|

Money

& Banking MGT411

VU

Lesson

38

THE

FACTS ABOUT

VELOCITY

Fisher's

logic led Milton Friedman to

conclude that central banks

should simply set

money

growth

at a constant rate.

Policymakers

should strive to ensure that

the monetary aggregates grow at a rate

equal to the

rate

of real growth plus the desired

level of inflation.

Knowing

that the multiplier is a variable,

Friedman suggested changes in

regulations that

would

Limit

banks' discretion in creating

money

Tighten

the relationship between the monetary

aggregates and the monetary

base.

However,

even with Friedman's recommendations, the

central bank would stabilize

inflation by

keeping

money growth constant only

if velocity were constant.

In

the long run, the velocity of

money is stable, though there can be

significant short-run

variations.

From

the point of view of policymakers,

these fluctuations in velocity

are enormous.

Assuming

that central bank can

accurately control the growth rate of M2

as well as accurately

forecast

real growth.

Money

Growth + Velocity Growth =

Inflation + Real Growth

With

an inflation objective of 2% and a real

growth forecast of 3.5%,

equation of exchange

tells

us

that policy makers should

set money growth 5.5% minus

the growth rate of velocity.

If

velocity increases by 3% then

money growth needs to be

2.5%

If

it falls by 3% then money

growth needs to be

8.5%

When

inflation is low, short run

velocity growth can be several times the

policy makers'

inflation

objectives.

So

to use money growth targets

to stabilize inflation, policy

makers must understand

how

velocity

changes

Fluctuations

in velocity are tied to

changes in people's desire to

hold money and so in order

to

understand

and predict changes in velocity;

policymakers must understand the demand

for

money.

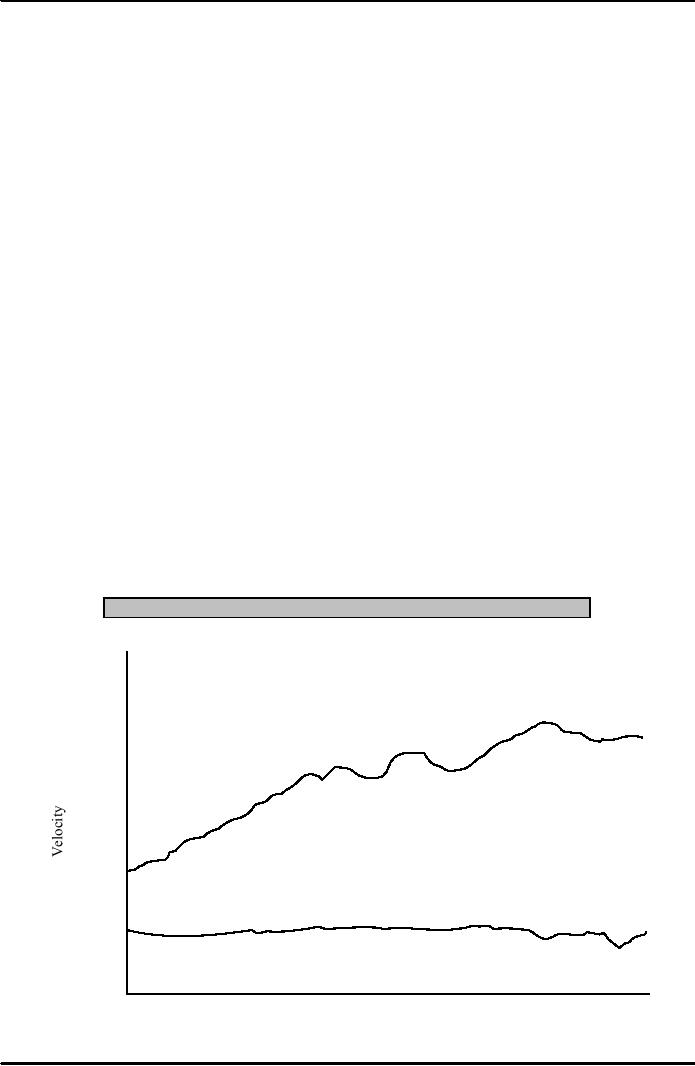

Figure:

Velocity of M1 and M2 (on the

same vertical scale)

10

___M1

Velocity ____M2 Velocity

9

8

7

6

5

4

3

2

1

0

1959

1963 1967 1971 1975

1979 1983 1987 1991

1995 1999 2003

119

Money

& Banking MGT411

VU

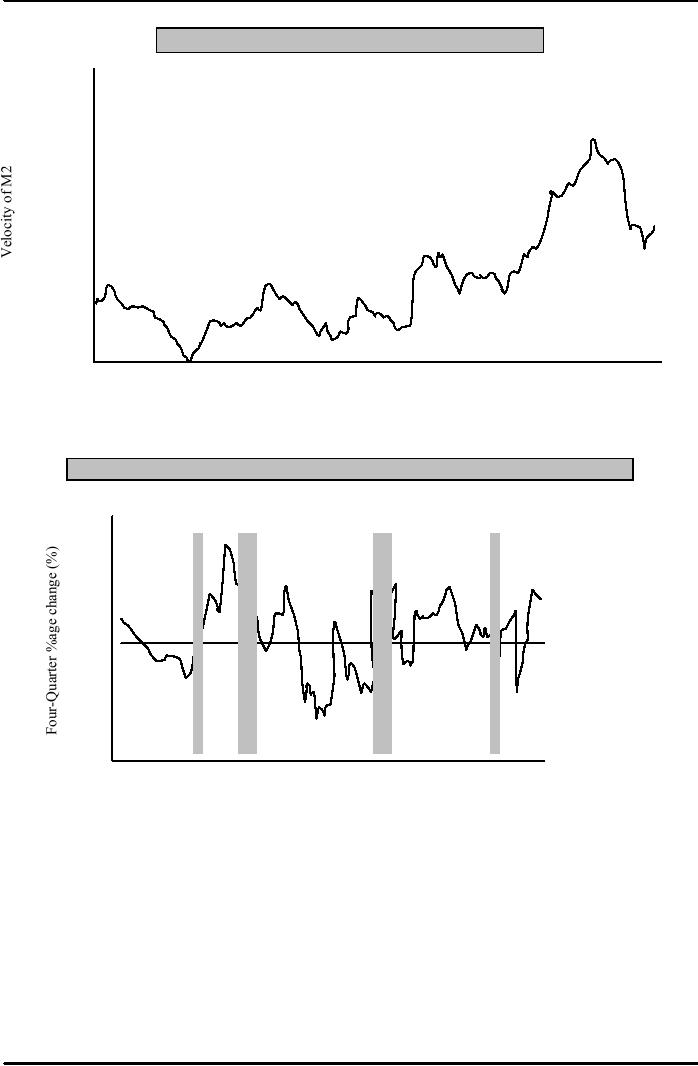

Figure:

Velocity of M2 (on its own

scale)

2.2

2.1

2.0

1.9

1.8

1.7

1.6

1959

1963 1967 1971 1975

1979 1983 1987 1991

1995 1999 2003

Years

Figure:

Percentage change in the short-run

velocity of M2, 1960-2004

8

6

4

2

0

-2

-4

-6

-8

1975

1980

1985

1990

1995

2000

Years

The

Transactions Demand for

Money

The

quantity of money people

hold for transactions

purposes depends on

Their

nominal income,

The

cost of holding

money,

The

availability of substitutes

Nominal

money demand rises with

nominal income, as more income

means more spending,

which

requires more money

Holding

money allows people to make

payments, but has cost of interest

foregone.

There

may also be costs in

switching between interest-bearing assets

and money.

Example

120

Money

& Banking MGT411

VU

If

your monthly earning is

Rs.30, 000 (deposited in bank

each month) and assuming you

spend

Rs.1,

000 each day, after 15

days your checking account

balance will decline to

Rs.15, 000 and

to

zero on 30th day

Your

bank offers you a choice of

leaving the entire 30,000 in the

account or shifting funds

back

and

forth between checking and a bond

fund.

The

bond fund pays interest but

adds a service charge of Rs.20

for each withdrawal.

How

would you manage your

funds and what should be

your frequency of shifting the

funds

between

the bond fund and checking

account?

Consider

the following alternatives.

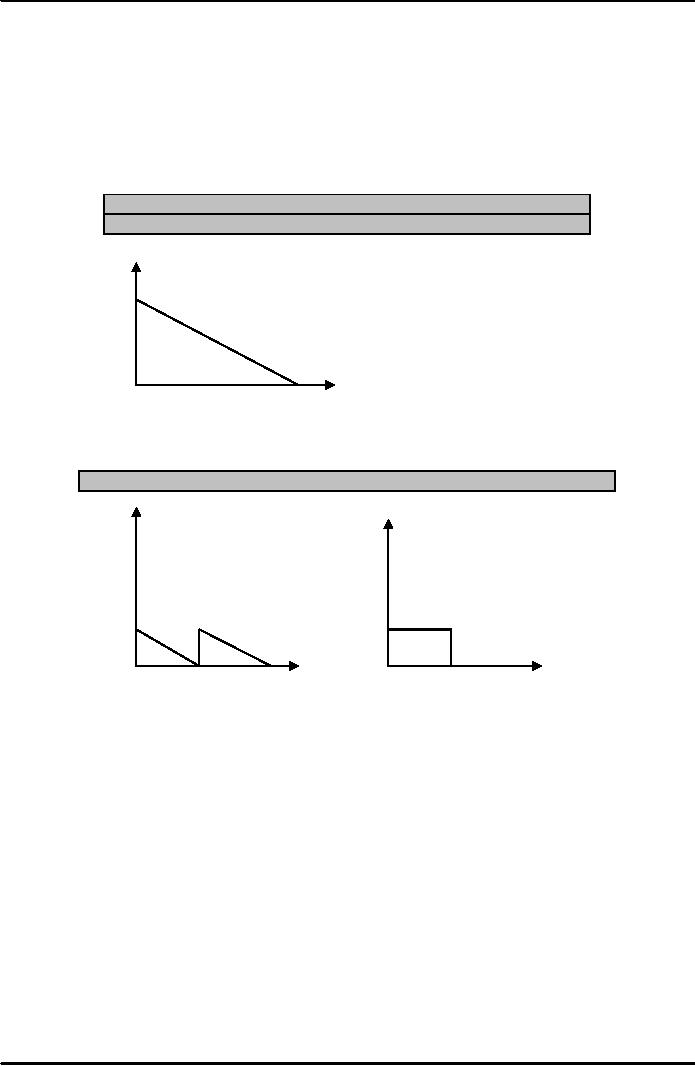

Two

alternatives for managing

your cash balance

Strategy

1: Leave entire balance in checking

account

Checking

account balance

Bond

fund

30,000

balance

is zero

throughout

the

month.

30

0

Day

of the month

Strategy

2: Transfer half to bond fund,

then transfer back at

mid-month

Bond

Fund Balance

Checking

account

balance

15,000

15,000

15

0

0

30

15

30

Day

of the Month

Day

of the month

Your

choice depends upon the interest rate you

receive on the bond

fund

If

interest income is at least as much as

the service charge then you

will split your pay

check at

the

beginning of the month.

Otherwise

you will not want to

invest in bond fund.

If

you shift half your

funds once , at the middle of the

month, you'll have Rs.15,000 in

bond

fund

during the first half of the

month and Rs.0 during the

second half, so your average

balance

will

be Rs.7,500.

Making

shift will cost you

Rs.20 so if the interest on Rs.7, 500 is

greater than 20, you

should

make

the shift.

At

monthly interest rate of 0.27%, Rs.7,

500 will produce an income of

Rs.20

(20

/ 7500= 0.0027)

So

if bond fund offers a higher

rate you should make the

shift.

As

the nominal interest rate rises, people

reduce their checking

account balances, which

allow

us

to predict that velocity

will change with the interest

rate.

Higher

the nominal interest rate, the less money

individuals will hold for a

given level of

transactions,

and higher the velocity of

money

121

Money

& Banking MGT411

VU

The

transactions demand for

money is also affected by

technology, as financial

innovation

allows

people to limit the amount of money

they hold.

The

lower the cost of shifting

money between accounts, the lower the

money holdings and the

higher

the velocity.

Suppose

your bank offers free

automatic transfer account. You sign up

for it but continue

using

your

old check and debit

account

Your

take home pay is the same

Rs.30, 000. Each time

you make a purchase, your

bank

automatically

shifts the amount of purchase from

your bond fund to your

checking account

where

it remains for one day

before being paid to your

creditor.

Spending

your Rs.30,000 in 30 days, your

average money holding will

be Rs.1000 far below

Rs.1,500

you would hold if you

simply left the 30,000 in

your checking account and

spent it at a

rate

of Rs.1,000 per day

So

lower the cost of shifting

funds from your bond

fund to your checking account, the

lower

your

money holdings at a given

level of income and the higher the

velocity of your

money

An

increase in the liquidity of stocks,

bonds, or any other asset

reduces the transactions

demand

for

money.

People

also hold money to ensure

against unexpected expenses; this is

called the precautionary

demand

for money and can be

included with the transactions

demand.

The

higher the level of uncertainty

about the future, the higher the

demand for money and

the

lower

the velocity of money

The

Portfolio Demand for

Money

Money

is just one of many financial instruments

that we can hold in our

investment portfolios.

Expectations

that interest rates will

change in the future are

related to the expected return on

a

bond

and also affect the demand

for money.

122

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY