|

Production

and Operations Management

MGT613

VU

Lesson

06

The

Decision Process

Decision

Process is more or less the fundamental

process of Management. Whether a

person works in a

manufacturing

organization or a services side

organization, he or she would be

asked to carry out

the

decision

process. Normally the decision

making process involves the

following six important

steps

1.

Specify Objectives and the Criteria

for decision making

2.

Develop Alternatives

3.

Analyze and compare

alternatives.

4.

Select the best

alternative.

5.

Implement the chosen

Alternative

6.

Monitor the results to ensure the desired

results are achieved.

Operations

Manager identifies the criteria by

which the proposed solutions will be

judged. The common

criteria

often relates to costs,

profits, return on investment,

productivity, risk, company image, impact

on

demand,

or similar variables. The

management is interested that the

Operations Manager should be

able

to

focus on parameters that will

increase or decrease? Ideally the

aim is that

1.

Costs should decrease and

Profits should

increase

2.

Return on Investment should

increase along with increase

in Productivity.

3.

Risk should decrease along

with increase in Company

image.

4.

Demand should increase for the

product or service.

5.

Monitor the results to ensure the desired

results are achieved.

The

Decision Process

Example

The

CEO of ABC Corporation has

asked you (the VP Operations) to

help the BOD reach a

decision

whether

to introduce a new automobile

model. The new model

would have the following effects

on

important

decision making process.

Certain Parameters will

increase and decrease?

Costs

decrease by 15 %

Profits

increase by 2%

Return

on Investment stays the

same

Productivity

decreases by 5%

Risk

increases by 5 %

Company

image may increase or

decrease

Demand

may increase or decrease for

the product or service.

Solution

�Based

on the above data, a Risk Averse

Manager would forego the new

project, A Risk taker would

go

for

it. These factors alone do

not present the overall big

picture, most of the times in practical

situations,

the

decision is based upon

important factors like ROI,

Productivity, Utilization of available

resources,

Profits

and Costs in line with

organizations operational and

organizational strategy and the mapping

of

the

organization with respect to

its competitors and competitive

environment..

Causes

of Poor Decisions

�Unforeseeable

and uncertain circumstances , which in

reality refers to a mistake or error in the

decision

making,

remedial action is to have a STEERING

COMMETIEE ( comprising of senior

management) to

review

the whole process and monitor the

decision steps.

Decision

Environments

�There

are three degrees of Certainty,

Risk and Uncertainty.

24

Production

and Operations Management

MGT613

VU

1.

Certainty: Means that the

relevant parameter such as

costs, capacity and demand have

known

values.

2.

Risk means that certain

parameters have probabilistic

outcomes.

3.

Uncertainty means that the

certain parameters have various possible

future events.

Decision

Environments often represent

the same three scenarios of

Certainty, Risk and

Uncertainty. Let

us

consider the example where we are making

a ball bearing which is to be

used in ceiling fan and

our

marketing

department comes with up three scenarios

with different set of

numbers. It costs us Rs 40 per

unit

to manufacture the ball bearing. The

marketing department has through

its market research

noted

that

our organization can have a

sale price of Rs. 90 per

unit.

�Certainty:

Profit per unit is Rs. 50.

You have an order for 2000

units. The decision is under

certainty as

the

Means that the relevant

parameter such as costs,

capacity and demand have known

values.

�Risk

There is a 25 % chance of demand of

2000 units, 50% chance of

demand of 1000 units and 25

%

chance

of an order of 500

units.

�Uncertainty

.There is no available data of

demand forecasts means that

the certain parameters

necessary

for decision making are

absent.

DECISION

THEORY

No

discussion in Production Operation

Management is complete without making a

reference to

Decision

Theory. Decision Theory is in

fact a general approach to decision

making.

Decision

theory consists of the following three

elements.

1.

A set of possible outcomes exist

that will have a bearing on the

results of the decision.

2.

A list of alternatives to choose

from.

3.

A known payoff for each

alternative under each possible

future condition.

An

operations manager would need to

develop an understanding of decision

theory knowledge and

needs

to employ the following.

1.

Identify a set of possible future

conditions called state of nature

which includes the low,

high,

medium

demand pattern and a working on the

competitor's introduction of new

product.

2.

Develop a list of alternatives, one of

which may be to do

nothing.

3.

Determine or estimate the payoff

associated with each

alternative for every possible

future

condition.

4.

If possible estimate the likely hood of

each possible future

condition.

5.

Evaluate alternatives according to

some decision criterion e.g.

maximize expected profit

and

select

the best alternatives to choose

from.

PAY

OFF TABLE

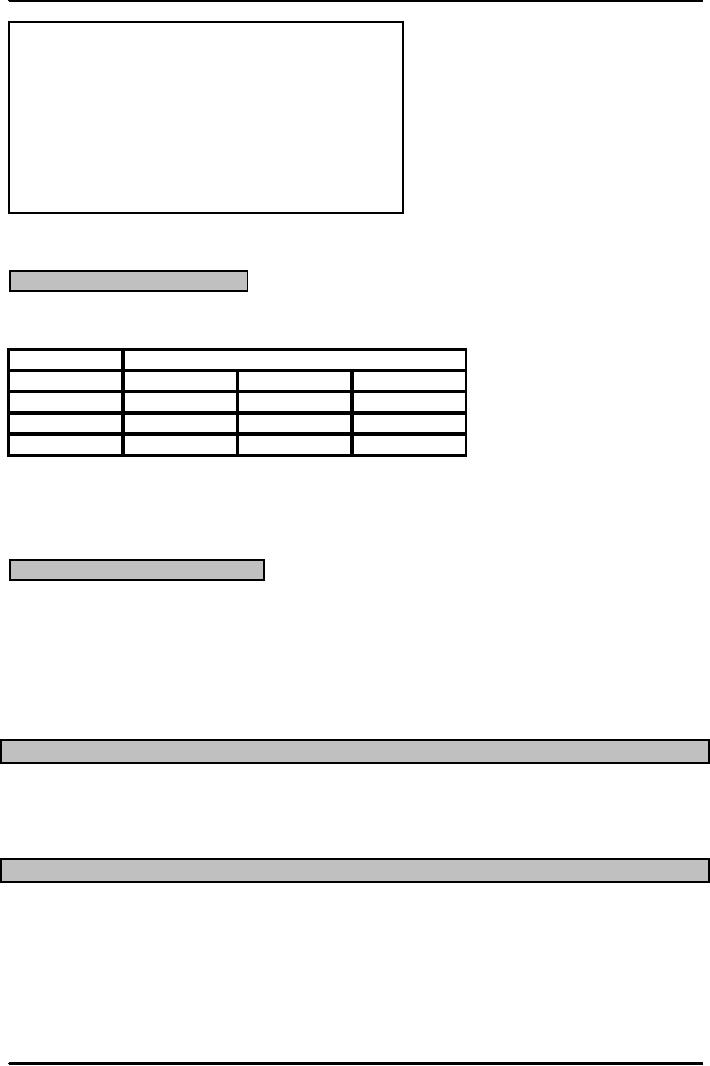

�Payoff

table summarizes the

information of a decision and captures

the expected payoffs under

various

possible

states of nature.

�Let

us consider an example, we are setting up

a pharmaceutical factory and our

state of nature indicates

that

If we built a small facility the

return remains the same

whether the demand is low or

high, the

medium

facility indicates a constant return on

moderate and high. If we

build a large facility

chances are

that

the return would only be

good if we have a high demand or

return.

25

Production

and Operations Management

MGT613

VU

Alternatives

Possible Future Demands

Low

Moderate

High

Small

Rs.

10 M

Rs.

10 M

Rs.

10 M

Facility

Medium

Rs.

5 M

Rs.

8 M

Rs.

12 M

Large

Rs.

1 M

Rs.

2 M

Rs.

15 M

The

states of nature are very

important, for our decision

making.

Decision

Making under Certainty

Decision

making under certainly is

always simple but never

available to the managers.

Alternatives

Possible

Future Demands

Low

Moderate

High

Small

Facility

Rs.

10 M

Rs.

10 M

Rs.

10 M

Medium

Rs.

5 M

Rs.

8 M

Rs.

12 M

Large

Rs.

1 M

Rs.

2 M

Rs.

15 M

Decision

Making under

Certainty

�It is

known with certainty that

the demand will be low,

moderate and high.

�In the

example, we just select the

best or highest payoff for

all the states of nature.

Decision

Making under Uncertainty

�In the

absence of clear information, An Operations

Manager would need to

carryout decision making

under

uncertainty. This is the usual pattern

when managers working at

assembly plants, services,

oil

refineries

or chemical processing plant end up

facing a dilemma to evaluate the

alternative of payoffs..

1.

Maximin

2.

Maximax

3.

Minimax Regret

4.

Laplace

MAXIMIN

Maximin

determines the worst payoff for

each alternative; the operations manager

chooses the best

worst

alternative. Meaning the least (best) of

the worst.

It

is a pessimistic approach.

Ensures

a guaranteed minimum.

MAXIMAX

Maximax

determines

the

best possible outcome

Choose

the Alternative with the best possible

payoff.

It

does not take into

account any other

alternative then the best

payoff.

An

optimistic approach.

Go

for it strategy.

26

Production

and Operations Management

MGT613

VU

LAPLACE

Determines

the Average payoff for

each alternative

And

chooses the alternative with the

best average.

This

is a cautious approach

Laplace

approach treats the states of nature as

equally likely.

Example

to calculate Maximin, Maximax and

Laplace

Alternatives

Possible

Future Demands

Low

Moderate

High

Small

Facility

Rs.

10 M

Rs.

10 M

Rs.

10 M

Medium

Rs.

5 M

Rs.

8 M

Rs.

12 M

Large

Rs.

1 M

Rs.

2 M

Rs.

15 M

Example

to calculate Maximin, Maximax and

Laplace

Maximin

, the worst payoff for

alternatives

Pick

the Minimum (Least) of the

maximum

Small

Facility Rs 10 M since the payoff

table shows that

Small

Facility

Rs.

10 M

Medium

Rs.

12 M

Large

Rs.

15 M

Example

to calculate Maximin, Maximax and

Laplace

Laplace

, the best payoff of the average

for each alternatives

Small

Facility Rs 10 M since the payoff

table shows that

Small

Facility

Rs.

30/3= Rs. 10 M

Medium

Rs.

25/3= Rs. 8.33 M

Large

Rs.

18/3= Rs. 6 M

Decision

Making under

Uncertainty

Minimax

Regret

Determines

the worst regret for each

alternative

Chooses

the alternative with the best

worst.

This

approach seeks to minimize the difference

between payoff that is realized

and best payoff

for

each

state of nature.

Example

to calculate Minimax Regret

�Minimax

Regret ,

�Step

I ; Construct the Table of Opportunity

Losses or Regrets.

Subtract the

column entries by subtracting the entry

from that of the highest

column value

Repeat

the process for all columns

�Step

II. Select the maximum regret value of

each row ( alternative

meaning

small, medium and

large

scale)

27

Production

and Operations Management

MGT613

VU

Example

to calculate Minimax Regret

Alternatives

Possible

Future Demands

Low

Moderate

High

Small

Facility

Rs.

10-10=0

Rs.

10-10=0

10-15=-5

Medium

Rs.

5-10=

Rs.

8-10=

Rs.

12-15=

-5

M

-2

M

-3

M

Large

Rs.1-10=

Rs.

2-10=

Rs.

15-15=

-9

M

-8

M

0M

EXPECTED

MONETARY VALUE CRITERION

Decision

Making under Risk

The

area between the certainty and

uncertainty is known as

Risk.

Expected

Monetary Value Criterion

(EMV)which refers to the best expected

value among the

alternatives

We

use the payoff table with

probabilities low =0.3,

moderate =0.5 and

highest=0.2.These

probabilities

must add to 1,mutually exclusive and

collectively exhaustive)

�EXPECTED

MONETARY VALUE CRITERION

�EV

small

=

0.3(10)+0.5(10)+0.2(10)

=

Rs.

10 M

�EV

medium= 0.3(5)+0.5(8)+0.2(12)

=

Rs.

7.9 M

�EV

large = 0.3(1)+0.5(2)+0.2(15)

=

Rs.

4.3 M

We

select the smallest facility

as it has the highest

value

Expected

Value of Perfect Information

In

certain situations, it is possible to

ascertain which state of nature (

level of demand) will

occur

with certainty. E.g. If you

want to construct a restaurant or trauma

centre on a motorway

highway

chances are you would get a

great ROI.

Expected

value of perfect information = Expected

payoff under certainty

-Expected payoff

under

risk

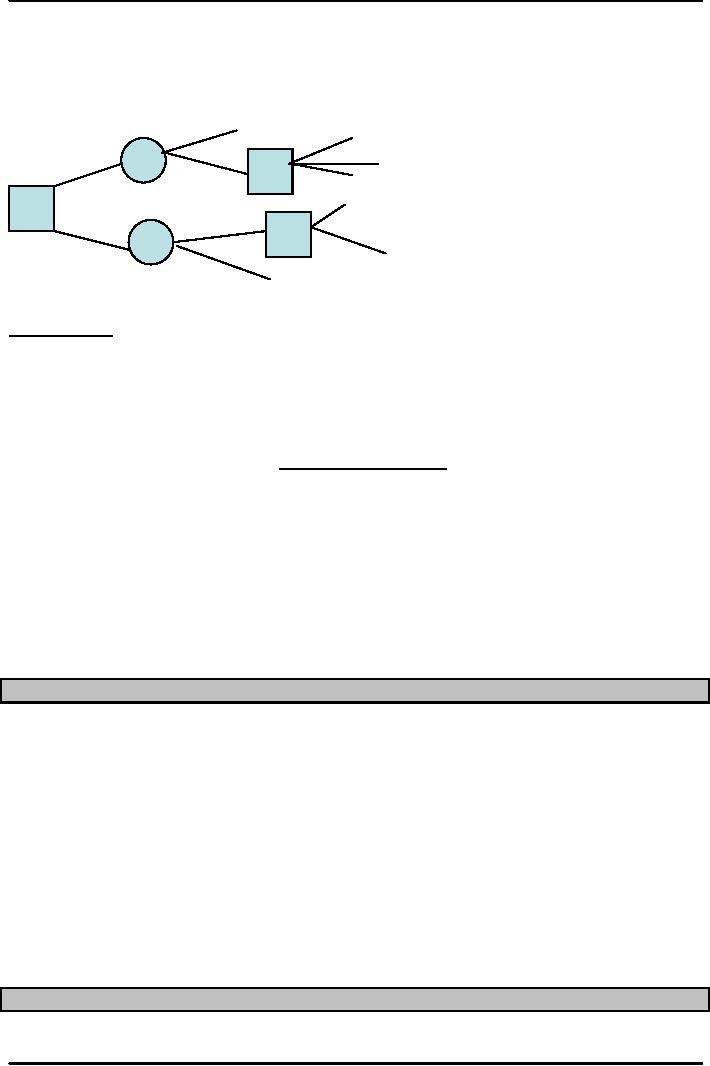

Visual

tool for analyzing Decision

Problems

Two

visual tools used for

analyzing decision problems

include

Decision

Trees

Graphical

Sensitivity Analysis

Decision

Trees

A

schematic representation of the alternatives

and their possible consequences is

presented graphically.

You

can refer.

The

diagram resembles a tree.

Extremely

suitable for analyzing and

evaluating situations which

involve sequential decisions.

Decision

Trees

Suppose

the Pakistani government decides to

operate a gas field.

Initially the government had

information

that it can exploit 1 million

cubic feet of gas but later

studies indicate

potential

28

Production

and Operations Management

MGT613

VU

reserves

of additional 10 million cubic feet. As

an operations manager you may be

ask to

prepare

a feasibility report to either expand or

make a new facility using

the new reserves.

Decision

Trees

Low

Demand = 0.4 Rs. 20

Do

Nothing Rs. 20

Reduce

capacity

Build

small

-

Rs 30

High

Expand

= Rs 50

Demand

=

0.6

Do

Nothing = Rs. 15

Low

Demand=0.4

Build

Large

Reduce

Prices Rs. 45

High

Demand= 0.6

Rs.

60/unit

Decision

Trees

The

tree is read from left to

right

Square

nodes represent decisions

Circular

nodes represent chance

events.

Branches

leaving square nodes

represent alternatives.

Branches

leaving the circular nodes

represent the chance events (

states of nature)

Decision

Trees Analysis

�Step

I. Analyze the decisions from Right to

left

�Step

II. Determine which alternative

would be selected for each

possible second decision.

For a

small facility with high

demand there are three alternatives ,

select the highest payoff

and

multiply

it with the probable outcome. Put a

double slash on the alternatives

which have lower

value.

Follow

the same procedure for small

facility with high

demand

�Step

III . Repeat the steps for

both low and demand

pattern for the larger

facility.

�Step

IV. Determine the product of chance

probabilities

�Step

V. Determine the expected value of each

initial alternative.

�Step

VI. Select the choice which has a

larger expected value than the

small facility.

Decision

Tree Example Solution

Option

I: Build Small

Facility

Low

Demand = 0.4 X Rs. 20= Rs.

8

High

Demand=0.6 X Rs. 50= Rs.

30

Option

II: Build Large

Facility

Low

Demand = 0.4 X Rs. 45= Rs.

18

High

Demand=0.6 X Rs. 60= Rs.

54

Option

III: Determine the Expected Value of each

initial alternative

Build

Small Facility = Rs. 8+ Rs.

30= Rs. 38

Build

Large Facility=Rs. 18+Rs.

36= Rs. 54

Select

the Larger Facility as it

has a larger expected value

than the small

facility

Sensitivity

Analysis

Determining

the range of probability for which an

alternative has the best expected

payoff.

29

Production

and Operations Management

MGT613

VU

A

graphical solution

Makes

use of Algebra

Prime

importance

CONCLUSION

Decision

Making is a critical responsibility

that stays with a manager

throughout his active

professional

life.

It goes without saying that,

at the start of the service, the decision

making involves low

impact

financial

impact but with the passage

of time, the decision making

becomes more critical and

highly

finance

focused. This very aspect

gives the field of decision

making a competitive edge

over other

important

tools available to an operations manager.

The related field of game

theory is often used

in

conjunction

with decision theory.

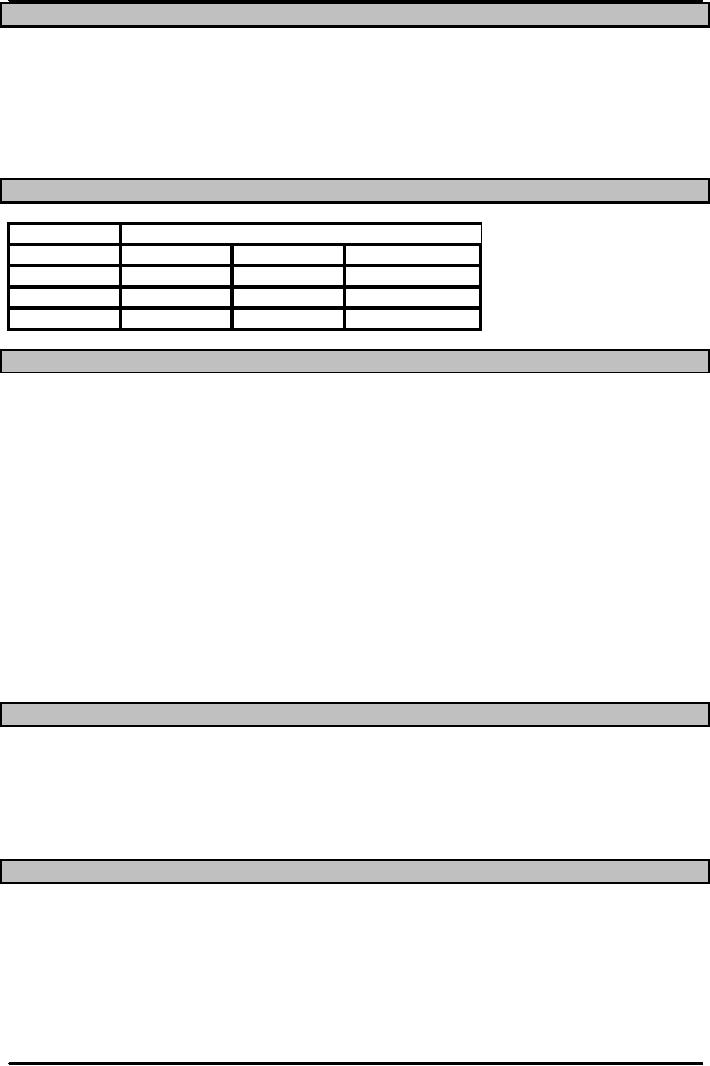

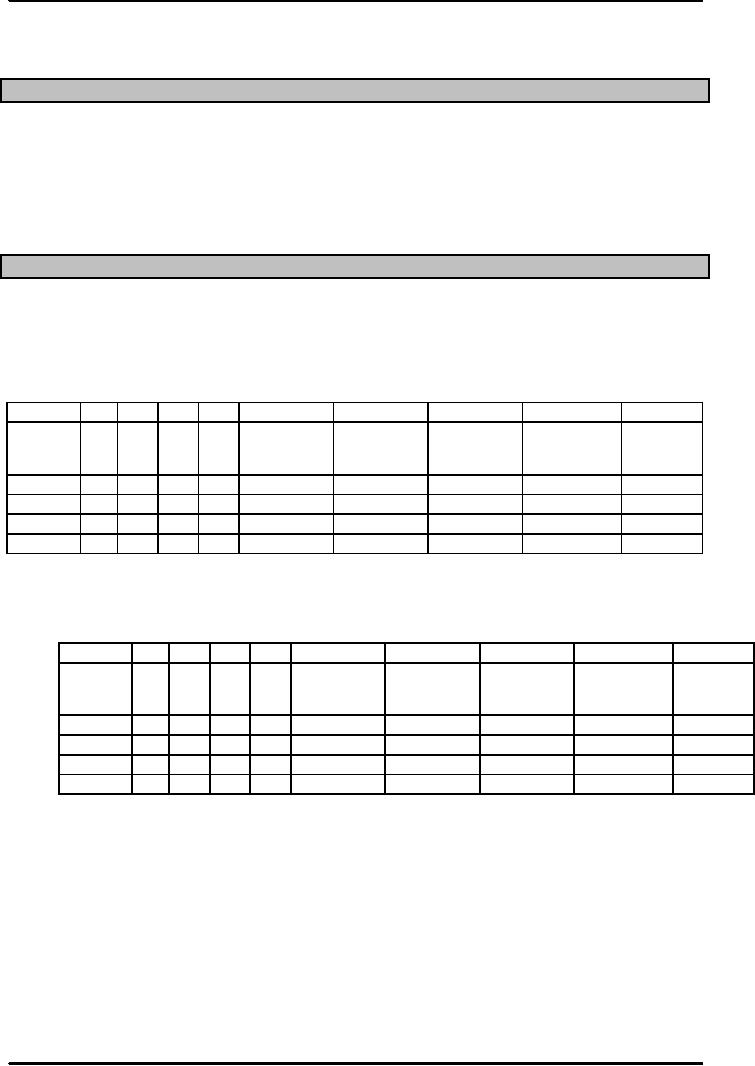

PAYOFF

TABLE HOMEWORK

The

following table shows profit

payoffs. Calculate the results

for the five rules and

indicate for each

rule

the best and worst decision

alternatives. All Cost and Revenue

numbers in Rs. 000. d1,d2,

d3 and

d4

represent decision options and

s1,s2,s3 and s4 show states of

nature.

0.30

0.25 0.10 0.35

S1

S2 S3 S4 MAXIMIN

MAXIMAX LAPLACE EXPECTED

MINIMAX

MONETARY

REGRET

VALUE

d1

50

-20

75

60

d2

80

30

100

-10

d3

25

35

10

45

d4

55

65

-15

40

The

following table shows cost

payoffs. Calculate the results

for the five rules and

indicate for each

rule

the best and worst decision

alternatives.

0.40

0.15 0.10 0.35

S1

S2 S3 S4 MAXIMIN

MAXIMAX LAPLACE EXPECTED

MINIMAX

MONETARY

REGRET

VALUE

d1

40

20

75

60

d2

30

70

90

10

d3

60

55

5

85

d4

40

100

15

35

30

Table of Contents:

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Decision Making

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Strategy

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Service Delivery System

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Productivity

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:The Decision Process

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Demand Management

- Roadmap to the Lecture:Fundamental Types of Forecasts, Finer Classification of Forecasts

- Time Series Forecasts:Techniques for Averaging, Simple Moving Average Solution

- The formula for the moving average is:Exponential Smoothing Model, Common Nonlinear Trends

- The formula for the moving average is:Major factors in design strategy

- The formula for the moving average is:Standardization, Mass Customization

- The formula for the moving average is:DESIGN STRATEGIES

- The formula for the moving average is:Measuring Reliability, AVAILABILITY

- The formula for the moving average is:Learning Objectives, Capacity Planning

- The formula for the moving average is:Efficiency and Utilization, Evaluating Alternatives

- The formula for the moving average is:Evaluating Alternatives, Financial Analysis

- PROCESS SELECTION:Types of Operation, Intermittent Processing

- PROCESS SELECTION:Basic Layout Types, Advantages of Product Layout

- PROCESS SELECTION:Cellular Layouts, Facilities Layouts, Importance of Layout Decisions

- DESIGN OF WORK SYSTEMS:Job Design, Specialization, Methods Analysis

- LOCATION PLANNING AND ANALYSIS:MANAGING GLOBAL OPERATIONS, Regional Factors

- MANAGEMENT OF QUALITY:Dimensions of Quality, Examples of Service Quality

- SERVICE QUALITY:Moments of Truth, Perceived Service Quality, Service Gap Analysis

- TOTAL QUALITY MANAGEMENT:Determinants of Quality, Responsibility for Quality

- TQM QUALITY:Six Sigma Team, PROCESS IMPROVEMENT

- QUALITY CONTROL & QUALITY ASSURANCE:INSPECTION, Control Chart

- ACCEPTANCE SAMPLING:CHOOSING A PLAN, CONSUMER’S AND PRODUCER’S RISK

- AGGREGATE PLANNING:Demand and Capacity Options

- AGGREGATE PLANNING:Aggregate Planning Relationships, Master Scheduling

- INVENTORY MANAGEMENT:Objective of Inventory Control, Inventory Counting Systems

- INVENTORY MANAGEMENT:ABC Classification System, Cycle Counting

- INVENTORY MANAGEMENT:Economic Production Quantity Assumptions

- INVENTORY MANAGEMENT:Independent and Dependent Demand

- INVENTORY MANAGEMENT:Capacity Planning, Manufacturing Resource Planning

- JUST IN TIME PRODUCTION SYSTEMS:Organizational and Operational Strategies

- JUST IN TIME PRODUCTION SYSTEMS:Operational Benefits, Kanban Formula

- JUST IN TIME PRODUCTION SYSTEMS:Secondary Goals, Tiered Supplier Network

- SUPPLY CHAIN MANAGEMENT:Logistics, Distribution Requirements Planning

- SUPPLY CHAIN MANAGEMENT:Supply Chain Benefits and Drawbacks

- SCHEDULING:High-Volume Systems, Load Chart, Hungarian Method

- SEQUENCING:Assumptions to Priority Rules, Scheduling Service Operations

- PROJECT MANAGEMENT:Project Life Cycle, Work Breakdown Structure

- PROJECT MANAGEMENT:Computing Algorithm, Project Crashing, Risk Management

- Waiting Lines:Queuing Analysis, System Characteristics, Priority Model