|

Money

& Banking MGT411

VU

Lesson

5

FINANCIAL

INTERMEDIARIES

Financial

Intermediaries

Financial

Instruments

Uses

Characteristics

Value

Examples

Financial

Intermediaries

The

informal arrangements that were

the mainstay of the financial system

centuries ago have

since

given way to the formal

financial instruments of the modern

world

Today,

the international financial system exists

to facilitate the design, sale, and

exchange of a

broad

set of contracts with a very

specific set of characteristics.

We

obtain the financial resources we

need from this system in

two ways:

Directly

from lenders and

Indirectly

from financial institutions

called financial

intermediaries.

Indirect

Finance

A

financial institution (like a

bank) borrows from the

lender and then provides

funds to the

borrower.

If

someone borrows money to buy

a car, the car becomes his or her

asset and the loan a

liability.

Direct

Finance

Borrowers

sell securities directly to lenders in the

financial markets.

Governments

and corporations finance their

activities this way

The

securities become assets to the lenders

who buy them and liabilities to the

borrower who

sells

them

Financial

and Economic Development

Financial

development is inextricably linked to

economic growth

There

aren't any rich countries

that have very low levels of

financial development.

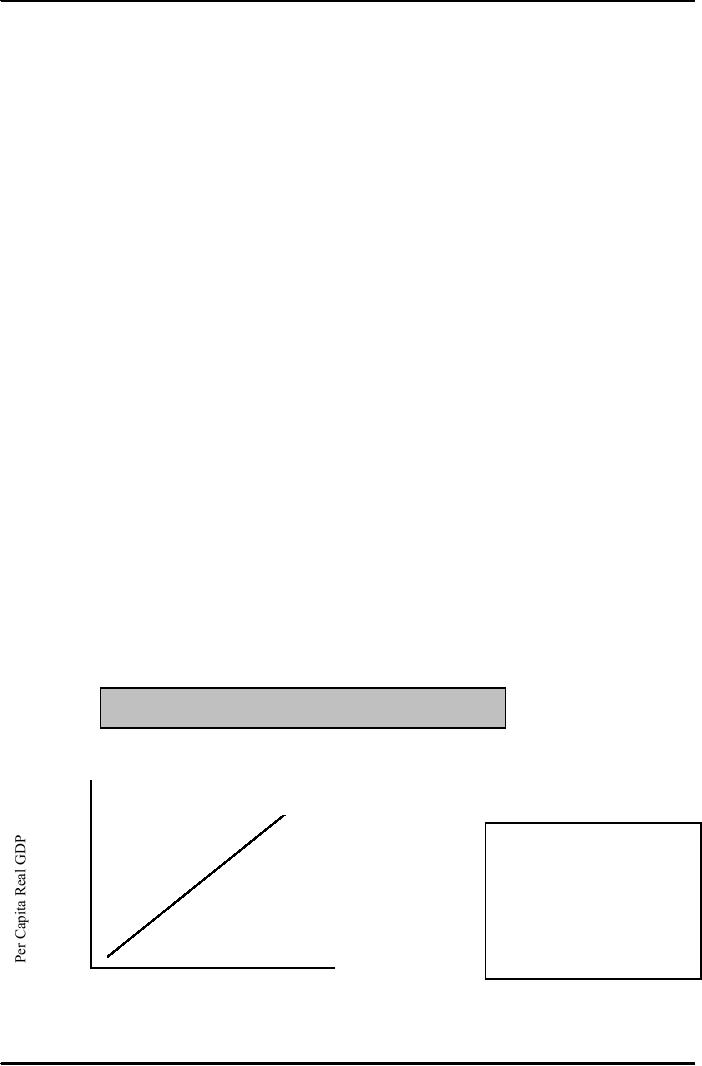

Figure:

Financial and Economic

Development

Correlation=0.62

25000

��

�

�

Financial

Development is

20000

�

Hong

Kong

�

measured

by the commonly

��

used

ratio of broadly

defined

15000

�

money

to GDP. Economic

Korea

10000

�

development

is measured by

Malaysia

�

the

real GDP per capita.

�

5000

���

China

50

100

150

200

250

0

Financial

Market Development

14

Money

& Banking MGT411

VU

Financial

Instruments

A

financial instrument is the written

legal obligation of one party to transfer

something of value

usually money to another party at

some future date, under

certain conditions, such as

stocks,

loans,

or insurance.

Written

legal obligation means that

it is subject to government enforcement;

The

enforceability of the obligation is an

important feature of a financial

instrument.

The

"party" referred to can be a

person, company, or

government

The

future date can be specified

or can be when some event

occurs

Financial

instruments generally specify a number of possible

contingencies under which

one

party

is required to make a payment to

another

Stocks,

loans, and insurance are all

examples of financial instruments

Uses

of Financial Instruments

1.

Means

of Payment

Purchase

of Goods or Services

2.

Store

of Value

Transfer

of Purchasing Power into the

future

3.

Transfer

of Risk

Transfer

of risk from one person or company to

another

Characteristics

of Financial Instruments

Standardization

Standardized

agreements are used in order

to overcome the potential costs of

complexity

Because

of standardization, most of the financial

instruments that we encounter on a

day-to-day

basis

are very homogeneous

Communicate

Information

Summarize

certain essential information

about the issuer

Designed

to handle the problem of "asymmetric

information",

Borrowers

have some information that

they don't disclose to

lenders

Classes

of Financial Instruments

Underlying

Instruments (Primary or Primitive

Securities)

E.g.

Stocks and bonds

Derivative

Instruments

Value

and payoffs are "derived

from" the behavior of the

underlying instruments

Futures

and options

Value

of Financial Instruments

Size

of the promised payment

People

will pay more for an

instrument that obligates the

issuer to pay the holder a greater

sum.

The

bigger the size of the promised payment,

the more valuable the financial

instrument

When

the payment will be

received

The

sooner the payment is made the more

valuable is the promise to make it

The

likelihood the payment will be

made (risk).

The

more likely it is that the payment

will be made, the more valuable the

financial instrument

The

conditions under which the

payment will be made

Payments

that are made when we

need them most are more

valuable than other

payments

15

Money

& Banking MGT411

VU

Value

of Financial Instruments

1.

Size

Payments

that are larger are more

valuable

2.

Timing

Payments

that are made sooner

are more valuable

3.

Likelihood

Payments

that are more likely to be

made are more

valuable

4.

Circumstances

Payments that are made

when we need them most are

more

valuable

16

Money

& Banking MGT411

VU

Lesson

6

FINANCIAL

INSTRUMENTS & FINANCIAL

MARKETS

Financial

Instruments

Examples

Financial

Markets

Roles

Structure

Financial

Institutions

Examples

of Financial Instruments

Primarily

Stores of Value

Bank

Loans

A

borrower obtains resources from a

lender immediately in exchange

for a promised set of

payments

in the future

Bonds

A

form of a loan, whereby in exchange

for obtaining funds today a

government or corporation

promises

to make payments in the future

Home

Mortgages

A

loan that is used to

purchase real estate

The

real estate is collateral

for the loan,

It

is a specific asset pledged by the

borrower in order to protect the

interests of the lender in the

event

of nonpayment.

If

payment is not made the

lender can foreclose on the

property.

Stocks

An

owner of a share owns a piece of the firm

and is entitled to part of

its profits.

Primarily

to transfer risk

Insurance

Contracts

The

primary purpose is to assure

that payments will be made

under particular (and often

rare)

circumstances

Futures

Contracts

An

agreement to exchange a fixed

quantity of a commodity, such as wheat or

corn, or an asset,

such

as a bond, at a fixed price on a

set future date

It

is a derivative instrument since

its value is based on the

price of some other

asset.

It

is used to transfer the risk of price

fluctuations from one party to

another

Options

Derivative

instruments whose prices are

based on the value of some

underlying asset;

They

give the holder the right

(but not the obligation) to

purchase a fixed quantity of

the

underlying

asset at a predetermined price at

any time during a specified

period.

Financial

Markets

Financial

Markets are the places where

financial instruments are bought

and sold.

Enable

both firms and individuals to

find financing for their

activities.

Promote

economic efficiency by ensuring that

resources are placed at the disposal of

those who

can

put them to best use.

When

they fail to function

properly, resources are no

longer channeled to their best possible

use

and

the society suffers at large

17

Money

& Banking MGT411

VU

Role

of Financial Markets

Liquidity

Ensure

that owners of financial instruments can

buy and sell them cheaply

and easily

Information

Pool and communicate information about

the issuer of a financial

instrument

Risk

Sharing Provide individuals

with a place to buy and sell

risk, sharing them with

individuals

Financial

markets need to be designed in a way

that keeps transactions

costs low

Structure

of Financial Markets

Primary

vs. Secondary Markets

In

a primary market a borrower

obtains funds from a lender

by selling newly issued

securities.

Most

companies use an investment

bank, which will determine a

price and then purchase

the

company's

securities in preparation for resale to

clients; this is called

underwriting.

In

the secondary markets people

can buy and sell

existing securities

Centralized

Exchanges vs. Over-the-counter

Markets

In

the centralized exchange (e.g. Karachi

Stock Exchange www.kse.com.pk ), the

trading is

done

"on the floor"

Over-the-counter

(or OTC)

OTC

market are electronic

networks of dealers who trade

with one another from wherever

they

are

located

Debt

and Equity vs. Derivative

Markets

Equity

markets are the markets for

stocks, which are usually

traded in the countries where the

companies

are based.

Debt

instruments can be categorized as

Money

market (maturity of less

than one year) or Bond

markets (maturity of more than

one

year)

Characteristics

of a well-run financial

market

Low

transaction costs.

Information

communicated must be accurate and

widely available

If

not, the prices will not be

correct

Prices

are the link between the financial

markets and the real

economy

Investors

must be protected.

A

lack of proper safeguards

dampens people's willingness to

invest

18

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY