|

TIME VALUE OF MONEY:Future Value, Present Value |

| << FINANCIAL INSTITUTIONS:The structure of the financial industry |

| APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates >> |

Money

& Banking MGT411

VU

Lesson

8

TIME

VALUE OF MONEY

Time

Value of Money

Future

Value Concepts

Present

value

Application

in financial environment

Time

Value of Money

Credit

is one of the critical mechanisms we have

for allocating

resources.

Even

the simplest financial transaction, like

saving some of your paycheck

each month to buy a

car,

would be impossible.

Corporations,

most of which survive from

day to day by borrowing to

finance their

activities,

would

not be able to

function.

Yet

even so, most people still

take a dim view of the fact

that lenders charge interest.

The

main reason for the enduring

unpopularity of interest comes from the

failure to appreciate

the

fact that lending has an

opportunity cost.

Think

of it from the point of view of the

lender.

Extending

a loan means giving up the

alternatives. While lenders can

eventually recoup the sum

they

lend, neither the time that

the loan was outstanding nor

the opportunities missed during

that

time

can be gotten back.

So

interest isn't really "the

breeding of money from

money,'' as Aristotle put

it; it's more like a

rental

fee that borrowers must pay

lenders to compensate them for lost

opportunities.

It's

no surprise that in today's world,

interest rates are of enormous

importance to virtually

everyone

Individuals,

businesses, and governments

They

link the present to the future,

allowing us to compare payments

made on different

dates.

Interest

rates also tell us the

future reward for lending

today, as well as the cost of

borrowing

now

and repaying later.

To

make sound financial decisions, we

must learn how to calculate and

compare different

rates

on

various financial instruments

Future

Value

Future

Value is the value on some

future date of an investment

made today.

To

calculate future value we multiply the

present value by the interest rate

and add that amount

of

interest to the present value.

PV

+

Interest

=

FV

PV

+

PV*i

=

FV

$100

+ $100(0.05)

=

$105

PV

= Present Value

FV

= Future Value

i

= interest rate (as a percentage)

The

higher the interest rate (or the amount

invested) the higher the future

value.

Future

Value in one year

FV

= PV*(1+i)

22

Money

& Banking MGT411

VU

Now

we need to figure out what

happens when the time to repayment

varies

When

we consider investments with interest payments

made for more than one year

we need to

consider

compound interest, or the fact that

interest will be paid on interest

Future

Value in two

years

$100+$100(0.05)

+$100(0.05) + $5(0.05)

=$110.25

Present

Value of the Initial Investment +

Interest on the initial investment in the

1st Year + Interest

on

the

initial investment in the 2nd

Year+ Interest on the Interest

from the 1stYear in the 2nd

Year

=

Future Value in Two

Years

General

Formula for compound interest

Future value of an investment of PV in n

years at interest rate

i

(measured as a decimal, or 5% =

.05)

FVn = PV*(1+i) n

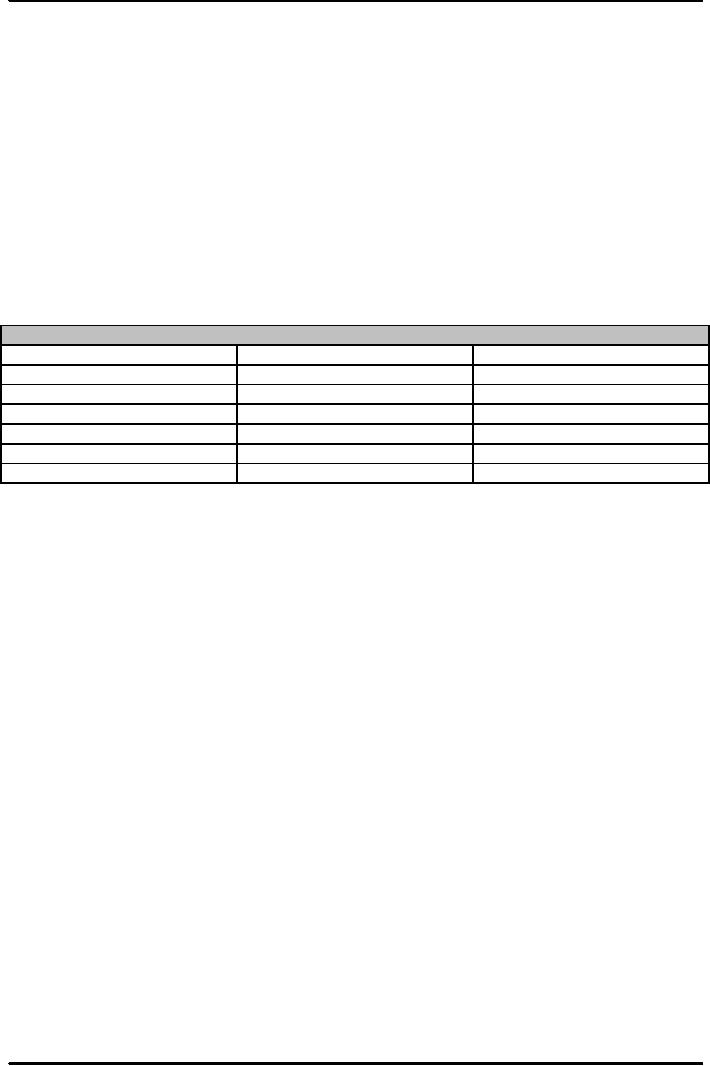

Table:

Computing the Future Value

of $100 at 5% annual interest

rate

Years

into future

Computation

Future

value

1

$100(0.5)

$105.00

2

2

$100(0.5)

$110.25

3

3

$100(0.5)

$115.76

4

4

$100(0.5)

$121.55

5

5

$100(0.5)

$127.63

10

10

$100(0.5)

$162.89

Note:

Both

n and i must be measured in same

time units--if i is annual,

then n must be in years, so

future

value

of $100 in 18 months at 5% is

FV

= 100 *(1+.05)1.5

How

useful it is?

If

you put $1,000 per year

into bank at 4% interest, how

much would you have saved

after 40

years?

Taking

help of future value concept, the

accumulated amount through the saving

will be

$98,826

more than twice the $40,000

you invested

How

does it work?

The

first $1,000 is deposited for 40

years so its future value

is

$1,000

x (1.04)40 = 4,801.02

The

2nd $1,000 is deposited for 39

years so its future value

is

$1,000

x (1.04)39 = 4,616.37

And

so on.....up to the $1,000 deposited in the

40th year

Adding

up all the future values gives

you the amount of $98,826

Present

Value

Present

Value (PV) is the value

today (in the present) of a

payment that is promised to be

made

in

the future. OR

Present

Value is the amount that must be

invested today in order to

realize a specific amount on

a

given future date.

To

calculate present value we invert the

future value

calculation;

We

divide future value by one

plus the interest rate (to find the

present value of a payment to

be

made

one year from now).

Solving

the Future Value

Equation

23

Money

& Banking MGT411

VU

FV

= PV*(1+i)

Present

Value of an amount received in one

year.

Example:

$100

received in one year,

i=5%

PV=$100/

(1+.05) = $95.24

Note:

FV

= PV*(1+i) = $95.24*(1.05) =

$100

For

payments to be made more than one

year from now we divide

future value by one plus

the

interest

rate raised to the nth power where n is the number of

years

Present

Value of $100 received n

years in the future:

Example

Present

Value of $100 received in 2 ½

years and an interest rate of

8%.

PV

= $100 / (1.08)2.5 = $82.50

Note:

FV

=$82.50 * (1.08)2.5 = $100

24

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY