrative or diversification) is

usually the first option

that should be considered.

Qurdant-3

contains

that company's weak

competitive situation and slow

market growth. The firms

fall

in

this quadrant compete in slow-growth industries

and have weak competitive

positions. These firms

must

make some drastic changes

quickly to avoid further

demise and possible

liquidation. Extensive

cost

and asset reduction (retrenchment) should

be pursued first. An alternative strategy

is to shift

resources

away from the current business

into different areas. If all

else fails, the final

options for

Quadrant

III businesses are divestiture or

liquidation.

Qurdant-4

contains

that company's strong competitive

situation and slow market

growth. Finally,

Quadrant

IV businesses have a strong competitive

position but are in a slow-growth

industry. These

firms

have the strength to launch

diversified programs into

more promising growth areas. Quadrant

IV

firms

have characteristically high

cash flow levels and

limited internal growth

needs and often

can

pursue

concentric, horizontal, or conglomerate

diversification successfully. Quadrant IV firms

also may

pursue

joint ventures

As

above figure there are

four quadrants in grand

matrix that further contain

various set

strategies.

Quardrant-1

Market

development

Market

penetration

Product

development

Forward

integration

Backward

integration

Horizontal

integration

Concentric

diversification

Quardrant-2

Market

development

Market

penetration

Product

development

Horizontal

integration

Divestiture

Liquidation

Quardrant-3

Retrenchment

Concentric

diversification

Horizontal

diversification

Conglomerate

diversification

Liquidation

Quardrant-4

Concentric

diversification

Horizontal

diversification

Conglomerate

diversification

Joint

ventures

108

Strategic

Management MGT603

VU

Conclusion

Every

firm fall any one

four quadrants and if the

firm fall in quadrant-1 it must

follow the list of

strategies

given in it. As further if the firm

falls in quarrant-2 must adopt the

strategies given in

quadrant-2

and so on

109

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000’s USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porter’s Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning