|

SME

Management (MGT-601)

VU

Lesson

25

Working

capital management or current asset

management is one of the most

important aspects of

overall

financial

management in an enterprise. It is

basically concerned with the

management of current assets

and

current

liabilities and inter relationship

between them.

MEANING

OF WORKING CAPITAL

Working

capital is the amount of funds needed by an

enterprise to finance its day to

day operation. It is the

part

of capital employed in short-term

operation such as raw

materials, semi finished

products, sundry

debtors.

Because

of its variable nature, the working

capital is also referred to as circulating

capital. It may be

pointed

out

that the total working

capital is composed of two

parts.

1)

Regular Capital

2)

Variable Capital

Regular

Working capital is required for

permanent investment in any business

for holing certain

minimum

quantity

of raw material, finished

product or cash. Such investment is

irreducible minimum and

remains

permanently

sunk into business.

The

remaining portion of working capital is

variable. The variable portion

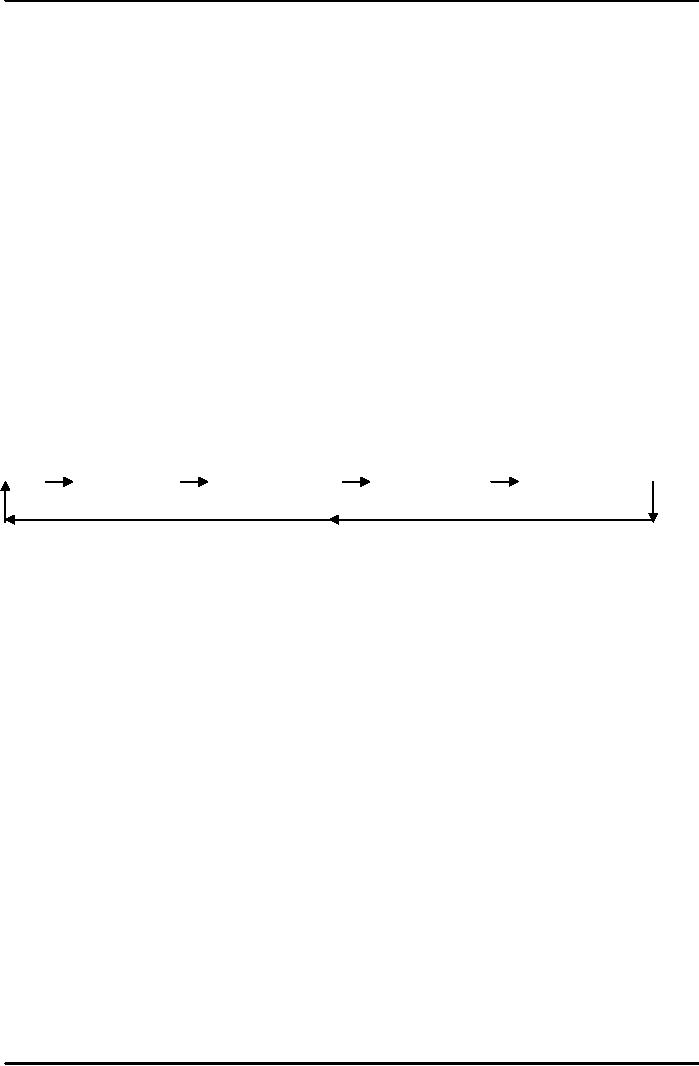

first gets tied up into

raw

materials

which are then converted

into finished goods. On the

sale of goods it gets converted

into account

receivables

or cash and circle is then

completed. It is depicted in following

figure.

Cash

Raw

Material

Stock

in Process

Finished

Goods

Bills

Receivable

Working

Capital Cycle

"Different

Senses of "Working

Capital"

The

term working capital is usually

used in two different senses

namely.

1)

Gross Working

Capital

2)

Net Working

Capital

Gross

Working Capital

It

represents total value of current

assets. In other words, it is the

sum total of net working

capital and

current

liabilities. It is a quantities concept showing the

total amount available for

financing the current

assets.

It cannot reveal the true position of the

company. For instance, every

increase in borrowings will

increase

the gross working capital

but net working capital will

remain the same.

Net

Working Capital

It

represents excess of current assets

over current liabilities. Current assets include

cash, debtors, stock,

and

bills

receivable, Current liabilities include

bills payable, accounts

payable, expenses payable. It

indicates the

liquidity

position of an enterprise i.e. the

soundness or otherwise of the current financial

position.

The

ratio of 2:1 between current

assets and current liabilities is

considered sound. The

concept of net

working

capital is quantitative concept

indicating firm's capacity to

meet operating expenses and

current

liabilities.

Net working capital is

increased only when there is an

increase in current assets

without

corresponding

increase in current liabilities.

Net

Working Capital = Current

assets Current

liabilities.

72

SME

Management (MGT-601)

VU

Significance

of Working Capital

�

Conversion of

cash into inventory.

�

Conversion of

inventory into

receivable.

�

Conversion of

receivable into cash.

These

events constitute operating cycle of

business. If all these

events could happen simultaneously,

there

would

not arise any need

for working capital. Since

cash inflows and cash

outflows do not match,

an

organization

need necessary cash and

liquidity to be able to meet

its obligations. Thus adequate

capital is

required

for smooth operation of any

business concern.

Sound

working capital management

results in maximization of productivity

and Profits. It requires

the

maintenance

of proper balance between

working and fixed capital,

so as to maintain both profitability

and

solvency.

Proper management synchronizes cash

receipts and cash

outlays.

For

small concerns, efficient

working capital management is

still more essential to

ensure purchase of inputs

at

competitive prices and

timely payment to factors of

production. It may be noted

that shorter the gap

between

spending of money on production of

goods and the recovery of

money through rapid

sales

turnover,

the better shall be the quality of

working capital

management.

Factors

Affecting Working Capital

Requirements

In

case of a small enterprise, the

various factors affecting its

working capital

requirements.

Size

of Business.

Size

of unit and the volume of

business.

Nature

of Process.

Nature

of production process i.e.

lengthier the duration of production,

higher shall be the working

capital

needs

and vice-versa.

Proportion

of Raw Materials and Total

Cost.

Proportion

of raw material to total

cost must be decided.

Terms

of Sale & Purchase.

Terms

of sale and purchase e.g.

sales are on cash terms,

lesser working capital will

be sufficient.

Turnover

of Inventories.

If

inventories are large and

their turnover is slow, larger

working capital would be

needed.

Labour

Vs. Capital

Intensive.

Labour

vs. capital intensive, the former

requiring higher amounts of working

capital.

Cash

Requirements.

Cash

requirements will have direct

impact on working capital

quantum.

Banking

Facilities.

Availability

of goods and dependable

banking facilities reduces working

capital needed.

Seasonal

Requirements.

Seasonal

requirements may push up the amount of

working capital

needed.

Contingencies.

If

the demand and prices for

small concerns products are

subject to wide fluctuation, contingency

provision

will

have to be made for

arranging higher amounts of working

capital.

73

SME

Management (MGT-601)

VU

Determination

of Working Capital

Needs

Working

capital requirements of a small

enterprise vary from unit to

unit and in accordance with

the

difference

on the nature of the enterprise. Broadly

speaking, working capital should be

adequate to meet

operating

expenses like raw materials,

labour, factory and other

overheads etc. Operating

expenses can be

ascertained

from the final accounts of the

firm. But the working

capital requirements needs

not be equal to

the

level of expenses. Operating cycle is of primary

significance in every

case.

Working

Capital Requirement Formula =

Operating

Exp in Previous Year

Number

of operating Cycles in Year

Ingredients

of Working Capital Management in

Small Enterprise

Budget

the Material

Requirements.

Budget

the material requirements and

devising a proper system of

control.

Production

Goes on Uninterrupted.

Ensure

that production goes on

uninterrupted so that there id

minimum blockage of working

capital in the

production

process.

Realize

Cash Fast.

Expeditious

dispatch the finished goods to

realize cash fast.

Follow

the Bills.

Follow

the bills for early realization of

cash.

Identify

Surplus Cash.

In

the field of cash management,

clearly identify the quantum of really

surplus cash which could be

utilized

to

meet financial obligations.

Working

Capital Sources.

Ensure

proper management of working

capital sources so that

there is no costly fund

rising. There must be

a

judicious blending of different resources

so that sufficient funds are

raised at the cheapest

cost.

74

Table of Contents:

- THE HISTORY:Cottage Industry, CONCEPT OF SMALL BUSINESS

- THE RELATIONSHIP BETWEEN SMALL AND BIG BUSINESS:The SME’S in Pakistan

- THE ROLE OF ENTREPRENEURSHIPS IN SMEs:Focus and Perseverance Guide the Entrepreneur

- THE ROLE OF ENTREPRENEURSHIPS IN SMEs:Kinds of Entrepreneurs

- SMALL ENTREPRENEURS IN PAKISTAN:National Approaches

- THE DEVELOPMENT OF SMES IN PAKISTAN:The Industrial History of Pakistan

- GOVERNMENT’S EFFORT TOWARDS SME DEVELOPMENT:Financing Programs

- THIS LECTURE DEFINES THE ROLE OF NGOS AND SMEDA:Mission Statement

- ISSUES AND POLICY DEVELOPMENT FOR SME:Monitoring Developments

- ISSUES IN SME DEVELOPMENT:Business Environment, Taxation Issues

- LABOR ISSUES:Delivery of Assistance and Access to Resources, Finance

- HUMAN RESOURCE DEVELOPMENT:Market and Industry Information, Monitoring Developments

- MARKET AND INDUSTRY INFORMATION:Measuring Our Success, Gender Development

- LONG TERM ISSUES:Law and Order, Intellectual Property Rights, Infrastructure

- THE START UP PROCESS OF A SMALL ENTERPRISE:Steps in Innovative Process

- TECHNICAL FEASIBILITY:Market Feasibility, Market Testing

- FINANCIAL FEASIBILITY:Financial resources and other costs, Cash Flow Analysis

- ASSESSMENT OF PERSONAL REQUIREMENTS AND ORGANIZATIONAL CAPABILITIES:Analysis of Competition

- Post Operative Problems of a New Enterprise:Environmental Causes

- HOW TO APPROACH LENDERS:Bank’s Lending Criteria, Specific Purpose, Be Well Prepared

- WHAT A BANK NEEDS TO KNOW ABOUT YOU:General Credentials, Financial Situation

- COMMERCIAL INFORMATION:Checklist for Feasibility Study, The Market

- GUARANTEES OR COLLATERAL YOU CAN OFFER:Typical Collateral

- Aspects of Financial Management:WINNING THE CASH FLOW WAR, The Realization Concept

- MEANING OF WORKING CAPITAL:Gross Working Capital, Net Working Capital

- RECRUITMENT, SELECTION AND TRAINING:Job Description, Job Specification

- SELECTION AND HIRING THE RIGHT CANDIDATE:Application Blank, Orientation

- TRAINGING AND DEVELOPMENT:Knowledge, Methods of Training

- CONDITIONS THAT STIMULATE LEARNING:Limitations of Performance Appraisal, Discipline

- QUALITY CONTROL:Two Aspects of Quality, Manufactured Quality

- QUALITY CONTROL:International Quality Standards, MARKETING

- MARKETING:Marketing Function, MARKETING PROCESS - STEPS

- MARKETING:Controllable Variable, Marketing Uncontrollable, Marketing Mix

- MARKETING:Demerits of Product Mix, Development of new product, SMEDA

- ROLE OF TECHNOLOGY:Training programmes, Publications

- ROLE OF TECHNOLOGY:Measure to Undertake for Promoting Framework.

- EXPORT POTENTIAL OF SME IN DEVELOPING COUNTRIES I:Commonly Seen Assistance Programme

- EXPORT POTENTIAL OF SME IN DEVELOPING Countries. II:At the national level

- WORLD TRADE ORGANIZATION (WTO):WTO Agreements: Salient Features

- WTO MINISTERIAL CONFERENCES:PAKISTAN AND WTO

- WORLD TRADE ORGANIZATION (WTO) PAKISTAN & WTO. II:International Treaties

- WORLD TRADE ORGANIZATION (WTO) PAKISTAN & WTO. III:Agriculture

- WORLD TRADE ORGANIZATION (WTO):PAKISTAN & WTO. III

- WORLD TRADE ORGANIZATION (WTO):CONCLUSIONS AND RECOMMENDATIONS

- SUMMARY & CONCLUSIONS:Financing Tool, Financing Tool