|

DERIVING THE MONETARY POLICY REACTION CURVE |

| << MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND |

| THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve >> |

Money

& Banking MGT411

VU

Lesson

41

DERIVING

THE MONETARY POLICY REACTION

CURVE

To

ensure that deviations of

inflation from the target

are only temporary,

monetary

policymakers

respond to change in inflation by

changing the real interest rate in the

same

direction.

The

monetary policy reaction

curve is set so that when

current inflation equals

target

inflation,

the real interest rate equals the

long-run real interest rate.

The

slope of the curve depends on

policymakers' objectives;

When

central bankers decide how

aggressively to pursue their

inflation target, and how

willing

they are to tolerate

temporary changes in inflation,

they determine the slope of the

curve

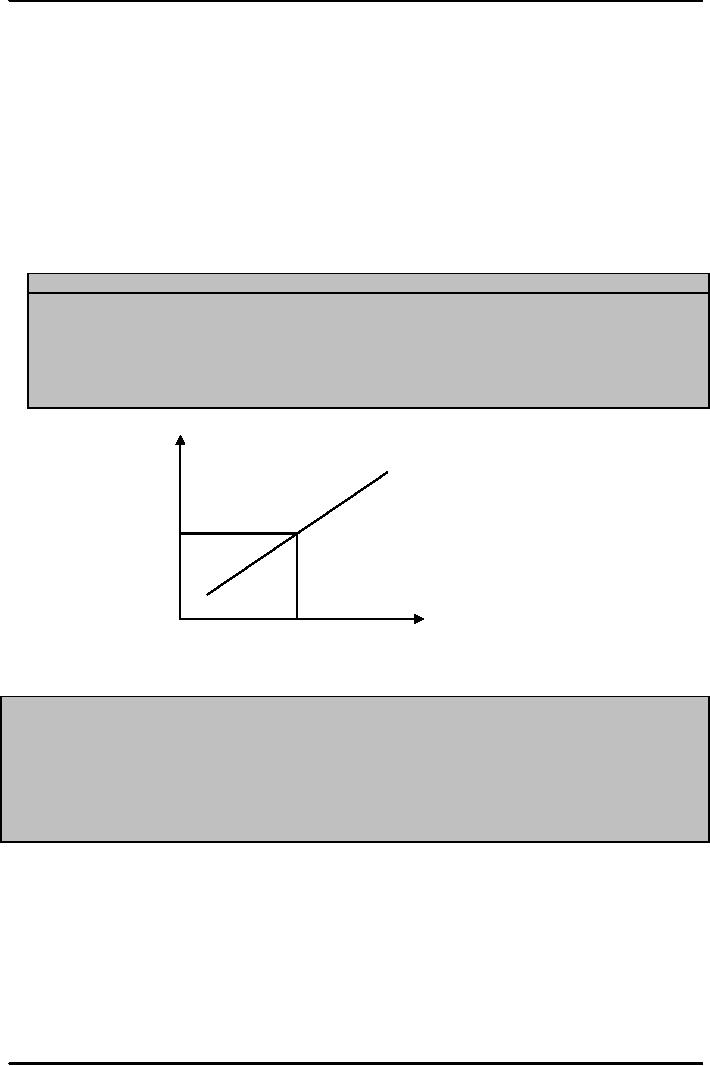

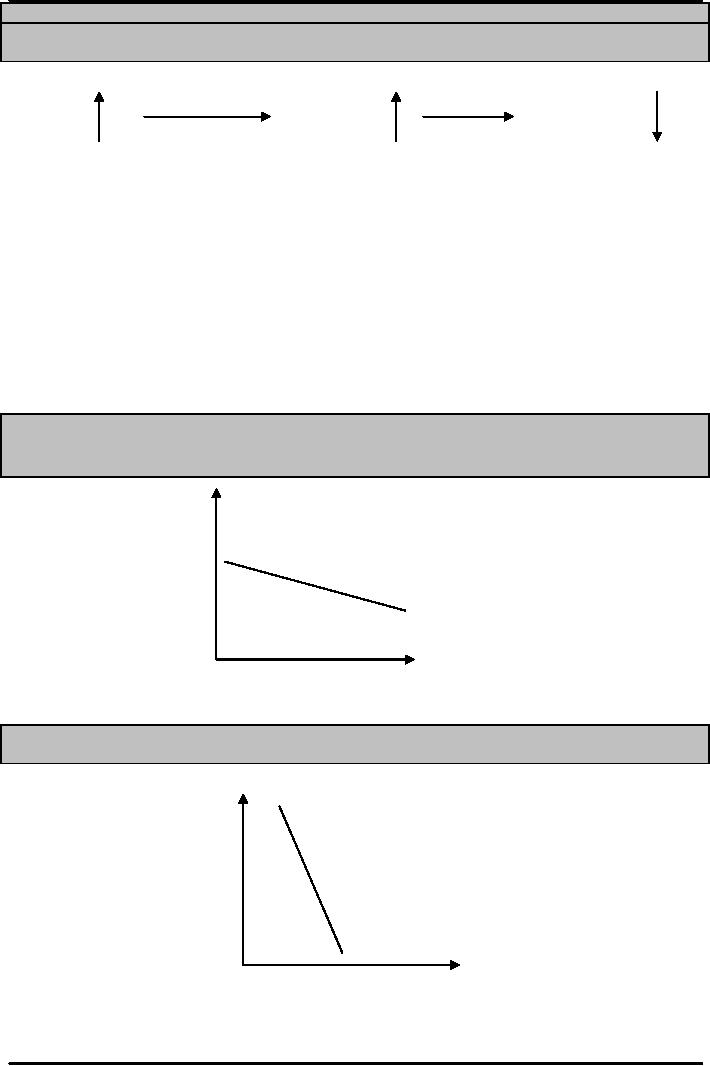

Figure:

The Monetary Policy Reaction

Curve

A.

The Monetary Policy Reaction

Curve

Monetary

policy makers react to

changes in current inflation by

changing the real interest rate.

Increases

in current inflation lead them to

raise the real interest rate, while

decreases lead them to

lower

it. The monetary policy

reaction curve is located so that the

central bank's target

inflation is

consistent

with the long-run real interest rate,

which equates aggregate

demand with potential

output.

Real

interest

rate

(r)

Monetary

Policy

Reaction

Curve

Long

Run

Real

Interest

Rate

(r*)

Inflation

(�)

Target

Inflation

(�T)

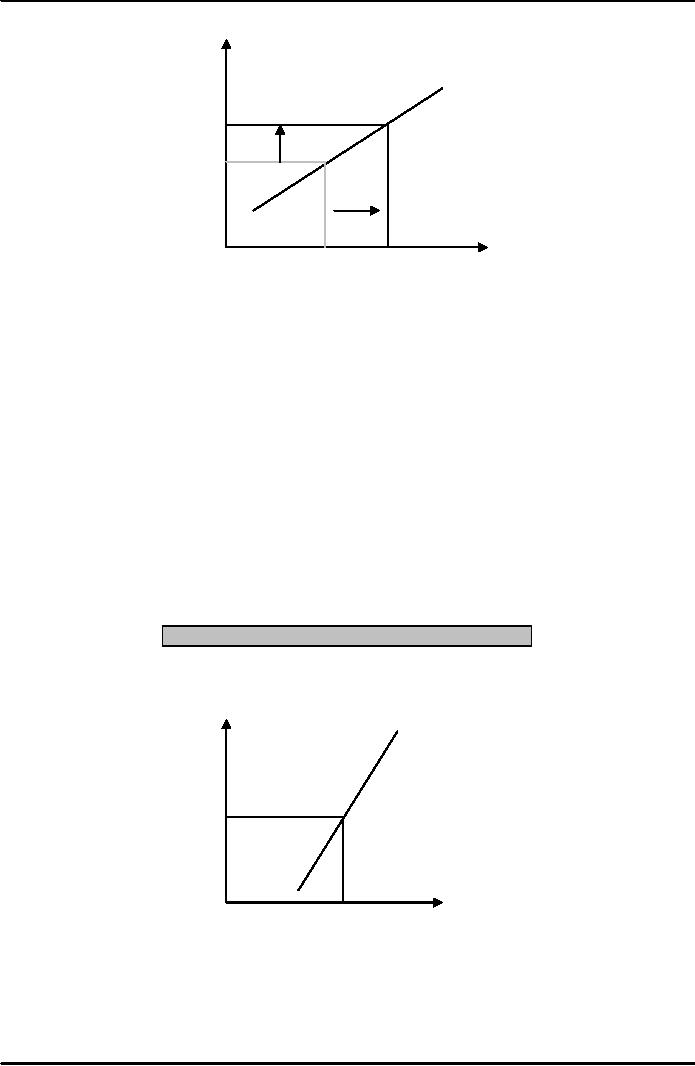

B.

Movements along the Monetary Policy

Reaction Curve

The

long run real interest rate

in an economy is roughly 2.5% and

the central bank's

implicit

inflation

target is approximately 2%.

The monetary policy reaction

curve implies that a

1%age

point

increase in inflation calls

for a half %age point

increase in the real

interest rate--- a

movement

along the monetary policy

reaction curve. That means

that an increase in

inflation

from

2 to 3 % calls for an increase in

the real interest rate from

2.5 to 3 %.

127

Money

& Banking MGT411

VU

Real

interest

r

increases from

Monetary

Policy

rate

(r)

2.5%

to 3%

Reaction

Curve

3%

Long

Run Real

Interest

Rate

�

Increases

(r*=2.

5%)

from

2% to

3%

Inflation

(�)

Target

3%

Inflation

(�T=2%)

Shifting

the Monetary Policy Reaction

Curve

Policymakers

who are aggressive in

keeping current inflation

near target will have a

steep

curve,

meaning that a small change

in inflation will be met

with a large change in the

real

interest

rate

A

relatively flat curve means

that central bankers are

less concerned than they

might be

with

keeping current inflation

near target over the short

term.

The

monetary policy reaction

curve is set so that when

current inflation equals

target

inflation,

the

Real

interest rate equals the long-run real

interest rate.

r

= r* when �

=

�T.

When

policymakers adjust the real interest rate

they are either moving

along a fixed

monetary

policy reaction curve or

shifting the curve.

A

movement along the curve is a reaction to

a change in current inflation; a

shift in the

curve

represents a change in the level of the

real interest rate at every level of

inflation.

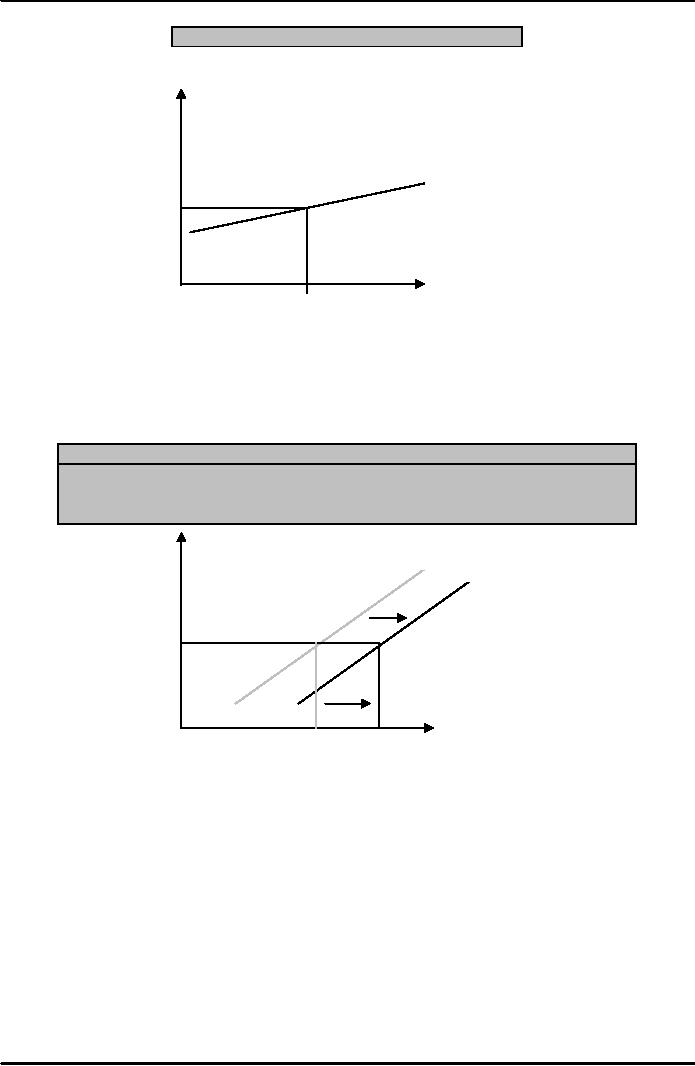

Figure

A: Monetary Policy Reaction

Curve

Real

Interest

Monetary

policy

rate

(r)

reaction

curve of a

central

bank that is

aggressive

in keeping

Long

Run Real

current

inflation close

Interest

Rate (r*)

to

its target in the

short

run

Inflation

(�)

Target

Inflation

(�T)

128

Money

& Banking MGT411

VU

Figure

B: Monetary Policy Reaction

Curve

Real

Interest

rate

(r )

Monetary

Policy

Reaction

Curve of a

central

bank that is

less

concerned about

Long

run real

keeping

current

interest

rate (r*)

inflation

near

its

target

in the short run

Inflation

(�)

Target

If

either target inflation or

theIlolagi-on n�real

interest rate change, then the entire

curve will

n

t ru (

T)

nf

shift

With

a higher inflation target, the

central bank will set a

lower current real interest

rate at

every

level of current inflation,

shifting the monetary policy

reaction curve to the right

(a

reduction

would have the opposite

effect).

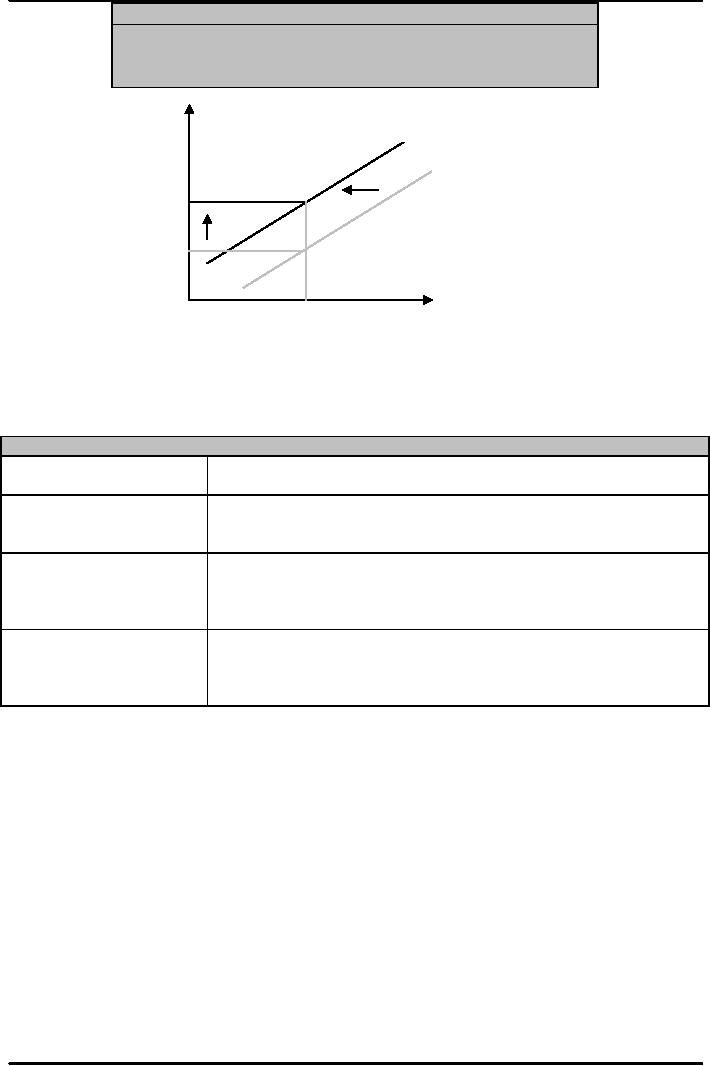

Figure

A: An increase in the Central

Bank's Inflation

Target

An

increase in the central bank's

inflation target from an

initial level of �o

to the

new

level

of �1

shifts the

monetary policy reaction

curve to the right, lowering the

real

interest

rate at every level of current

inflation.

Real

Interest

Old

New

Rate

(r)

Long

Run Real

Interest

Rate

(r*)

New

Target

Inflation

(�1)

Inflation

(�)

Initial

Target

Inflation

(�o)

The

long-run real interest rate is determined

by the structure of the economy;

If

it were to rise as a result of an increase in

government purchases (or

some other

component

of aggregate demand that is

not sensitive to the real interest rate)

then the

monetary

policy reaction curve would

shift left

129

Money

& Banking MGT411

VU

Figure

B: An increase in the Long-run real

interest rate

An

increase in the economy's

long run real interest rate

from ro

to

r1 shifts

the monetary policy reaction

curve to the left,

raising

the

real interest rate at every

level of current

inflation

Real

interest rate

New

(r)

Old

New

Long run

real

interest rate

(r1)

Initial

Long Run

real

interest rate

(ro)

Inflation

(�)

Target

Inflation

(�T)

Any

shift in the monetary policy

reaction curve can be characterized as

either a change in

target

inflation or a shift in the long-run

real interest rate

The

Monetary Policy Reaction

Curve

The

relationship between current inflation

and the real interest rate set

by

What

is it?

monetary

policy makers

Drawn

so that, when current

inflation equals target

inflation,

What

determines its

policymakers

will set the real interest rate

equal to the long run

real

location?

interest

rate

Policymaker's

attitude toward inflation.

The more aggressive

What

determines its

policymakers

are in keeping current

inflation close to target

level, and

slope?

the

less tolerant they are of

temporary changes in inflation, the

steeper

the

slopes

In

response to changes in either the

long run real interest rate or

the

When

does it shift?

central

bank's inflation target. An

increase in the long run

real interest

rate

shifts the curve to the left. An

increase in the inflation target

shifts

the

curve to the right.

The

Aggregate Demand Curve

When

current inflation

rises

Monetary

policymakers raise the real interest

rate, moving upward along the

monetary

policy

reaction curve

The

higher real interest rate reduces

consumption, investment, and net exports

causing

aggregate

demand (output) to

fall.

130

Money

& Banking MGT411

VU

The

link between Current

Inflation and Aggregate

Demand

When

current inflation rises ,

policy makers react by

raising the real interest rate, which

reduces

consumption,

investment, and net exports. The result

is a reduction in aggregate

demand.

Real

Aggregate

Current

Interest

Demand

Inflation

Monetary

Policy

Consumption,

Rate

Investment.

reacts

by tightening

Net

exports all

fall

Changes

in current inflation move the economy

along a downward-sloping aggregate

demand

curve

This

is in addition to the effect of higher

inflation on real money

balances noted

earlier

The

slope of the aggregate demand curve

tells us how sensitive current

output is to a given

change

in current inflation.

The

aggregate demand curve will

be relatively

Flat

if current output is very sensitive to

inflation (a change in current

inflation causes a

large

movement

in current output)

Steep

if current output is not

very sensitive to inflation

Figure

A: When the monetary policy reaction

curve is steep, the central bank

is

aggressive

in keeping current inflation

near its target level, the aggressive

demand curve

is

flat.

Inflation

(�)

Flat

Aggregate Demand

Output

(Y)

Figure

B: When the monetary policy

reaction curve is flat, the central

bank is less

concerned

about

keeping current inflation near

its target level; the

aggregate demand curve is

steep.

Inflation

(�)

Steep

Aggregate Demand

Output

(Y)

131

Money

& Banking MGT411

VU

Three

factors influence the sensitivity of

current output to

inflation:

The

strength of the effect of inflation on

real money balances,

The

extent to which monetary

policymakers react to a change in

current inflation,

The

size of the response of aggregate

demand to changes in the interest

rate

The

second factor relates to the slope of the

monetary policy reaction

curve

If

policymakers react aggressively to a

movement of current inflation away

from its

target

level with a large change in

the real interest rate, the monetary

policy reaction

curve

will be steep and the aggregate

demand curve is flat

If

policymakers respond more cautiously, the

monetary policy reaction

curve is flat and

the

aggregate demand curve is

steep

The

slope of the aggregate demand curve

depends in part on the preferences of

the

central

bank;

How

aggressive policymakers are in

responding to deviations of inflation

from the

target

level

132

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY