|

Production

and Operations Management

MGT613

VU

Lesson

17

In

our earlier lectures we talked

about importance of capacity

planning along with the idea

that capacity

planning

decisions are carried out

with certain objectivity in

mind both at the individual

level as well as

at

the organizational level. We also

learnt the various measures of

capacity. We now focus our

attention

on

various alternatives available to us

along with cost volume

relationship.

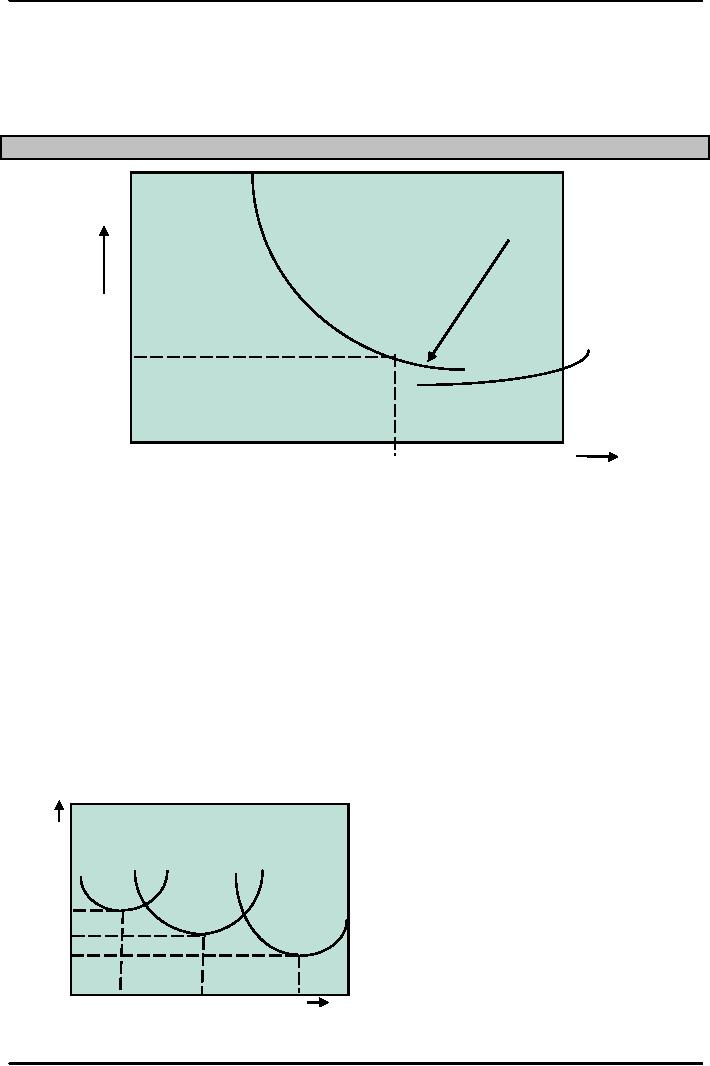

Evaluating

Alternatives

Minimum

Average Cost per

Unit

Average

cost

per

unit

Minimum

Cost

0

Rate

of output

Explanation

of the Cost Curve

The

explanation for the shape of

the cost curve is that

low levels of output

(Production), the costs of

facilities

and equipment must be absorbed

(paid for) by few units.

Hence the cost per unit is very

high.

As

the output is increased, there are more

units to absorb the fixed

cost of utilities, facilities

and

equipment,

so unit cost is

decreased.

Minimum

Cost would be recorded at the

optimal rate, beyond that the

unit cost will

start

to increase. Other factors now

become more important which

include worker fatigue,

equipment

breakdown,

the loss of flexibility, which

leaves less margin for

error and increases

difficulty in

coordinating

activities.

Evaluating

Alternatives

Minimum

cost & optimal operating rate are

functions of size of

production

unit.

Average

cost per unit

Small

Medium

plant

plant

Large

plant

0

Output

rate

72

Production

and Operations Management

MGT613

VU

Evaluating

Alternatives

As

the general capacity of the plant

increases, the optimal

output rate increases and

the

minimum

cost for the optimal rate

decreases. This is the prime

reason why larger plants

tend to

have

higher optimal output rates

and lower minimum costs than

smaller plants. The senior

management

normally takes in to account the

same considerations in addition to

availability of

financial,

capital resources and

forecasted demand.

The

important step is to determine

enough points for each

size facility to be able to

make a

comparison

among different sizes. In some

industries or types of services, facility

sizes are

given,

where as in other facility size

are continuous variable.

Occasionally the management

decides

for a size which does

not have the desired rate of output. E.g.

Pharmaceutical Company,

oil

field, gas fields.

An

organization needs to examine the

alternatives for future

capacity from a number of

different

perspectives.

Economic Conditions set the

external conditions which

influence the following

5.

Will Alternative be

feasible.

6.

How much will it

cost?

7.

How soon can we have

it?

8.

What will be the operating and

maintenance costs?

Possible

Negative Opinion due to the following

decisions.

4.

Decision to build a new

power plant, nuclear, coal,

geothermal

5.

Displacement of people if a new hydro

plant is to be built.

6.

Environmental issues related to

company's new

project.

Planning

Service Capacity

Services

are different that

manufacturing cant be inventoried

while services cannot be inventoried,

this

reason

alone makes it necessary and

pertinent to plan for service

capacity.

Need

to be near customers as Capacity

and location are closely

tied.

Inability

to store services as Capacity

must be matched with timing

of demand

Degree

of volatility of demand it can

vary between peak and low periods.

Cost-Volume

Relationships

73

Production

and Operations Management

MGT613

VU

Assumptions

of Cost-Volume Analysis

1.

One

product is involved

2.

Everything

produced can be sold

3.

Variable

cost per unit is the same

regardless of volume

4.

Fixed

costs do not change with

volume

5.

Revenue

per unit constant with

volume

6.

Revenue

per unit exceeds variable

cost per unit

Cost

Volume Relationship focuses on

relationships between costs, revenue and

volume of output. The

primary

purpose of cost volume analysis is to

estimate the income of an organization

under different

operating

conditions. It is particularly useful as

a tool for comparing

capacity alternatives.

The

application of Cost Volume

Relationships requires identification of

all costs related to

the

production

of a given product. These

costs are assigned to fixed

costs or variable

costs.

Fixed

costs tend to remain

constant regardless of volume of

output. Examples include Rental

costs,

property

taxes, equipment costs,

heating and cooling expenses, and

certain administration

costs.

Variable

costs vary directly with

volume of output. The major

portions of variable cost

are materials

and

labor cost. For our analysis

part we can assume that the

variable cost per unit

remains the same

regardless

of volume of output.

Let

us construct the model for Cost

Volume Relationship. If we select FC ,

VC, TC, TR R , Q, QBEP , P

and

R to represent Fixed Cost,

Variable Cost, Total Cost,

Total Revenue, Revenue per unit, Quantity

or

Volume

of Output, Quantity or Volume of

Output at BREAK EVEN and

Profit respectively

then

Step

I

The

total cost TC associated

with a given volume of

output is equal to the sum of the

fixed cost FC and

the

Variable Cost per

Unit

TC=

FC+ VC X Q

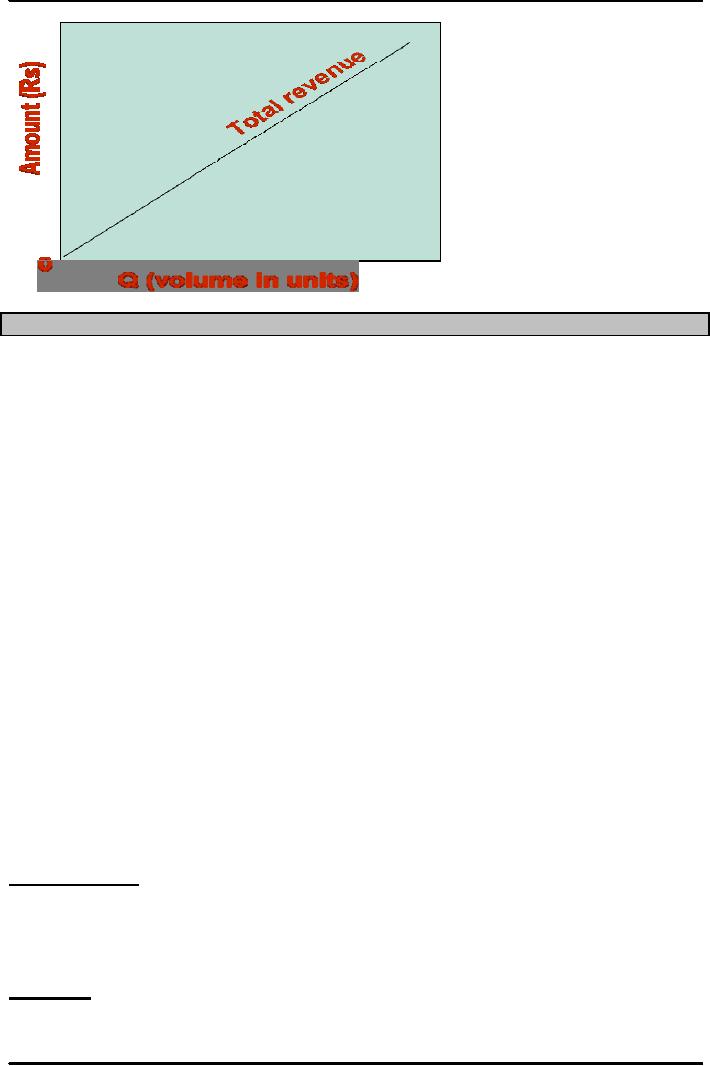

Step

II

Revenue

per unit, like variable cost

per unit, is assumed to be the same

regardless of the quantity of

output.

Total Revenue will have a linear

relationship with the

output.

TR=

R X Q

Cost-Volume

Relationships

Step

III

74

Production

and Operations Management

MGT613

VU

Profit

is P difference between Revenue TR and

Costs TC. Construct the model

for Cost Volume

Relationship

P=

TR-TC

P=

R X Q (FC + VC X Q)

Rearranging

and factorizing

P=Q

( R-VC) FC

Or

P + FC= Q ( R-VC)

Also

Q = ( P +FC)/ (R-VC)

Q=

Quantity or Volume of

Output

QBEP=

Quantity or Volume of Output at

BREAK EVEN, would be

where

P=Profit

is 0

So

QBEP = FC/ R-VC

Cost-Volume

Relationships

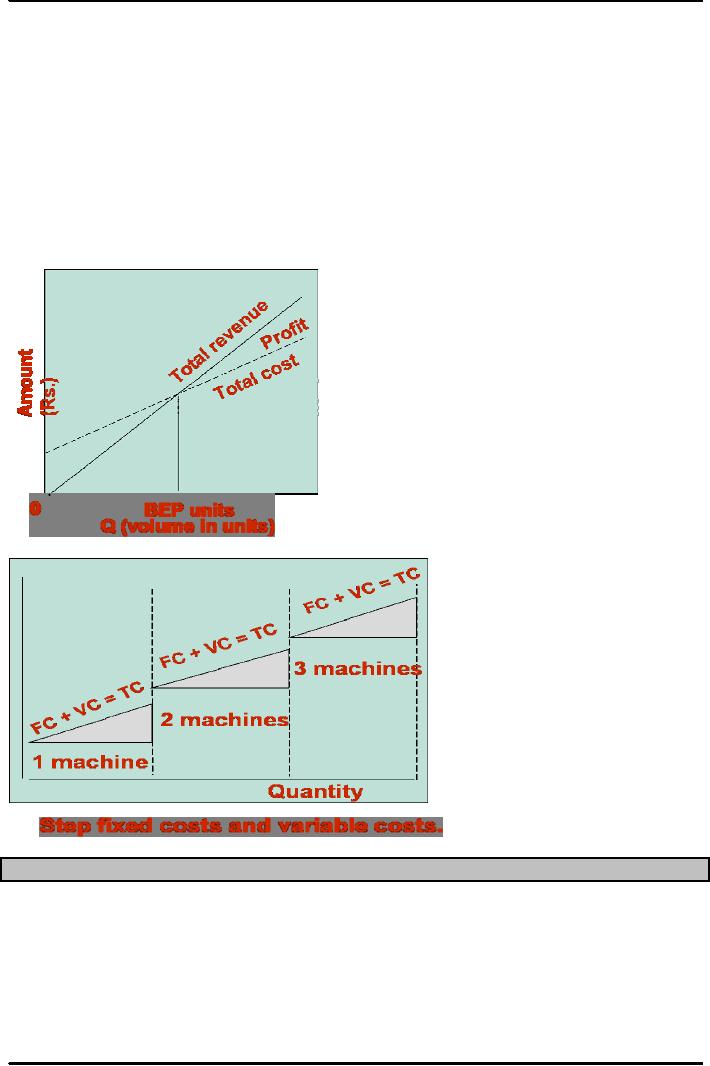

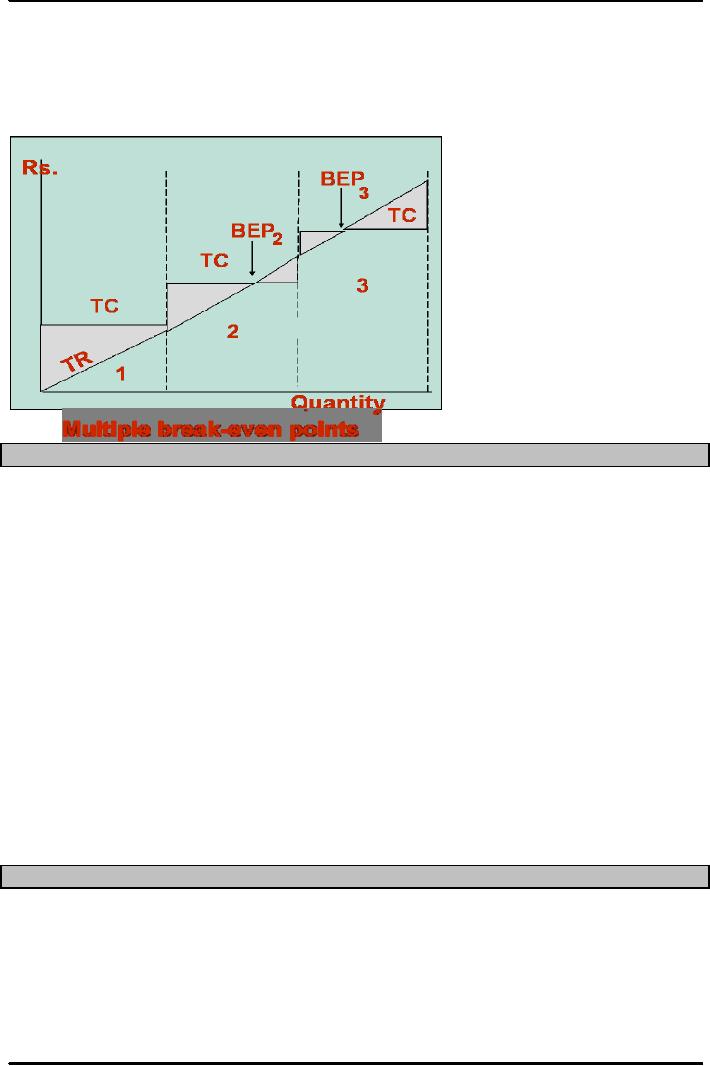

Capacity

alternatives involve step

costs.

These

step costs increase in

stepwise as potential volume

increases.

For

example an organization may have the

option of purchasing one, two or three

machines, with

each

additional machine increasing fixed cost

in a non linear way.

In

such a scenario, the fixed

costs and potential volume

would depend on number of machines

purchased

or installed.

Break-Even

Problem with Step Fixed

Costs

75

Production

and Operations Management

MGT613

VU

The

implication is that multiple

break even quantities may

occur, possibly one for each

range.

Note

the total revenue line might

not intersect the fixed cost

line in a particular range, meaning

that

would

be no break even point in the first

range.

In

order to decide how many

machines to purchase a manager

must consider projected

annual

demand

(volume) relative to Multiple

Break Even Points and the most

appropriate number of

machines.

Example

The

Business Owner of a sports

good factory in Sialkot is

contemplating adding a new

line of cricket

bats,

which will require leasing

new equipment for a monthly

payment of Rs. 60,000.

Variable Costs

would

be Rs. 200 per bat and Bats

would be sold for Rs.

2000 only.

1.

How many bats would be

sold in order to break

even?

2.

What would be the profit or

loss if the 100 bats are

made and sold in 1 month?

3.

How many bats must be

sold to realize a profit of

Rs. 40,000?

Solution

1.

QBEP= FC/ ( R-VC)

=Rs.

60,000/ 2000-200=

60,000/1800

=

33.33 bats = 33 Bats

2.

For Q =100 bats, the Profit

or Loss would be

P=

Q(R-VC)-FC=100(2000-200)-60,000=100X

1800-60,000=180,000-60,000=120,000

3.

For P =40,000

Q

= (FC+P)/ (

R-VC)=(60,000+40,000)/(2000-200)

=100,000/1800=55.56

= 56 Bats

Financial

Analysis

Mathematical

Techniques that can be used

to evaluate alternatives

are

�Cost

Volume Relationships

�Financial

Analysis

�Decision

Theory

�Waiting

Line Analysis

76

Production

and Operations Management

MGT613

VU

Capacity

alternatives are often

evaluated with the aid of

certain financial analyses. Operations

manager

along

with managerial accountant often

work to calculate what cash

flow or present value in

terms of

rupees

is available for the organization to

proceed with a capacity

alternative decision. It is important

to

understand

what cash flow and

present values are

1.

Cash Flow - the difference between

cash received from sales

and other sources, and

cash

outflow

for labor, material, overhead,

and taxes.

2.

Present Value - the sum, in

current value, of all future

cash flows of an investment

proposal.

Waiting

Line Analysis and decision

theory are also two

important ways in which capacity

alternatives

are

evaluated.

Conclusion

Capacity

planning is important that it helps an

organization to formulate its

long term (organizational)

strategy

and short term (operational) strategy.

Long term capacity decisions relate to

overall level of

capacity

while short term capacity decisions refer

to seasonal, random or irregular

variations in demand.

Ideally

capacity should match demand

but it rarely happens.

Capacity alternative decisions should

be

taken

in view of what we have already covered

the concept of systems approach or the

over all big

picture

approach as quite often removing a

bottle neck at the department level may

not improve the

organizations

effectiveness. An effective operations manager

would make use of qualitative as

well as

quantitative

analysis to evaluate capacity

alternatives.

Capacity

decisions are often based on

facilities layout and

together they define the

very existence of an

organizational

unit.

77

Table of Contents:

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Decision Making

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Strategy

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Service Delivery System

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Productivity

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:The Decision Process

- INTRODUCTION TO PRODUCTION AND OPERATIONS MANAGEMENT:Demand Management

- Roadmap to the Lecture:Fundamental Types of Forecasts, Finer Classification of Forecasts

- Time Series Forecasts:Techniques for Averaging, Simple Moving Average Solution

- The formula for the moving average is:Exponential Smoothing Model, Common Nonlinear Trends

- The formula for the moving average is:Major factors in design strategy

- The formula for the moving average is:Standardization, Mass Customization

- The formula for the moving average is:DESIGN STRATEGIES

- The formula for the moving average is:Measuring Reliability, AVAILABILITY

- The formula for the moving average is:Learning Objectives, Capacity Planning

- The formula for the moving average is:Efficiency and Utilization, Evaluating Alternatives

- The formula for the moving average is:Evaluating Alternatives, Financial Analysis

- PROCESS SELECTION:Types of Operation, Intermittent Processing

- PROCESS SELECTION:Basic Layout Types, Advantages of Product Layout

- PROCESS SELECTION:Cellular Layouts, Facilities Layouts, Importance of Layout Decisions

- DESIGN OF WORK SYSTEMS:Job Design, Specialization, Methods Analysis

- LOCATION PLANNING AND ANALYSIS:MANAGING GLOBAL OPERATIONS, Regional Factors

- MANAGEMENT OF QUALITY:Dimensions of Quality, Examples of Service Quality

- SERVICE QUALITY:Moments of Truth, Perceived Service Quality, Service Gap Analysis

- TOTAL QUALITY MANAGEMENT:Determinants of Quality, Responsibility for Quality

- TQM QUALITY:Six Sigma Team, PROCESS IMPROVEMENT

- QUALITY CONTROL & QUALITY ASSURANCE:INSPECTION, Control Chart

- ACCEPTANCE SAMPLING:CHOOSING A PLAN, CONSUMER’S AND PRODUCER’S RISK

- AGGREGATE PLANNING:Demand and Capacity Options

- AGGREGATE PLANNING:Aggregate Planning Relationships, Master Scheduling

- INVENTORY MANAGEMENT:Objective of Inventory Control, Inventory Counting Systems

- INVENTORY MANAGEMENT:ABC Classification System, Cycle Counting

- INVENTORY MANAGEMENT:Economic Production Quantity Assumptions

- INVENTORY MANAGEMENT:Independent and Dependent Demand

- INVENTORY MANAGEMENT:Capacity Planning, Manufacturing Resource Planning

- JUST IN TIME PRODUCTION SYSTEMS:Organizational and Operational Strategies

- JUST IN TIME PRODUCTION SYSTEMS:Operational Benefits, Kanban Formula

- JUST IN TIME PRODUCTION SYSTEMS:Secondary Goals, Tiered Supplier Network

- SUPPLY CHAIN MANAGEMENT:Logistics, Distribution Requirements Planning

- SUPPLY CHAIN MANAGEMENT:Supply Chain Benefits and Drawbacks

- SCHEDULING:High-Volume Systems, Load Chart, Hungarian Method

- SEQUENCING:Assumptions to Priority Rules, Scheduling Service Operations

- PROJECT MANAGEMENT:Project Life Cycle, Work Breakdown Structure

- PROJECT MANAGEMENT:Computing Algorithm, Project Crashing, Risk Management

- Waiting Lines:Queuing Analysis, System Characteristics, Priority Model