|

FINANCIAL INSTITUTIONS:The structure of the financial industry |

| << FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value |

| TIME VALUE OF MONEY:Future Value, Present Value >> |

Money

& Banking MGT411

VU

Lesson

7

FINANCIAL

INSTITUTIONS

Financial

Institutions

Structure

of Financial Industry

Time

Value of Money

Financial

Institutions

Financial

institutions are the firms

that provide access to the

financial markets;

They

sit between savers and

borrowers and so are known

as financial intermediaries.

Banks,

insurance companies, securities firms and

pension funds

A

system without financial

institutions would not work

very well for three

reasons

Individual

transactions between saver-lenders and borrower-spenders

would be extremely

expensive.

Lenders

need to evaluate the creditworthiness of

borrowers and then monitor them,

and

individuals

are not equipped to do

this.

Most

borrowers want to borrow long term,

while lenders favor short-term

loans

Role

of Financial Institutions

Reduce

transactions cost by specializing in the

issuance of standardized securities

Reduce

information costs of screening and

monitoring borrowers.

Curb

information asymmetries, helping to

ensure that resources flow

into their most

productive

uses

Make

long-term loans but allow

savers ready access to their

funds.

Provide

savers with financial instruments (more

liquid and less risky than

the individual stocks

and

bonds) that savers would

purchase directly in financial

markets

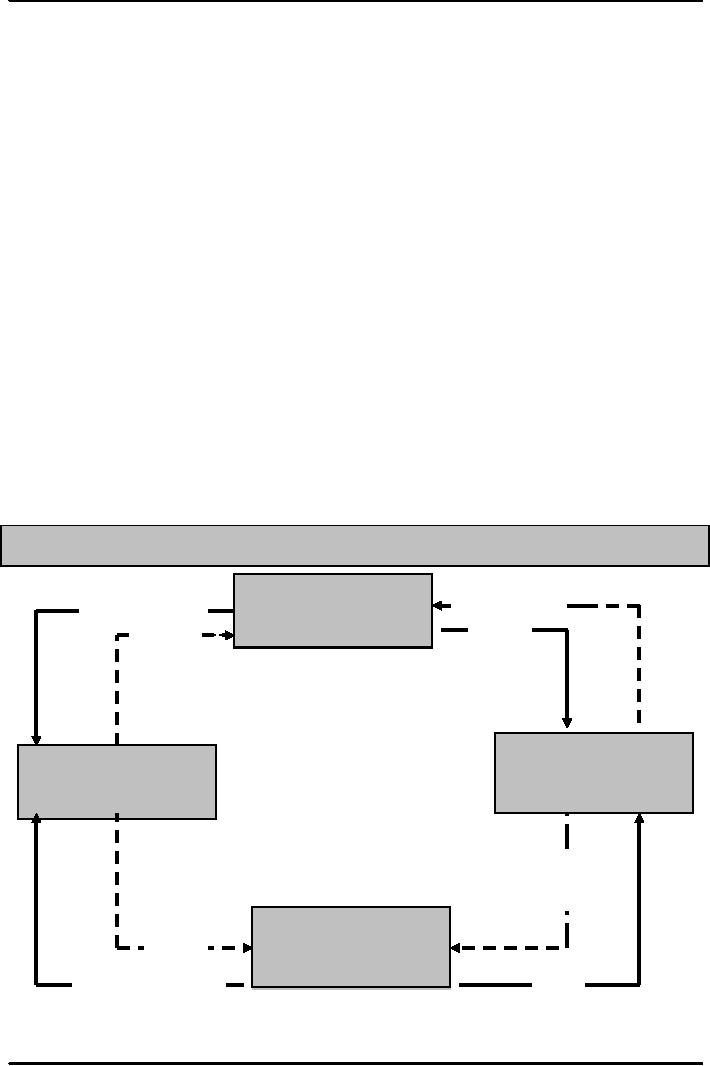

Figure:

Flow of funds through

Financial Institutions: Access to

Financial Markets

Financial

Institutions

Bonds

& Stocks

Bonds &

SStcks s

nds

& toock

that

act as Brokers

Funds

Funds

s

Borooroers/rS/Spends

rs

Br

rw we spendere

Lenders/Savers

(Primarily

Governments

(Primarily

and

Firms)

(Primarily

Households)

Governments

and

Loans,

Bonds,

Stocks

and

Real

Estate

Financial

Institutions

Financial

Institutions

that

transform assets

Funds

that

transform assets

Deposits

& Insurance

Funds

Policies

Indirect

Finance

20

Money

& Banking MGT411

VU

The

simplified Balance Sheet of a

Financial Institution

Assets

Liabilities

Bonds

Deposits

Stocks

Insurance

policies

Loans

Real

estate

The

structure of the financial

industry

The

structure of the financial

industry:

Financial

institutions or intermediaries can be

divided into two broad

categories

Depository

institutions -

take deposits and make

loans.

(Commercial

banks, savings banks, and credit

unions)

Nondepository

institutions

Insurance

companies, securities firms, mutual

fund companies, finance

companies, and pension

funds

Insurance

companies

Accept

premiums, which they invest in securities

and real estate in return

for promising

compensation

to policyholders should certain

events occurs (like death,

property losses, etc.)

Pension

funds

Invest

individual and company contributions into

stocks, bonds and real

estate in order to

provide

payments to retired

workers.

Securities

firms

They

include brokers, investment banks, and

mutual fund companies

Brokers

and investment banks issue

stocks and bonds to corporate customers,

trade them, and

advise

clients.

Mutual

fund companies pool the

resources of individuals and companies

and invest them in

portfolios

of bonds, stocks, and real

estate.

Government

Sponsored Enterprises:

Federal

credit agencies that provide

loans directly for farmers

and home mortgages, as well

as

guarantee

programs that insure the loans made by

private lenders.

HBFC,

ZTBL, Khushhali bank, SME

Bank

The

government also provides

retirement income and medical

care to the elderly (and

disabled)

through

Social Security and

Medicare.

Finance

Companies:

Raise

funds directly in the financial

markets in order to make loans to

individuals and firms.

The

monetary aggregates are made

up of liabilities of commercial banks, so

clearly the financial

structure

is tied to the availability of money and

credit.

21

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY