|

THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX |

| << THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX |

| BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks >> |

Strategic

Management MGT603

VU

Lesson

26

THE

STRATEGIC POSITION AND ACTION EVALUATION

(SPACE) MATRIX

These

dimensions are explained below:

Internal

Strategic Position

External

Strategic Position

Financial

Strength (FS)

Environmental

Stability (ES)

Impact

of technology

Risk

involved in business

Price

elasticity of demand

Debt

to equity ratio

Political

situation

Working

capital condition

Leverage

Liquidity

Demand

variability

Ease

of exit from market

Price

range of competing products

Cash

flow statement

Rate

of inflation

Return

on investment

Competitive

pressure

Competitive

Advantage (CA)

Industry

Strength (IS)

Demand

and supply factors

Access

to the market

Resource

utilization

Market

share

Growth

potential

Quality

of product and

services

Profit

potential

Product

life cycle

Financial

stability

Customer

loyalty

Technological

know-how

Capacity,

location and layout

Productivity,

capacity utilization

Technological

know-how

Capital

intensity

Backward

and forward

integration

Ease

of entry into market

After

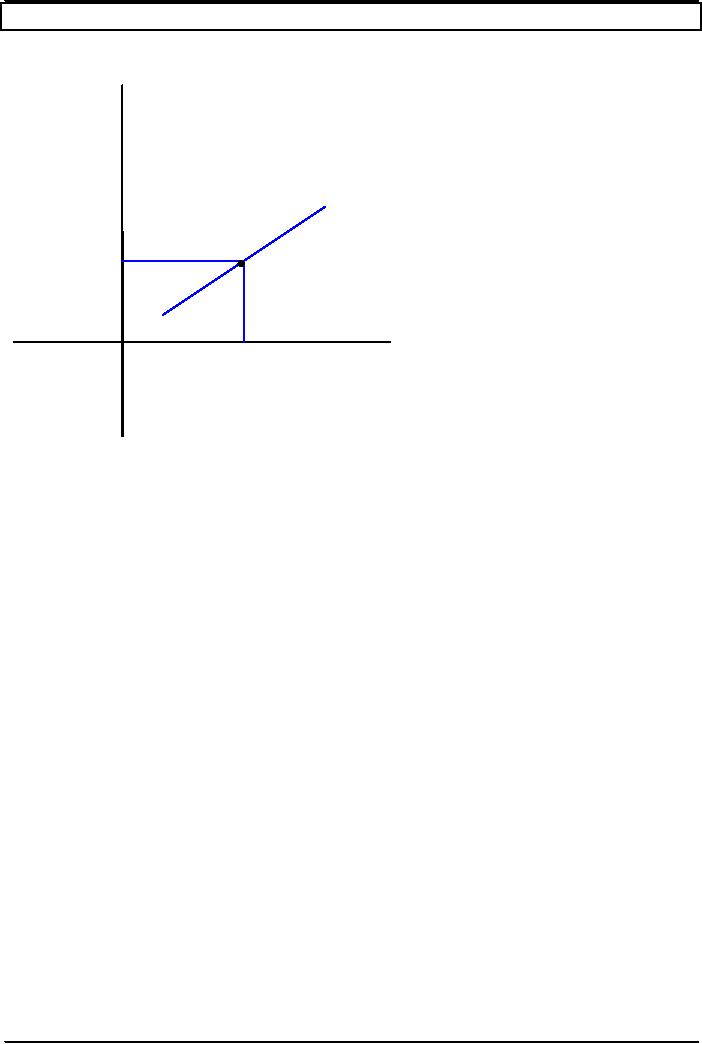

the selection of variables the rating is

assigned to each. After the

addition of these variables

taking the

average.

For example financial strength is explain

below

Financial

Strength (FS)

Rating

High

Return on investment

3

Large

amount of capital

2

Consistently

increasing revenue

4

Working

capital condition

1

Financial

strength average is (3+2+4+1)/4 =

2.5

The

industry strength is explained as

follows

Industry

Strength (IS)

Rating

Demand

and supply factors

5

Resource

utilization

3

Profit

potential

3

Technological

know-how

6

101

Strategic

Management MGT603

VU

Ease

of entry into market

2

Industry

strength

average

is

(5+3+3+6+2)/5

=

3.8.

It

is

plotted

on

graph:

6

FS

5

4

(2.5,

3.8)

3

2

1

IS

1

2

3

4

5

6

The

graph indicates that firm

adopts aggressive

strategy

Steps

for the preparation of SPACE

Matrix

The

steps required to develop a SPACE Matrix

are as follows:

1.

Select a set of variables to relating to

financial strength, competitive

advantage, environmental

stability,

and industry

strength.

2.

Assign a numerical value ranging

from +1 (worst) to +6 (best) to

each of the variables that

make

up

the financial strength and industry strength

dimensions. Assign a numerical

value ranging from -

1

(best) to -6 (worst) to each of the

variables that make up the

environmental stability

and

competitive

advantage dimensions.

3.

Compute an average score and

dividing by the number of

variables

4.

Plot the average scores in the

SPACE Matrix.

5.

Add the two scores on the

x-axis and plot the

resultant point on X. Add the

two scores on the y-

axis

and plot the resultant point

on Y. Plot the intersection of the new xy

point.

6.

Draw a directional vector from the

origin of the SPACE Matrix

through the new intersection

point.

This

vector reveals the type of strategies

recommended for the organization:

aggressive,

competitive,

defensive, or conservative.

102

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000’s USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porter’s Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning