|

SME

Management (MGT-601)

VU

Lesson

2

This

lecture will throw light on

the relationship between small and

big business ,concept of SME's in

our

region

i.e. South East Asia and in

Pakistan. It should give a student a

clear idea about its

definitions in these

areas

and will help him in

differentiating the variable factors of

labor, investment and production

volume of

our

region in comparison with developed

countries of Europe and

USA.

THE

RELATIONSHIP BETWEEN SMALL AND

BIG BUSINESS

Small

businesses powerfully effected by

developments within the big

business sector this relationship

serves

the

interest of general economic

disequilibria. Small business is less

affected by economic disruptions and

is

more

or less self-adjusting. It tends to

act as cushion for economy

.The nature of interlink age

between

small

and medium business is as

under

1: Job

subcontracting i.e. the large

business provides materials and

components to small units who

process

the

same into finished

goods

2:

purchase subcontracting i.e. in this

case the material is procured by small

unit who manufactures

a

specific

part or component needed by a particular

large unit

3:

Complementary:

in this case the product manufactured by

small company is purchased by a

big unit as

accessory

like plastic dust covers

for video recorders, electronic

passive components, packaging

etc.

4: Merchandising or

commercial trading: in this case the

small units manufacture the goods

and big units on

the

strength of their financial power market

it with their own brands

like fans, washing

machines,

refrigerators

etc.

5:

Maintenance

and repair services: many

large enterprises give the operation

and maintenance contract to

the

small companies due to being

more economical and

helpful

6:

Social benefits: employment generation,

decentralization of industrial benefits

etc.

THE

REGIONAL CONCEPT OF

SME'S

The

countries generally try to

identify their SME sector in

order to target it for

special assistance.

Yet,

the

definition of an SME depends to a

greater extent on local conditions. An

enterprise considered an

SME

in

one country might well be

bigger than many large

countries in another. In some cases, the

SME sector is

further

broke down in to two

separate groups

A

generic definition is not

easy to find, any definition

of classification of SME can

thus be considered

specific

to the country in question. Countries

have widely different

definitions of SME's for example,

in

India;

the criteria for determining SME status

are based on investment while in South

Africa SME

eligibility

depends

on the number of employees and turn

over. There are nevertheless

three parameters that

are

generally

accepted, either signally or in

combination, in defining SME's in most

countries, these are

Number

of workers employed which is the most

widely used criteria

The

level of capital investments or

assets

The

volume of production or business

turnover.

In

many countries, medium scale

industry is not defined and

is understood to include those that

fall

between

small and large

industries

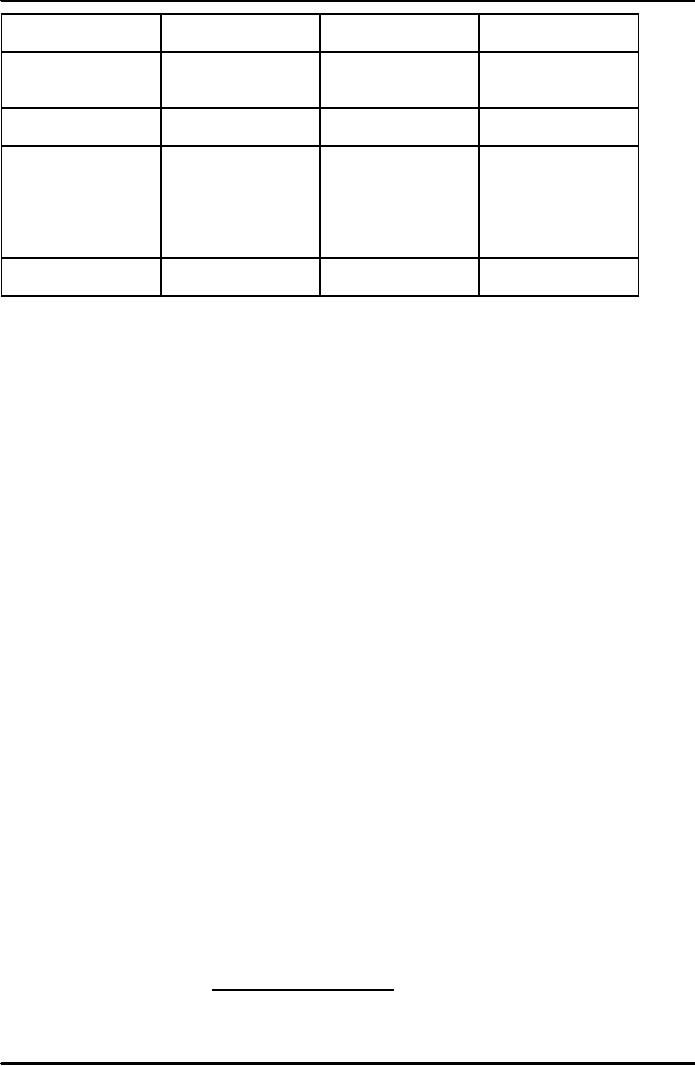

Table

1 criteria used to define

SME's in south East Asian

countries

Employees

Capital

Turnover

(Number)

(US

$ `000)

(US

$ `000)

Brunei

Small

1-10

Darussalam

Medium-

sized 11-100

Indonesia

SME's

<100

SME's

<84

SME's

< 1,000 (sales)

(Total

assets)

Lao

PDR

Small

< 10

Depends

on the

Medium-

sized 10-29 number of

establishments

in

sector

Malaysia

SME's

< 76

Small

< 198

Medium-sized

198-

939

Myanmar

Small

<50

Small

<167

Small

417

4

SME

Management (MGT-601)

VU

Medium-sized

50-100

Medium-sized

Medium-

sized 17-

167-

835

1,670

(production)

Small

10-99

Small

<570

Philippines

Medium-sized

100-

Medium

570-2,282

199

Singapore

Services

sector

Manufacturing

sector

SME's

<100

SME's

< 8570

Thailand

Labor-intensive

Capital

intensive

industries:

Industries-

fixed

Small

<50

assets:

Medium-sized

50-200

Small

781

Medium-sized

781-

3,905

Viet

Nam

Small

< 50

Small

<4

Medium-sized

50-100 Medium-sized 4-18

Source

(United Nations, Small industry

bulletin for Asia and

Pacific (No, 30 page

44)

The

SME'S in Pakistan

Pakistan's

economy is an economy of SME's. Policies

in the past have given a general

perspective,

direction

and defining broad parameters of

activity within the macro

economic framework, but efforts

have

focused

on the large enterprises, neglecting

SMEs which are at the heart

of our economy while SME's

are

being

mentioned in some of our socio-economic

strategies and policy

documents, measures are

not

sufficiently

specified and prioritized

for us to be able to speak of

any coherent SME policy or

approach. SME

promotion

is an important issue for

many government departments and

central offices. However,

there is an

existing

lack of coordination and

regular information exchange

mechanism among institutions

that constrains

their

collective ability to deliver in the SME

development process.

The

Government's Effort towards

SME Development

The

government of Pakistan keeping in view the importance

of SME's has adopted multi

pronged

approaches at the regional, sub regional

and national levels.

Initiatives at the national and

sub

regional

levels include efforts to strengthen

economic integration and cooperation. At

the national level,

structural

adjustment programs have

been inauguration along with

attempts at re structuring and

diversifying

the production base, integration the

informal sector into the

economic mainstream

and

stimulating

increased participation at the enterprise

level. The development process was

initiated in the 60's

and

the concept of development derived its

origin from within, "Indian

model" of small

enterprise

development.

The basic idea behind this

model is to develop infrastructure facilities such as

industrial

estates,

common facility centers and

vocational training institutes which

would to a great extent the

problems

faced by SME's. Based on this model

numerous provincial level organizations

were setup mostly

with

the help of foreign assistance in the

shape of grants and soft

loans. The definitions thus

depend upon

the

criteria set out by such

provincial or federal

institutions.

DEFINITIONS

BY PROVINCIAL LEVEL

INSTITUTIONS

a)

Punjab

Small Industries Corporation

(PSIC):

b)

Sindh

Small Industry Corporation

(SSIC):

c)

Small

Industries Development Board

(SIDB)

d)

Directorate

of Industries Balochistan (DIB)

These

organizations defined the small

industries as under:

An

industrial undertaking with fixed

investments up to 20 million excluding the

cost

of

land and no limit of people

employed.

5

SME

Management (MGT-601)

VU

DEFINITION

BY Small Business Finance Corporation

(SBFC)

Small:

�

No

limit of people employed.

�

Productive

assets limit of 20

million

Medium:

�

No

limit of people employed.

�

Productive

assets limit of rupees 100

million.

Youth

Investment Promotion Scheme

(YIPS)

According

to the concept paper on SME's in

Pakistan, developed by YIPS, small-scale

industry was defined

as

industrial enterprise with

fixed assets of up to rupees 10

million. (Excluding the cost of land

and

building).

It

is pertinent to note that

majority of the definitions have

been formulated either by the

national

institutions

themselves or with the objective of

meeting the financial

requirements

The

State Bank of Pakistan:

MICRO:

The

State Bank's federal credit

scheme (small loan scheme)

for micro and small scale

enterprises, defined

their

target group in year 1972

1973 as enterprise with

assets of less than rupees

one million (excluding the

cost

of land and building). This

limit was redefined in the year

1992 and increased to rupees

20 million.

SMALL:

�

Assets

up to rupees 20 million (excluding the

cost of land and

building)

SMALL

& MEDIUM ENTERPRISE DEVELOPMENT

AUTHORITY (SMEDA)

The

government to promote the cause of SME

development in the country has recently

established

SMEDA.

Given the mandate of SMEDA, it

was not possible to work in

the absence of definition

for

the

target segment. At a broader level

SMEDA's objective is not only

limited to catering to the

financial

requirements

of the SME's whereas its mandate

encompasses all other

aspects such as marketing,

human

resource development etc. SMEDA went

one step ahead and

used two variables to

define

SME's

in Pakistan. Following are the

definitions of the SME's:

Micro:

�

Less

than 10 people employed

�

Productive

assets limit of 2 million

rupees.

Small:

�

Between

10-35 people employed.

�

Productive

assets limit of 20

million.

Medium:

�

Between

36-99 people employed

�

Productive

assets limit of 40

million.

Definitions

of SME's in Pakistan

The

definitions of "small" and

"medium" sized enterprises

differ from one country to

another. Each

country

has adopted different criteria for

defining SME's. such as the number of

workers employed the,

volume

of output or sales, the value of

assets, etc. As far as the

case of Pakistan is concerned

no

concentrated

efforts are observed at a

macro level to define SME's. Numerous

efforts have been

made

to

formulate basic policy

guidelines limited to the small-scale

industry while ignoring a

vital component,

the

medium sized

enterprises.

As

a result, inconsistent policies

have been formed from time

to time without taking

into

considerations

the overall importance of SME sector.

The need for a uniform

definition is crucial

for

the

successful development of this sector.

Various organizations follow

different definitions of SME's

6

SME

Management (MGT-601)

VU

according

to their needs. Mainly these

definitions are based on one

variable, the fixed assets;

key motive

is

to cater the credit requirements of the

small-scale sector.

References:

1-Pakistans

Small industries entrepreneurs

Gallup/BRB World Bank

survey

2-Resarch

cells LCCI (Lahore chamber of

commerce and industry)

3-SMEDA

(research Cell)

4-Small

Enterprises in developing Countries By Dr.

Asghar S. Nasir

5-

State Banks circular for

Micro credits

Book

Recommended

Small

Enterprises in developing Countries By

Dr. Asghar S. Nasir

KET

TERMS

1-Multi

pronged (with many tips,

branches)

2-generic

(Belonging to a class or group)

3-Soft

Loan (A loan with very low

interest)

4-Grant

(A non returnable helping money or

commodity)

7

Table of Contents:

- THE HISTORY:Cottage Industry, CONCEPT OF SMALL BUSINESS

- THE RELATIONSHIP BETWEEN SMALL AND BIG BUSINESS:The SME’S in Pakistan

- THE ROLE OF ENTREPRENEURSHIPS IN SMEs:Focus and Perseverance Guide the Entrepreneur

- THE ROLE OF ENTREPRENEURSHIPS IN SMEs:Kinds of Entrepreneurs

- SMALL ENTREPRENEURS IN PAKISTAN:National Approaches

- THE DEVELOPMENT OF SMES IN PAKISTAN:The Industrial History of Pakistan

- GOVERNMENT’S EFFORT TOWARDS SME DEVELOPMENT:Financing Programs

- THIS LECTURE DEFINES THE ROLE OF NGOS AND SMEDA:Mission Statement

- ISSUES AND POLICY DEVELOPMENT FOR SME:Monitoring Developments

- ISSUES IN SME DEVELOPMENT:Business Environment, Taxation Issues

- LABOR ISSUES:Delivery of Assistance and Access to Resources, Finance

- HUMAN RESOURCE DEVELOPMENT:Market and Industry Information, Monitoring Developments

- MARKET AND INDUSTRY INFORMATION:Measuring Our Success, Gender Development

- LONG TERM ISSUES:Law and Order, Intellectual Property Rights, Infrastructure

- THE START UP PROCESS OF A SMALL ENTERPRISE:Steps in Innovative Process

- TECHNICAL FEASIBILITY:Market Feasibility, Market Testing

- FINANCIAL FEASIBILITY:Financial resources and other costs, Cash Flow Analysis

- ASSESSMENT OF PERSONAL REQUIREMENTS AND ORGANIZATIONAL CAPABILITIES:Analysis of Competition

- Post Operative Problems of a New Enterprise:Environmental Causes

- HOW TO APPROACH LENDERS:Bank’s Lending Criteria, Specific Purpose, Be Well Prepared

- WHAT A BANK NEEDS TO KNOW ABOUT YOU:General Credentials, Financial Situation

- COMMERCIAL INFORMATION:Checklist for Feasibility Study, The Market

- GUARANTEES OR COLLATERAL YOU CAN OFFER:Typical Collateral

- Aspects of Financial Management:WINNING THE CASH FLOW WAR, The Realization Concept

- MEANING OF WORKING CAPITAL:Gross Working Capital, Net Working Capital

- RECRUITMENT, SELECTION AND TRAINING:Job Description, Job Specification

- SELECTION AND HIRING THE RIGHT CANDIDATE:Application Blank, Orientation

- TRAINGING AND DEVELOPMENT:Knowledge, Methods of Training

- CONDITIONS THAT STIMULATE LEARNING:Limitations of Performance Appraisal, Discipline

- QUALITY CONTROL:Two Aspects of Quality, Manufactured Quality

- QUALITY CONTROL:International Quality Standards, MARKETING

- MARKETING:Marketing Function, MARKETING PROCESS - STEPS

- MARKETING:Controllable Variable, Marketing Uncontrollable, Marketing Mix

- MARKETING:Demerits of Product Mix, Development of new product, SMEDA

- ROLE OF TECHNOLOGY:Training programmes, Publications

- ROLE OF TECHNOLOGY:Measure to Undertake for Promoting Framework.

- EXPORT POTENTIAL OF SME IN DEVELOPING COUNTRIES I:Commonly Seen Assistance Programme

- EXPORT POTENTIAL OF SME IN DEVELOPING Countries. II:At the national level

- WORLD TRADE ORGANIZATION (WTO):WTO Agreements: Salient Features

- WTO MINISTERIAL CONFERENCES:PAKISTAN AND WTO

- WORLD TRADE ORGANIZATION (WTO) PAKISTAN & WTO. II:International Treaties

- WORLD TRADE ORGANIZATION (WTO) PAKISTAN & WTO. III:Agriculture

- WORLD TRADE ORGANIZATION (WTO):PAKISTAN & WTO. III

- WORLD TRADE ORGANIZATION (WTO):CONCLUSIONS AND RECOMMENDATIONS

- SUMMARY & CONCLUSIONS:Financing Tool, Financing Tool