|

TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION |

| << MONEY MULTIPLIER:The Quantity of Money (M) Depends on |

| WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity >> |

Money

& Banking MGT411

VU

Lesson

36

TARGET

FEDERAL FUNDS RATE AND OPEN

MARKET OPERATION

The

central bank chooses to

control the federal funds rate by

manipulating the quantity of

reserves

through open market operations: the

central bank buys or sells securities to

add or drain

reserves

as required.

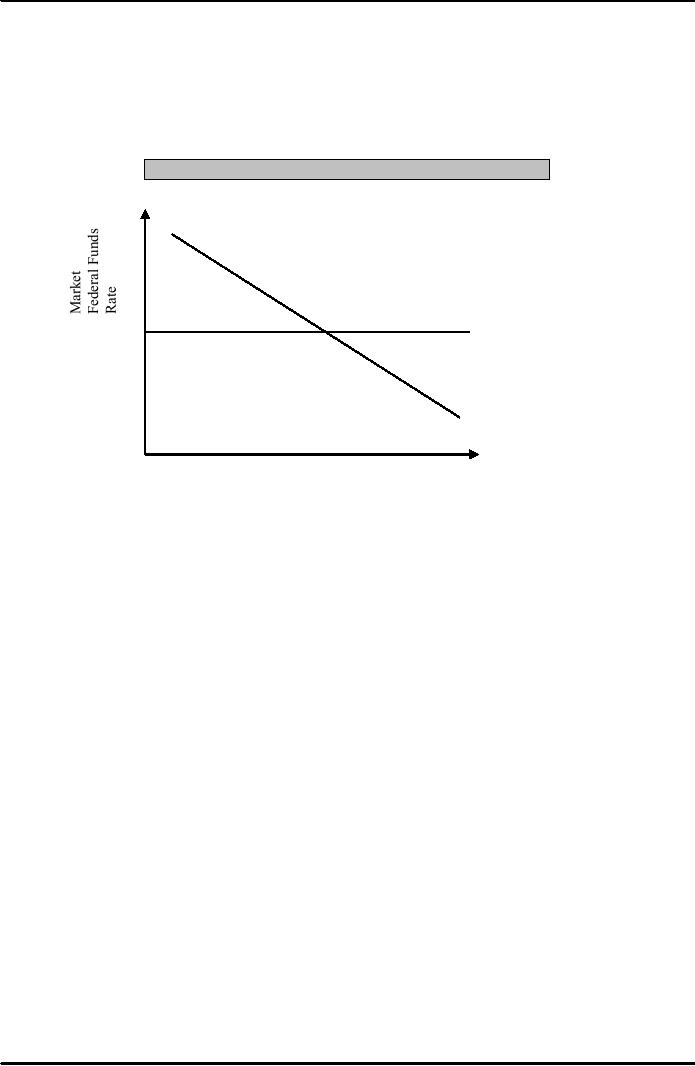

Figure:

The Market for Bank

Reserves

Reserve

Supply

Target

Rate

Reserve

Demand

Quantity

of Reserves

Discount

Lending, the Lender of Last

Resort and Crisis

Management

Lending

to commercial banks is not an important

part of the central bank's day-to-day

monetary

policy.

However,

such lending is the central

bank's primary tool for

ensuring short-term financial

stability,

for eliminating bank panics

and preventing the sudden collapse of

institutions that are

experiencing

financial difficulties.

The

central bank is the lender of last

resort, making loans to banks when no one

else can or will,

but

a bank must show that it is

sound to get a loan in a crisis.

The

current discount lending

procedures also help the

central bank meet its

interest-rate stability

objective.

The

central bank makes three types of

loans:

Primary

credit,

Secondary

credit,

Seasonal

credit

Primary

credit is extended on a very short-term

basis, usually overnight, to

sound institutions.

It

is designed to provide additional

reserves at times when the day's

reserve supply falls short

of

the

banking system's

demand.

The

system provides liquidity in

times of crisis, ensures financial

stability, and restricts

the

range

over which the market

federal funds rate can move

(helping to maintain interest-rate

stability).

Secondary

credit is available to institutions

that are not sufficiently

sound to qualify for

primary

credit.

Banks

may seek secondary credit

due to a temporary shortfall in reserves

or because they have

longer-term

problems that they need to

work out.

Seasonal

credit is used primarily by

small agricultural banks to

help in managing the

cyclical

nature

of farmers' loans and deposits

113

Money

& Banking MGT411

VU

Reserve

Requirements

By

adjusting the reserve requirement, the

central bank can influence

economic activity because

changes

in the requirement affect deposit

expansion.

Unfortunately,

the reserve requirement turns out

not to be very useful

because small changes

in

the

reserve requirement have large

(really too large) impacts

on the level of deposits.

Today,

the reserve requirement exists primarily

to stabilize the demand for

reserves and help the

Central

bank to maintain the market

federal funds rate close to

target; it is not used as a

direct

tool

of monetary policy.

The

central bank's Monetary Policy

Toolbox

The

Tools of Monetary

Policy

What

is it?

How

is it controlled?

What

is its impact?

Changes

interest rates

Interest

rate charged on

Supply

of reserves adjusted

Target

Federal

throughout

the

overnight

loans between

through

open market

Funds

Rate

economy

banks

operations

to meet

expected

demand at the

target

rate

Interest

rate charged by the Set as a

premium over the

Provides

short-term

Discount

rate

central

bank on loans to

target

federal funds rate

liquidity

to bank in

commercial

banks

times

of crisis and aids

in

controlling the

federal

funds rate

Fraction

of deposits that

Set

by the central bank

Stabilizes

the demand

Reserve

bank

must keep either on

within

a liquidity imposed

for

reserves

requirement

deposit

at the central bank

range

or

as cash in their

vaults

Linking

Tools to Objectives

Desirable

Features of a Policy

Instrument

Easily

observable by everyone

Controllable

and quickly changed

Tightly

linked to the policymakers'

objectives

These

requirements leave policymakers with

few choices, and over the

years central banks

have

switched

between controlling the quantity and

controlling the prices.

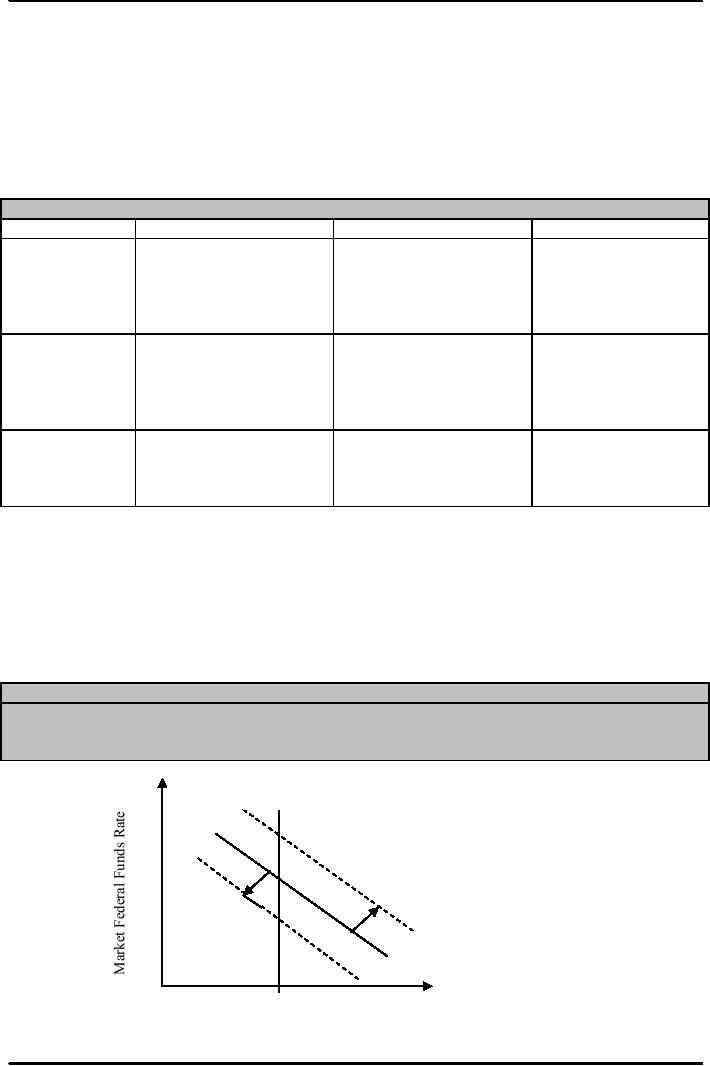

Figure:

The Market for Bank

Reserves when the central

bank targets the quantity of

reserves

When

central bank targets the

quantity of reserves, a shift in

reserve demand causes the

market federal

funds

rate to move. An increase in reserve

demand forces the interest rate up,

while a fall in

reserve

demand

forces the interest rate down.

Reserve

Supply

Increase

in Reserve Demand

Fall

in

Reserve

Demand

Reserve

Demand

Target

Quantity Quantity of Reserves

114

Money

& Banking MGT411

VU

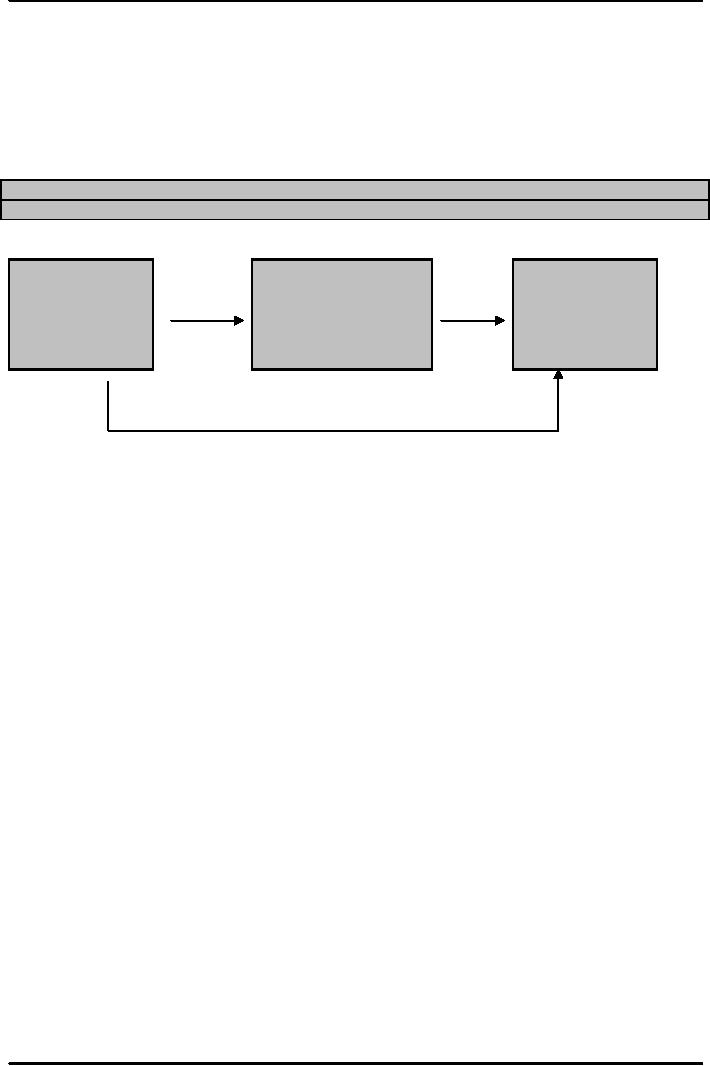

Targets

and Instruments

Operating

instruments refer to actual tools of

policy, instruments that the central

bank controls

directly.

Intermediate

target refers to instruments that are

not directly under the

control of the central

bank

but that lie between their

policymaking tools and their

objectives.

Over

the last two centuries, central bankers

largely abandoned intermediate targets,

having

realized

that they didn't make

much sense.

Instead,

policymakers focus on how their actions

directly affect their target

objectives

Instruments,

Targets and Objectives

Using

policy instruments to target objectives

directly

Link

Link

Operating

Intermediate

Targets

Final

Objectives

#1

#2

Instruments

Examples:

Examples:

Examples:

Low

inflation

Interest

Rates

Growth

in Monetary

High

Growth

Monetary

Base

Aggregates

Link

# 3

115

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY