|

Strategic

Management MGT603

VU

Lesson

15

INTERNAL

ASSESSMENT

(FINANCE/ACCOUNTING)

Objectives:

Financial

condition is often considered the

single best measure of a firm's

competitive position

and

overall

attractiveness to investors. Determining

an organization's financial strengths

and weaknesses is

essential

to formulating strategies effectively. A

firm's liquidity, leverage, working

capital, profitability,

asset

utilization, cash flow, and

equity can eliminate some strategies as

being feasible alternatives.

Financial

factors often alter existing strategies

and change implementation

plans. After reading

this

lecture,

you will be able to know

that what are the basics

types of ratios and who

business measure its

financial

strength using these ratios

analysis.

Finance/Accounting

Functions

Determining

financial strengths and weaknesses

key to strategy

formulation

Investment

decision (Capital budgeting)

Financing

decision

Dividend

decision

According

to James Van Horne, the

functions

of finance/accounting comprise

three decisions: the

investment

decision, the financing decision,

and the dividend

decision.

Financial

ratio analysis is the most

widely used method for determining an

organization's strengths

and

weaknesses

in the investment, financing, and dividend

areas. Because, the functional

areas of business

are

so closely related, financial ratios

can signal strengths or

weaknesses in management,

marketing,

production,

research and development, and computer

information systems

activities.

The

investment

decision,

also

called capital

budgeting,

is the allocation

and reallocation of capital

and

resources to projects, products,

assets, and divisions of an organization.

Once strategies are

formulated,

capital budgeting decisions are required

to implement strategies successfully. The

financing

decision

concerns

determining the best capital structure

for the firm and includes

examining various

methods

by which the firm can raise

capital (for example, by

issuing stock, increasing debt,

selling

assets,

or using a combination of these

approaches). The financing

decision must consider both

short-

term

and long-term needs for

working capital. Two key

financial ratios that indicate whether a

firm's

financing

decisions have been effective

are the debt-to-equity ratio

and the debt-to-total-assets

ratio.

Dividend

decisions concern

issues such as the percentage of

earnings paid to stockholders, the

stability

of dividends paid over time, and the

repurchase or issuance of stock.

Dividend decisions

determine

the amount of funds that are retained in

a firm compared to the amount paid out

to

stockholders.

Three

financial ratios that are

helpful in evaluating a firm's dividend

decisions are the

earnings-per-

share

ratio, the dividends-per-share ratio,

and the price-earnings ratio.

The benefits of paying dividends

to

investors must be balanced

against the benefits of retaining funds internally,

and there is no set

formula

on how to balance this trade-off.

For the reasons listed here,

dividends are sometimes paid

out

even

when funds could be better reinvested in the business

or when the firm has to obtain

outside

sources

of capital:

1.

Paying cash dividends is customary.

Failure to do so could be thought of as a stigma. A

dividend

change

is considered a signal about the

future.

2.

Dividends represent a sales

point for investment bankers.

Some institutional investors

can buy only

dividend-paying

stocks.

3.

Shareholders often demand dividends,

even in companies with great

opportunities for reinvesting

all

available funds.

4.

A myth exists that paying dividends

will result in a higher stock

price.

Basic

Types of Financial Ratios

Financial

ratios are computed from an

organization's income statement

and balance sheet.

Computing

financial

ratios is like taking a picture

because the results reflect a situation at

just one point in

time.

Comparing

ratios over time and to

industry averages is more

likely to result in meaningful statistics

that

can

be used to identify and

evaluate strengths and

weaknesses. Trend analysis, illustrated

in Figure, is a

useful

technique that incorporates both the time

and industry average

dimensions of financial ratios.

64

Strategic

Management MGT603

VU

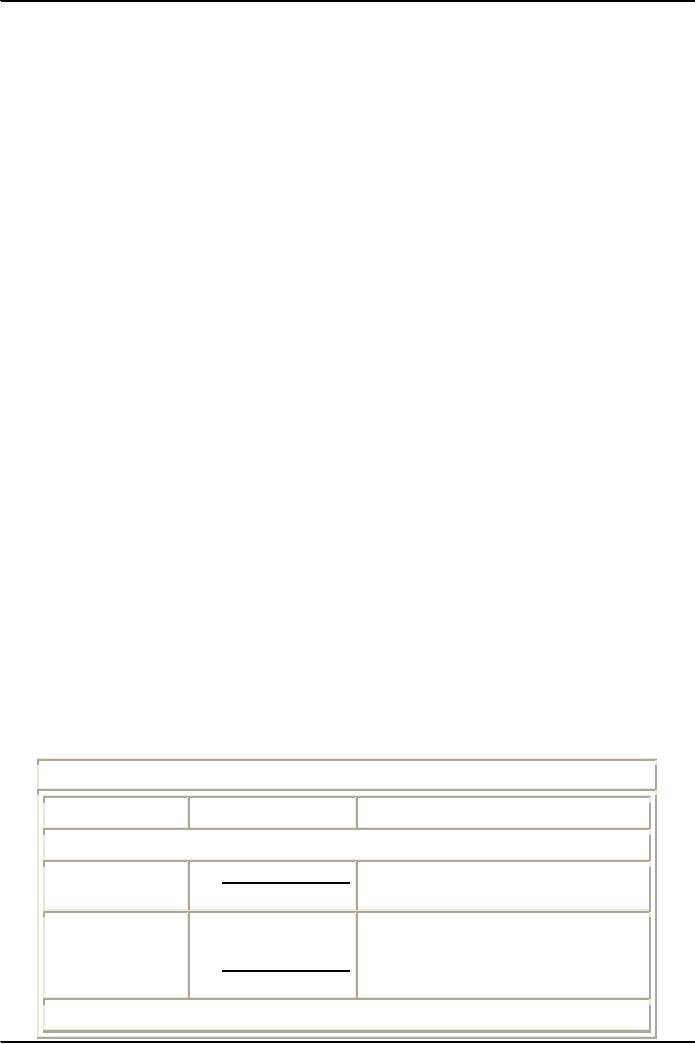

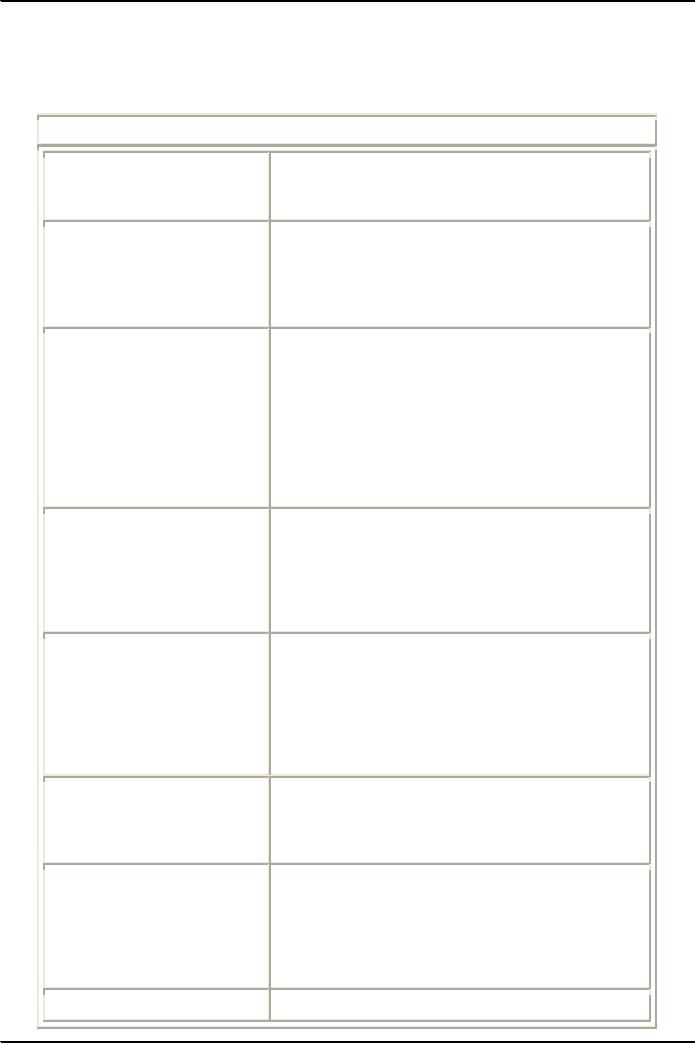

Table

provides a summary of key financial

ratios showing how each

ratio is calculated and what

each

ratio

measures. However, all the

ratios are not significant

for all industries and

companies. For

example,

accounts

receivable turnover and

average collection period

are not very meaningful to a company

that

does

primarily cash receipts

business. Key financial ratios

can be classified into the

following five types:

Liquidity

ratios measure

a firm's ability to meet maturing short-term

obligations. It includes:

Current

ratio

Quick

(or acid-test) ratio

Leverage

ratios measure

the extent to which a firm has

been financed by debt.

Debt-to-total-assets

ratio

Debt-to-equity

ratio

Long-term

debt-to-equity ratio

Times-interest-earned

(or coverage) ratio

Activity

ratios measure

how effectively a firm is

using its resources.

Inventory-turnover

Fixed

assets turnover

Total

assets turnover

Accounts

receivable turnover

Average

collection period

Profitability

ratios measure

management's overall effectiveness as

shown by the returns generated

on

sales

and investment.

Gross

profit margin

Operating

profit margin

Net

profit margin

Return

on total assets (ROA)

Return

on stockholders' equity

(ROE)

Earnings

per share

Price-earnings

ratio

Growth

ratios measure

the firm's ability to maintain its

economic position in the growth of

the

economy

and industry.

Sales

Net

income

Earnings

per share

Dividends

per share

A

Summary of Key Financial

Ratios

Ratio

How

Calculated

What

It Measures

Liquidity

Ratios

Current

Ratio

Current

assets

The

extent to which a firm can

meet its

Current

liabilities

short-term

obligations

Quick

Ratio

Current

assets

The

extent to which a firm can

meet its

minus

short-term

obligations without relying

inventory

upon

the sale of its inventories

Current

liabilities

Leverage

Ratios

65

Strategic

Management MGT603

VU

Debt-to-Total-

Total

debt

The

percentage of total funds that

are

Assets

Ratio

Total

assets

provided

by creditors

Debt-to-Equity

Total

debt

The

percentage of total funds

provided

Ratio

Total

stockholders'

by

creditors versus by

owners

equity

Long-Term

Long-term

debt

The

balance between debt and

equity

Debt-to-Equity

Total

stockholders'

in

a firm's long-term capital

structure

Ratio

equity

Times-Interest-

Profits

before

The

extent to which earnings

can

Earned

Ratio

interest

decline

without the firm

becoming

and

taxes

unable

to meet its annual interest

costs

Total

interest

charges

Activity

Ratios

Inventory

Sales

Whether

a firm holds excessive

stocks

Turnover

Inventory

of

of

inventories and whether a firm is

finished

goods

selling

its inventories slowly compared

to

the industry average

Fixed

Assets

Sales

Sales

productivity and plant

and

Turnover

Fixed

assets

equipment

utilization

Total

Assets

Sales

Whether

a firm is generating a

Turnover

Total

assets

sufficient

volume of business for

the

size

of its asset investment

The

average length of time it takes

a

Accounts

Annual

credit

sales

firm

to collect credit sales (in

Receivable

Accounts

percentage

terms)

Turnover

receivable

The

average length of time it takes

a

Average

Accounts

receivable

firm

to collect on credit sales (in

days)

Collection

Total

credit

Period

sales/365

days

Profitability

Ratios

Sales

minus cost

The

total margin available to

cover

Gross

Profit

of

goods sold

operating

expenses and yield a

profit

Margin

Sales

Earnings

before

Operating

interest

and taxes

Profitability

without concern for

taxes

Profit

Margin

(EBIT)

and

interest

Sales

Net

Profit

Net

income

After-tax

profits per dollar of

sales

Margin

Sales

After-tax

profits per dollar of

assets;

Net

income

Return

on Total

Total

assets

this

ratio is also called return

on

Assets

(ROA)

investment

(ROI)

66

Strategic

Management MGT603

VU

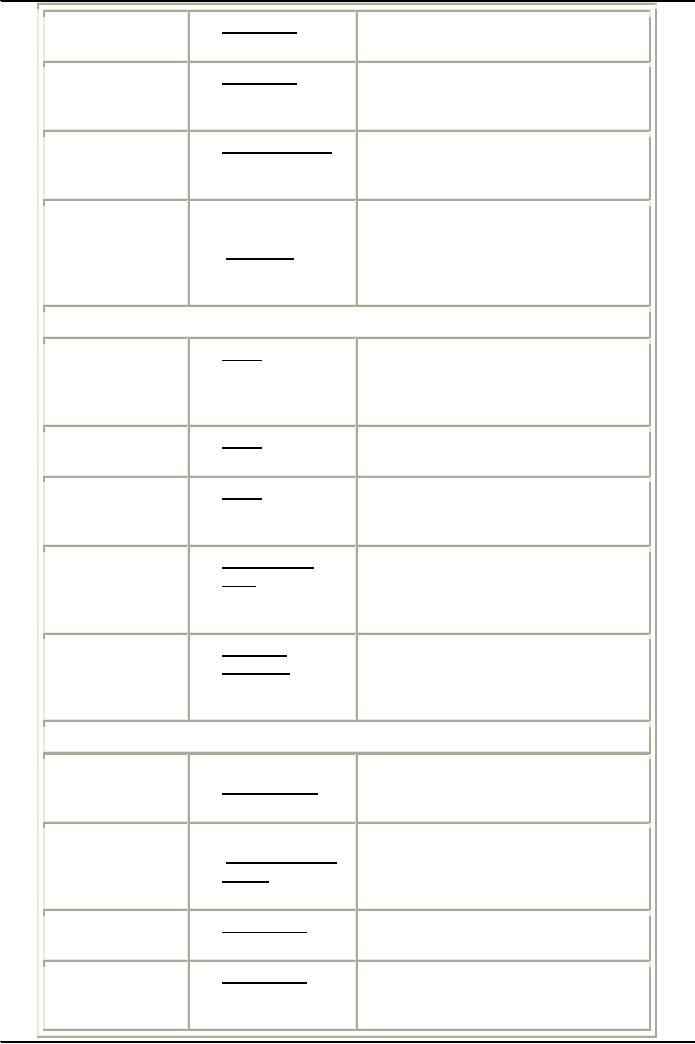

Return

on

Net

income

After-tax

profits per dollar of

Stockholders'

Total

stockholders'

stockholders'

investment in the firm

Equity

(ROE)

equity

Net

income

Earning

Per

Number

of shares

Earnings

available to the owners of

Share

(EPS)

of

common stock

common

stock

outstanding

Market

price per

Attractiveness

of firm on equity

Price-Earnings

share

markets.

Ratio

Earnings

per share

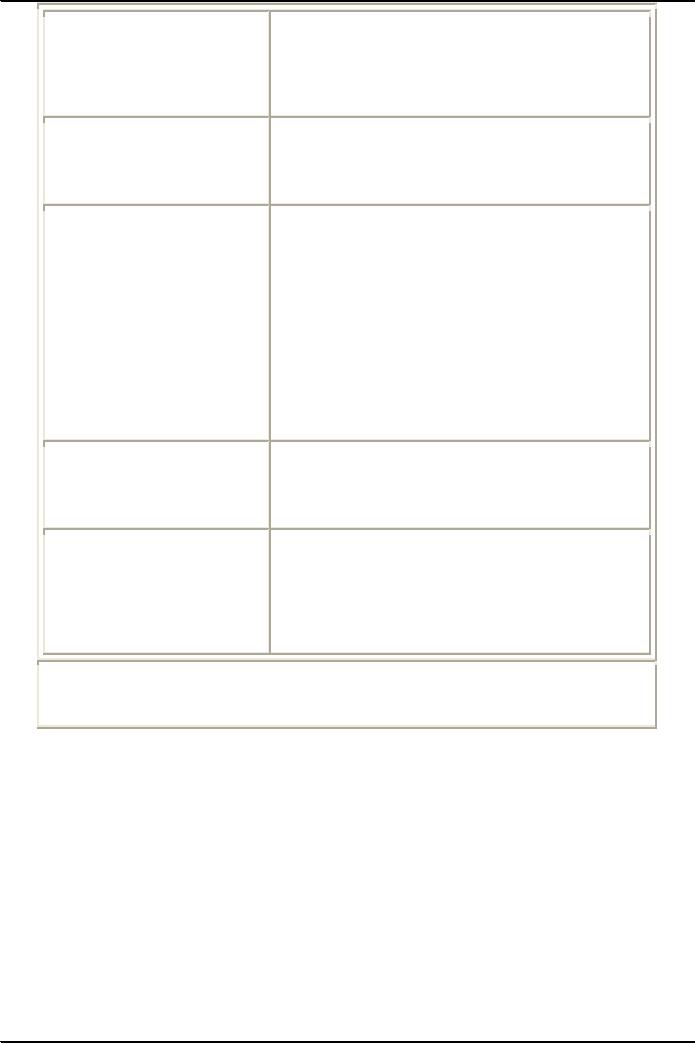

Growth

Ratios

Sales

Annual

percentage

Firm's

growth rate in sales

growth

in total

sales

Income

Annual

percentage

Firm's

growth rate in

profits

growth

in profits

Earnings

Per

Annual

percentage

Firm's

growth rate in EPS

Share

growth

in EPS

Dividends

Per

Annual

percentage

Firm's

growth rate in dividends

per

Share

growth

share

in

dividends per

share

Limitations

of Financial ratios:

Financial

ratio analysis is not

without some limitations. First of all,

financial ratios are based

on

accounting

data, and firms differ in

their treatment of such items as

depreciation, inventory valuation,

research

and development expenditures, pension

plan costs, mergers, and

taxes. Also, seasonal

factors

can

influence comparative ratios. Therefore,

conformity to industry composite ratios

does not establish

with

certainty that a firm is performing

normally or that it is well

managed. Likewise, departures

from

industry

averages do not always indicate

that a firm is doing

especially well or badly.

For example, a

high

inventory turnover ratio could indicate

efficient inventory management

and a strong working

capital

position, but it also could indicate a

serious inventory shortage

and a weak working

capital

position.

It

is important to recognize that a firm's

financial condition depends

not only on the functions

of

finance,

but also on many other

factors that include:

Management,

marketing, production/operations, research

and development, and computer

information

systems decisions;

Actions

by competitors, suppliers, distributors, creditors,

customers, and shareholders;

and

Economic,

social, cultural, demographic, environmental,

political, governmental, legal,

and

technological

trends.

So

financial ratio analysis, like

all other analytical tools, should be

used wisely.

Finance/Accounting

Audit Checklist of Questions

Similarly

as provided earlier, the following

finance/accounting questions should be

examined:

1.

Where is the firm financially

strong and weak as indicated by financial

ratio analyses?

2.

Can the firm raise needed

short-term capital?

3.

Can the firm raise needed

long-term capital through

debt and/or equity?

4.

Does the firm have

sufficient working

capital?

67

Strategic

Management MGT603

VU

5.

Are capital budgeting procedures

effective?

6.

Are dividend payout policies

reasonable?

7.

Does the firm have good

relations with its investors

and stockholders?

8.

Are the firm's financial managers

experienced and well

trained?

Production/Operations

The

production/operations

function of a

business consists of all

those activities that transform

inputs into

goods

and services. Production/operations

management deals with inputs,

transformations, and

outputs

that vary across industries

and markets. A manufacturing operation

transforms or converts

inputs

such as raw materials,

labor, capital, machines,

and facilities into finished

goods and services.

As

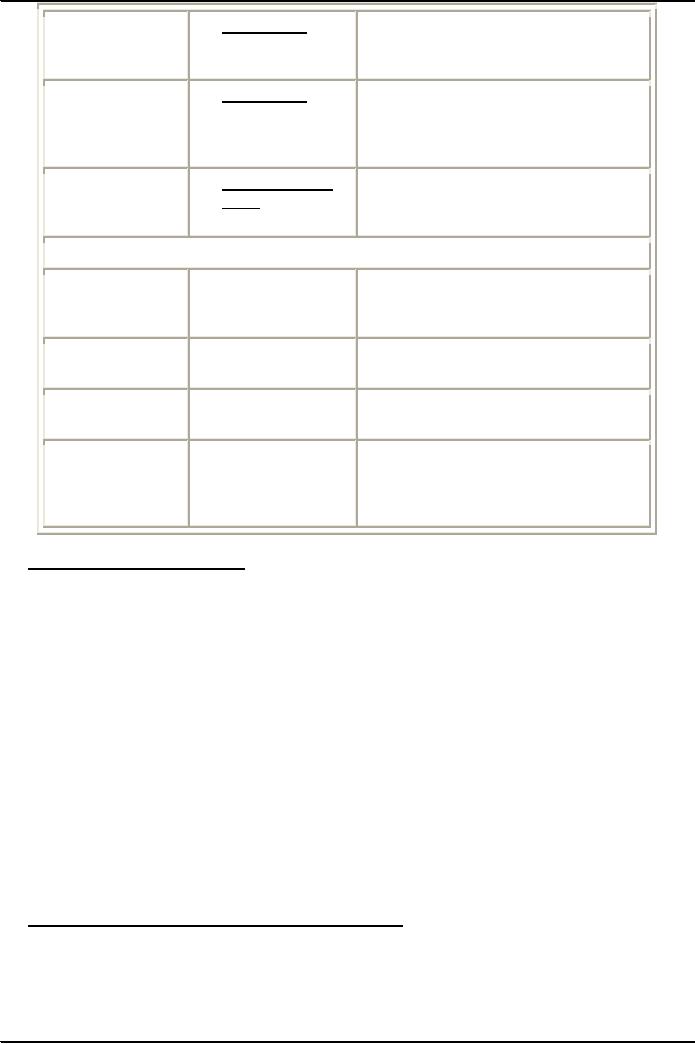

indicated

in Table, production/operations

management comprises five

functions or decision

areas:

process,

capacity, inventory, workforce,

and quality.

The

Basic Functions of Production

Management

Function

Description

1.

Process

Process

decisions concern the design of the

physical production

system.

Specific decisions include choice of

technology, facility

layout,

process flow analysis,

facility location, line

balancing,

process

control, and transportation

analysis.

2.

Capacity

Capacity

decisions concern determination of

optimal output levels

for

the organization--not too much

and not too little.

Specific

decisions

include forecasting, facilities planning,

aggregate

planning,

scheduling, capacity planning,

and queuing analysis.

3.

Inventory

Inventory

decisions involve managing the level of

raw materials,

work

in process, and finished

goods. Specific decisions

include

what

to order, when to order, how

much to order, and

materials

handling.

4.

Workforce

Workforce

decisions are concerned with

managing the skilled,

unskilled,

clerical, and managerial

employees. Specific

decisions

include

job design, work

measurement, job enrichment,

work

standards,

and motivation

techniques.

5.

Quality

Quality

decisions are aimed at

ensuring that high-quality

goods and

services

are produced. Specific

decisions include quality

control,

sampling,

testing, quality assurance,

and cost control.

Source:

Adapted

from R. Schroeder, Operations

Management (New

York: McGraw-Hill

Book

Co.,

1981): 12.

Production/operations

activities often represent the largest

part of an organization's human

and capital

assets.

In most industries, the major costs of

producing a product or service

are incurred within

operations,

so production/operations can have

great value as a competitive weapon in a

company's

overall

strategy. Strengths and

weaknesses in the five functions of

production can mean the

success or

failure

of an enterprise.

Many

production/operations managers are

finding that cross-training of

employees can help their

firms

respond

to changing markets faster.

Cross-training of workers can

increase efficiency, quality,

productivity,

and job satisfaction.

There

is much reason for concern

that many organizations have

not taken sufficient account

of the

capabilities

and limitations of the

production/operations function in

formulating strategies.

Scholars

contend

that this neglect has had

unfavorable consequences on corporate performance in

America. As

shown

in Table, James Dilworth

outlined several types of

strategic decisions that a

company might

make

with production/operations implications of

those decisions. Production

capabilities and

policies

can

also greatly affect

strategies:

68

Strategic

Management MGT603

VU

Given

today's decision-making environment

with shortages, inflation, technological

booms, and

government

intervention, a company's

production/operations capabilities and

policies may not be

able

to

fulfill the demands dictated by

strategies. In fact, they may

dictate corporate strategies. It is hard

to

imagine

that an organization can formulate

strategies today without first

considering the constraints

and

limitations

imposed by its existing

production/operations structure.

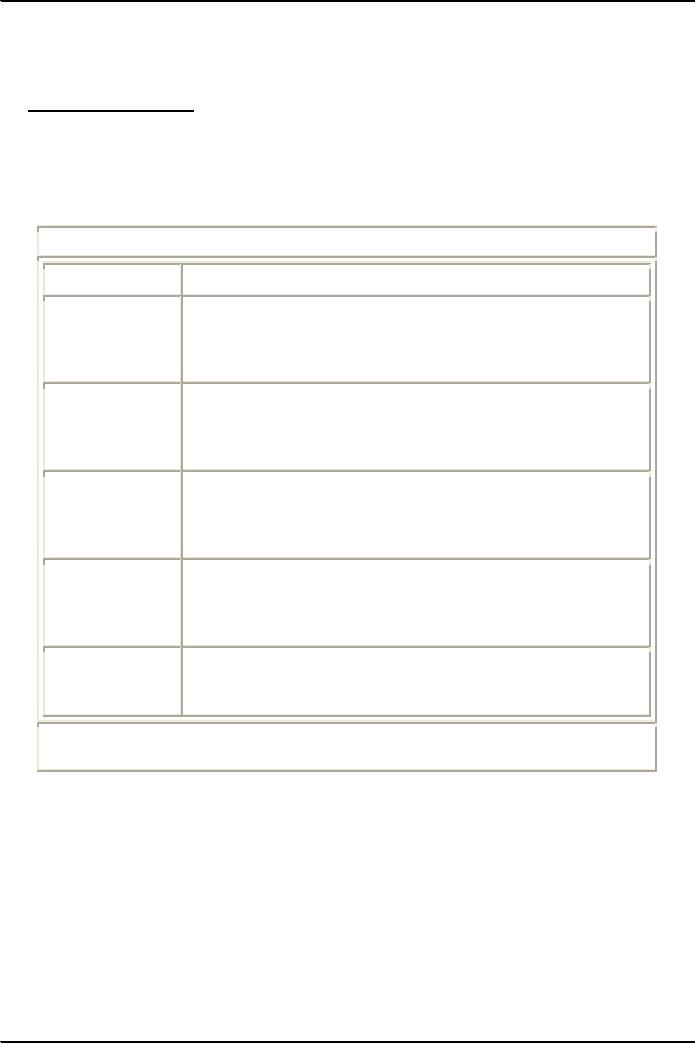

Impact

of Strategy Elements on Production

Management

Concomitant

Conditions That May Affect

the

Possible

Elements of

Operations

Function and Advantages and

Strategy

Disadvantages

1.

Compete as low-cost

Discourages

competition

provider

of goods or

Broadens

market

services

Requires

longer production runs and fewer

product

changes

Requires

special-purpose equipment and

facilities

2.

Compete as high-quality

Often

possible to obtain more

profit per unit, and

provider

perhaps

more total profit from a

smaller volume of

sales

Requires

more quality-assurance effort

and higher

operating

cost

Requires

more precise equipment, which is

more

expensive

Requires

highly skilled workers, necessitating

higher

wages

and greater training

efforts

3.

Stress customer

service

Requires

broader development of service people

and

service

parts and equipment

Requires

rapid response to customer

needs or

changes

in customer tastes, rapid

and accurate

information

system, careful

coordination

Requires

a higher inventory investment

4.

Provide rapid and

Requires

versatile equipment and people

frequent

introduction of

Has

higher research and development

costs

new

products

Has

high retraining costs and

high tooling and

changeover

in manufacturing

Provides

lower volumes for each

product and fewer

opportunities

for improvements due to the

learning

curve

5.

Strive for absolute

Requires

accepting some projects or products

with

growth

lower

marginal value, which

reduces ROI

Diverts

talents to areas of weakness

instead of

concentrating

on strengths

6.

Seek vertical integration

Enables

company to control more of the

process

May

not have economies of scale

at some stages of

process

May

require high capital investment as well

as

technology

and skills beyond those

currently

available

within the organization

7.

Maintain reserve

Provides

ability to meet peak demands

and quickly

69

Strategic

Management MGT603

VU

capacity

for flexibility

implement

some contingency plans if forecasts

are

too

low

Requires

capital investment in idle

capacity

Provides

capability to grow during the lead

time

normally

required for expansion

8.

Consolidate processing

Can

result in economies of

scale

(Centralize)

Can

locate near one major

customer or supplier

Vulnerability:

one strike, fire, or flood

can halt the

entire

operation

9.

Disperse processing of

Can

be near several market

territories

service

(Decentralize)

Requires

more complex coordination

network:

perhaps

expensive data transmission

and duplication

of

some personnel and equipment at

each location

If

each location produces one

product in the line,

then

other products still must be transported

to be

available

at all locations

If

each location specializes in a type of

component

for

all products, the company is vulnerable

to strike,

fire,

flood, etc.

If

each location provides total

product line, then

economies

of scale may not be

realized

10.

Stress the use of

Requires

high capital investment

mechanization,

Reduces

flexibility

automation,

robots

May

affect labor relations

Makes

maintenance more

crucial

11.

Stress stability of

Serves

the security needs of employees

and may

employment

develop

employee loyalty

Helps

to attract and retain highly skilled

employees

May

require revisions of make-or-buy decisions,

use

of

idle time, inventory, and

subcontractors as

demand

fluctuates

Source:

Production and Operations

Management: Manufacturing and

Nonmanufacturing, Second

Edition,

by J. Dilworth. Copyright � 1983 by

Random House, Inc. Reprinted

by

permission

of Random House, Inc.

Production/Operations

Audit Checklist of Questions

Questions

such as the following should be

examined:

1.

Are suppliers of raw

materials, parts, and

subassemblies reliable and

reasonable?

2.

Are facilities, equipment, machinery, and

offices in good condition?

3.

Are inventory-control policies

and procedures

effective?

4.

Are quality-control policies

and procedures

effective?

5.

Are facilities, resources, and

markets strategically

located?

6.

Does the firm have technological

competencies?

70

Table of Contents:

- NATURE OF STRATEGIC MANAGEMENT:Interpretation, Strategy evaluation

- KEY TERMS IN STRATEGIC MANAGEMENT:Adapting to change, Mission Statements

- INTERNAL FACTORS & LONG TERM GOALS:Strategies, Annual Objectives

- BENEFITS OF STRATEGIC MANAGEMENT:Non- financial Benefits, Nature of global competition

- COMPREHENSIVE STRATEGIC MODEL:Mission statement, Narrow Mission:

- CHARACTERISTICS OF A MISSION STATEMENT:A Declaration of Attitude

- EXTERNAL ASSESSMENT:The Nature of an External Audit, Economic Forces

- KEY EXTERNAL FACTORS:Economic Forces, Trends for the 2000’s USA

- EXTERNAL ASSESSMENT (KEY EXTERNAL FACTORS):Political, Governmental, and Legal Forces

- TECHNOLOGICAL FORCES:Technology-based issues

- INDUSTRY ANALYSIS:Global challenge, The Competitive Profile Matrix (CPM)

- IFE MATRIX:The Internal Factor Evaluation (IFE) Matrix, Internal Audit

- FUNCTIONS OF MANAGEMENT:Planning, Organizing, Motivating, Staffing

- FUNCTIONS OF MANAGEMENT:Customer Analysis, Product and Service Planning, Pricing

- INTERNAL ASSESSMENT (FINANCE/ACCOUNTING):Basic Types of Financial Ratios

- ANALYTICAL TOOLS:Research and Development, The functional support role

- THE INTERNAL FACTOR EVALUATION (IFE) MATRIX:Explanation

- TYPES OF STRATEGIES:The Nature of Long-Term Objectives, Integration Strategies

- TYPES OF STRATEGIES:Horizontal Integration, Michael Porter’s Generic Strategies

- TYPES OF STRATEGIES:Intensive Strategies, Market Development, Product Development

- TYPES OF STRATEGIES:Diversification Strategies, Conglomerate Diversification

- TYPES OF STRATEGIES:Guidelines for Divestiture, Guidelines for Liquidation

- STRATEGY-FORMULATION FRAMEWORK:A Comprehensive Strategy-Formulation Framework

- THREATS-OPPORTUNITIES-WEAKNESSES-STRENGTHS (TOWS) MATRIX:WT Strategies

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- THE STRATEGIC POSITION AND ACTION EVALUATION (SPACE) MATRIX

- BOSTON CONSULTING GROUP (BCG) MATRIX:Cash cows, Question marks

- BOSTON CONSULTING GROUP (BCG) MATRIX:Steps for the development of IE matrix

- GRAND STRATEGY MATRIX:RAPID MARKET GROWTH, SLOW MARKET GROWTH

- GRAND STRATEGY MATRIX:Preparation of matrix, Key External Factors

- THE NATURE OF STRATEGY IMPLEMENTATION:Management Perspectives, The SMART criteria

- RESOURCE ALLOCATION

- ORGANIZATIONAL STRUCTURE:Divisional Structure, The Matrix Structure

- RESTRUCTURING:Characteristics, Results, Reengineering

- PRODUCTION/OPERATIONS CONCERNS WHEN IMPLEMENTING STRATEGIES:Philosophy

- MARKET SEGMENTATION:Demographic Segmentation, Behavioralistic Segmentation

- MARKET SEGMENTATION:Product Decisions, Distribution (Place) Decisions, Product Positioning

- FINANCE/ACCOUNTING ISSUES:DEBIT, USES OF PRO FORMA STATEMENTS

- RESEARCH AND DEVELOPMENT ISSUES

- STRATEGY REVIEW, EVALUATION AND CONTROL:Evaluation, The threat of new entrants

- PORTER SUPPLY CHAIN MODEL:The activities of the Value Chain, Support activities

- STRATEGY EVALUATION:Consistency, The process of evaluating Strategies

- REVIEWING BASES OF STRATEGY:Measuring Organizational Performance

- MEASURING ORGANIZATIONAL PERFORMANCE

- CHARACTERISTICS OF AN EFFECTIVE EVALUATION SYSTEM:Contingency Planning