|

Project

Management MGMT627

VU

LESSON

44

PROJECT

RISK MANAGEMENT

BROAD

CONTENTS

What

is Risk?

Primary

Components

Tolerance

of Risk

Risk

Management

Categories

of Risk

Risk

Planning

Risk

Identification

Risk

Assessment (identification and

analysis)

Risk

Handling

In

the early days of project

management on many commercial programs,

the majority of project

decisions

heavily favored cost and

schedule. This favoritism occurred

because we knew more about

cost

and

scheduling than we did about

technical risks. Technology forecasting

was very rarely

performed

other

than by extrapolating past

technical knowledge into the

present.

Today,

the state of the art of technology

forecasting is being pushed to the

limits. For projects with

time

duration

of less than one year, we

normally assume that the

environment is known and stable,

particularly

the technological environment. For

projects over a year or so in length,

technology

forecasting

must be considered. Computer technology

doubles in performance about every two

years.

Engineering

technology is said to double

every three or so years. How

can a project manager

accurately

define

and plan the scope of a three- or

four-year project without

expecting engineering

changes

resulting

from technology improvements?

44.1

What

are the Risks?

A

Midwest manufacturing company embarked on an

eight-year project to design the

manufacturing

factory

of the future. The plant is

scheduled to go into the construction

phase in the year 2000. How

do

we

design the factory of the future without

forecasting the technology? What computer

technology will

exist?

What types of materials will exist and

what types of components will

our customers

require?

What

production rate will we need and

will technology exist to support

this production

level?

Economists

and financial institutions forecast

interest rates. The forecasts

appear in public

newspapers

and

journals. Yet, every company

involved in high tech does

some form of technology

forecasting, but

appears

very reluctant to publish the data.

Technology forecasting is regarded as company

proprietary

information

and may be part of the company's

strategic planning process.

We

read in the newspaper about

cost overruns and schedule slips on a

wide variety of large-scale

development

projects. Several issues within the

control of the buyer, seller, or

major stakeholders can

lead

to cost growth and schedule

slippage on development projects. These

causes include, but are

not

limited

to:

�

Starting a project with a

budget and/or schedule that

is inadequate for the desired level

of

performance

or scope (e.g., integration

complexity).

�

Having an overall development

process (or key parts of

that process) that favors

performance

(or

scope) over cost and

schedule.

�

Establishing a design that is near

the feasible limit of achievable

performance or integration

complexity

at a given point in

time.

�

Making major project design

decisions before the relationships between

cost, performance,

schedule,

and risk are understood.

352

Project

Management MGMT627

VU

These

four causes will contribute

to uncertainty in forecasting technology

and the associated design

needed

to meet performance requirements. And the

inability to perfectly forecast

technology and the

associated

design will contribute to a project's

technical risk, and can also

lead to cost and schedule

risk.

Today,

the competition for technical achievement

has become fierce. Companies have gone

through

life-cycle

phases of centralizing all

activities, especially management

functions, but are

decentralizing

technical

expertise. By the mid 1980s, many

companies recognized the need to

integrate technical risks

with

cost and schedule risks, and

other activities (e.g., quality).

Risk management processes

were

developed

and implemented where risk

information was made

available to key decision-makers.

The

risk management process,

however, should be designed to do more

than just identify the

risk.

The

process must also include: a

formal planning

activity,

analysis

to

quantify the likelihood and

predict

the

impact on the project, a handling

strategy

for selected risks, and the ability to

monitor

the

progress

in

reducing these selected risks to the

desired level.

A

project, by definition, is something that

we have not done previously and will

not do again in the

future.

Because of this uniqueness, we have

developed a ''live with it"

attitude on risk and attribute it

as

part

of doing business. If risk

management is set up as a continuous,

disciplined process of

planning,

assessment

(identification and analysis), handling, and

monitoring, then the system

will easily

supplement

other systems as organization,

planning and budgeting, and cost

control. Surprises

that

become

problems will be diminished because

emphasis will now be on

proactive rather than

reactive

management.

Risk

management can be justified on almost

all projects. The level of

implementation can vary

from

project

to project, depending on such factors as

size, type of project, who

the customer is, relationship to

the

corporate strategic plan, and corporate

culture. Risk management is

particularly important when

the

overall

stakes are high and a great

deal of uncertainty exists. In the past,

we treated risk as a "let's

live

with

it." Today, risk management

is a key part of overall

project management. It forces us to focus

on

the

future where uncertainty exists and

develop suitable plans of action to

prevent potential issues

from

adversely

impacting the project.

Risk

is a measure of the probability and

consequence of not achieving a

defined project goal.

Most

people

agree that risk involves the

notion of uncertainty. Can the

specified aircraft range be

achieved?

Can

the computer be produced within budgeted cost?

Can the new product launch

date be met? A

probability

measure can be used for

such questions; for example,

the probability of not

meeting the new

product

launch date is 0.15.

However, when risk is considered, the

consequences or damage

associated

with

occurrence must also be

considered.

Goal

A, with a probability of occurrence of

only 0.05, may present a

much more serious (risky)

situation

than

goal B, with a probability of

occurrence of 0.20, if the consequences

of not meeting goal A are,

in

this

case, more than four times more

severe than failure to meet

goal B. Risk is not always

easy to

assess,

since the probability of occurrence

and the consequence of occurrence

are usually not

directly

measurable

parameters and must be estimated by

statistical or other

procedures.

44.2

Components

of Risk

Risk

has two primary components

for a given event:

�

A probability of occurrence of that

event

�

Impact of the event occurring

(amount at stake)

353

Project

Management MGMT627

VU

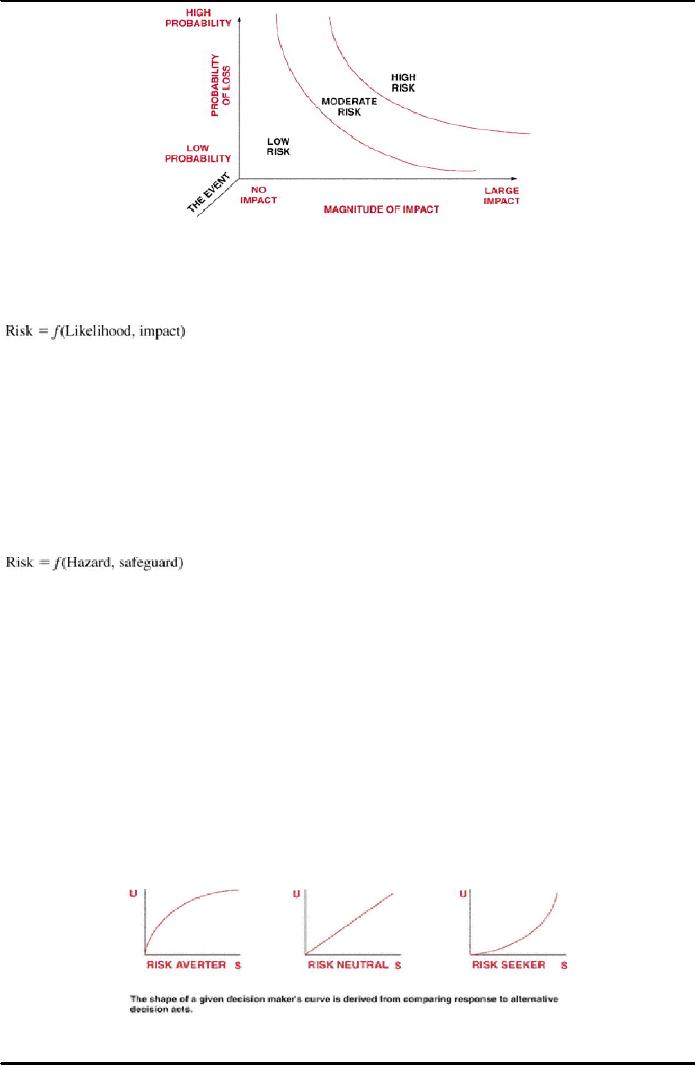

Figure

44.1: Overall

risk is a function of its

components.

Figure

44.1 shows the components of

risk.

Conceptually,

risk for each event

can be defined as a function of

likelihood and impact; that

is,

In

general, as either the likelihood or

impact increases, so does the

risk. Both the likelihood

and impact

must

be considered in risk management.

Risk

constitutes a lack of knowledge of future

events. Typically, future

events (or outcomes) that

are

favorable

are called opportunities,

whereas unfavorable events

are called risks.

Another

element of risk is the cause of risk.

Something, or the lack of something, can

induce a risky

situation.

We denote this source of danger as the

hazard. Certain hazards can

be overcome to a great

extent

by knowing them and taking action to

overcome them. For example, a large

hole in a road is a

much

greater danger to a driver who is unaware of it

than to one who travels the

road frequently and

knows

enough to slow down and go

around the hole. This leads

to the second representation of

risk:

Risk

increases with hazard but

decreases with safeguard. The

implication of this equation is

that good

project

management should be structured to

identify hazards and to allow

safeguards to be developed to

overcome

them. If enough safeguards are

available, then the risk can

be reduced to an acceptable

level.

44.3

Tolerance

of Risk

There

is no single textbook answer on

how to manage risk. The

project manager must rely

upon sound

judgment

and the use of the appropriate tools in

dealing with risk. The

ultimate decision on how to

deal

with

risk is based in part upon

the project manager's tolerance for

risk.

The

three commonly used classifications of

tolerance for risk appear in

Figure 44.2. They include

the

risk

averter or avoider, the neutral

risk taker, and the risk

seeker or lover. The

Y

axis

in Figure 44.2

represents

"utility," which can be

defined as the amount of satisfaction or

pleasure that the

individual

receives

from a payoff. (This is also

called the project manager's tolerance

for risk.) The X axis

in this

case

is the amount of money at stake.

Figure

44.2: Risk preference &

utility function

354

Project

Management MGMT627

VU

With

the risk averter, utility

rises at a decreasing

rate.

In other words, when more money is at

stake, the

project

manager's satisfaction or tolerance

diminishes. With the risk

lover, the project

manager's

satisfaction

increases when more money is at

stake (i.e., an increasing slope to the

curve). A risk

averter

prefers

a more certain outcome and will demand a

premium to accept

risk.

A

risk lover prefers the more uncertain

outcome and may be willing to

pay a penalty to take a

risk.

44.4

Risk

Management

Risk

management is the act or practice of

dealing with risk. It

includes planning

for

risk, assessing

(identifying

and analyzing)

risk issues, developing

risk

handling options,

and monitoring

risks

to

determine

how risks have changed.

Risk

management is not a separate

project office activity

assigned to a risk management department,

but

rather

is one aspect of sound project

management. Risk management

should be closely coupled

with key

project

processes, including but not

limited to: overall project

management, systems engineering,

cost,

scope,

quality, and schedule.

Proper

risk management is proactive rather

than reactive. As an example, an

activity in a

network

requires that a new

technology be developed. The

schedule indicates six

months for

this

activity, but project engineers

think that nine months is

closer to the truth. If the

project

manager

is proactive, he might develop a

Risk Handling Plan right

now.

If the project manager

is

reactive (e.g., a "problem

solver"), then he will do nothing

until the problem actually

occurs.

At

that time the project

manager must react rapidly to the

crisis, and may have lost

valuable

time

when contingencies could

have been developed. Hence,

proper risk management will

attempt

to reduce the likelihood of an event

occurring and/or the

magnitude of its

impact.

44.5

Categories

of Risk

The

Project Management Institute

categorizes

risks as

follows:

Externalunpredictable:

Government

regulations, natural hazards, and

acts of God

Externalpredictable:

Cost

of money, borrowing rates,

raw material

availability

The

external risks are outside of the

project manager's control

but may affect the direction

of the project.

Internal

(nontechnical): Labor

stoppages, cash flow problems, safety

issues, health and benefit

plans.

The

internal risks may be within the

control of the project

manager and present uncertainty

that may

affect

the project.

Technical:

Changes

in technology, changes in state of the

art, design issues,

operations/maintenance

issues.

Technical risks relate to the utilization

of technology and the impact it has on

the direction of the

project.

Legal:

Licenses,

patent rights, lawsuits, subcontractor performance,

contractual failure

To

identify risk issues, evaluators

should break down program

elements to a level where they

can

perform

valid assessments. The

information necessary to do this varies

according to the phase of the

program.

During the early phases,

requirement and scope documents, and

acquisition plans may be the

only

program-specific data available.

They should be evaluated to

identify issues that may

have adverse

consequences.

Another

method of decomposition is to create a

Work Breakdown Structure (WBS) as

early as possible

in

a program, and use this in a structured

approach to evaluate candidate risk

categories against

candidate

system or lower level

designs. To use this approach,

each element at level three of the WBS

is

further

broken down to the fourth or

fifth level and is subjected to a risk

analysis. Items at system,

segment

or group, or subsystem levels, as

well as management items, are

assessed using attributes

such

as

maturity and complexity of hardware and

software items or the dependency of the item on

existing

systems,

facilities, or contractors to evaluate

their risk levels.

355

Project

Management MGMT627

VU

Another

approach is to evaluate risk associated

with some key processes

(e.g., design and

manufacturing)

that will exist on a

project. Information on this approach is

contained in the government

DoD

directive 4245.7-M, which

provides a standard structure for

identifying technical risk

areas in the

transition

from development to production.

The structure is geared toward

programs that are

mid-to-late

in

the development phase but,

with modifications, could be

used for other projects. The

directive

identifies

a template

for

each major technical

activity. Each template identifies

potential areas of

risk.

Overlaying

each template on a project

allows identification of mismatched

areas, which are

then

identified

as "at risk." Having used

all applicable templates, the program

manager will have created

a

"watch

list" of production transition

risk areas and can

prioritize control actions--

many of which will

be

the responsibility of systems

engineering. DoD Directive

4245.7-M describes technical

methods for

reducing

the risk in each identified

area.

High-risk

areas may reflect missing

capabilities in the project manager's

organization or in supporting

organizations.

They may also reflect

technical difficulties in the design or

development process. In

either

case, "management" of risk

involves using project

management assets to reduce the

identified

risks.

The

value in each of these

approaches to risk identification

lies in the methodical nature of the

approach,

which

forces disciplined, consistent treatment

of risk. However, using any

method in a "cookbook"

manner

may cause unique risk

aspects of the project to be overlooked.

Before acting on the outcome of

any

assessment, the project manager

must review the strengths

and weaknesses of the approach

and

identify

other factors that may

introduce technical, schedule,

cost, program, or other

risks.

Certainty,

Risk, and

Uncertainty

Decision-making

falls into three categories: certainty,

risk, and uncertainty. Decision-making

under

certainty

is the easiest case to work

with. With certainty, we

assume that all of the

necessary

information

is available to assist us in making the

right decision, and we can

predict the outcome with a

high

level of confidence.

Decision-Making

under Certainty

Decision-making

under certainty implies that

we know with 100 percent

accuracy what the states

of

nature

will be and what the expected payoffs

will be for each state of

nature. Mathematically, this can

be

shown

with payoff tables.

To

construct a payoff matrix, we must

identify (or select) the

states of nature over which

we

have no

control.

We then select our own

action to be taken for each

of the states of nature. Our actions are

called

strategies.

The elements in the payoff

table are the outcomes for

each strategy.

A

payoff matrix based on

decision-making under certainty

has two controlling

features.

�

Regardless of which state of nature

exists, there will be one dominant strategy

that will produce

larger

gains or smaller losses than any

other strategy for all the

states of nature.

�

There are no probabilities

assigned to each state of

nature.

Decision-Making

under Risk

In

most cases, there usually

does not exist one

dominant strategy for all

states of nature. In a realistic

situation,

higher profits are usually

accompanied by higher risks and therefore

higher probable

losses.

When

there does not exist a

dominant strategy, a probability

must be assigned to the occurrence of

each

state

of nature.

Risk

can be viewed as outcomes

(i.e., states of nature)

that can be described within

established

confidence

limits (i.e., probability

distributions). These probability

distributions are obtained

from well-

defined

experimental distributions.

Decision-making

under Uncertainty

The

difference between risk and uncertainty

is that under risk there are

assigned probabilities, and

under

uncertainty

meaningful assignments of probabilities

are not possible. As with

decision making under

356

Project

Management MGMT627

VU

risk,

uncertainty also implies

that there may exist no

single dominant strategy.

The decision-maker,

however,

does have at his disposal four

basic criteria from which to

make a management decision.

The

decision

about which criterion to use

will depend on the type of project as

well as the project

manager's

tolerance

to risk.

Risk

Management Process

It

is important that a risk

management strategy is established early in a

project and that risk

is

continually

addressed throughout the project

life cycle. Risk management

includes several related

actions

involving risk: planning,

assessment (identification and analysis),

handling, and monitoring:

�

Risk

planning: This

is the process of developing

and documenting an organized,

comprehensive, and

interactive

strategy and methods for

identifying and tracking risk

issues, developing risk

handling plans,

performing

continuous risk assessments to

determine how risks have changed, and

assigning adequate

resources.

�

Risk assessment: This

process involves identifying and

analyzing program areas and

critical technical

process

risks to increase the likelihood of

meeting cost, performance, and schedule

objectives.

�Risk

identification is the

process of examining the program

areas and each critical

technical process to

identify

and document the associated risk.

Risk

analysis is the

process of examining each

identified risk

issue

or process to refine the description of

the risk, isolate the cause,

and determine the effects.

�

Risk handling: This

is the process that identifies,

evaluates, selects, and implements

options in order

to

set risk at acceptable

levels given program constraints

and objectives. This

includes the specifics on

what

should be done, when it should be

accomplished, who is responsible, and associated

cost and

schedule.

Risk handling options

include assumption, avoidance, control

(also known as mitigation), and

transfer.

The most desirable handling

option is selected, and a

specific approach is then developed

for

this

option.

�

Risk monitoring: This

is the process that systematically

tracks and evaluates the performance of

risk

handling

actions against established metrics throughout the

acquisition process and provides

inputs to

updating

risk handling strategies, as

appropriate.

44.6

Risk

Planning

Risk

planning is the detailed formulation of a

program of action for the

management of risk. It is the

process

to:

�

Develop and document an organized,

comprehensive, and interactive risk

management strategy.

�

Determine the methods to be used to

execute a program's risk management

strategy.

�

Plan for adequate

resources.

Risk

planning is iterative and includes the

entire risk management

process, with activities to

assess

(identify

and analyze), handle, monitor

(and document) the risk associated

with a program. The result

is

often

the risk management plan

(RMP).

Planning

begins by developing and documenting a

risk management strategy.

Early efforts establish the

purpose

and objective, assign responsibilities

for specific areas, identify

additional technical expertise

needed,

describe the assessment process

and areas to consider,

define a risk rating approach,

delineate

procedures

for consideration of handling

options, establish monitoring metrics

(where possible), and

define

the reporting, documentation, and

communication needs.

The

RMP is the roadmap that tells the

project team how to get from

where the program is today to

where

the program manager wants it to be in the

future. The key to writing a

good RMP is to

provide

the

necessary information so the program

team knows the objectives, goals, and the

risk management

process.

Since it is a roadmap, it may be specific in

some areas, such as the

assignment of

responsibilities

for project personnel and

definitions, and general in other areas

to allow users to

choose

the

most efficient way to proceed.

For example, a description of techniques

that suggests several

methods

for evaluators to use to assess

risk is appropriate, since

every technique has

advantages and

disadvantages

depending on the situation.

357

Project

Management MGMT627

VU

44.7

Risk

Assessment

Risk

assessment is the problem

definition stage

of risk management, the stage

that identifies,

analyzes,

and

quantifies program issues in

terms of probability and

consequences, and possibly

other

considerations

(e.g., the time to impact). The

results are a key input to

many subsequent risk

management

actions. It is often a difficult and

time-consuming part of the risk

management process.

There

are no quick answers or

shortcuts. Tools are

available to assist evaluators in

assessing risk, but

none

are totally suitable for

any program and are often

highly misleading if the user

does not understand

how

to apply them or interpret the results.

Despite its complexity, risk

assessment is one of the

most

important

phases of the risk management

process because the caliber

and quality of assessments

can

have

a large impact on program

outcomes.

The

components of assessment-- identification

and analysis-- are performed

sequentially with

identification

being the first step.

Risk

identification begins by compiling the program's

risk issues. Project issues

should be examined and

identified

by reducing them to a level of detail

that permits an evaluator to understand the

significance

of

any risk and its causes

(e.g., risk issues). This is a

practical way of addressing the

large and diverse

number

of potential risks that often occur in

moderate- to large-scale programs.

For

example, a WBS level 4 or 5 element

may be made up of several risk

issues associated with

a

specification

or function.

Risk

analysis is a technical and systematic

process to examine identified risks,

isolate causes,

determine

the

relationship to other risks, and express

the impact in terms of probability and

consequence of

occurrence.

44.8

Risk

Identification

The

second step in risk

management is to identify all

potential risk issues. This

may include a survey

of

the

program, customer, and users for

concerns and problems.

Some

degree of risk always exists in

project, technical, test,

logistics, production, and engineering

areas.

Project

risks include cost, funding,

schedule, contract relationships, and

political risks. (Cost and

schedule

risks are often so fundamental to a

project that they may be

treated as stand-alone risk

categories.)

Technical risks, such as related to

engineering and technology, may

involve the risk of

meeting

a performance requirement, but may

also involve risks in the feasibility of

a design concept or

the

risks associated with using

state-of-the-art equipment or software.

Production risk includes

concerns

over

packaging, manufacturing, lead times, and

material availability. Support risks

include

maintainability,

operability, and trainability concerns.

The understanding of risks in these and

other

areas

evolves over time.

Consequently,

risk identification must

continue through all project

phases.

The

methods for identifying risk

are numerous. Common practice is to

classify project risk

according to

its

source. Most sources are

either objective or

subjective.

Objective

sources: Recorded

experience from past projects and the

current project as it

proceeds

�

Lessons learned

files

�

Program documentation

evaluations

�

Current performance data

Subjective

sources: Experiences

based upon knowledgeable

experts

�

Interviews and other data

from subject matter experts

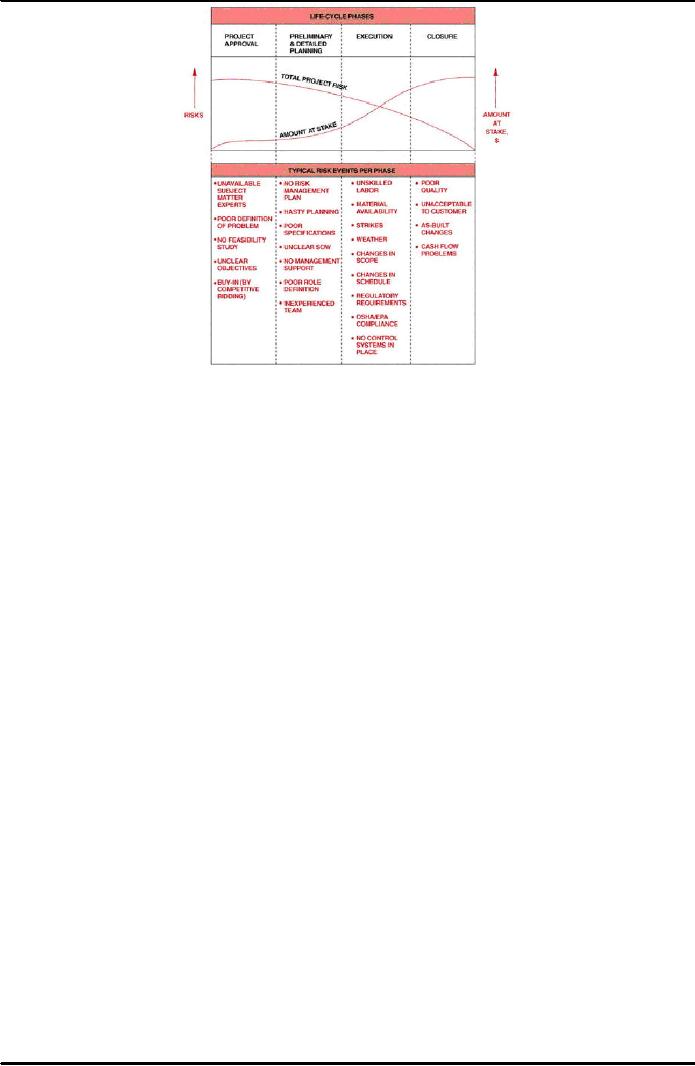

Risks

can also be identified according to

life-cycle phases, as shown in Figure

44.3. In the early

life-

cycle

phases, the total project

risk is high because of lack

of information. In the later life-cycle

phases,

the

financial risk is the

greatest.

358

Project

Management MGMT627

VU

Figure

44.3: Life-cycle

risk analysis

Any

source of information that

allows recognition of a potential

problem can be used for

risk

identification.

These include:

�

Systems engineering

documentation

�

Life-cycle cost analysis

�

Plan/WBS decomposition

�

Schedule analysis

�

Baseline cost estimates

�

Requirements documents

�

Lessons learned

files

�

Assumption analysis

�

Trade studies/analyses

�

Technical performance measurement

(TPM) planning/analysis

�

Models (influence diagrams)

�

Decision drivers

�

Brainstorming

�

Expert judgment

Expert

judgment techniques are applicable

not only for risk

identification, but also for

forecasting and

decision-making.

Two expert judgment techniques

are the Delphi method and the

nominal group

technique.

The Delphi method has the

following general steps:

Step

1: A

panel of experts is selected from

both inside and outside the

organization. The experts do

not

interact on a face-to-face basis and may

not even know who else

sits on the panel.

Step

2: Each

expert is asked to make an anonymous

prediction on a particular

subject.

Step

3: Each

expert receives a composite feedback of the

entire panel's answers and

is asked to

make

new predictions based upon

the feedback. The process is then

repeated as necessary.

Closely

related to the Delphi method is the

nominal group technique,

which allows for

face-to-face

contact

and direct communication. The

steps in the nominal group

technique are as

follows:

Step

1: A

panel is convened and asked to generate

ideas in writing.

Step

2: The

ideas are listed on a board

or a flip chart. Each idea is

discussed among the panelists.

Step

3: Each

panelist prioritizes the ideas,

which are then ranked

mathematically. Steps 2 and 3

may

be

repeated as necessary.

359

Project

Management MGMT627

VU

Expert

judgment techniques have the potential

for bias in risk

identification and analysis.

Factors

affecting

the bias include:

�

Overconfidence in one's

ability

�

Insensitivity to the problem or

risk

�

Proximity to project

�

Motivation

�

Recent event

recall

�

Availability of time

�

Relationship with other

experts

There

exist numerous ways to classify risks. In

a simple business context,

risk can be defined

as:

�

Business risk

�

Insurable risk

Business

risks provide us with opportunities of

profit and loss. Examples of business

risk would be

competitor

activities, bad weather, inflation,

recession, customer response,

and availability of

resources.

Insurable

risks provide us with only a

chance for a loss. Insurable

risks include such elements

as:

Direct

property damage: This

includes insurance for

assets such as fire insurance,

collision insurance,

and

insurance for project materials,

equipment, and properties.

Indirect

consequential loss: This

includes protection for contractors

for indirect losses due to

third

party

actions, such as equipment replacement and debris

removal.

Legal

liability: This

is protection for legal

liability resulting from

poor product design, design

errors,

product

liability, and project performance

failure. This does not

include protection from loss

of

goodwill.

Personnel:

This

provides protection resulting

from employee bodily injury

(worker's compensation),

loss

of key employees, replacement cost of key

employees, and several other types of

business losses

due

to employee actions.

On

construction projects, the owner/customer usually

provides ''wrap-up" or "bundle"

insurance, which

bundles

the owner, contractor, and subcontractors

into one insurable package.

The contractor may be

given

the responsibility to provide the bundled

package, but it is still

paid for by the

owner/customer.

44.9

Risk

Handling

Risk

handling includes specific

methods and techniques to deal with

known risks, identifies who

is

responsible

for the risk issue, and

provides an estimate of the cost and

schedule associated with

reducing

the

risk, if any. It involves

planning and execution with the

objective of reducing risks to an

acceptable

level.

The evaluators who assess

risk should begin the

process by identifying risks and

developing

handling

options and approaches to propose to the

program manager, who selects the

appropriate one(s)

for

implementation. There are several factors

that can influence our

response to a risk, including

but not

limited

to:

�

Amount

and quality of information on the actual

hazards that caused the risk

(descriptive

uncertainty)

�

Amount

and quality of information on the

magnitude of the damage (measurement

uncertainty)

�

Amount

and quality of information on probability

of occurrence

�

Personal

benefit to project manager

for accepting the risk (voluntary

risk)

�

Risk

forced upon project manager

(involuntary risk)

�

Confusion

and avoidability of the risk

�

The

existence of cost-effective alternatives

(equitable risks)

�

The

existence of high-cost alternatives or

possibly lack of options

(inequitable risks)

�

Length

of exposure to the risk

Risk

handling must be compatible

with the RMP and any

additional guidance the program

manager

provides.

A critical part of risk

handling involves refining and selecting

the most appropriate

handling

360

Project

Management MGMT627

VU

option(s)

and specific approach (es)

for selected risk issues

(often those with medium or

higher risk

levels).

Personnel

who evaluate candidate risk

handling options may use

the following criteria as

starting points

for

evaluation:

�

Can the option be feasibly

implemented and still meet the

user's needs?

�

What is the expected effectiveness of the

handling option in reducing

program risk to an

acceptable

level?

�

Is the option affordable in terms

of dollars and other resources (e.g.,

use of critical materials,

and

test facilities)?

�

Is time available to develop and

implement the option, and what

effect does that have on

the

overall

program schedule?

�

What effect does the

option have on the system's technical

performance?

Risk

handling options include:

risk assumption, risk avoidance,

risk control, and risk

transfer.

Although

the control option (often

called mitigation) is commonly

used in many high

technology

programs,

it should not automatically be

chosen. All four options

should be evaluated, and the best

one

chosen

for each risk

issue.

The

options for handling risk

fall into the following

categories:

Risk

assumption (i.e., retention): The

project manager says, ''I

know the risk exists and am aware of

the

possible

consequences. I am willing to wait and

see what happens. I accept

the risk and its

impact

should

it occur."

Risk

avoidance: The

project manager says, "I

will not accept this

option because of the

potentially

unfavorable

results."

Risk

control (i.e., prevention or mitigation):

The

project manager says, "I

will take the

necessary

measures

required to control this

risk by continuously reevaluating it and

developing contingency plans

or

fall-back positions. I will do

what is expected."

Risk

transfer: The

project manager says, "I

will share this risk

with others through

insurance or a

warranty,

or transfer the entire risk to them.

Perhaps I can convert the

risk into an

opportunity."

361

Table of Contents:

- INTRODUCTION TO PROJECT MANAGEMENT:Broad Contents, Functions of Management

- CONCEPTS, DEFINITIONS AND NATURE OF PROJECTS:Why Projects are initiated?, Project Participants

- CONCEPTS OF PROJECT MANAGEMENT:THE PROJECT MANAGEMENT SYSTEM, Managerial Skills

- PROJECT MANAGEMENT METHODOLOGIES AND ORGANIZATIONAL STRUCTURES:Systems, Programs, and Projects

- PROJECT LIFE CYCLES:Conceptual Phase, Implementation Phase, Engineering Project

- THE PROJECT MANAGER:Team Building Skills, Conflict Resolution Skills, Organizing

- THE PROJECT MANAGER (CONTD.):Project Champions, Project Authority Breakdown

- PROJECT CONCEPTION AND PROJECT FEASIBILITY:Feasibility Analysis

- PROJECT FEASIBILITY (CONTD.):Scope of Feasibility Analysis, Project Impacts

- PROJECT FEASIBILITY (CONTD.):Operations and Production, Sales and Marketing

- PROJECT SELECTION:Modeling, The Operating Necessity, The Competitive Necessity

- PROJECT SELECTION (CONTD.):Payback Period, Internal Rate of Return (IRR)

- PROJECT PROPOSAL:Preparation for Future Proposal, Proposal Effort

- PROJECT PROPOSAL (CONTD.):Background on the Opportunity, Costs, Resources Required

- PROJECT PLANNING:Planning of Execution, Operations, Installation and Use

- PROJECT PLANNING (CONTD.):Outside Clients, Quality Control Planning

- PROJECT PLANNING (CONTD.):Elements of a Project Plan, Potential Problems

- PROJECT PLANNING (CONTD.):Sorting Out Project, Project Mission, Categories of Planning

- PROJECT PLANNING (CONTD.):Identifying Strategic Project Variables, Competitive Resources

- PROJECT PLANNING (CONTD.):Responsibilities of Key Players, Line manager will define

- PROJECT PLANNING (CONTD.):The Statement of Work (Sow)

- WORK BREAKDOWN STRUCTURE:Characteristics of Work Package

- WORK BREAKDOWN STRUCTURE:Why Do Plans Fail?

- SCHEDULES AND CHARTS:Master Production Scheduling, Program Plan

- TOTAL PROJECT PLANNING:Management Control, Project Fast-Tracking

- PROJECT SCOPE MANAGEMENT:Why is Scope Important?, Scope Management Plan

- PROJECT SCOPE MANAGEMENT:Project Scope Definition, Scope Change Control

- NETWORK SCHEDULING TECHNIQUES:Historical Evolution of Networks, Dummy Activities

- NETWORK SCHEDULING TECHNIQUES:Slack Time Calculation, Network Re-planning

- NETWORK SCHEDULING TECHNIQUES:Total PERT/CPM Planning, PERT/CPM Problem Areas

- PRICING AND ESTIMATION:GLOBAL PRICING STRATEGIES, TYPES OF ESTIMATES

- PRICING AND ESTIMATION (CONTD.):LABOR DISTRIBUTIONS, OVERHEAD RATES

- PRICING AND ESTIMATION (CONTD.):MATERIALS/SUPPORT COSTS, PRICING OUT THE WORK

- QUALITY IN PROJECT MANAGEMENT:Value-Based Perspective, Customer-Driven Quality

- QUALITY IN PROJECT MANAGEMENT (CONTD.):Total Quality Management

- PRINCIPLES OF TOTAL QUALITY:EMPOWERMENT, COST OF QUALITY

- CUSTOMER FOCUSED PROJECT MANAGEMENT:Threshold Attributes

- QUALITY IMPROVEMENT TOOLS:Data Tables, Identify the problem, Random method

- PROJECT EFFECTIVENESS THROUGH ENHANCED PRODUCTIVITY:Messages of Productivity, Productivity Improvement

- COST MANAGEMENT AND CONTROL IN PROJECTS:Project benefits, Understanding Control

- COST MANAGEMENT AND CONTROL IN PROJECTS:Variance, Depreciation

- PROJECT MANAGEMENT THROUGH LEADERSHIP:The Tasks of Leadership, The Job of a Leader

- COMMUNICATION IN THE PROJECT MANAGEMENT:Cost of Correspondence, CHANNEL

- PROJECT RISK MANAGEMENT:Components of Risk, Categories of Risk, Risk Planning

- PROJECT PROCUREMENT, CONTRACT MANAGEMENT, AND ETHICS IN PROJECT MANAGEMENT:Procurement Cycles