|

INVENTORY MANAGEMENT:Economic Production Quantity Assumptions |

| << INVENTORY MANAGEMENT:ABC Classification System, Cycle Counting |

| INVENTORY MANAGEMENT:Independent and Dependent Demand >> |

Production

and Operations Management

MGT613

VU

Lesson

33

INVENTORY

MANAGEMENT

Learning

Objectives

Our

discussion on Inventory Management

would be complete only when we

are able to learn

and

understand

the types of Inventories and objectives of

Inventory Control. This

would ensure that we

are

able

to understand the major reasons for

holding inventories. We would be

able to differentiate between

independent

and dependent demand. We will also

learn the requirements of an effective

inventory

management

system. We will review both

periodic as well as perpetual

Inventory systems. We

will

discuss

in detail the ABC approach with a

suitable example. Our

discussion has focused on

the

objectives

of inventory management, basic EOQ

model, Economic Run Size,

Quantity Discount

Model

with

solved examples.

Example

(In terms of

Percentage)

CNG-LPG

company in Karachi, purchases 5000

compressors a year at Rs.8,000 each.

Ordering costs

are

Rs. 500 and Annual carrying

costs are 20 % of the

purchase price. Compute the Optimal

price and

the

total annual cost of

ordering and carrying the

inventory.

Data

D=Demand

=5,000

S=Ordering=

Rs. 500

H=Holding/Carrying

Cost=0.2 X 8,000=Rs.1600

Example

3 ( In terms of Percentage)

Q0= Sq

Root of ( 2(5,000)(500)/(1600))

=

55.9=56 Compressors

TC=

Carrying costs + Ordering

Costs

=Q0/2 ( H) +

D/Q0 (S)

=

56/2 ( 1600) + 5000/56

(500)

=

28 ( 1600)+ 44,643

=44,800+44,643=Rs.

89,443

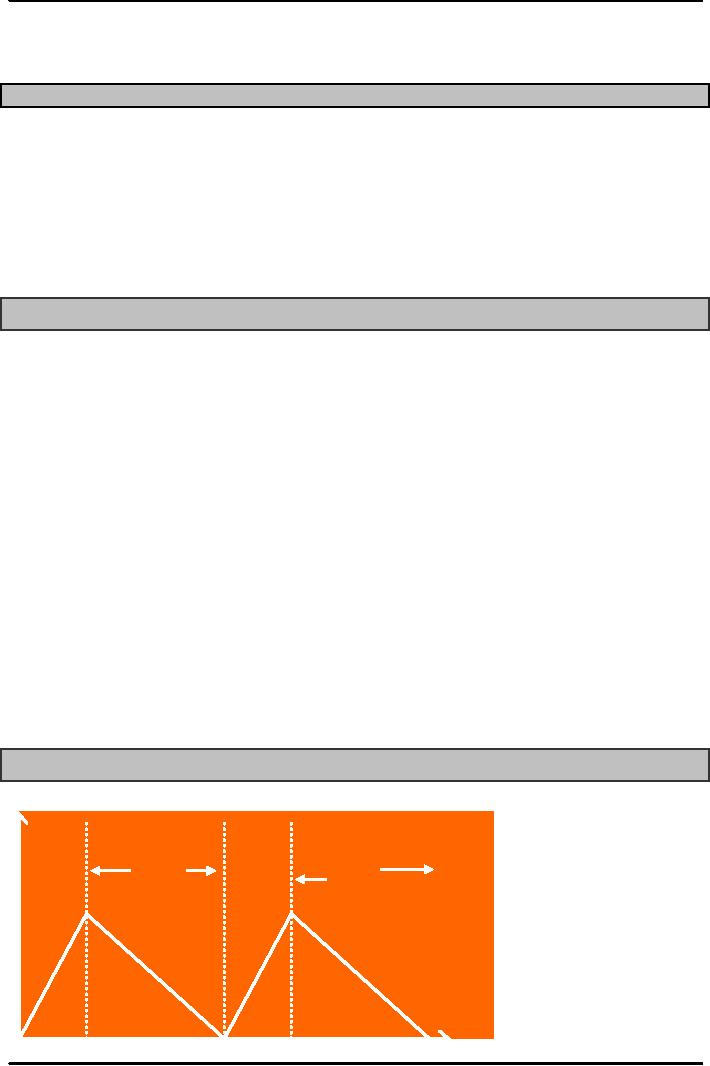

Economic

Production Quantity (EPQ)

Production

Production

Usage

&

Usage Usage

&

Usage

Inventory

Level

152

Production

and Operations Management

MGT613

VU

Economic

Production Quantity (EPQ)

Assumptions

Production

done in batches or lots

Capacity

to produce a part exceeds the part's

usage or demand rate.

Assumptions

of EPQ are similar to EOQ except

orders are received

incrementally during

production.

Economic

Production Quantity

Assumptions

1.

Only

one item is involved

2.

Annual

demand is known

3.

Usage

rate is constant

4.

Usage

occurs continuously

5.

Production

rate is constant

6.

Lead

time does not

vary

7.

No

quantity discounts

Finer

Points of Economic Production Quantity

Model

The

basic EOQ model assumes that

each order is delivered at a

single point in time.

If

the firm is the producer and user,

practical examples indicate that

inventories are

replenished

over

time and not

instantaneously.

If

usage and production ( delivery)

rates are equal, then there

is no buildup of inventory.

Set

up costs in a way our

similar to ordering costs

because they are independent

of lot size.

The

larger the run size, the

fewer the number of runs needed and

hence lower the annual

setup.

The

number of runs is D/Q and the annual

setup cost is equal to the number of

runs per year

times

the cost per run (

D/Q)S.

Total

Cost is

TC

min= Carrying Cost+ Setup

Cost

=

( I max/2)H+ (D/Q0)S

Where

I max= Maximum Inventory

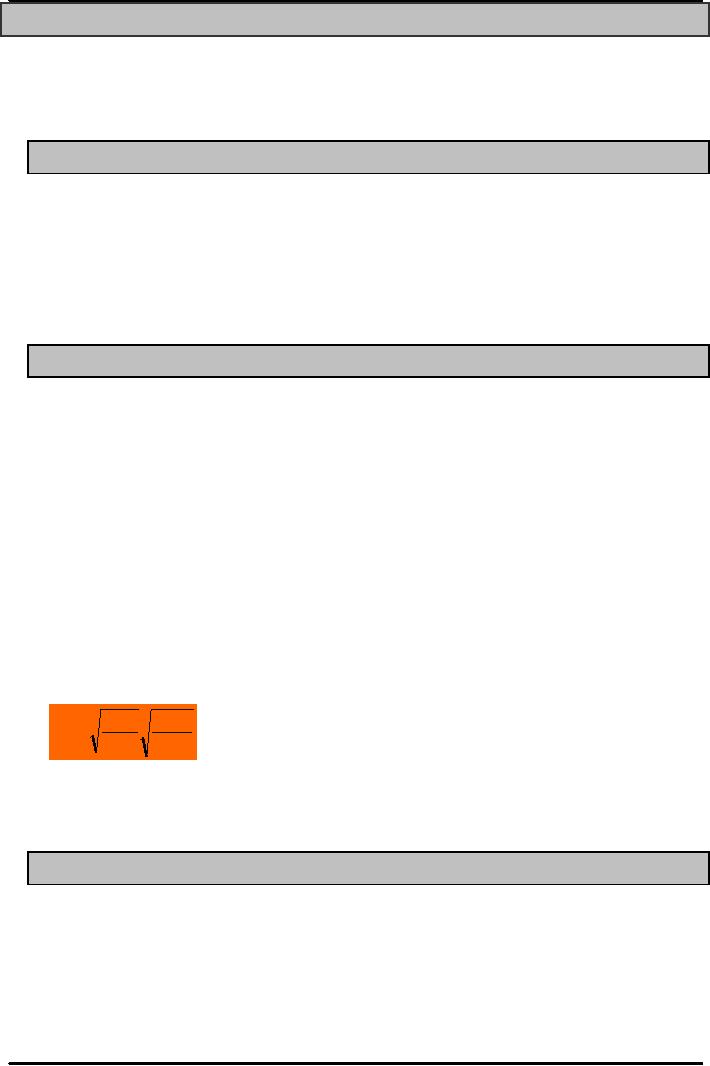

Economic

Run Size

2DS

p

Q0 =

p-u

H

Economic

Production Quantity

Assumptions

Where

p= production rate

U

= usage rate

Economic

Production Quantity

Assumptions

The

Run time ( the production

phase of the cycle) is a function of the

run size and production

rate

Run

time = Q0/p

The

maximum and average

inventory levels are

I

max = Q0/p

(p-u)

I

average= I max/2

153

Production

and Operations Management

MGT613

VU

Example

(Economic Run Size)

Example

for Economic Run

Size

A

firm in Sialkot produces

250,000 each world class

footballs for both domestic and

international

markets

. It can make footballs at a rate of

2000 per day. The footballs

are manufactured uniformly

over

the whole year. Carrying

cost is Rs. 100 per football

and Setup cost for a

production run is Rs.

2500.

The manufacturing unit

operates for 250 days per

year.

Determine

the

1.

Optimal Run Size.

2.

Minimum total annual cost

for carrying and setup

cost.

3.

Cycle time for the Optimal

Run Size.

4.

Run time by using the

formula

2DS

p

Q0 =

p-u

H

Solution

1.

Optimal Run Size.

=

Sq Root (2 X 250,000 X 2500/100 )( Sq

Root (2 000 /2000-1000

))

=

2500( sq.root2X2)=5000

footballs.

2.

Minimum total annual cost

for carrying and setup

cost.

=

Carrying Cost + Set up

Cost

=(

I max/2)H+ ( D/Q0)S

Where

I max= Q0/p

((p-u))=5000/2000(1000)

=2500

footballs

Now

TC= 2500/2 X 100 +

(250,000/5000 )(2500)

=1250

X 100 + 125,000

=125,000+

125,000

=

Rs. 250,000.

3.

Cycle time for the Optimal

Run Size.

Q0/U=5000/1000=

5 days

4.

Run time

Q0/p=5000/2000=

2.5 days

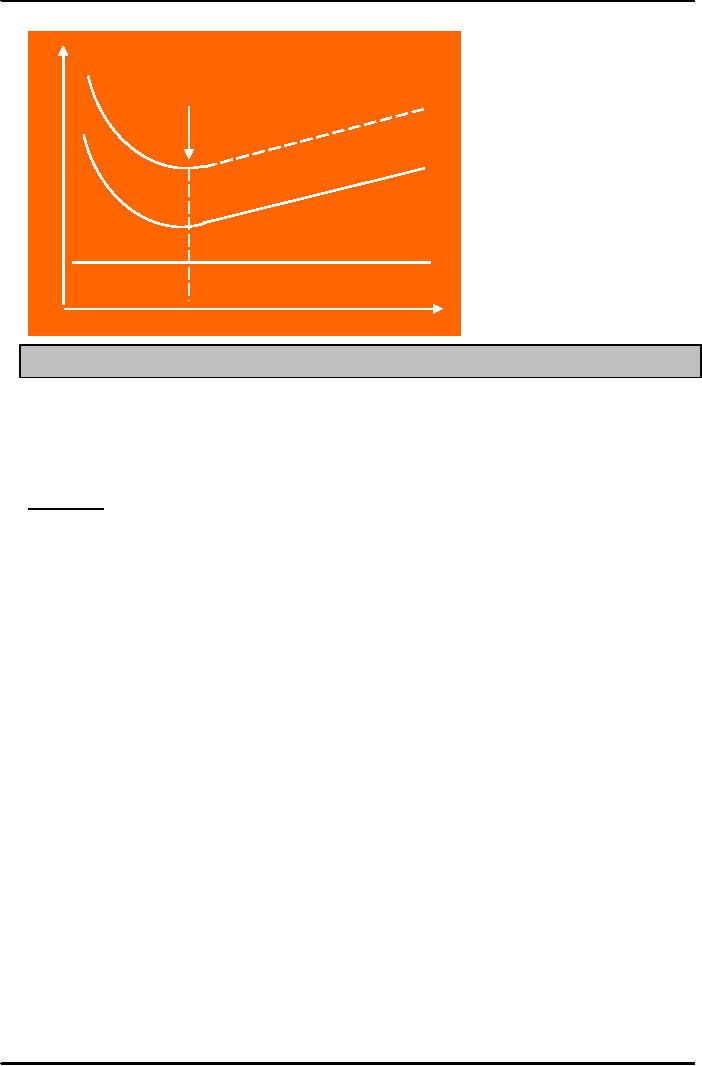

Quantity

Discount : Price reductions for large

orders are called Quantity

Discounts.

Total

Costs with Purchasing

Cost

Annual

Annual

Purchasing

+

carrying

ordering

+

TC

=

cost

cost

cost

Q

DS

PD

H

TC

=

+

+

Q

2

Total

Costs with PD

154

Production

and Operations Management

MGT613

VU

C

O

S

Adding

Purchasing cost

TC

with PD

T

doesn't

change EOQ

TC

without PD

PD

0

Quantity

EOQ

Example

for Optimal Order Quantity

and Total Cost

The

maintenance department of a large cardiology

hospital in Islamabad uses about

1200 cases of

corrosion

removal liquid, used for

maintenance of hospital. Ordering costs

are Rs 100, carrying

cost

are

Rs 20 per case, and the new

price schedule indicates that

orders of less than 50 cases

will cost

Rs

1250 per case, 50 to 79 cases

will cost Rs 1150 per case ,

80 to 99 cases will cost Rs

1050 per

case

and larger costs will be Rs

1000 per case.

Determine

the Optimal Order Quantity and the

Total Cost.

Given

Data

D=1200

case.

S=

Rs. 100 per case

H=Rs.20

per case

Range

Price

1

to 49

Rs

1250

50

to 79

Rs

1150

80

to 99

Rs

1050

100

or more

Rs

1000

Compute

the Common EOQ=Sq Root (2DS/H)

=

Sq Root (2 X 100 X

1200/20)

=Sq

Root (12000)

=109.5=110

cases which would be brought

at 1000 per order

The

total Cost to Purchase 1200

cases per year would

be

TC=

Carrying Cost+ Order Cost+

Purchase Cost

=(Q/2)H+(D/Q0)S+PD

=(110/2)20+(1200/110)100+1200X

1000

=1100+1091+12000,000

=Rs.

1,202,191

155

Production

and Operations Management

MGT613

VU

When

to Reorder with EOQ Ordering

Reorder

Point - When the quantity on hand of an

item drops to this amount, the item is

reordered.

Safety

Stock - Stock that is held

in excess of expected demand due to

variable demand rate

and/or

lead

time.

Service

Level - Probability that

demand will not exceed

supply during lead

time.

Example

for Reorder Point

An

apartment complex in Quetta requires water

for its home

use.

Usage=

2 barrels a day

Lead

time= 5 days

ROP=

Usage X Lead Time

=

2 barrels a day X 7 = 14 barrels

Determinants

of the Reorder Point

1.

The

rate of demand

2.

The

lead time

3.

Stock

out risk (safety

stock)

4.

Demand

and/or lead time

variability

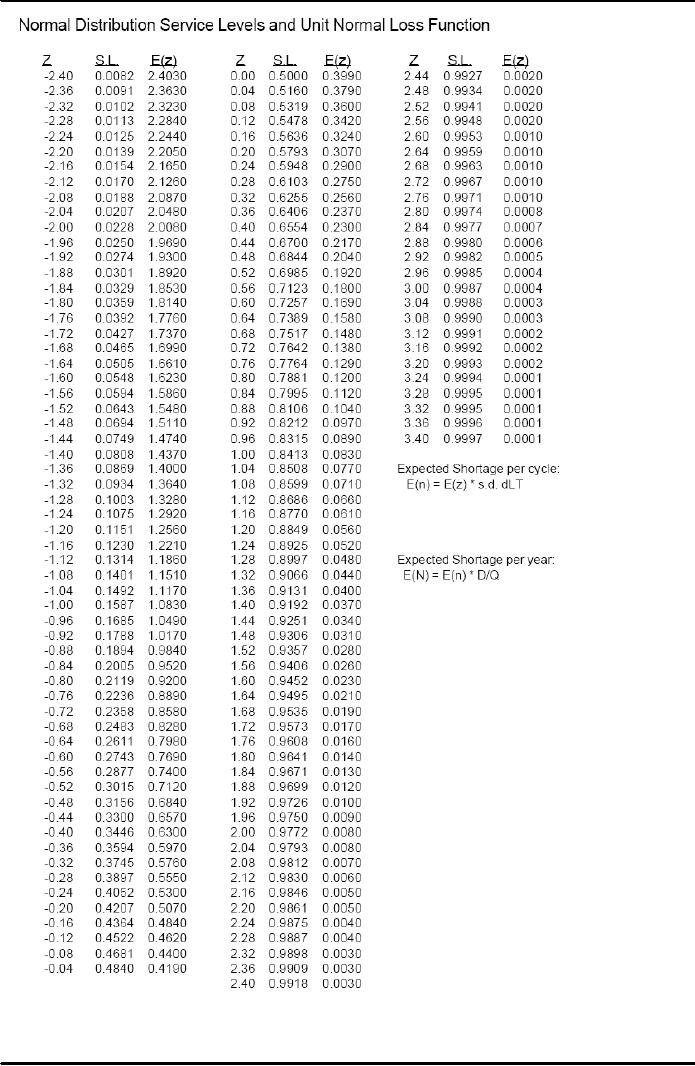

Example

An

owner of a Montessori equipment

firm in Karachi, determined

from historical records

that

demand

for wood required for

Montessori equipment averages 25

tones per anum. His operations

management

expertise allowed him to determine the

demand during lead that

could be described by

a

normal distribution that has

a mean of 25 tons and a standard

deviation of 2.5 tons, with a

stock

out

risk not limited to 6

percent.

a.

Appropriate value of Z? Please

use the table given on the

next page (9)

b.

Safety stock level?

c.

Reorder Point?

d.

Expected weight of wood short for

any order cycle, if he wants

to maintain a service level of

80%

Use the attached service level

table. Please use the

table given on page (

10)

e.

Annual Service Level, if service level

=80

156

Production

and Operations Management

MGT613

VU

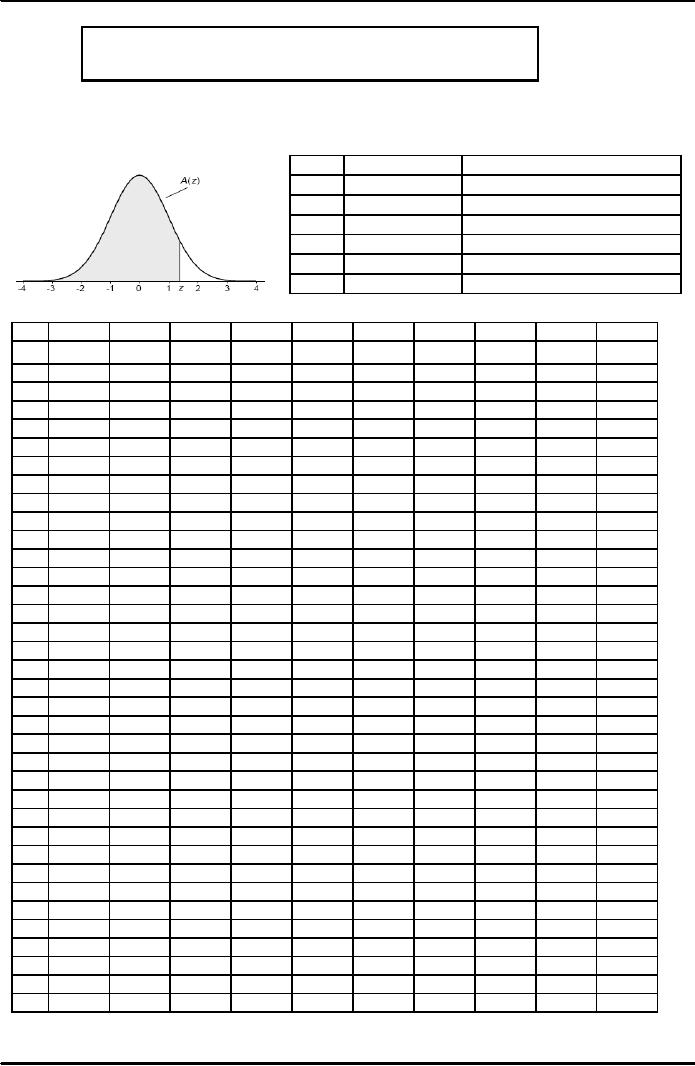

Area

under the standardizes normal curve

from -∞

to

z

A(z)

is the integral of the standardized normal

distribution from ∞-to z

(in other words, the area

under the curve

to

the left of z). It gives the probability

of a normal random variable not

being more than z standard

deviations

above

its mean. Values of z of

particular importance:

z

A(z)

1.645

0.9500

Lower

limit of right 5%

tail

1.960

0.9750

Lower

limit of right 2.5%

tail

2.326

0.9900

Lower

limit of right 1%

tail

2.576

0.9950

Lower

limit of right 0.5%

tail

3.090

0.9990

Lower

limit of right 0.1%

tail

3.291

0.9995

Lower

limit of right 0.05%

tail

Cumulative

Standardized Normal

Distribution

z

0.00

0.01

0.02

0.03

0.04

0.05

0.06

0.07

0.08

0.09

0.0

0.5000

0.5040

0.5080

0.5120

0.5160

0.5199

0.5239

0.5279

0.5319

0.5359

0.1

0.5398

0.5438

0.5478

0.5517

0.5557

0.5596

0.5636

0.5675

0.5714

0.5753

0.2

0.5793

0.5832

0.5871

0.5910

0.5948

0.5987

0.6026

0.6064

0.6103

0.6141

0.3

0.6179

0.6217

0.6255

0.6293

0.6331

0.6368

0.6406

0.6443

0.6480

0.6517

0.4

0.6554

0.6591

0.6628

0.6664

0.6700

0.6736

0.6772

0.6808

0.6844

0.6879

0.5

0.6915

0.6950

0.6985

0.7019

0.7054

0.7088

0.7123

0.7157

0.7190

0.7224

0.6

0.7257

0.7291

0.7324

0.7357

0.7389

0.7422

0.7454

0.7486

0.7517

0.7549

0.7

0.7580

0.7611

0.7642

0.7673

0.7704

0.7734

0.7764

0.7794

0.7823

0.7852

0.8

0.7881

0.7910

0.7939

0.7967

0.7995

0.8023

0.8051

0.8078

0.8106

0.8133

0.9

0.8159

0.8186

0.8212

0.8238

0.8264

0.8289

0.8315

0.8340

0.8365

0.8389

1.0

0.8413

0.8438

0.8461

0.8485

0.8508

0.8531

0.8554

0.8577

0.8599

0.8621

1.1

0.8643

0.8665

0.8686

0.8708

0.8729

0.8749

0.8770

0.8790

0.8810

0.8830

1.2

0.8849

0.8869

0.8888

0.8907

0.8925

0.8944

0.8962

0.8980

0.8997

0.9015

1.3

0.9032

0.9049

0.9066

0.9082

0.9099

0.9115

0.9131

0.9147

0.9162

0.9177

1.4

0.9192

0.9207

0.9222

0.9236

0.9251

0.9265

0.9279

0.9292

0.9306

0.9319

1.5

0.9332

0.9345

0.9357

0.9370

0.9382

0.9394

0.9406

0.9418

0.9429

0.9441

1.6

0.9452

0.9463

0.9474

0.9484

0.9495

0.9505

0.9515

0.9525

0.9535

0.9545

1.7

0.9554

0.9564

0.9573

0.9582

0.9591

0.9599

0.9608

0.9616

0.9625

0.9633

1.8

0.9641

0.9649

0.9656

0.9664

0.9671

0.9678

0.9686

0.9693

0.9699

0.9706

1.9

0.9713

0.9719

0.9726

0.9732

0.9738

0.9744

0.9750

0.9756

0.9761

0.9767

2.0

0.9772

0.9778

0.9783

0.9788

0.9793

0.9798

0.9803

0.9808

0.9812

0.9817

2.1

0.9821

0.9826

0.9830

0.9834

0.9838

0.9842

0.9846

0.9850

0.9854

0.9857

2.2

0.9861

0.9864

0.9868

0.9871

0.9875

0.9878

0.9881

0.9884

0.9887

0.9890

2.3

0.9893

0.9896

0.9898

0.9901

0.9904

0.9906

0.9909

0.9911

0.9913

0.9916

2.4

0.9918

0.9920

0.9922

0.9925

0.9927

0.9929

0.9931

0.9932

0.9934

0.9936

2.5

0.9938

0.9940

0.9941

0.9943

0.9945

0.9946

0.9948

0.9949

0.9951

0.9952

2.6

0.9953

0.9955

0.9956

0.9957

0.9959

0.9960

0.9961

0.9962

0.9963

0.9964

2.7

0.9965

0.9966

0.9967

0.9968

0.9969

0.9970

0.9971

0.9972

0.9973

0.9974

2.8

0.9974

0.9975

0.9976

0.9977

0.9977

0.9978

0.9979

0.9979

0.9980

0.9981

2.9

0.9981

0.9982

0.9982

0.9983

0.9984

0.9984

0.9985

0.9985

0.9986

0.9986

3.0

0.9987

0.9987

0.9987

0.9988

0.9988

0.9989

0.9989

0.9989

0.9990

0.9990

3.1

0.9990

0.9991

0.9991

0.9991

0.9992

0.9992

0.9992

0.9992

0.9993

0.9993

3.2

0.9993

0.9993

0.9994

0.9994

0.9994

0.9994

0.9994

0.9995

0.9995

0.9995

3.3

0.9995

0.9995

0.9995

0.9996

0.9996

0.9996

0.9996

0.9996

0.9996

0.9997

3.4

0.9997

0.9997

0.9997

0.9997

0.9997

0.9997

0.9997

0.9997

0.9997

0.9998

3.5

0.9998

0.9998

0.9998

0.9998

0.9998

0.9998

0.9998

0.9998

0.9998

0.9998

157

Production

and Operations Management

MGT613

VU

.

158

Production

and Operations Management

MGT613

VU

SOLUTION

a.

Expected Lead Time Demand= 25 tonnes,

also σdLT= 2.5 tonnes,

Risk= 6%. Using the

given

table

values, 1-0.06=.9400 therefore +

Z=1.1.55

b.

The safety stock = ZσdLT= 1.55 x 2.50

tonnes= 3.875 tonnes

c.

Reorder Point =

Expected

Lead Time Demand + Safety

Stock

=

25

tonnes + 3.875=28.875

tonnes

d.

From the Service Level Table,

Lead time Service Level z=0.8

therefore E(z)=0.7881,using the

formula

E(n)=E(z) X σdLT

Now

Since σ

dLT= 2.5

tonnes

Therefore

E(n)=0.7881(2.50)=39.41 tonnes= 1.97025

tonnes

e.

SL annual= 1-E(z) σdLT/Q

Now

Since Q= 25 tonnes, E(z)=

We

can calculate the Annual Service Level by

substituting values in the formula

above

SL

annual=

1-0.7881(50)/1000=1-39.405/1000=1-0.03941=0.961

Fixed-Order-Interval

Model

1.

Orders

are placed at fixed time

intervals.

2.

Order

quantity for next

interval?

3.

Suppliers

might encourage fixed

intervals.

4.

May

require only periodic checks

of inventory levels.

5.

Risk

of stock out.

Summary

In

this lecture we studied

various important concepts

relating to Inventory Management.

Most

importantly

we learnt how to make use of

statistical tables to calculate lead

points and service

levels.

This

lecture forms the basis for

Supply Chain Management and

Just In Time Production

Systems.

159

Table of Contents:

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Decision Making

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Strategy

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Service Delivery System

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Productivity

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:The Decision Process

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Demand Management

- Roadmap to the Lecture:Fundamental Types of Forecasts, Finer Classification of Forecasts

- Time Series Forecasts:Techniques for Averaging, Simple Moving Average Solution

- The formula for the moving average is:Exponential Smoothing Model, Common Nonlinear Trends

- The formula for the moving average is:Major factors in design strategy

- The formula for the moving average is:Standardization, Mass Customization

- The formula for the moving average is:DESIGN STRATEGIES

- The formula for the moving average is:Measuring Reliability, AVAILABILITY

- The formula for the moving average is:Learning Objectives, Capacity Planning

- The formula for the moving average is:Efficiency and Utilization, Evaluating Alternatives

- The formula for the moving average is:Evaluating Alternatives, Financial Analysis

- PROCESS SELECTION:Types of Operation, Intermittent Processing

- PROCESS SELECTION:Basic Layout Types, Advantages of Product Layout

- PROCESS SELECTION:Cellular Layouts, Facilities Layouts, Importance of Layout Decisions

- DESIGN OF WORK SYSTEMS:Job Design, Specialization, Methods Analysis

- LOCATION PLANNING AND ANALYSIS:MANAGING GLOBAL OPERATIONS, Regional Factors

- MANAGEMENT OF QUALITY:Dimensions of Quality, Examples of Service Quality

- SERVICE QUALITY:Moments of Truth, Perceived Service Quality, Service Gap Analysis

- TOTAL QUALITY MANAGEMENT:Determinants of Quality, Responsibility for Quality

- TQM QUALITY:Six Sigma Team, PROCESS IMPROVEMENT

- QUALITY CONTROL & QUALITY ASSURANCE:INSPECTION, Control Chart

- ACCEPTANCE SAMPLING:CHOOSING A PLAN, CONSUMER’S AND PRODUCER’S RISK

- AGGREGATE PLANNING:Demand and Capacity Options

- AGGREGATE PLANNING:Aggregate Planning Relationships, Master Scheduling

- INVENTORY MANAGEMENT:Objective of Inventory Control, Inventory Counting Systems

- INVENTORY MANAGEMENT:ABC Classification System, Cycle Counting

- INVENTORY MANAGEMENT:Economic Production Quantity Assumptions

- INVENTORY MANAGEMENT:Independent and Dependent Demand

- INVENTORY MANAGEMENT:Capacity Planning, Manufacturing Resource Planning

- JUST IN TIME PRODUCTION SYSTEMS:Organizational and Operational Strategies

- JUST IN TIME PRODUCTION SYSTEMS:Operational Benefits, Kanban Formula

- JUST IN TIME PRODUCTION SYSTEMS:Secondary Goals, Tiered Supplier Network

- SUPPLY CHAIN MANAGEMENT:Logistics, Distribution Requirements Planning

- SUPPLY CHAIN MANAGEMENT:Supply Chain Benefits and Drawbacks

- SCHEDULING:High-Volume Systems, Load Chart, Hungarian Method

- SEQUENCING:Assumptions to Priority Rules, Scheduling Service Operations

- PROJECT MANAGEMENT:Project Life Cycle, Work Breakdown Structure

- PROJECT MANAGEMENT:Computing Algorithm, Project Crashing, Risk Management

- Waiting Lines:Queuing Analysis, System Characteristics, Priority Model