|

Strategic

Management MGT603

VU

Lesson

27

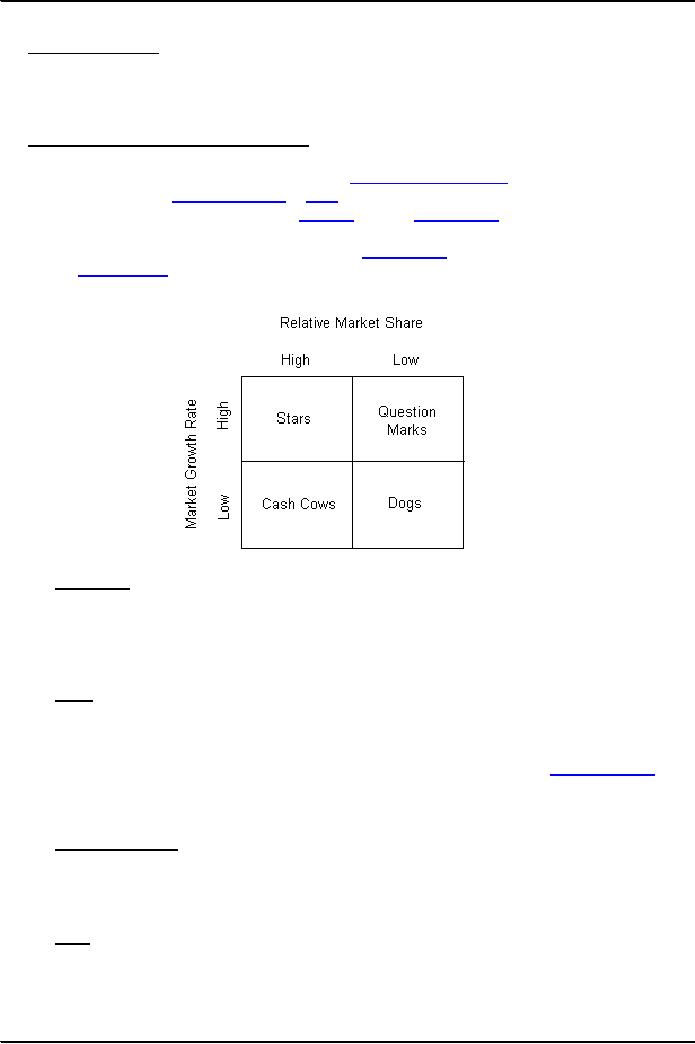

BOSTON

CONSULTING GROUP (BCG)

MATRIX

Learning

objective

After

understanding this chapter you are

able to understand BCG and

IE matrices and also

understand

how

to prepare these matrices

for any organization and what

its practical implementation in

various

organizations.

Boston

Consulting Group (BCG)

Matrix

The

Boston Consulting Group (BCG)

is a management

consulting firm

founded by Harvard

Business

School alum Bruce

Henderson in

1963.

The growth-share

matrix is a

chart created by

group

in

1970 to help corporation

analyze their business

units

or product

lines,

and decide where to

allocate

cash.

It was popular for two

decades, and is still used

as an analytical tool.

To

use the chart, corporate analysts

would plot a scatter

graph of

their business units, ranking

their

relative

market

shares and

the growth rates of their

respective industries. This led to a

categorization of

four

different types of

businesses:

�

Cash

cows Units

with high market share in a

slow-growing industry. These units

typically generate

cash

in excess of the amount of cash needed to

maintain the business. They are regarded

as staid

and

boring, in a "mature" market,

and every corporation would

be thrilled to own as many

as

possible.

They are to be "milked" continuously

with as little investment as possible,

since such

investment

would be wasted in an industry

with low growth.

�

Dogs

More

charitably called pets, units with

low market share in a

mature, slow-growing industry.

These

units typically "break even", generating

barely enough cash to maintain the

business's market

share.

Though owning a break-even

unit provides the social benefit of

providing jobs and

possible

synergies

that assist other business

units, from an accounting point of

view such a unit is

worthless,

not

generating cash for the

company. They depress a profitable

company's return

on assets ratio,

used

by many investors to judge

how well a company is being

managed. Dogs, it is thought,

should

be

sold off.

�

Question

marks Units

with low market share in a

fast-growing industry. Such business

units

require

large amounts of cash to

grow their market share.

The corporate goal must be to

grow the

business

to become a star. Otherwise, when the

industry matures and growth

slows, the unit will

fall

down into the dog's

category.

�

Stars

Units

with a high market share in

a fast-growing industry. The hope is that

stars become the

next

cash cows. Sustaining the

business unit's market leadership

may require extra cash, but

this is

worthwhile

if that's what it takes for the

unit to remain a leader.

When growth slows, stars

become

cash

cows if they have been able

to maintain their category

leadership.

103

Strategic

Management MGT603

VU

As

a particular industry matures and its

growth slows, all business

units become either cash cows

or

dogs.

The

overall goal of this ranking

was to help corporate analysts

decide which of their

business units to

fund,

and how much; and

which units to sell. Managers

were supposed to gain

perspective from this

analysis

that allowed them to plan with confidence to

use money generated by the

cash cows to fund

the

stars and, possibly, the question marks.

As the BCG stated in

1970:

Only

a diversified company with a

balanced portfolio can use

its strengths to truly

capitalize on its

growth

opportunities. The balanced

portfolio has:

�

Stars

whose high share and

high growth assure the

future;

�

Cash

cows that supply funds for

that future growth;

and

�

Question

marks to be converted into stars

with the added funds.

Practical

Use of the Boston

Matrix

For

each product or service the

'area' of the circle represents the

value of its sales. The

Boston Matrix

thus

offers a very useful 'map' of the

organization's product (or

service) strengths and

weaknesses (at

least

in terms of current profitability) as

well as the likely cash

flows.

The

need which prompted this

idea was, indeed, that of

managing cash-flow. It was reasoned

that one

of

the main indicators of cash generation

was relative market share,

and one which pointed to

cash

usage

was that of market growth

rate.

Relative

market share

This

indicates likely cash

generation, because the higher the share

the more cash will be

generated. As a

result

of 'economies of scale' (a basic

assumption of the Boston Matrix), it is

assumed that these

earnings

will grow faster the higher the share.

The exact measure is the

brand's share relative to

its

largest

competitor. Thus, if the brand had a

share of 20 per cent, and

the largest competitor had

the

same,

the ratio would be 1:1. If the

largest competitor had a

share of 60 per cent, however, the

ratio

would

be 1:3, implying that the

organization's brand was in a relatively

weak position. If the

largest

competitor

only had a share of 5 per

cent, the ratio would be

4:1, implying that the brand owned

was in

a

relatively strong position, which might

be reflected in profits and cash

flow. If this technique is

used

in

practice, it should be noted that this

scale is logarithmic, not

linear.

On

the other hand, exactly what is a

high relative share is a matter of

some debate. The best

evidence is

that

the most stable position (at

least in FMCG markets) is

for the brand leader to have a

share double

that

of the second brand, and treble that of

the third. Brand leaders in this position

tend to be very

stable

- and profitable

The

reason for choosing relative

market share, rather than just

profits, is that it carries

more

information

than just cash flow. It

shows where the brand is positioned

against its main

competitors,

and

indicates where it might be

likely to go in the future. It can

also show what type of marketing

activities

might be expected to be effective.

Limitations

1.

Viewing every business as a

star, cash cow, dog, or question

mark is overly

simplistic.

2.

Many businesses fall right

in the middle of the BCG matrix

and thus are not

easily classified.

3.

The BCG matrix does

not reflect whether or not various

divisions or their industries are

growing

over

time.

4.

Other variables besides relative

market share position and

industry growth rate in

sales are

important

in making strategic decisions about

various divisions.

Conclusion

After

discussion, the BCG matrix is an

important matrix regarding

strategy adopted by firm. Still

this

matrix

concern four strategy first

growth or build strategy

enhance market share),

second is hold

strategy

(hold existing position), third

Harvesting strategy (no further

growth or select

other

opportunity),

fourth is diversity (sell out the

part of business)

104

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000’s USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porter’s Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning