|

Project

Management MGMT627

VU

LESSON

12

PROJECT

SELECTION (CONTD.)

Broad

Contents

Q-Sort

Model

Pay-back

Period

Average

Rate of Return

Discounted

Cash Flow

Internal

Rate of Return (IRR)

12.1

Types

of Project Selection Models

(Continued):

�

Non-Numeric

Models:

�

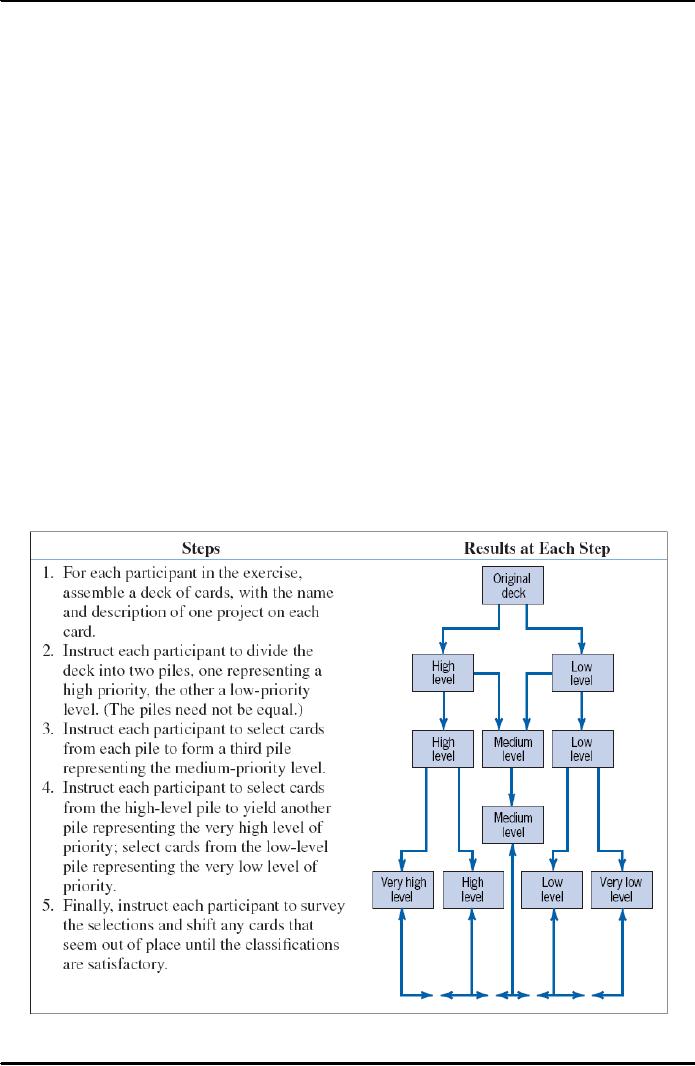

Q-Sort

Model:

Of

the several techniques for ordering projects, the

Q-Sort (Helin and

Souder,

1974)

is one of the most straightforward.

First, the projects are divided

into

three

groups--good,

fair, and

poor--according

to their relative merits. If

any

group

has more than eight members,

it is subdivided into two categories,

such

as

fair-plus

and

fair-minus.

When all categories have

eight or fewer

members,

the

projects within each category

are ordered from best to

worst. Again, the

order

is determined on the basis of relative

merit. The rater may use

specific

criteria

to rank each project, or may

simply use general overall

judgment. (See

Figure

12.1 below for an example of

a Q-Sort.)

Figure

12.1: Example of a

Q-Sort

97

Project

Management MGMT627

VU

The

process described may be carried

out by one person who is responsible

for

evaluation

and selection, or it may be performed by a committee

charged with

the

responsibility. If a committee handles the task, the

individual rankings

can

be

developed anonymously, and the set of

anonymous rankings can be

examined

by the committee itself for consensus. It

is common for such

rankings

to

differ somewhat from rater to

rater, but they do not

often vary strikingly

because

the individuals chosen for

such committees rarely

differ widely on

what

they feel to be appropriate

for the parent organization.

Projects

can then be selected in the

order of preference, though they

are usually

evaluated

financially before final

selection.

There

are other, similar

nonnumeric models for accepting or

rejecting projects.

Although

it is easy to dismiss such models as

unscientific, they should

not be

discounted

casually. These models are

clearly goal-oriented and directly

reflect

the

primary concerns of the

organization.

The

sacred cow model, in

particular, has an added

feature; sacred cow

projects

are

visibly supported by "the powers that

be." Full support by top

management

is

certainly an important contributor to

project success (Meredith,

1981).

Without

such support, the probability of project

success is sharply

lowered.

�

Numeric

Models: Profit/Profitability

As

noted earlier, a large

majority of all firms using

project evaluation and selection

models

use profitability as the sole

measure of acceptability. We will

consider these

models

first, and then discuss models

that surpass the profit test

for acceptance.

1.

Payback

Period:

The

payback period for a project

is the initial fixed investment in the

project

divided

by the estimated annual net cash inflows

from the project. The

ratio of

these

quantities is the number of years

required for the project to

repay its

initial

fixed investment. For

example, assume a project

costs $100,000 to

implement

and has annual net cash

inflows of $25,000.

Then

This

method assumes that the cash

inflows will persist at

least long enough to

pay

back the investment, and it ignores any

cash inflows beyond the

payback

period.

The method also serves as an

(inadequate) proxy for risk.

The faster the

investment

is recovered, the less the risk to which

the firm is exposed.

2.

Average

Rate of Return:

Often

mistaken as the reciprocal of the payback

period, the

average rate of

return

is the ratio of the average annual profit

(either before or after

taxes) to

the

initial or average investment in the

project. Because

average annual

profits

are

usually not equivalent to net

cash inflows, the average rate of

return does

not

usually equal the reciprocal of the

payback period. Assume, in the

example

just

given, that the average

annual profits are

$15,000:

Neither

of these evaluation methods is

recommended for project

selection,

though

payback period is widely

used and does have a

legitimate value for

cash

98

Project

Management MGMT627

VU

budgeting

decisions. The major advantage of these

models is their simplicity,

but

neither takes into account

the time-value of money. Unless interest

rates are

extremely

low and the rate of

inflation is nil, the failure to

reduce future cash

flows

or profits to their present

value will result in serious

evaluation errors.

3.

Discounted

Cash Flow:

Also

referred to as the Net Present Value

(NPV) method, the discounted

cash

flow

method determines the net present value of all

cash flows by

discounting

them

by the required rate of return

(also known as the hurdle

rate, cutoff

rate,

and

similar terms) as

follows:

To

include the impact of inflation

(or deflation) where pt

is

the predicted rate of

inflation

during period t,

we

have

Early

in the life of a project, net cash

flow is likely to be negative, the

major

outflow

being the initial investment in the

project, A0.

If the project is

successful,

however, cash flows will

become positive. The project

is acceptable

if

the sum of the net present values of all

estimated cash flows over

the life of

the

project is positive. A simple

example will suffice. Using

our $100,000

investment

with a net cash inflow of

$25,000 per year for a

period of eight

years,

a required rate of return of 15 percent, and an

inflation rate of 3 percent

per

year, we have

Because

the present value of the inflows is

greater than the present value of

the

outflow--

that is, the net present value is

positive--the project is

deemed

acceptable.

For

example:

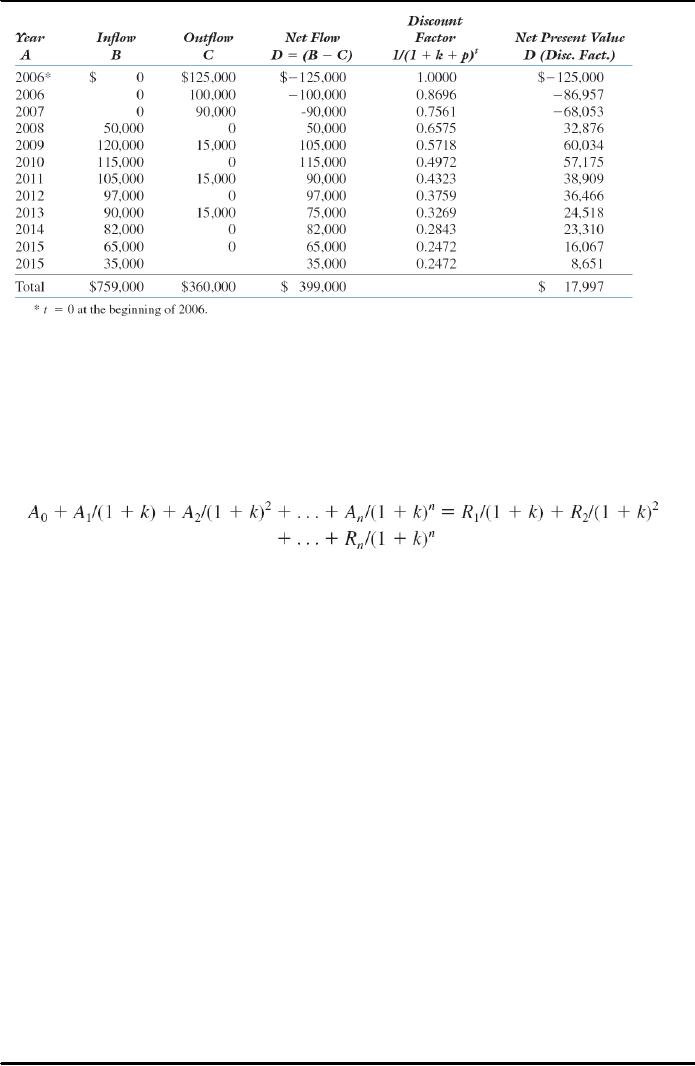

PsychoCeramic

Sciences, Inc. (PSI), a

large producer of cracked pots and

other

cracked

items, is considering the installation of a

new marketing

software

package

that will, it is hoped, allow more

accurate sales information

concerning

the

inventory, sales, and

deliveries of its pots as

well as its vases designed

to

hold

artificial flowers.

The

information systems (IS) department

has submitted a project

proposal that

estimates

the investment requirements as follows: an

initial investment of

$125,000

to be paid up-front to the Pottery

Software.

99

Project

Management MGMT627

VU

Corporation;

an additional investment of $100,000 to

modify and install the

software;

and another $90,000 to integrate the new

software into the

overall

information

system. Delivery and installation is

estimated to take one year;

integrating

the entire system should

require an additional

year.

Thereafter,

the IS department predicts that scheduled

software updates will

require

further expenditures of about

$15,000 every second year,

beginning in

the

fourth year. They will

not, however, update the software in the last

year of

its

expected useful life.

The

project schedule calls for

benefits to begin in the third

year, and to be up-

to-speed

by the end of that year. Projected

additional profits resulting

from

better

and more timely sales

information are estimated to be $50,000

in the first

year

of operation and are expected to peak at

$120,000 in the second year

of

operation,

and then to follow the

gradually declining pattern shown in the

table

12.1

below.

Project

life is expected to be 10 years from

project inception, at which

time the

proposed

system will be obsolete for

this division and will have to be

replaced.

It

is estimated, however, that the software

can be sold to a smaller division

of

PsychoCeramic

Sciences, Inc. (PSI) and

will thus, have a salvage value of

$35,000.

The Company has a 12 percent

hurdle rate for capital investments

and

expects

the rate of inflation to be about 3 percent

over the life of the

project.

Assuming

that the initial expenditure

occurs at the beginning of the year

and

that

all other receipts and

expenditures occur as lump

sums at the end of

the

year,

we can prepare the Net

Present Value analysis for the

project as shown in

the

table 12.1 below.

The

Net Present Value of the

project is positive and, thus, the

project can be

accepted.

(The project would have been

rejected if the hurdle rate were 14

percent.)

Just for the intellectual

exercise, note that the

total inflow for the

project

is $759,000, or $75,900 per year on

average for the 10 year

project. The

required

investment is $315,000 (ignoring the

biennial overhaul

charges).

Assuming

10 year, straight line

depreciation, or $31,500 per year, the

payback

period

would be:

A

project with this payback

period would probably be considered

quite

desirable.

100

Project

Management MGMT627

VU

Table

12.1: Net Present Value

(NPV) Analysis

4.

Internal

Rate of Return (IRR):

If

we have a set of expected

cash inflows and cash

outflows, the internal rate

of

return

is the discount rate that

equates the present values of the two

sets of

flows.

If

At

is

an expected cash outflow in the period

t

and

Rt

is

the expected

inflow

for the period t

,

the internal rate of return is the value

of k

that

satisfies

the

following equation (note

that the A

0

will be positive in this

formulation of

the

problem):

The

value of k

is

found by trial and

error.

5.

Profitability

Index:

Also

known as the benefitcost ratio, the

profitability index is the net

present

value

of all future expected cash

flows divided by the initial

cash investment.

(Some

firms do not discount the

cash flows in making this

calculation.) If this

ratio

is greater than 1.0, the project

may be accepted.

6.

Other

Profitability Models:

There

are a great many variations of the models

just described. These

variations

fall

into three general categories. These

are:

a)

Those

that subdivide net cash flow

into the elements that

comprises the

net

flow.

b)

Those

that include specific terms

to introduce risk (or

uncertainty,

which

is treated as risk) into the

evaluation.

c)

Those

that extend the analysis to consider effects

that the project

might

have

on other projects or activities in the

organization.

12.1.1

Advantages of Profit-Profitability Numeric

Models:

Several

comments are in order about

all the profit-profitability numeric

models. First,

let

us consider their advantages:

�

The

undiscounted models are simple to use and

understand.

�

All

use readily available

accounting data to determine the

cash flows.

�

Model

output is in terms familiar to

business decision

makers.

101

Project

Management MGMT627

VU

�

With

a few exceptions, model output is on an

"absolute" profit/profitability

scale

and

allows "absolute" go/no-go

decisions.

�

Some

profit models account for

project risk.

12.1.2

Disadvantages of Profit-Profitability

Numeric Models:

The

disadvantages of these models

are the following:

�

These

models ignore all

non-monetary factors except risk.

�

Models

that do not include

discounting ignore the timing of the

cash flows and the

timevalue

of money.

�

Models

that reduce cash flows to

their present value are

strongly biased toward

the

short

run.

�

Payback-type

models ignore cash flows

beyond the payback

period.

�

The

internal rate of return model

can result in multiple

solutions.

�

All

are sensitive to errors in the input

data for the early years of

the project.

�

All

discounting models are nonlinear, and the

effects of changes (or errors) in

the

variables

or parameters are generally

not obvious to most decision

makers.

�

All

these models depend for input on a

determination of cash flows,

but it is not

clear

exactly how the concept of

cash flow is properly

defined for the purpose

of

evaluating

projects.

12.1.3

Profit-Profitability Numeric Models

An Overview:

A

complete discussion of profit/profitability

models can be found in any

standard work

on

financial management--see Ross,

Westerfield, and Jordan (1995), for

example.

In

general, the net present value models are

preferred to the internal rate of

return

models.

Despite wide use, financial models

rarely include non-financial

outcomes in

their

benefits and costs. In a discussion of

the financial value of adopting

project

management

(that is, selecting as a project the use

of project management) in a

firm,

Githens

(1998) notes that

traditional financial models "simply

cannot capture the

complexity

and value-added of today's

process-oriented firm."

The

commonly seen phrase "Return

on Investment," or ROI, does

not denote any

specific

method

of calculation. It usually involves

Net Present Value (NPV) or

Internal

Rate

of Return (IRR) calculations,

but we have seen it used in reference

to

undiscounted

average rate of return models and

(incorrectly) payback period

models.

In

our experience, the payback period

model, occasionally using discounted

cash flows,

is

one of the most commonly

used models for evaluating

projects and other investment

opportunities.

Managers generally feel that

insistence on short payout periods tends

to

minimize

the risks

associated

with outstanding monies over the

passage of time.

While

this

is certainly logical, we prefer

evaluation methods that

discount cash flows and

deal

with

uncertainty more directly by considering

specific risks. Using the payout

period as

a

cash-budgeting tool aside, its

primary virtue is its

simplicity.

Real

Options: Recently,

a project selection model was

developed based on a

notion

well

known in financial markets. When one

invests, one foregoes the value of

alternative

future investments. Economists refer to

the value of an opportunity

foregone

as

the "opportunity cost" of the investment

made.

The

argument is that a project may have

greater net present value if

delayed to the

future.

If the investment can be delayed,

its cost is discounted compared to a

present

investment

of the same amount. Further, if the

investment in a project is delayed,

its

value

may increase (or decrease)

with the passage of time

because some of the

102

Project

Management MGMT627

VU

uncertainties

will be reduced. If the value of the

project drops, it may fail the

selection

process.

If the value increases, the investor

gets a higher payoff. The

real options

approach

acts to reduce both

technological and commercial risk.

For a full

explanation

of

the method and its use as a strategic selection

tool, see Luehrman (1998a

and 1998b).

An

interesting application of real

options as a project selection tool

for pharmaceutical

Research

and Development (R and D) projects is described by

Jacob and Kwak

(2003).

Real

options combined with Monte

Carlo simulation is compared

with alternative

selection/assessment

methods by Doctor, Newton, and

Pearson (2001).

PROJECT

PROPOSAL

12.2

Introduction:

Project

Proposal is the initial document that converts an

idea or policy into details

of a potential

project,

including the outcomes, outputs,

major risks, costs, stakeholders and an

estimate of the

resource

and time required.

To

begin planning a proposal,

remember the basic definition:

a

proposal is an offer or bid to

do

a

certain project for someone. Proposals

may contain other elements

technical background,

recommendations,

results of surveys, information about

feasibility, and so on. But

what makes a

proposal

a proposal is, that it asks the audience

to approve, fund, or grant permission to

do the

proposed

project.

If

you plan to be a consultant or

run your own business,

written proposals may be one of

your

most

important tools for bringing

in business. And, if you

work for a government

agency, non-

profit

organization, or a large corporation,

the proposal can be a

valuable tool for

initiating

projects

that benefit the organization or

you the employee proposed (and

usually both).

A

proposal should contain

information that would enable the

audience of that proposal to

decide

whether

to approve the project, to approve or

hire you to do the work, or

both. To write a

successful

proposal, put yourself in the place of

your audience the recipient of the

proposal,

and

think about what sorts of

information that person

would need to feel confident

having you

do

the project.

It

is easy to get confused about proposals.

Imagine that you have a

terrific idea for

installing

some

new technology where you

work and you write up a document

explaining how it

works

and

why it is so great, showing the benefits,

and then end by urging management to go

for it. Is

that

a proposal? The answer is "No", at

least not in this context.

It is more like a feasibility

report,

which studies the merits of a project and

then recommends for or against

it. Now, all it

would

take to make this document a

proposal would be to add elements

that ask management

for

approval for you to go ahead

with the project. Certainly,

some proposals must sell

the

projects

they offer to do, but in

all cases proposals must

sell the writer (or the

writer's

organization)

as the one to do the project.

12.3

Types

of Project Proposals:

Consider

the situations in which proposals occur.

A company may send out a

public

announcement

requesting proposals for a specific

project. This public announcement,

called a

Request

for Proposal (RFP),

could be issued through

newspapers, trade journals, Chamber

of

Commerce

channels, or individual letters. Firms or

individuals interested in the project

would

then

write proposals in which they

summarize their qualifications,

project schedules and

costs,

and

discuss their approach to the project.

The recipient of all these

proposals would then

evaluate

them, select the best candidate, and then

work up a contract.

103

Project

Management MGMT627

VU

But

proposals come about much

less formally. Imagine that

you are interested in doing a

project

at

work (for example,

investigating the merits of bringing in

some new technology to

increase

productivity).

Imagine that you visited

with your supervisor and tried to

convince her of this.

She

might respond by saying,

"Write me a proposal and I will

present it to upper management."

As

you can see from

these examples, proposals can be

divided into several categories:

1.

Internal

Proposal:

If

you write a proposal to someone

within your organization (a

business, a government

agency,

etc.), it is an internal proposal. With

internal proposals, you may

not have to

include

certain sections (such as

qualifications), or you may

not have to include as

much

information in them.

2.

External

Proposal:

An

external proposal is one written by a

separate, independent consultant

proposing to

do

a project for another firm.

It

can be a proposal from

organization or individual to

another

such entity.

3.

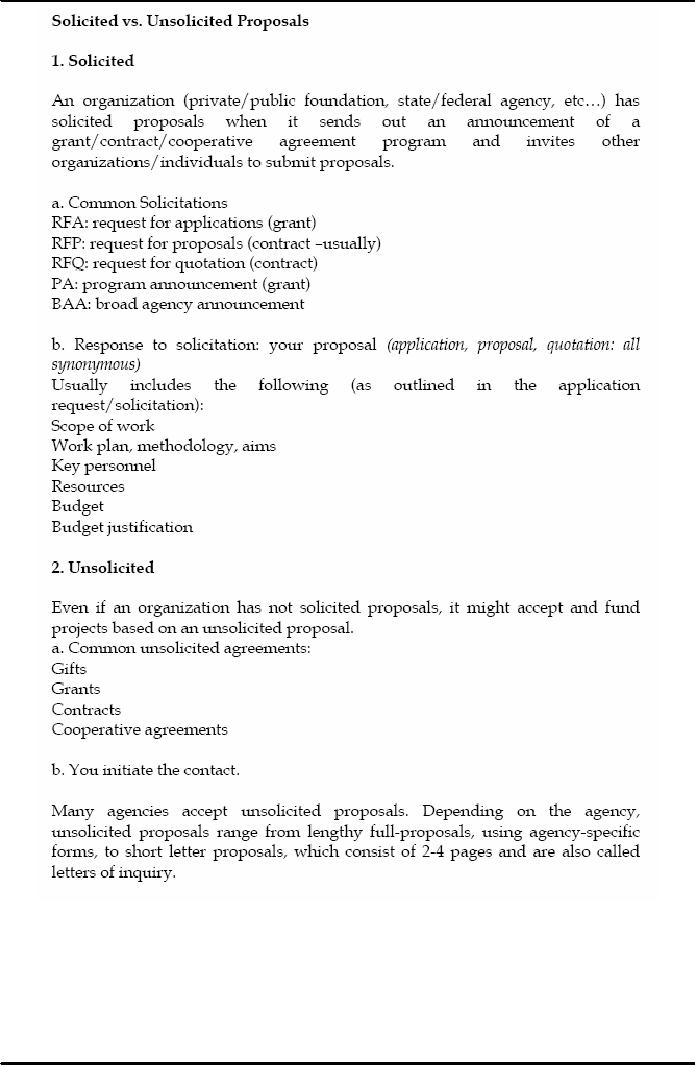

Solicited

Proposal:

If

a proposal is solicited, the recipient of

the proposal in some way

requested the

proposal.

Typically,

a company will send out

requests for proposals (RFPs)

through the

mail

or publish them in some news

source. But proposals can be

solicited on a very

local

level. For example, you

could be explaining to your

boss what a great thing

it

would

be to install a new technology in the

office; your boss might get

interested and

ask

you to write up a proposal

that offered to do a formal

study of the idea.

4.

Unsolicited

Proposal:

Unsolicited

proposals are those in which

the recipient has not

requested proposals.

With

unsolicited proposals, you sometimes

must convince the recipient

that a problem

or

need exists before you can

begin the main part of the

proposal.

104

Project

Management MGMT627

VU

Table

12.2: Solicited Versus

Unsolicited Proposals

12.3.1

Request for

Proposal:

A

Request for Proposal (referred to as RFP)

is an invitation for suppliers, through

a

bidding

process, to submit a proposal on a

specific product or service.

105

Project

Management MGMT627

VU

A

Request for Proposal (RFP) typically

involves more than the price.

Other requested

information

may include basic corporate

information and history, financial

information

(can

the company deliver without risk of

bankruptcy), technical capability

(used on

major

procurements of services, where the item

has not previously been

made or where

the

requirement could be met by

varying technical means),

product information such

as

stock

availability and estimated completion

period, and customer references

that can be

checked

to determine a company's

suitability.

In

the military, Request for Proposal (RFP)

is often raised to fulfill an

Operational

Requirement

(OR), after which the

military procurement authority will

normally issue a

detailed

technical specification against which

tenders will be made by

potential

contractors.

In the civilian use, Request

for Proposal (RFP) is usually part of a

complex

sales

process, also known as enterprise

sales.

Request

for Proposals (RFPs) often

include specifications of the item,

project or service

for

which a proposal is requested.

The more detailed the specifications, the

better the

chances

that the proposal provided

will be accurate. Generally

Request for Proposals

(RFPs)

are sent to an approved

supplier or vendor

list.

The

bidders return a proposal by a set

date and time. Late proposals

may or may not be

considered,

depending on the terms of the initial

Request for Proposal. The

proposals

are

used to evaluate the suitability as a

supplier, vendor, or institutional

partner.

Discussions

may be held on the proposals

(often to clarify technical

capabilities or to

note

errors in a proposal). In some

instances, all or only

selected bidders may be

invited

to

participate in subsequent bids, or

may be asked to submit their

best technical and

financial

proposal, commonly referred to as a

Best and Final Offer

(BAFO).

12.3.2

Request for Proposal (RFP)

Variation:

The

Request for Quotation (RFQ)

is used where discussions are

not required with

bidders

(mainly when the specifications of a

product or service are already

known), and

price

is the main or only factor in selecting

the successful bidder. Request

for Quotation

(RFQ)

may also be used as a step

prior to going to a full-blown

Request for Proposal

(RFP)

to determine general price

ranges. In this scenario, products,

services or suppliers

may

be selected from the Request

for Quotation (RFQ) results

to bring in to further

research

in order to write a more fully fleshed

out Request for Proposal

(RFP).

Request

for Proposal (RFP) is sometimes used

for a Request for

Pricing.

12.3.3

Request for Information

(RFI):

Request

for Information (RFI) is a

proposal requested from a

potential seller or a

service

provider to determine what products

and services are potentially

available in the

marketplace

to meet a buyer's needs and to

know the capability of a seller in

terms of

offerings

and strengths of the seller. Request

for Information (RFIs) are

commonly used

on

major procurements, where a requirement

could potentially be met

through several

alternate

means. A Request for

Information (RFI), however, is

not an invitation to

bid,

is

not binding on either the

buyer or sellers, and may or may

not lead to a Request

for

Proposal

(RFP) or Request for Quotation

(RFQ).

106

Table of Contents:

- INTRODUCTION TO PROJECT MANAGEMENT:Broad Contents, Functions of Management

- CONCEPTS, DEFINITIONS AND NATURE OF PROJECTS:Why Projects are initiated?, Project Participants

- CONCEPTS OF PROJECT MANAGEMENT:THE PROJECT MANAGEMENT SYSTEM, Managerial Skills

- PROJECT MANAGEMENT METHODOLOGIES AND ORGANIZATIONAL STRUCTURES:Systems, Programs, and Projects

- PROJECT LIFE CYCLES:Conceptual Phase, Implementation Phase, Engineering Project

- THE PROJECT MANAGER:Team Building Skills, Conflict Resolution Skills, Organizing

- THE PROJECT MANAGER (CONTD.):Project Champions, Project Authority Breakdown

- PROJECT CONCEPTION AND PROJECT FEASIBILITY:Feasibility Analysis

- PROJECT FEASIBILITY (CONTD.):Scope of Feasibility Analysis, Project Impacts

- PROJECT FEASIBILITY (CONTD.):Operations and Production, Sales and Marketing

- PROJECT SELECTION:Modeling, The Operating Necessity, The Competitive Necessity

- PROJECT SELECTION (CONTD.):Payback Period, Internal Rate of Return (IRR)

- PROJECT PROPOSAL:Preparation for Future Proposal, Proposal Effort

- PROJECT PROPOSAL (CONTD.):Background on the Opportunity, Costs, Resources Required

- PROJECT PLANNING:Planning of Execution, Operations, Installation and Use

- PROJECT PLANNING (CONTD.):Outside Clients, Quality Control Planning

- PROJECT PLANNING (CONTD.):Elements of a Project Plan, Potential Problems

- PROJECT PLANNING (CONTD.):Sorting Out Project, Project Mission, Categories of Planning

- PROJECT PLANNING (CONTD.):Identifying Strategic Project Variables, Competitive Resources

- PROJECT PLANNING (CONTD.):Responsibilities of Key Players, Line manager will define

- PROJECT PLANNING (CONTD.):The Statement of Work (Sow)

- WORK BREAKDOWN STRUCTURE:Characteristics of Work Package

- WORK BREAKDOWN STRUCTURE:Why Do Plans Fail?

- SCHEDULES AND CHARTS:Master Production Scheduling, Program Plan

- TOTAL PROJECT PLANNING:Management Control, Project Fast-Tracking

- PROJECT SCOPE MANAGEMENT:Why is Scope Important?, Scope Management Plan

- PROJECT SCOPE MANAGEMENT:Project Scope Definition, Scope Change Control

- NETWORK SCHEDULING TECHNIQUES:Historical Evolution of Networks, Dummy Activities

- NETWORK SCHEDULING TECHNIQUES:Slack Time Calculation, Network Re-planning

- NETWORK SCHEDULING TECHNIQUES:Total PERT/CPM Planning, PERT/CPM Problem Areas

- PRICING AND ESTIMATION:GLOBAL PRICING STRATEGIES, TYPES OF ESTIMATES

- PRICING AND ESTIMATION (CONTD.):LABOR DISTRIBUTIONS, OVERHEAD RATES

- PRICING AND ESTIMATION (CONTD.):MATERIALS/SUPPORT COSTS, PRICING OUT THE WORK

- QUALITY IN PROJECT MANAGEMENT:Value-Based Perspective, Customer-Driven Quality

- QUALITY IN PROJECT MANAGEMENT (CONTD.):Total Quality Management

- PRINCIPLES OF TOTAL QUALITY:EMPOWERMENT, COST OF QUALITY

- CUSTOMER FOCUSED PROJECT MANAGEMENT:Threshold Attributes

- QUALITY IMPROVEMENT TOOLS:Data Tables, Identify the problem, Random method

- PROJECT EFFECTIVENESS THROUGH ENHANCED PRODUCTIVITY:Messages of Productivity, Productivity Improvement

- COST MANAGEMENT AND CONTROL IN PROJECTS:Project benefits, Understanding Control

- COST MANAGEMENT AND CONTROL IN PROJECTS:Variance, Depreciation

- PROJECT MANAGEMENT THROUGH LEADERSHIP:The Tasks of Leadership, The Job of a Leader

- COMMUNICATION IN THE PROJECT MANAGEMENT:Cost of Correspondence, CHANNEL

- PROJECT RISK MANAGEMENT:Components of Risk, Categories of Risk, Risk Planning

- PROJECT PROCUREMENT, CONTRACT MANAGEMENT, AND ETHICS IN PROJECT MANAGEMENT:Procurement Cycles