|

SME

Management (MGT-601)

VU

Lesson

17

Dealing

with the financial feasibility, flow

sheets, short term and long term

loans, cash flow analysis

and

financial

cost.

FINANCIAL

FEASIBILITY

It

covers the following:

Determination

of total financial

requirements

It

can be done by preparing a financial statement in the

following way:

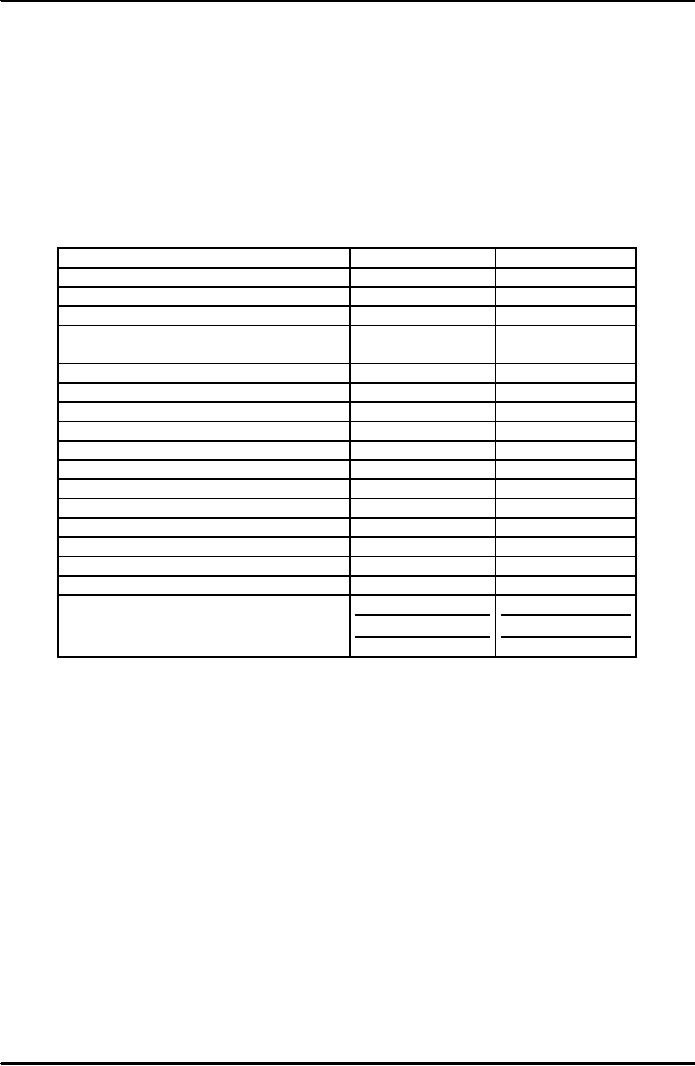

Financial

Requirement Statement:

Initial

Expense

Period

1

Period

2

Expense

in product development

-------

-------

Legal

expense

-------

-------

Product

testing expenditure

-------

-------

Marketing

and technical

feasibility

-------

-------

Expenditure

Miscellaneous

expense

-------

-------

Fixed

investments

-------

-------

Building

-------

-------

Equipment

and machinery

-------

-------

Patents

-------

-------

Other

equipments

-------

-------

Operational

expenditure

-------

-------

Material

-------

-------

Wages

-------

-------

Sales

promotion, distribution

-------

-------

Rent,

interest, insurance,

taxes

-------

-------

Contingency

-------

-------

TOTAL

In

making the above estimation, provision

must be made for cost

escalation that is inevitable

due to price

changes.

Besides, appropriate sales forecasts

should also be made to have a

clear picture of expenditure. The

projection

could be weekly or monthly.

Financial

resources and other

costs

Financial

resources could be categorized on the

basis of periodicity

into:

Short

term resources: (those

payable in a year). Trade credit

supplies, short term loans

from

backs

or other lending institutions,

sales of account receivable

etc. belong to this

category.

Term

Loans: Intermediate

term loans are those

available for one to three

(sometimes five)

years.

It includes terms loans from

banks, lease finance,

financial assistance

from

institutions

etc.

Long-term

loans are

those from banks, equity

capital and investments of

earnings.

While

considering different sources, it is

better to consider specific costs as

well as advantages

and

disadvantages of each. It would be

appropriate to compute weighted average

cost of funds

as

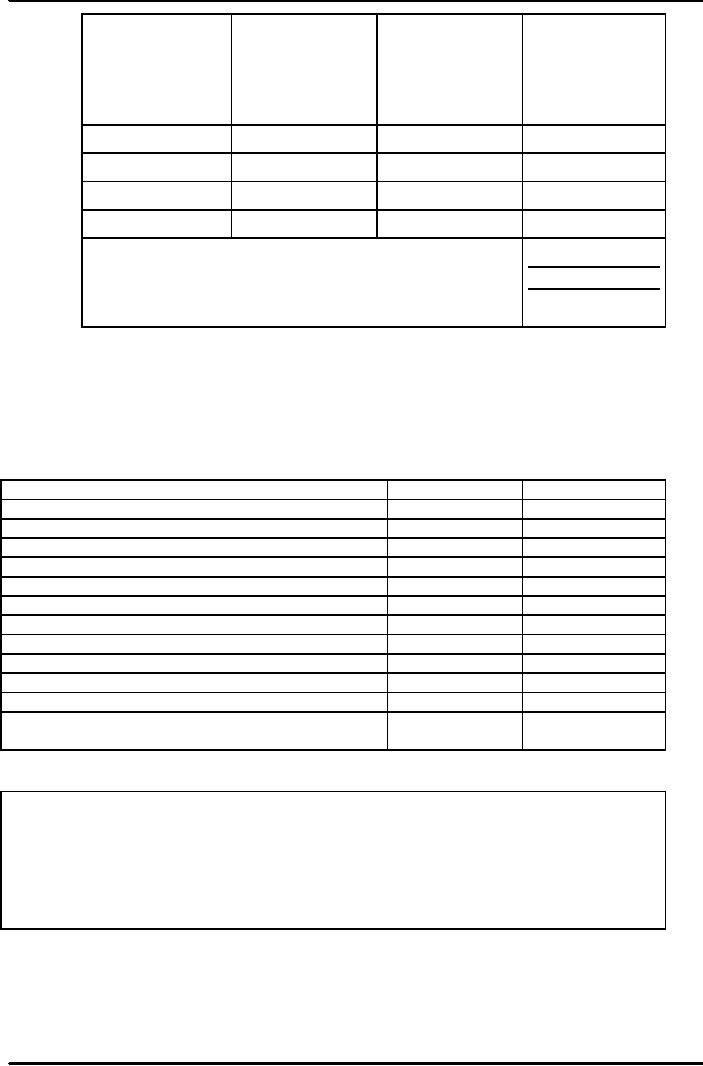

illustrated below:

50

SME

Management (MGT-601)

VU

4

1

2

3

Weighted

Cost

Method

of finance

Proportion

Cost

(Assumed)

[2X3]

(Assumed)

Short

term debt

20

7%

1.40

Intermediate

dept

10

8%

0.80

Long

term debt

20

9%

1.80

Equity

20

10%

5.00

Weighted

Average Cost of

Capital

9.00

On

the basis of average cost of

capital, it is possible to ascertain

whether there is positive

net

present value when anticipated cash

flow are discounted at

average rate of cost of

capital.

C)

Cash Flow

Analysis

If

the projected sales associated financial

requirements and available financial

resources are known,

the

anticipated

cash flow can easily be

determined.

Cash

Flow (projected)

Cash

flow and financial

transactions

Period

1

Period

2

1)

Cash flow

Initial

expense

Fixed

investment

Operating

expense

Total

cash outflow

2)

Cash inflow

Cash

sales

Account

receivables

Total

operating inflow

3)

Net cash flow

(2-1)

4)

Desired minimum cash

balance

5)

Total amount of funds

required

[3

(if negative +

4)]

Source

of funds

Short

term:

Net

trade credit

Commercial

loans

�

Intermediate

loans

�

Long

term loans

�

Equity

Total

Financing

Anticipated

return on investment

Financial

feasibility is adjudged on the basis of

satisfactory yield on investment. It can

be calculated by

relating

the average earnings expected

over a given period to either the total

amount of investment or

51

SME

Management (MGT-601)

VU

net

worth of organization (Return on equity). Both

are compared with potential

yield from alternative

investment

opportunities to ascertain the

acceptability or otherwise of a new

venture.

Key

Terms

Feasibility

study

a

detailed study about judging

the future of a commercial

project/product

52

Table of Contents:

- THE HISTORY:Cottage Industry, CONCEPT OF SMALL BUSINESS

- THE RELATIONSHIP BETWEEN SMALL AND BIG BUSINESS:The SME’S in Pakistan

- THE ROLE OF ENTREPRENEURSHIPS IN SMEs:Focus and Perseverance Guide the Entrepreneur

- THE ROLE OF ENTREPRENEURSHIPS IN SMEs:Kinds of Entrepreneurs

- SMALL ENTREPRENEURS IN PAKISTAN:National Approaches

- THE DEVELOPMENT OF SMES IN PAKISTAN:The Industrial History of Pakistan

- GOVERNMENT’S EFFORT TOWARDS SME DEVELOPMENT:Financing Programs

- THIS LECTURE DEFINES THE ROLE OF NGOS AND SMEDA:Mission Statement

- ISSUES AND POLICY DEVELOPMENT FOR SME:Monitoring Developments

- ISSUES IN SME DEVELOPMENT:Business Environment, Taxation Issues

- LABOR ISSUES:Delivery of Assistance and Access to Resources, Finance

- HUMAN RESOURCE DEVELOPMENT:Market and Industry Information, Monitoring Developments

- MARKET AND INDUSTRY INFORMATION:Measuring Our Success, Gender Development

- LONG TERM ISSUES:Law and Order, Intellectual Property Rights, Infrastructure

- THE START UP PROCESS OF A SMALL ENTERPRISE:Steps in Innovative Process

- TECHNICAL FEASIBILITY:Market Feasibility, Market Testing

- FINANCIAL FEASIBILITY:Financial resources and other costs, Cash Flow Analysis

- ASSESSMENT OF PERSONAL REQUIREMENTS AND ORGANIZATIONAL CAPABILITIES:Analysis of Competition

- Post Operative Problems of a New Enterprise:Environmental Causes

- HOW TO APPROACH LENDERS:Bank’s Lending Criteria, Specific Purpose, Be Well Prepared

- WHAT A BANK NEEDS TO KNOW ABOUT YOU:General Credentials, Financial Situation

- COMMERCIAL INFORMATION:Checklist for Feasibility Study, The Market

- GUARANTEES OR COLLATERAL YOU CAN OFFER:Typical Collateral

- Aspects of Financial Management:WINNING THE CASH FLOW WAR, The Realization Concept

- MEANING OF WORKING CAPITAL:Gross Working Capital, Net Working Capital

- RECRUITMENT, SELECTION AND TRAINING:Job Description, Job Specification

- SELECTION AND HIRING THE RIGHT CANDIDATE:Application Blank, Orientation

- TRAINGING AND DEVELOPMENT:Knowledge, Methods of Training

- CONDITIONS THAT STIMULATE LEARNING:Limitations of Performance Appraisal, Discipline

- QUALITY CONTROL:Two Aspects of Quality, Manufactured Quality

- QUALITY CONTROL:International Quality Standards, MARKETING

- MARKETING:Marketing Function, MARKETING PROCESS - STEPS

- MARKETING:Controllable Variable, Marketing Uncontrollable, Marketing Mix

- MARKETING:Demerits of Product Mix, Development of new product, SMEDA

- ROLE OF TECHNOLOGY:Training programmes, Publications

- ROLE OF TECHNOLOGY:Measure to Undertake for Promoting Framework.

- EXPORT POTENTIAL OF SME IN DEVELOPING COUNTRIES I:Commonly Seen Assistance Programme

- EXPORT POTENTIAL OF SME IN DEVELOPING Countries. II:At the national level

- WORLD TRADE ORGANIZATION (WTO):WTO Agreements: Salient Features

- WTO MINISTERIAL CONFERENCES:PAKISTAN AND WTO

- WORLD TRADE ORGANIZATION (WTO) PAKISTAN & WTO. II:International Treaties

- WORLD TRADE ORGANIZATION (WTO) PAKISTAN & WTO. III:Agriculture

- WORLD TRADE ORGANIZATION (WTO):PAKISTAN & WTO. III

- WORLD TRADE ORGANIZATION (WTO):CONCLUSIONS AND RECOMMENDATIONS

- SUMMARY & CONCLUSIONS:Financing Tool, Financing Tool