|

Strategic

Management MGT603

VU

Lesson

22

TYPES

OF STRATEGIES

Objectives:

This

lecture brings strategic

management to life with many

contemporary examples. Sixteen types

of

strategies

are defined and exemplified,

including Michael Porter's

generic strategies: cost

leadership,

differentiation,

and focus. Guidelines are

presented for determining when

different types of strategies

are

most

appropriate to pursue. An overview of

strategic management in nonprofit

organizations, governmental

agencies,

and small firms is provided.

After reading this lecture

you will be able to know

about:

Types

of Strategies

Defensive

strategies

Defensive

Strategies

In

addition to integrative, intensive, and

diversification strategies, organizations

also could pursue

retrenchment,

divestiture, or liquidation.

Divestiture

Selling

a division or part of an organization is

called divestiture.

Divestiture

often is used to raise

capital for

further

strategic acquisitions or investments.

Divestiture can be part of an

overall retrenchment strategy to

rid

an organization of businesses that are

unprofitable, that require too

much capital, or that do not

fit well

with

the firm's other activities.

Guidelines

for Divestiture

Five

guidelines when divestiture may be an

especially effective strategy to pursue

are listed below:

When

firm has pursued retrenchment

but failed to attain needed

improvements

When

a division needs more

resources than the firm can

provide

When

a division is responsible for the

firm's overall poor

performance

When

a division is a misfit with the

organization

When

a large amount of cash is needed

and cannot be obtained from other

sources.

Divestiture

has become a very popular

strategy as firms try to focus on

their core strengths,

lessening their

level

of diversification.

For

example, retailer Venator Group,

formerly Woolworth, in 1999

divested eight divisions in order

to

become

solely an athletic footwear and

apparel company. The eight divisions

were Music Box, Randy

River,

Foot

Locker Outlets, Colorado U.S.,

Team Edition, Going to the

Game, Weekend Edition, and

Burger

King.

Venator several years ago

was a $4.6 billion

conglomerate before CEO Farah

divested thirty-five of

Venator's

forty-two divisions, including all

Woolworth and Kinney Shoe

stores. A few divestitures

consummated

in 2000 are given in

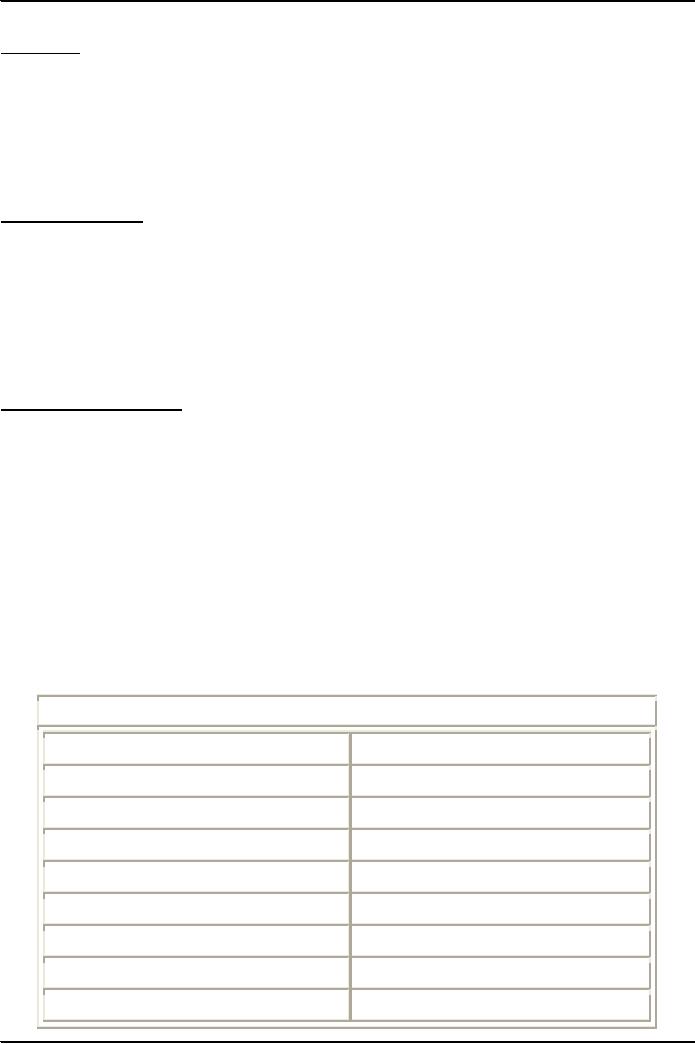

Table.

Recent

Divestitures

Parent

Company

Divested

Company

Microsoft

Sidewalk

Entertainment

AlliedSignal

Laminate-Systems

Monsanto

NutraSweet

Compaq

Computer Corp.

AltaVista

Dupont

Conoco

Mead

Corp.

Northwood,

Inc.

IBM

Networking

Technology

Kohlberg

Kravis Roberts

Gillette

94

Strategic

Management MGT603

VU

Borg-Warner

Automotive

Kuhlman

Electric

De

La Rue PLC

Smart

Cards

Walt

Disney

Anaheim

Angels

Walt

Disney

Anaheim

Might Ducks

Walt

Disney

Fairchild

Publications

Harcourt

General

Neiman

Marcus

3Com

Palm

Computing

North

American Van Lines

Allied

Van Lines

Harvard

Industries, Inc.

Kingston-Warren

Cendant

Corp.

Entertainment

Publications

Marks

& Spencer PLC

Kings

Supermarket

U.S.

Industries, Inc.

USI

Diversified

Silicon

Graphics, Inc.

Cray

Supercomputer

Eastman

Kodak Co.

Image

Bank

Microsoft

Expedia

Kellogg

Company

Lender's

Bagels

Sabre

Holdings

Travelocity.com

Liquidation

Selling

all of a company's assets, in

parts, for their tangible

worth

Selling

all of a company's assets, in

parts, for their tangible

worth is called liquidation.

Liquidation

is

recognition

of defeat and, consequently,

can be an emotionally difficult

strategy. However, it may be

better

to

cease operating than to continue losing

large sums of money.

Guidelines

for Liquidation

Three

guidelines when liquidation

may be an especially effective strategy

to pursue are:

When

both retrenchment and divestiture have

been pursued

unsuccessfully

If

the only alternative is bankruptcy,

liquidation is an orderly

alternative

When

stockholders can minimize their

losses by selling the firm's

assets

Means

of achieving strategies: Joint Venture

and Combination Strategies

Joint

Venture

Two

or more companies form a temporary

partnership or consortium for purpose of capitalizing

on some

opportunity.

Joint

venture is a

popular strategy that occurs

when two or more companies

form a temporary partnership or

consortium

for the purpose of capitalizing on some

opportunity. Often, the two or

more sponsoring firms

form

a separate organization and have

shared equity ownership in the new

entity. Other types of

cooperative

arrangements

include

research and development partnerships,

cross-distribution agreements,

cross-licensing

agreements,

cross-manufacturing agreements, and

joint-bidding consortia.

95

Strategic

Management MGT603

VU

Cooperative

Arrangements

Research

and development partnerships

Cross-distribution

agreements

Cross-licensing

agreements

Cross-manufacturing

agreements

Joint-bidding

consortia

Joint

ventures and cooperative arrangements

are being used increasingly

because they allow companies

to

improve

communications and networking, to

globalize operations, and to minimize

risk.

Nestl�

and Pillsbury recently formed a

joint venture named Ice

Cream Partners USA based in

northern

California.

The new company primarily

sells super premium ice

cream that is high in

fat--and price. Super

premium

ice cream sales were up

nearly 13 percent in

1998.

When

a privately owned organization is forming a

joint venture with a publicly owned

organization; there

are

some advantages of being privately held,

such as close ownership; there

are some advantages of

being

publicly

held, such as access to stock

issuances as a source of capital.

Sometimes, the unique advantages

of

being

privately and publicly held

can be synergistically combined in a

joint venture

Guidelines

for Joint Ventures

Six

guidelines when joint venture may be an

especially effective strategy to purse

are:

Combination

of privately held and

publicly held can be synergistically

combined

Domestic

forms joint venture with foreign

firm, can obtain local

management to reduce certain

risks

Distinctive

competencies of two or more firms

are complementary

Overwhelming

resources and risks where

project is potentially very profitable

(e.g., Alaska

pipeline)

Two

or more smaller firms have

trouble competing with larger

firm

A

need exists to introduce a

new technology quickly

Some

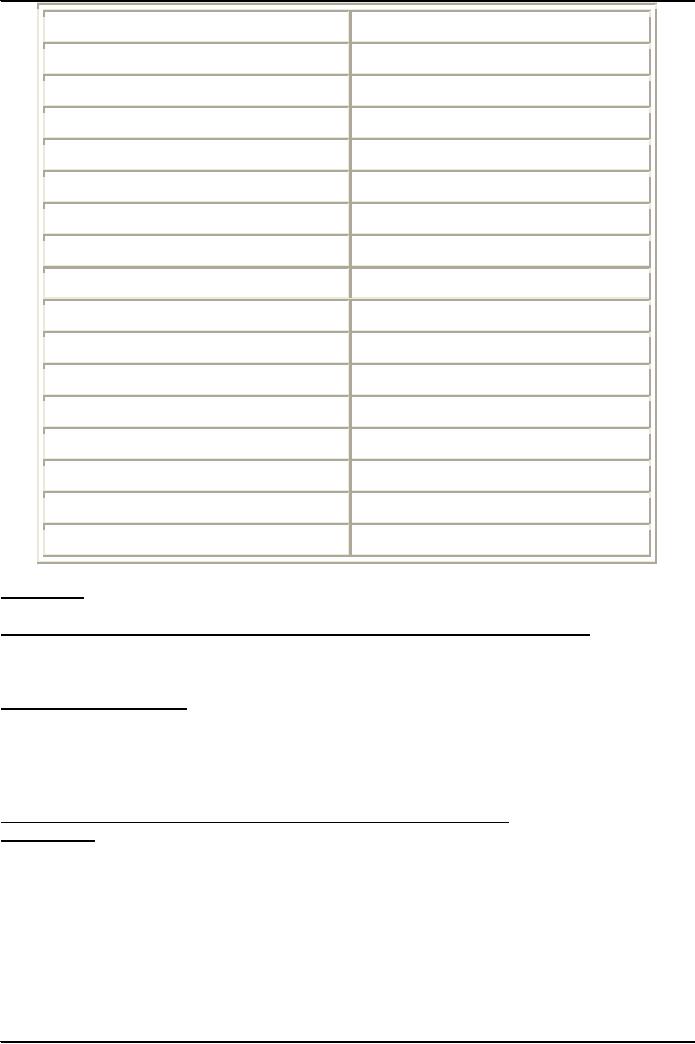

Recent Example Joint

Ventures

Parent

Company #1

Parent

Company #2

Newly

Created Company

AOL

Bertelsmann

AG

AOL

Europe

Walt

Disney

Infoseek

Go

Network

Nestl�

Pillsbury

Ice

Cream Partners USA

Dow

Jones

Pearson

Vedomosti

Volkswagen

AG

Porsche

Sport

Utility Vehicle

Pacific

Century Group

DaimlerChrysler

Aerospace AG

Pacific

Century Matrix

Microsoft

Ford

Motor Company

CarPoint

EBay

Microsoft

Fair

Market

Excite

At Home

Tele

Columbus Gmblt

At

Home Deutschland

96

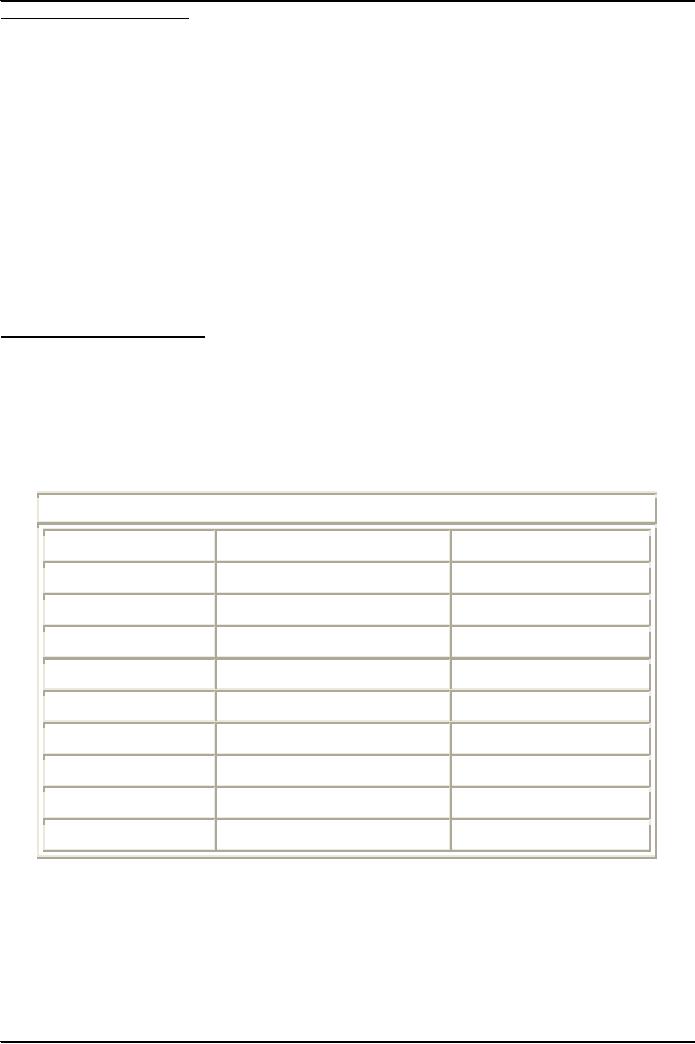

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000’s USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porter’s Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning