|

MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND |

| << THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run |

| DERIVING THE MONETARY POLICY REACTION CURVE >> |

Money

& Banking MGT411

VU

Lesson

40

MONEY

GROWTH, INFLATION, AND AGGREGATE

DEMAND

To

shift the focus to inflation, we need to

look at changes in the price

level.

Suppose

that inflation exceeds money

growth (with velocity held

constant).

Real

money

balances

will fall and so will

aggregate demand

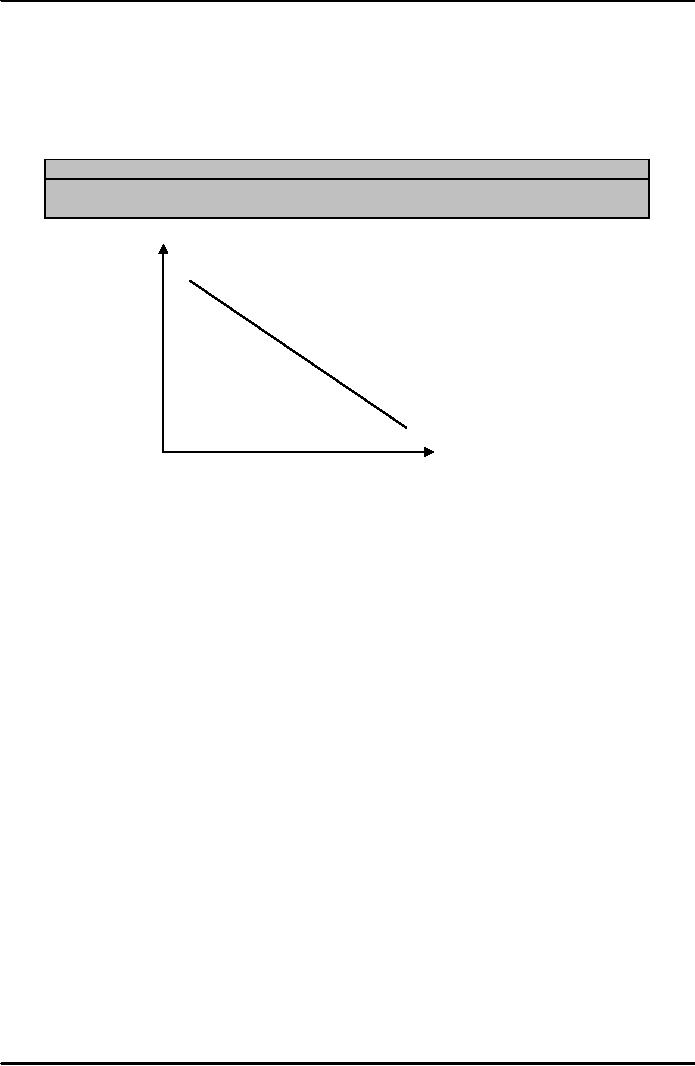

Figure:

The Aggregate Demand Curve

At

higher level of inflation,

real money balances fall,

resulting in a lower level

of

aggregate

demand.

Inflation

(�)

Aggregate

Demand Curve

Output

(Y)

Because

real money balances fall at

higher levels of inflation,

resulting in a lower level

of

aggregate

demand, the aggregate demand

curve is downward

sloping.

Changes

in the interest rate also provide a

mechanism for aggregate

demand to slope down

Monetary

Policy and the Real Interest

Rate

Central

bankers control short-term nominal

interest rates by controlling the market

for reserves.

But

the economic decisions of households and firms depend

on the real interest rate;

To

alter the course of the economy,

central banks must influence

the real interest rate as well

In

the short run, because inflation is

slow to respond, when monetary

policymakers change

the

nominal

interest rate they change the real

interest rate.

The

real interest rate, then, is the lever

through which monetary

policymakers influence the

real

economy.

In

changing real interest rates,

they influence aggregate

demand.

Aggregate

Demand and the Real Interest

Rate

Aggregate

demand is divided into four

components:

Consumption,

Investment,

Government

purchases,

Net

exports

Aggregate

Govt.'s Net Demand = Consumption +

Investment + Purchases +

Exports

Yad

= C + I + G + NX

It

is helpful to think of aggregate

demand as having two parts,

one that is sensitive to real

interest

rate changes and one that is

not

Investment

is the most important of the components

of aggregate demand that are

sensitive to

changes

in the real interest rate.

125

Money

& Banking MGT411

VU

An

investment can be profitable

only if its internal rate of

return exceeds the cost of

borrowing

Consumption

and net exports also respond to the real

interest rate;

Consumption

decisions often rely on borrowing,

and the alternative to consumption is

saving

(higher

rates mean more

saving).

As

for net exports, when the real interest

rate in a country rises, her financial

assets become

attractive

to foreigners, causing local

currency to appreciate, which in turn

means more imports

and

fewer exports (lower net

exports)

While

changes in real interest rate may have an

impact on the government's budget by

raising

the

cost of borrowing, the effect is

likely to be small and

ignorable.

Thus,

considering consumption, investment, and

net exports, an increase in the real

interest rate

reduces

aggregate demand (the effect

on the 4th component, government spending, is

small

enough

to be ignored).

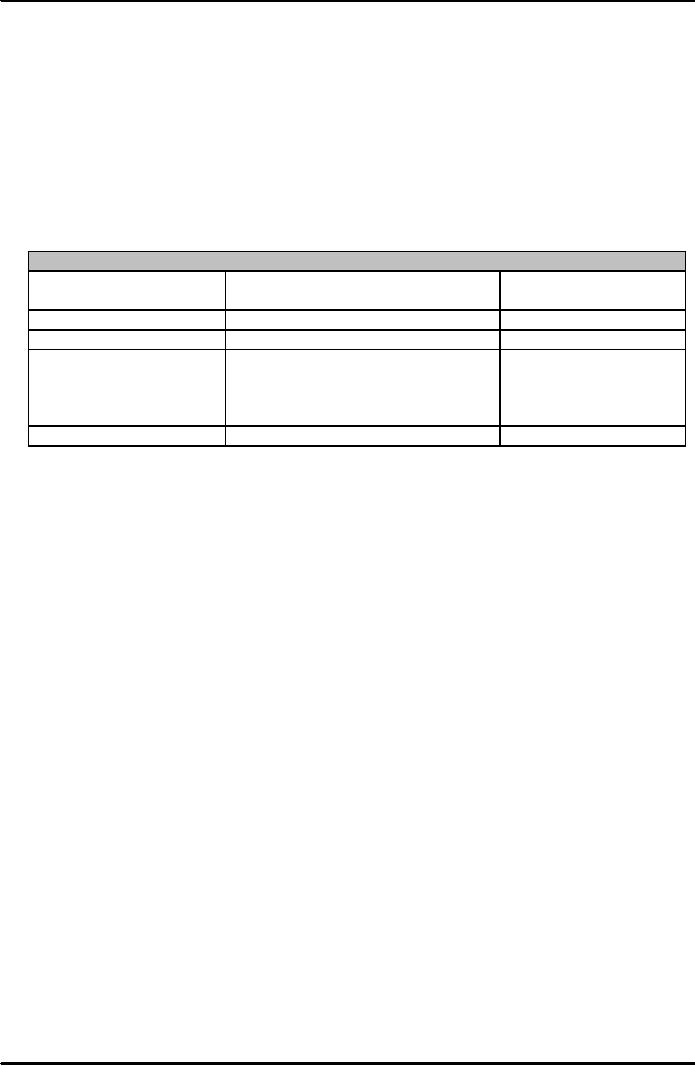

Impact

of rise in the Real interest

rate on Components of Aggregate

Demand

Components

of

Effect

of a rise in the real

interest

Impact

on component

Aggregate

Demand

rate

of

Aggregate Demand

Consumption

(C)

Reward

to saving rises

Consumption

falls

Investment

(I)

Cost

of financing rises

Investment

falls

Net

Exports (NX)

Demand

for domestic assets

rises,

Exports

fall; imports

causing

a currency appreciation,

rises;

net exports fall

raising

the price of exports and

reducing

the cost of imports

Aggregate

Demand (Yad)

C,

I and

NX

all

fall

Aggregate

demand falls

The

Long-Run Real Interest Rate

There

must be some level of the

real interest rate at which aggregate

demand equals

potential

output;

this is the long-run real interest

rate.

The

long-run real interest rate equates

aggregate demand with

potential output.

The

rate will change if a component of

aggregate demand that is not

sensitive to the real interest

rate

goes up (or down) or if

potential output

changes.

For

example, an increase in government

purchases (all else held

constant) will raise

aggregate

demand

at every level of the real interest

rate.

To

remain in equilibrium, one of the

interest-sensitive components of

aggregate demand must

fall,

and for that to happen, the long-run

real interest rate must rise.

The

same would be true for

increases in other components of

aggregate demand that are

not

interest

sensitive.

A

change in potential output

has an inverse effect on the

long-run real interest rate;

When

potential output rises,

aggregate demand must rise

with it, which requires a

decrease in

the

real interest rate

Inflation,

the Real Interest Rate, and the

Monetary Policy Reaction

Curve

Policymakers

set their short-run nominal

interest rate targets in response to economic

conditions

in

general and inflation in

particular.

When

current inflation is high or

current output is running above

potential output,

central

bankers

will raise nominal interest

rates; when current

inflation is low or current

output is well

below

potential, they will lower

interest rates

While

they state their policies in

terms of nominal rates they

do so knowing that changes in

the

nominal

interest rate will eventually translate

into changes in the real interest rate,

and it is those

changes

that influence the economic decisions of

firms and households

Experts

agree that any (coherent)

monetary policy can be

written as an inflation target

plus a

response

to supply shocks

126

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY