|

DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves |

| << THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet |

| MONEY MULTIPLIER:The Quantity of Money (M) Depends on >> |

Money

& Banking MGT411

VU

Lesson

34

DEPOSIT

CREATION IN A SINGLE

BANK

If the

central bank buys a security

from a bank, the bank has

excess reserves, which it

will seek

to

lend

The

loan replaces the securities as an asset

on the bank's balance

sheet

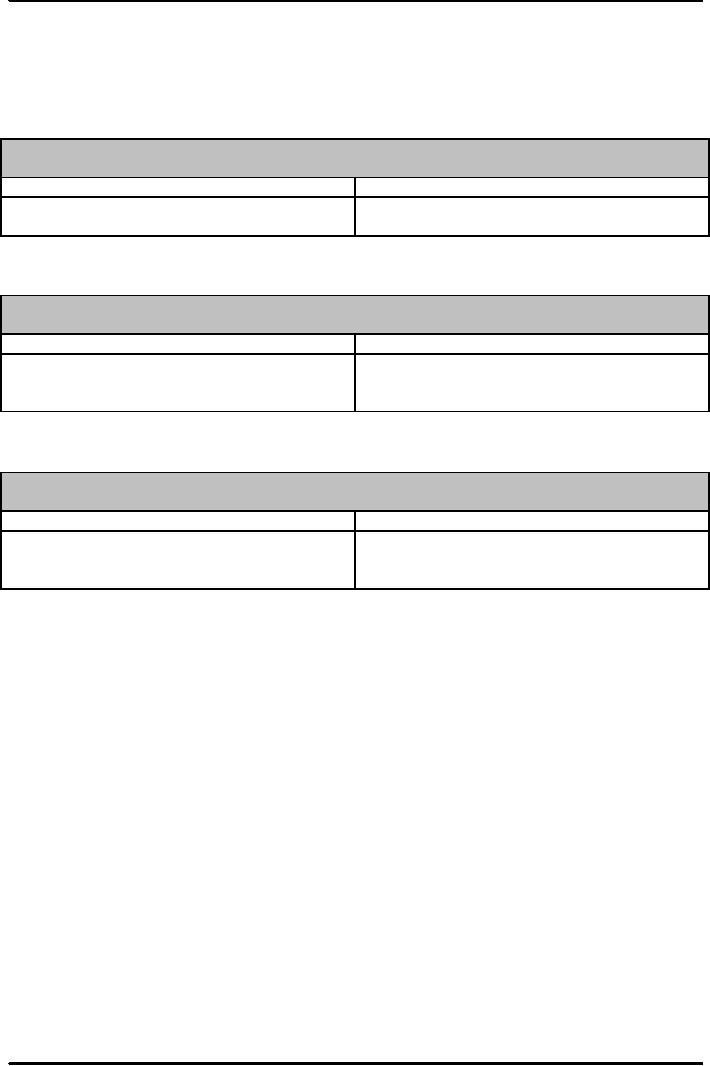

Table:

Change in First Bank's

Balance Sheet following

Central Bank's purchase of a

Treasury

bond

Assets

Liabilities

Reserves

+$100,000

Securities

-$100,000

Assuming

First bank has granted a

loan of $100,000 to Office

Builders Incorporated

(OBI)

Table:

Change in First Bank's

Balance sheet following

Central Bank's purchase of a

Treasury

bond

and Extension of a loan

Assets

Liabilities

Reserves

+$100,000

OBI

Checking account

+$100,000

Securities

-$100,000

Loans

+$100,000

OBI

paid off its employees and suppliers

through checks worth

$100,000

Table:

Change in First Bank's

balance sheet following

Central Bank's purchase of a

Treasury

Bond,

Extension of a loan, and withdrawal by

the borrower

Assets

Liabilities

Reserves

$0

Checkable

deposits

$0

Securities

-$100,000

Loans

+$100,000

Deposit

Expansion in a System of Banks

The

loan that the First bank

made was spent and as the

checks cleared, reserves were

transferred

to

other banks

The

banks that receive the

reserves will seek to lend

their excess reserves, and the

process

continues

until all of the funds have

ended up in required

reserves

Types

of Reserves

Actual

Reserves (R)

Required

Reserves (RR=rDD)

Excess

Reserves (ER)

Assume

Bank

holds no excess

reserves.

The

reserve requirement ratio is

10%

Currency

holding does not change

when deposits and loans

change.

When

a borrower writes a check, none of the

recipients of the funds deposit them back

in the

bank

that initially made the

loan.

Let's

say, OBI uses the $100,000

loan to pay its supplier

American Steel Co (ASC), which

it

deposits

in its bank the Second

bank.

105

Money

& Banking MGT411

VU

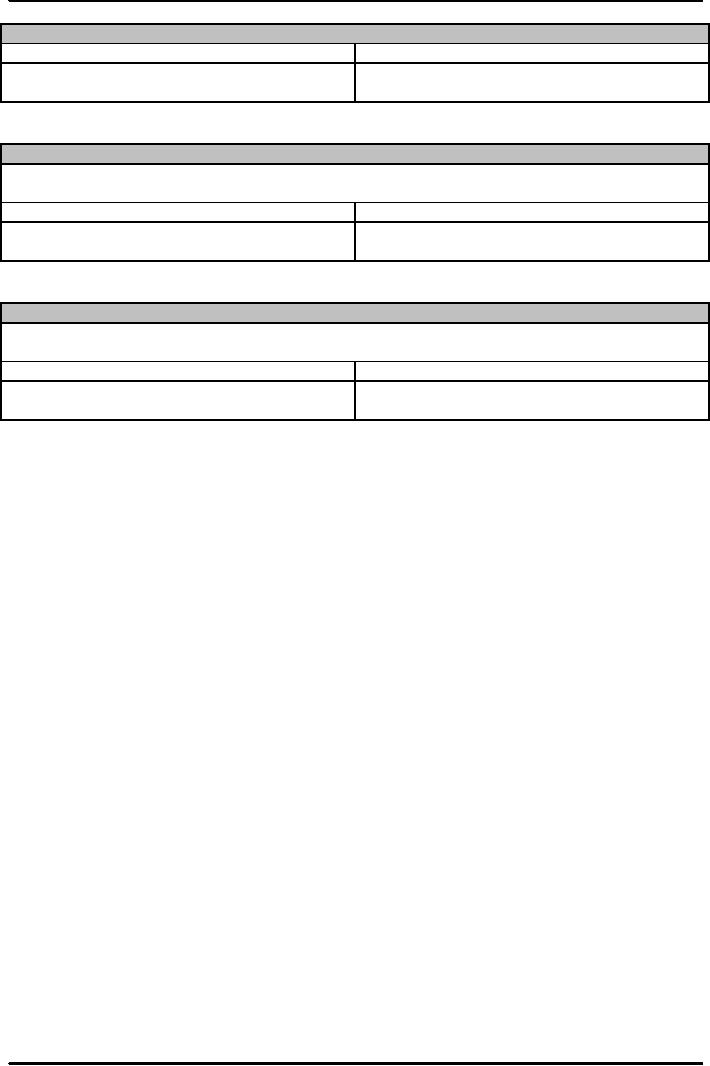

Table:

Change in Second Bank's

Balance sheet following

American Steel's

Deposit

Assets

Liabilities

Reserves

+$100,000

American

Steel's checking

+$100,000

account

Table:

Change in Second Bank's

Balance sheet following a

Deposit and Extension of a

loan

Assuming

a 10% reserve requirement,

banks hold no excess

reserves, and there are no changes

in

currency

holdings.

Assets

liabilities

Reserves

+$10,000

American

Steel's Checking

+$100,000

Loan

+$90,000

account

Table:

Change in Third Bank's

Balance Sheet following a

Deposit and Extension of a

loan

Assuming

a 10% reserve requirement,

banks hold no excess

reserves, and there are no changes

in

currency

holdings.

Assets

Liabilities

Reserves

+$9,000

Checking

account

+$90,000

Loan

+$81,000

106

Money

& Banking MGT411

VU

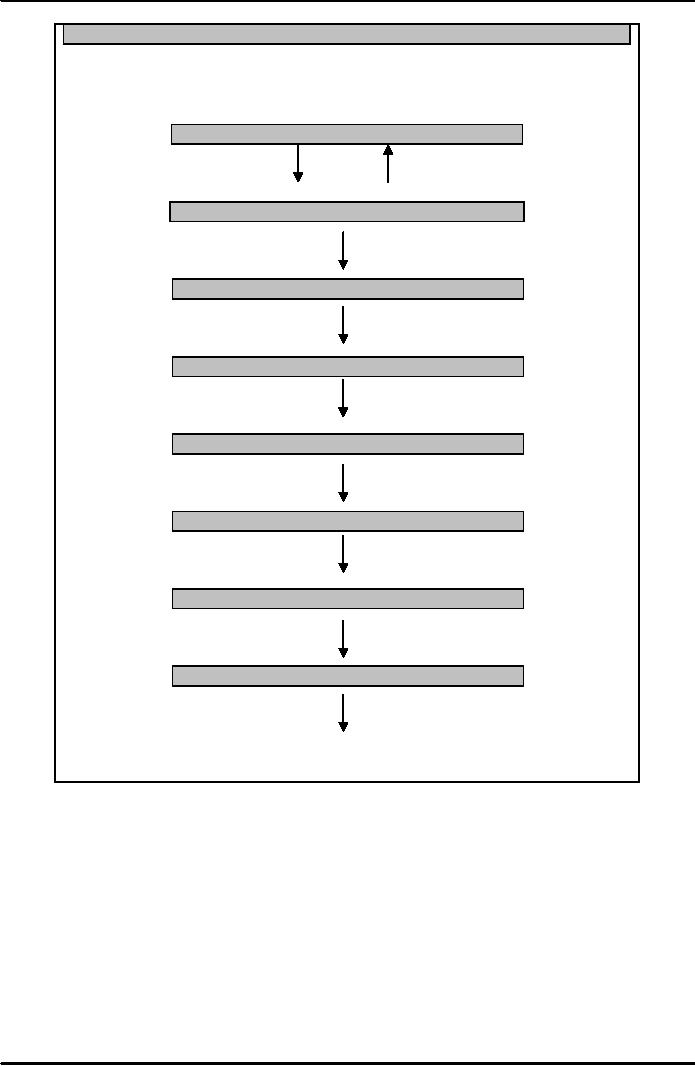

Multiple

Deposit Creation

Assuming

a 10% reserve requirement,

banks hold no excess

reserves and there are

no

changes

in currency holdings.

Central

Bank

$100,000

Reserves

$100,000

Securities

First

Bank

$100,000

Loan

Office

Builders lnc.

$100,000

Payment

American

Steel Co.

$100,000

Deposit

Second

Bank retains $10,000 in

reserves

$90,000

Loans

Third

Bank retains $90,000 in

reserves

$81,000

Loan

Fourth

Bank retains $8,100 in

reserves

$72,900

Loan

Fifth

Bank retains $7,290 in

reserves

$65,610

Loan

And

so on

And

so on

107

Money

& Banking MGT411

VU

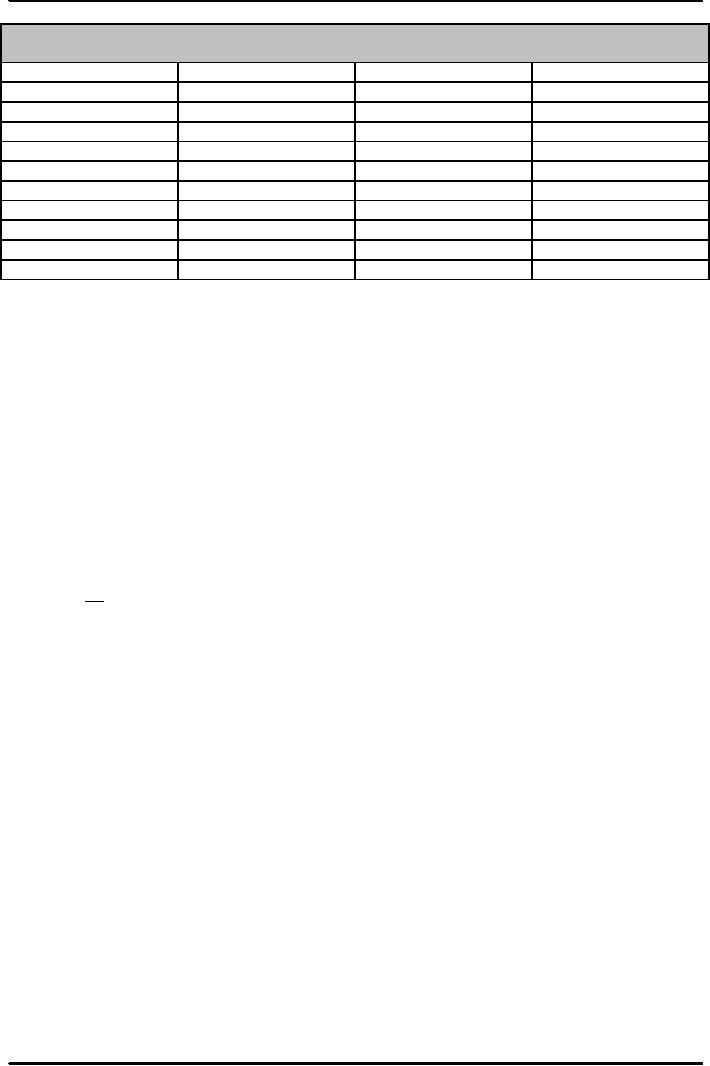

Table:

Multiple Deposit Expansion following a

$100,000 Open Market

Purchase Assuming a

10%

reserve

requirement

Bank

Increase

in Deposits

Increase

in Loans

Increase

in Reserves

First

bank

$0

$100,000

$0

Second

bank

$100,000

$90,000

$10,000

Third

bank

$90,000

$81,000

$9,000

Fourth

bank

$81,000

$72,900

$8,100

Fifth

bank

$72,900

$65,610

$7,290

Sixth

bank

$65,610

$59,049

$6,561

-

-

-

-

-

-

-

-

-

-

-

-

The

Banking System

$1,000,000

$1,000,000

$100,000

Deposit

Expansion Multiplier

Assuming

No

excess reserves are

held

There

are no changes in the amount of currency

held by the public,

The

change in deposits will be the inverse of

the required deposit reserve ratio

(rD) times the

change

in required reserves, or

ĆD =

(1/rD) ĆRR

Alternatively

RR

= rDD

or ΔRR = rDΔD

So

for every dollar increase in

reserves, deposits rise by

1/rD

The

term (1/rD)

represents the simple deposit

expansion multiplier.

A

decrease in reserves will

generate a deposit contraction in a

multiple amount too

RD=10% (0.10), and ΔRR=$100,000

1

$

100 , 000

ΔD=

.1

ΔD=

$1,000,000

Deposit

Expansion with Excess Reserves

and Cash Withdrawals

The

simple deposit expansion

multiplier was derived

assuming no excess reserves

are held and

that

there is no change in currency holdings by the

public.

These

assumptions are now relaxed

as

5%

withdraw of cash.

Excess

reserves of 5% of deposits

Continuing

with our previous example,

if American Steel Co (ASC) removes 5% of

its new

funds

in cash, which leaves

$95,000 in the checking account and

$95,000 in the Second

bank's

reserve

account

Bank

wishes to hold excessive

reserves of 5% of deposits, it would keep

reserves of 15% of

$95,000

or $14,250 and making a loan of

$80,750

108

Money

& Banking MGT411

VU

Table:

Change in Second Bank's

Balance sheet following a

Deposit and Extension of a

Loan

Assuming

excess reserves and cash

holdings. Note: American Steel

also has $5,000 in

cash.

Assets

Liabilities

Required

reserves

+$9,500

American

Steel's checking

+$95,000

Excess

reserves

+$4,750

account

Loan

+$80,750

The

desire of banks to hold

excess reserves and the desire of

account holders to withdraw

cash

both

reduce the impact of a given

change in reserves on the total

deposits in the system.

The

more excess reserves banks

desire to hold, and the more

cash that is withdrawn, the

smaller

the

impact.

Money

Multiplier

The

money multiplier shows how

the quantity of money (checking

account plus currency)

is

related

to the monetary base (reserves in the

banking system plus currency

held by the nonbank

public)

Taking

m for money multiplier and MB

for monetary base, the

Quantity of Money, M is

M

= m x MB

(This

is why the MB is called High Powered

Money)

Consider

the following relationships

Money

= Currency + Checkable deposits

M=C+D

Monetary

Base = Currency +

Reserves

MB

= C +R

Reserves

= Req. Res. + Exc.

Res

R

= RR + ER

The

amount of excess reserves a bank

holds depends on the costs and

benefits of holding them,

The

cost is the interest foregone

The

benefit is the safety from having the

reserves in case there is an increase in

withdrawals

The

higher the interest rate, the lower

banks' excess reserves will

be; the greater the concern

over

possible deposit withdrawals, the higher

the excess reserves will

be

Introducing

Excess Reserve Ratio

{ER/D}

R

= RR + ER

=

rDD

+ {ER/D} D

=

(rD +

{ER/D}) D

109

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY