|

Project

Management MGMT627

VU

LESSON

10

PROJECT

FEASIBILITY (CONTD.)

Broad

Contents

Characteristics

of a Feasibility Study

The

Feasibility Study - What Bankers

Like to See in Them

The

Feasibility Assessment

Process

The

Process of Feasibility

Study

Conclusion

Feasibility Study

10.1

Characteristics

of a Feasibility Study:

The

feasibility study phase

considers the technical aspects of the

conceptual alternatives and

provides

a firmer basis on which to decide

whether to undertake the

project.

The

purpose of the feasibility phase is

to:

�

Plan

the project development and

implementation activities.

�

Estimate

the probable elapsed time,

staffing, and equipment

requirements.

�

Identify

the probable costs and consequences of

investing in the new

project.

If

practical, the feasibility study

results should evaluate the

alternative conceptual solutions

along

with associated benefits and

costs.

The

objective of this step is to

provide management with the

predictable results of

implementing

a specific project and to provide

generalized project requirements. This, in

the

form

of a feasibility study report, is

used as the basis on which to decide

whether to proceed

with

the costly requirements, development, and

implementation phases.

User

involvement during the feasibility

study is critical. The user

must supply much of

the

required

effort and information, and, in addition,

must be able to judge the

impact of alternative

approaches.

Solutions must be operationally,

technically, and economically feasible.

Much of

the

economic evaluation must be substantiated by the

user.

Therefore,

the primary user must be

highly qualified and intimately

familiar with the

workings

of

the organization and should come

from the line

operation.

The

feasibility study also deals

with the technical aspects of the

proposed project and requires

the

development of conceptual solutions. Considerable

experience and technical expertise

are

required

to gather the proper information, analyze

it, and reach practical

conclusions.

Improper

technical or operating decisions made

during this step may go

undetected or

unchallenged

throughout the remainder of the process.

In the worst case, such an

error could

result

in the termination of a valid project --

or the continuation of a project that is

not

economically

or technically feasible.

In

the feasibility study phase, it is

necessary to define the project's basic

approaches and its

boundaries

or scope. A typical feasibility

study checklist might

include:

�

Summary

level

�

Evaluate

alternatives

�

Evaluate

market potential

�

Evaluate

cost effectiveness

79

Project

Management MGMT627

VU

�

Evaluate

producibility

�

Evaluate

technical base

�

Detail

level

�

A

more specific determination of the

problem

�

Analysis

of the state-of-the-art technology

�

Assessment

of in-house technical

capabilities

�

Test

validity of alternatives

�

Quantify

weaknesses and unknowns

�

Conduct

trade-off analysis on time, cost, and

performance

�

Prepare

initial project goals and

objectives

�

Prepare

preliminary cost estimates and

development plan

The

end result of the feasibility

study is a management decision on

whether to terminate the

project

or to approve its next

phase. Although management

can stop the project at several

later

phases,

the decision is especially critical at

this point, because later

phases require a

major

commitment

of resources. All too often,

management review committees approve

the

continuation

of projects merely because termination at

this point might cast

doubt on the group's

judgment

in giving earlier

approval.

The

decision made at the end of the

feasibility study should

identify those projects that

are to be

terminated.

Once a project is deemed

feasible and is approved for

development, it must be

prioritized

with previously approved projects

waiting for development

(given a limited

availability

of capital or other resources). As

development gets underway,

management is given

a

series of checkpoints to monitor the project's actual

progress as compared to the

plan.

10.2

The

Feasibility Study - What Bankers

Like to See in Them:

A

cardinal rule in banking is to

borrow from a lender who

understands your business;

or, never

to

lend money on a business

project that you do not

understand. For this reason, even

though

most

groups involve their banker

early in the process, a feasibility

study is often done with

an

eye

towards explaining the project to

potential financers. Bankers, as different

clients for the

feasibility

study, can have different requirements

for the study than group

members. In many

cases,

the feasibility study is the formal

project presentation to a lender. This

section

summarizes

a feasibility study here

with the banker in

mind.

Many

groups work with bankers

with whom they already have

an established business

relationship.

This relationship could be

with another cooperative project or

with their personal

business.

This can ease the process of

obtaining financing for a

project. However even

when

working

with a banker, who is

familiar with the members, it is

important that the banker

know

and

understand the unique aspects of

cooperatives.

From

the perspective of a banker, or other perspective

financer, the feasibility

study should

contain

the information described in the table

10.1 below.

80

Project

Management MGMT627

VU

Table

10.1: Information Content of Feasibility

Study

This

does not mean that a

banker or financer is not interested in

other aspects of the

feasibility

study.

Each has their own

area of interest and concern; however,

the following will be

needed

for

most, if not all

bankers.

1.

Executive

Summary:

This

should be short, to the point, yet

still complete. If the banker cannot read

the

summary

and understand the basics of the project

the odds are that project

will receive

financing.

This should contain:

�

Project

purpose: What

is the project and who is

involved?

�

Repayment

possibility: Does

the study show the ability of the

investment to be

recovered

over a specific time period?

Does it give investment (cost)

parameters?

Can

it convince bankers the investment is

needed, even if it is marginally

feasible?

�

Projected

Financial Returns: What

are the projected financial

scale, the revenues,

and

the operating costs? What is net the

income?

�

Economic

Benefits: What

are the Return on Investment

(ROI) and the Internal

Rate

of

Return (IRR) of the

project?

2.

The

Financial Package

Blueprint:

The

banker needs to clearly see

what resources the group

wants from the bank.

The

bank

will require information to calculate

potential project risk and the

bank's exposure

for

any monies loaned to the group.

They also want to know the

financial commitment

to

the project from the members.

This blueprint should

contain the following

elements:

�

Characteristics

of assets to be financed.

�

Expected

rate of conversion to cash-liquidity

What is the project's funding

potential

and what repayment terms will be

required?

�

Risk

evaluation data What

are internal (yields, costs,

etc) and external (inflation,

energy,

etc) project risks? What if the

key assumptions are not

perfect? What is the

bank's

exposure?

�

Evaluating

Economic Consequences Do net reserves

cover capital cost? Does

the

plan

keep the project from capital

erosion?

81

Project

Management MGMT627

VU

�

Financial

Forecast What are the

next three years projected

cash flows, operating

statements,

and balance sheets? What are

the source and use of funds?

�

Documentation

What rational is used to support

the assumptions?

10.3

The

Feasibility Assessment

Process:

It

is often suggested that

feasibility studies should

encompass at least two

assessments:

�

Technical

feasibility

�

Economic

feasibility

The

technical feasibility embodies an

assessment of the physical, technical and

technological

dimensions

of the project while the economic

feasibility assesses the project's

economic

viability

within its defined

domain.

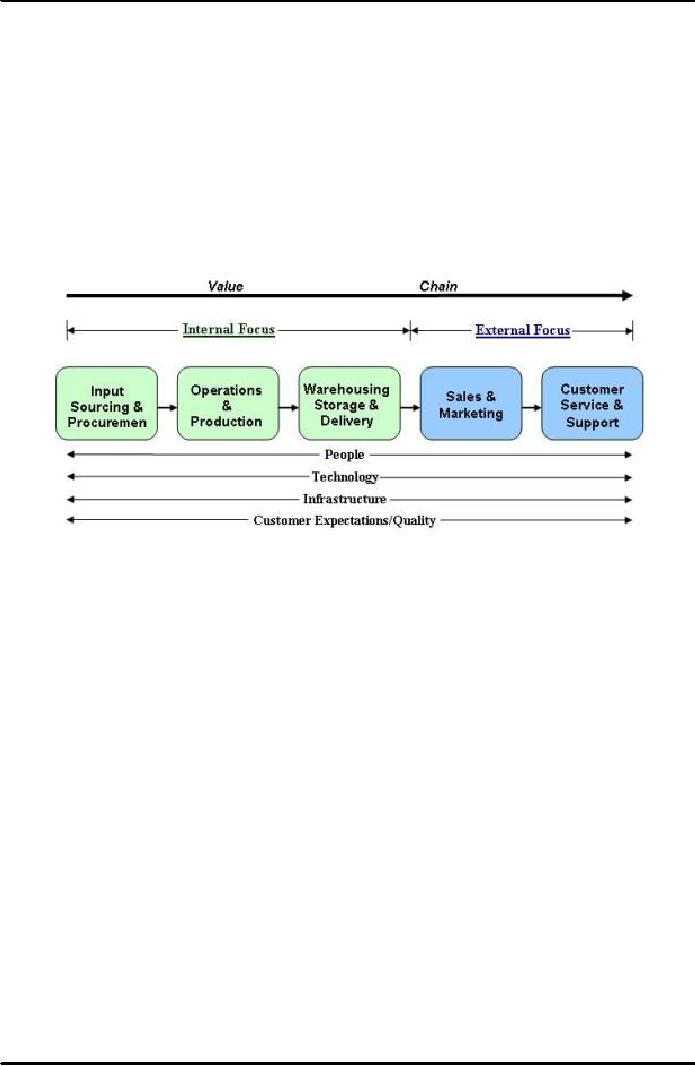

Figure

10.1: The Value Chain

Approach to Feasibility

Assessment

The

value chain approach (shown in

Figure 10.1 above) allows

the two assessments to be

embedded

into a single initiative,

facilitating an increased understanding

and appreciation of the

domain's

effects on the different stages from

input sourcing and procurement to

customer

service

and support. It also facilitates an

appreciation of the resources,

technology, customer

expectations

and infrastructure required for the

initiative to succeed, allowing an

assessment of

their

level and depth at each

subsequent stage in the value

chain.

10.3.1

Input Sourcing and

Procurement:

We

begin conducting the feasibility of the

business initiative from the

logical point in

the

value chain, i.e., input

sourcing and procurement. The

technical dimension of the

analysis

at this stage encompasses

the availability of the required

inputs in the

appropriate

levels of quality and quantity.

The assessment of availability

involves an

evaluation

of cycles and trends for

both quantity and quality of the

inputs. We are also

interested

in the physical movement of the inputs

from their origination

points to the

facilities

where they will be processed.

Different sources of supply

are evaluated for

their

quality and quantity as well

as cycles/trends in these characteristics. If

specific

human

resources and technologies are

required to facilitate the effectiveness of

the

input

sourcing and procurement stage, their

availability is assessed within the

domain of

the

project. Likewise, the infrastructure

support for effectively procuring

inputs from

origination

points to processing facility is

also assessed.

The

economics of input sourcing and

procurement emanates directly from the

technical

assessment.

The prevailing market prices

of inputs as well as costs

associated with the

procurement

are assessed at the input

sourcing and procurement stage. The

objective is

82

Project

Management MGMT627

VU

not

to determine the price but the range of

prices that have been

typical in the domain

over

a reasonable period of time to

allow for the capture of the trends

and cycles in the

prices.

The price trends and

cycles can be matched against the

quantity and quality

trends

and cycles to provide insights

into potential bottlenecks in the

input sourcing and

procurement

function of the business initiative

under consideration.

10.3.2

Operations and Production:

The

transformation of inputs into outputs

occurs at the operations and production

stage

of

the value chain. This is

also the stage that will

generally absorb the lion's

share of

the

investment capital. Therefore,

from the capital resource

allocation perspective, the

feasibility

requirements at the operations and production

stage must be conducted

with

all

the diligence necessary to address

all the requisite

issues.

The

objective of the technical feasibility

assessment at operations and production

stage

of

the value chain is to determine if the

technology being envisaged for the

proposed

project

is suitable for the desired quantity and

quality of product the project

wants to

present

to the marketplace. It also seeks to

determine if the equipment and

its

associated

technologies are at the appropriate

operational scale. Within the

value chain

framework,

the feasibility assessment of the operations and

production technologies is

conducted

by laying out the physical

process from input receipts to

packaging and

transfer

to storage and warehousing and/or

delivery.

Because

of the level of specialized knowledge

required to do justice to the

operations

and

production technical aspects of the

feasibility assessment, it is pertinent

that the

professionals

with the required knowledge and

experience are recruited to provide

the

intellectual

content for the process. It is important

that you do not lock

yourself into a

technological

jam by myopically focusing

only on a single technology.

Instead, you

must

encourage your engineering and

technical professional input

providers to provide

you

with the full range of their

knowledge about the technologies and

equipments

available.

You also need to assess the

physical layout of the equipment

and its impact

on

operational efficiency. These

professionals must also be encouraged to

provide

insights

into how the different

technologies compare with

respect to the number of

people

and their requisite skill

levels required to operate them from

beginning to end as

well

as their attendant operational inputs

electricity, natural gas or

gasoline,

maintenance

protocols and shut down

protocols, availability and turnaround

of

technical

support, etc.

The

previous information provides the

foundation for the economic assessment of

the

alternative

technical solutions that can

be used in the production process and

their

attendant

operational requirements. The technical

efficiencies of the alternative

technologies

should be weighed against their economic

efficiencies to determine

their

overall

effectiveness in the project's feasibility.

The best sources of the economic

data

to

support the assessment of the technologies

and operations are the suppliers of

the

equipment.

Such

primary data can be

collected by providing a detailed

description of your

product

to

potential suppliers in a Request for

Quote (RFQ) offer. The

principal advantage of

using

a Request for Quote (RFQ) is to

improve your knowledge of

alternative solutions

which

you may be unaware of,

should you settle on the supplier

you know. Given the

rate

of technical obsolescence, it is

imperative that capital investments in

technologies

are

made to maximize their

longevity given technical and economic

efficiency

considerations.

You should not overlook the

alternative of not making

direct

investments

in operations and production technologies,

but seek to assess

the

possibilities

of allying with a company with

existing processing and operation

capacity.

83

Project

Management MGMT627

VU

The

technical nature of the operations and

production stages of the

feasibility

assessment

requires that unbiased people who

are knowledgeable of the processes

are

hired

to help review the responses to the

Request for Quote (RFQ). You

should arrange

for

the responding suppliers to make presentations so

you and your consultants can

ask

the

necessary questions. Although this

process can be cumbersome and

time

consuming,

it is worthwhile if the equipment,

buildings and other operational

inputs are

a

significant component of the proposed project's

capital outlay.

10.3.3

Warehousing, Storage and

Delivery:

Generally,

agricultural value-added products are

stored or warehoused prior to

delivery

to

customers. Therefore, the feasibility

analysis should assess the implications

of

warehousing,

storage and delivery systems

for the project. It is important

that the

feasibility

study assesses alternative

sources of warehousing and

storage from

owning

facilities

to renting facilities to strategic

alliance with others. The

objective of these

alternatives

is to provide the project with

realistic alternatives for

consideration if the

project

is found to be feasible. The

feasibility assessment should

not only focus on the

physical

facilities but also on the

management technologies of warehouse and

storage

facilities

management. The product

tracking systems that

facilitate maximization of

space

utilization and turnover are

critical components of the assessment

process.

Additionally,

available infrastructures to support the physical

movement of products to

warehouses

or storage, and from there to customers,

must also be assessed.

For

example,

transportation systems may

influence how consumer ready

products can be

shipped

to improve processor

efficiently.

The

economics of the physical buildings,

location, infrastructure, technologies

and

other

associated resources are

brought to bear on the technical

options to ensure that

the

most

technically efficient and

economically effective alternatives

qualify for

consideration.

The best sources of

technical and economic information are

suppliers of

warehousing

and storage services. Trucking and

rail companies are often

very

forthcoming

in providing information on delivery

charges for specific products

from

certain

locations to certain destinations. The

accuracy of the data supplied by

these

service

suppliers is dependent on the clarity and

precision of the input information

they

need

to calculate their estimates. Thus, the

stepwise process of gathering

information is

important

because it provides the requisite

information that feeds into

future steps.

10.3.4

Sales and

Marketing:

Marketing

and sales are often

taken for granted in feasibility

studies. However,

they

provide

a direct insight into the

project's potential market and the

Structure,

Conduct

and

Performance (SCP) characteristics

of the players within the industry.

Therefore,

the

sales and marketing

feasibility assessment bridges the

intra-firm feasibility

dimensions

(those inside the firm) with

the extra-firm feasibility dimensions

(those

outside

of the firm).

The

conceptual backbone for the Structure, Conduct and

Performance (SCP) is the

assessment

of the demand and supply conditions of

the product and the behavior of

the

other

firms in the industry. The

supply and demand conditions

should cover the size

and

scope economies in the industry,

seasonality and trends, availability and strength

of

substitutes

to the product, industry growth

rates and demand

elasticities.

Industry

(market) structure refers to the number and size of

the firms (products) in the

industry

(market) that you intend to

enter. Industry conduct describes the

pricing

behavior

and price discovery mechanisms

used by firms in the industry. In

addition, it

84

Project

Management MGMT627

VU

assesses

product distribution mechanisms and

available channels as well as

promotional

initiatives

that are used in the

industry. The intensity of

research and development and

the

extent of legal tactics in the

industry all provide

indications of the depth of the

transaction

costs emanating from the conduct of firms

in the industry. Finally, the

industry

performance assesses the profitability of

firms in the industry. This

requires

information

on prices, product quality, technical

progress and industry

capacity

utilization.

10.3.5

Non-Market Factors:

A

technically and economically feasible

project can fail when

confronted with

certain

government

policies and/or regulations.

Therefore, feasibility studies

should assess the

existing

and/or planned regulatory

initiatives that impinge on the

project. For example,

environmental

regulations that are in place and

their technical and economic

compliance

effects on the project must be analyzed to

assess their implications

for

technology,

location, and other decisions. Similarly,

there is need to assess the

implications

of specific policies targeted to the

industry of interest and evaluate

changes

in

these policies. For example,

policies that offer

significant competitive advantage

to

the

industry but are subject to

change by administrative fiat

need to be assessed for

the

potential

effect on the viability of the proposed

project.

The

results of the foregoing analysis form

the backdrop for assessing the

feasibility of

your

product in the defined market

domain. It helps you position

your product within

the

context of what already exists and

how it may differentiate

itself to ensure its

competitive

advantage. The characteristics that

are engineered into the product, as

well

as

the pricing, promotion and distribution

or placement opportunities are all

influenced

by

a clear understanding and appreciation of the

industry's Structure, Conduct and

Performance

(SCP).

10.3.6

Data Collection:

Information

on industry structure and performance may be

obtained from various

government

statistics, such as those

developed and maintained by the Department

of

Commerce.

These databases offer

information on the number of firms and

employees,

average

wages and benefits, total

value of shipments, gross margins,

etc. In addition to

government

databases, specific industries

also collect their own

statistics and

commission

reports that may be purchased.

Interviews with specific

industry experts

can

also be a major information

source. Similarly, significant

information may be

obtained

from industry news in the

main media or in industry-specific

publications. For

example,

when industry news reports

indicate that plant closures

are increasing, it may

be

logically extrapolated that

industry capacity is high and

utilization is low.

The

implication

of this for performance is often

easily inferred for

undifferentiated or

commodity

industries. Marketing and promotional

information may be obtained

from

special

publications focusing on product

marketing and promotions. These

function-

specific

publications often discuss the

successful initiatives and can

provide significant

insights

into the approaches used in

particular industries. Another

source of

information

on industries is academics publications

and government documents.

Because

Structure, Conduct and Performance (SCP)

issues present important

policy

implications,

they are the subject of study in

many government and

academic

documents

and they can provide

important and significant insights on

market structure,

conduct

and performance situation in many

industries.

For

agricultural value-added initiatives,

secondary data can suffice

for the input

sourcing

and procurement segment of the

feasibility assessment. The

sources of these

secondary

data include industry and trade

publications as well as statistics of

industry

85

Project

Management MGMT627

VU

associations.

Additionally, a number of government

departments collect, analyze and

publish

some of these data. In special

cases, primary data

collection may be

necessary

and

this may be done through

formal surveys or interviews. For

example, different

suppliers

may be asked to provide

information on their products prices,

quantities and

qualities

as well as the stability of their

quotes, e.g., the frequency with

which they

change

their prices, quantities and quality. In

most cases, when potential

suppliers feel

the

project initiative is credible,

they will invest their

best efforts to provide the

required

information.

It

is important to note that the

effective collection of primary

data can be expensive

and

time

consuming. An alternative to primary data

when secondary data is not

neatly

available

is to pull them together from

different sources, ensuring

that measurements

and

definitions are similar

across sources. It may

sometimes be necessary to

transform

data

from different sources to comparable

units to attain the necessary

congruence

required

for

analysis.

10.3.7

Customer Service and

Support:

What

do customers want? Ask them.

The final step in the value

chain framework to

feasibility

assessment is finding out

what customers needs are

not being satisfied by

the

current

marketplace. The purpose of this is to

determine if the proposed project's

offer

stand

to make a difference in satisfying

customer needs. The results

will provide a

credible

input into the project's

product differentiation index

and allow the proponents

to

identify the appropriate placement and

promotional options to employ.

Customer

service

and support research allow the proposed

project to gain insights

into the nature

and

structure of its potential market. It

can develop market segments

at this step,

allowing

it to refocus other components of the

initiative or revisit earlier

steps in the

feasibility

assessment process. Since customers

are the final arbiters on the success of

a

product,

assessing how the project

addresses their unmet needs is

fundamental to the

project's

economic feasibility.

Information

for the customer segment of the

feasibility can be obtained

from reviewing

consumer

publications and industry

publications for general assessment of

needs and

how

the project's offering addresses them.

Direct information may be

obtained by

conducting

focus group interviews, surveys and/or

interviews. While these

initiatives

can

be expensive, they are

worthwhile if technical and economic

assessments thus, far

are

supportive of the project and more

information is required to make the

decision.

For

this reason, it is prudent

for the customer segment to be where it

is in the value

chain,

i.e., the end. However, it is important

to remember that the process described

in

this

document is hardly linear but rather

iterative, using information

from one stage to

dig

deeper into or gather new

information gathered from an earlier

stage.

10.3.8

The Decision

Recommendation:

The

purpose of a business feasibility

study is to make a decision about

whether to

proceed

with a particular business

opportunity. It provides the general

internal and

external

value chain conditions that

confront the business initiative

and evaluates the

proposed

initiative's ability to be economically

viable if it is found to be technically

and

operationally

feasible. Therefore, the emphasis on the

recommendations resulting from

the

feasibility study is economic or

financial.

The

easiest approach to the economic decision is to gather

all the information at the

different

stages of the value chain

and identify those that

require capital

expenditure

and

estimate these expenditures.

Additionally, identify the different

types of people and

skills

required to operate each stage of the

value chain and determine

what their wages,

86

Project

Management MGMT627

VU

salaries

and benefits will be.

Finally, identify other

project related costs such

as

infrastructure

development or improvements, occupancy,

advertising and promotion,

office

supplies and utility as well as fees and

municipal or state development

taxes

specific

to the project. Next, using the

production capacity, projected

market share

growth

rates and the estimated market size, in

conjunction with price

information

collected

in the various stages of the feasibility

study; develop a projected revenue

or

sales

statement. It is important to

specifically define all

assumptions that drive

the

income

and cash flow projections, e.g., the

mean or median wages, salaries

and

benefits,

current price and industry

average of plant operating

capacity, etc. Also,

analyze

all the data that were

collected to determine their

ranges, adjusted for special

circumstances

and use these to conduct the

sensitivity analysis on the economic

outcomes

of the project.

10.3.9

Cost and Revenue

Projections:

The

cost and revenue projections together

allow the development of the net cash

flow

emanating

from the business over the

projected time frame. This

statement can then be

subjected

to capital investment analysis by selecting a

reasonable discount rate

and

estimating

the Net Present Value (NPV)

and/or estimating the Internal

Rate of Return

(IRR)

associated with the projected

cash flow. A positive Net

Present Value (NPV)

implies

an economically feasible project and the

larger the positive Net

Present Value,

the

more economically feasible the project,

assuming the technical and

operational

feasibility

can be assumed. If the project owners

are making a decision based

on the

Internal

Rate of Return, then they

need to determine their

required rate of return and

compare

it to the estimated Internal Rate of

Return. If the Internal Rate of

Return (IRR)

exceeds

their required rate of return, then the

project is economically feasible. On

the

other

hand, if the estimated Internal Rate of

Return is less than the

proponents' required

rate

of return, then the project is

deemed economically infeasible even if it

is both

operationally

and technically feasible.

10.3.10

Sensitivity Analysis:

It

is important that the project

cash flow is subjected to the full range

of sensitivity

analysis

under a range of prices based on data

that is collected for the

feasibility study.

This

will provide the full range of

conditions that support the feasibility

of the project.

The

wider the band of feasible outcomes

results from varying the

critical assumptions,

the

more confident you can be

about the viability of your

project. On the other hand, if

the

band of feasibility is narrow vis-�-vis

the critical variables, then

the project's

viability

is more susceptible to uncertain shifts in

its marketplace. For this

reason, it is

emphasized

that the sensitivity analysis of the

feasibility analysis be conducted over

the

full

range of the project's industry

possibilities. These possibilities

may be divided into

three

blocks worse case,

normal case and best

case scenarios. Additionally,

the

sensitivity

analysis must be conducted for different

scenarios, for example, best

price

with

worst demand conditions.

This provides insights into

the critical bottlenecks to the

project's

viability and allows the proponents to

assess the decision

recommendations

within

a more informed framework.

10.4

Conclusion:

The

purpose of a feasibility study is to

help assess the viability of a

business proposition,

technically,

operationally and economically. The

value chain framework for

conducting

feasibility

studies has the unique advantage of

laying out the project in

its logical

configuration

from input procurement to customer

service and assessing the technical,

operational and

economic

feasibility at each stage, and

finally putting it all

together to assess the total

project

feasibility.

The advantage in this approach is

revealed in exposing the bottlenecks to

feasibility

87

Project

Management MGMT627

VU

along

the value chain so they can

be assessed for possible improvement.

The iterative nature of

the

approach is also helpful because it

allows the analyst to revisit

previous steps when

information

from latter steps suggests

the need. In the end, the logical and

step-wise process for

conducting

feasibility assessment within the

value chain framework helps

enhance transparency

of

the analysis and provide the foundations

for better decisions.

The

report was laid out to

reflect expectation of presentation of a

good feasibility report.

Thus,

it

is expected that such a report

will cover the input

sourcing and procurement, operations and

production,

warehousing, storage and delivery.

These three cover the logistics

aspects of the

production

process and draws on the infrastructure

conditions, technological and

technical

realities,

human resource availability, capabilities

and skills and customer expectations

of

quality

associated with the product.

Marketing, sales and

customer service take the analysis

into

the project's external domain to

assess industry structure, conduct and

performance

characteristics

as well as regulatory hurdles that

confront the project. The

customer service and

support

component demand of the analyst to

determine the specific needs of

customers that may

be

addressed by the project's offering

and estimate the product

differentiation index.

Pulling

all the information together

into financial units, the

analyst can build the

investment,

operational

costs and revenue projections over a

reasonable time frame and estimate the

Net

Present

Value (NPV) and/or the

Internal Rate of Return

(IRR) to facilitate making

decision

recommendations.

A project returning a positive

Net Present Value is deemed

feasible and the

larger

the Net Present Value the

better. Project analyst

needs to determine the required rate

of

return

that investors in the project would

deem acceptable and compare

it to the Internal Rate of

Return

to determine the project's feasibility.

If the former is lower than the

estimated Internal

Rate

of Return, then the project is

judged to be feasible and vice

versa.

88

Table of Contents:

- INTRODUCTION TO PROJECT MANAGEMENT:Broad Contents, Functions of Management

- CONCEPTS, DEFINITIONS AND NATURE OF PROJECTS:Why Projects are initiated?, Project Participants

- CONCEPTS OF PROJECT MANAGEMENT:THE PROJECT MANAGEMENT SYSTEM, Managerial Skills

- PROJECT MANAGEMENT METHODOLOGIES AND ORGANIZATIONAL STRUCTURES:Systems, Programs, and Projects

- PROJECT LIFE CYCLES:Conceptual Phase, Implementation Phase, Engineering Project

- THE PROJECT MANAGER:Team Building Skills, Conflict Resolution Skills, Organizing

- THE PROJECT MANAGER (CONTD.):Project Champions, Project Authority Breakdown

- PROJECT CONCEPTION AND PROJECT FEASIBILITY:Feasibility Analysis

- PROJECT FEASIBILITY (CONTD.):Scope of Feasibility Analysis, Project Impacts

- PROJECT FEASIBILITY (CONTD.):Operations and Production, Sales and Marketing

- PROJECT SELECTION:Modeling, The Operating Necessity, The Competitive Necessity

- PROJECT SELECTION (CONTD.):Payback Period, Internal Rate of Return (IRR)

- PROJECT PROPOSAL:Preparation for Future Proposal, Proposal Effort

- PROJECT PROPOSAL (CONTD.):Background on the Opportunity, Costs, Resources Required

- PROJECT PLANNING:Planning of Execution, Operations, Installation and Use

- PROJECT PLANNING (CONTD.):Outside Clients, Quality Control Planning

- PROJECT PLANNING (CONTD.):Elements of a Project Plan, Potential Problems

- PROJECT PLANNING (CONTD.):Sorting Out Project, Project Mission, Categories of Planning

- PROJECT PLANNING (CONTD.):Identifying Strategic Project Variables, Competitive Resources

- PROJECT PLANNING (CONTD.):Responsibilities of Key Players, Line manager will define

- PROJECT PLANNING (CONTD.):The Statement of Work (Sow)

- WORK BREAKDOWN STRUCTURE:Characteristics of Work Package

- WORK BREAKDOWN STRUCTURE:Why Do Plans Fail?

- SCHEDULES AND CHARTS:Master Production Scheduling, Program Plan

- TOTAL PROJECT PLANNING:Management Control, Project Fast-Tracking

- PROJECT SCOPE MANAGEMENT:Why is Scope Important?, Scope Management Plan

- PROJECT SCOPE MANAGEMENT:Project Scope Definition, Scope Change Control

- NETWORK SCHEDULING TECHNIQUES:Historical Evolution of Networks, Dummy Activities

- NETWORK SCHEDULING TECHNIQUES:Slack Time Calculation, Network Re-planning

- NETWORK SCHEDULING TECHNIQUES:Total PERT/CPM Planning, PERT/CPM Problem Areas

- PRICING AND ESTIMATION:GLOBAL PRICING STRATEGIES, TYPES OF ESTIMATES

- PRICING AND ESTIMATION (CONTD.):LABOR DISTRIBUTIONS, OVERHEAD RATES

- PRICING AND ESTIMATION (CONTD.):MATERIALS/SUPPORT COSTS, PRICING OUT THE WORK

- QUALITY IN PROJECT MANAGEMENT:Value-Based Perspective, Customer-Driven Quality

- QUALITY IN PROJECT MANAGEMENT (CONTD.):Total Quality Management

- PRINCIPLES OF TOTAL QUALITY:EMPOWERMENT, COST OF QUALITY

- CUSTOMER FOCUSED PROJECT MANAGEMENT:Threshold Attributes

- QUALITY IMPROVEMENT TOOLS:Data Tables, Identify the problem, Random method

- PROJECT EFFECTIVENESS THROUGH ENHANCED PRODUCTIVITY:Messages of Productivity, Productivity Improvement

- COST MANAGEMENT AND CONTROL IN PROJECTS:Project benefits, Understanding Control

- COST MANAGEMENT AND CONTROL IN PROJECTS:Variance, Depreciation

- PROJECT MANAGEMENT THROUGH LEADERSHIP:The Tasks of Leadership, The Job of a Leader

- COMMUNICATION IN THE PROJECT MANAGEMENT:Cost of Correspondence, CHANNEL

- PROJECT RISK MANAGEMENT:Components of Risk, Categories of Risk, Risk Planning

- PROJECT PROCUREMENT, CONTRACT MANAGEMENT, AND ETHICS IN PROJECT MANAGEMENT:Procurement Cycles