|

SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis |

| << NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms |

| THE GOVERNMENT SAFETY NET:Supervision and Examination >> |

Money

& Banking MGT411

VU

Lesson

28

SECURITIES

FIRMS (Continued)

Securities

Firms

Investment

Banks

Mutual

Funds

Finance

Companies

Government

Sponsored Enterprises

Banking

Crisis

Sources

of Runs, Panics and Crisis

Government

Safety Net

Government:

Lender of Last Resort

Securities

Firms

Investment

banks are the conduits

through which firms raise

funds in the capital

markets

Through

their underwriting services,

investment banks issue new

stocks and a variety of

other

debt

instruments

In

underwriting, the investment bank

guarantees the price of a new

issue and then sells it

to

investors

at a higher price;

However,

this is not without risk,

since the selling price may

not in fact be higher than

the price

guaranteed

to the firm issuing the

security

Information

and reputation are central to the

underwriting business;

Underwriters

collect information to determine the

price of the new securities and then

put their

reputations

on the line when they go out

to sell the issues

In

addition to underwriting, investment

banks provide advice to

firms that wish to merge

with or

acquire

other firms, for which

advice they are paid a

fee

Finance

Companies

Finance

companies raise funds in the

financial markets by issuing

commercial paper and

securities

and use the funds to make loans to

individuals and corporations

These

companies are largely

concerned with reducing the

transactions and information

costs

that

are associated with

intermediated finance

Most

finance companies specialize in one of

three loan types:

Consumer

loans,

Business

loans,

Sales

loans (for example, the financing

for a consumer to purchase a

large-ticket item like

an

appliance)

Some

also provide commercial and home

mortgages

Business

finance companies provide loans to

businesses, for equipment

leasing

Business

finance companies also

provide short-term liquidity to firms by

offering

Inventory

loans (so that firms can

keep the shelves stocked)

Accounts

receivable loans (which provide

immediate resources against anticipated

revenue

streams)

Government-Sponsored

Enterprises

The

government is directly involved in the

financial intermediation system

through loan

guarantees

and in the chartering of financial

institutions to provide specific types of

financing

Zarai

Taraqiati Bank Limited

(ZTBL)

Small

and Medium Enterprise (SME)

Bank

House

Building Finance Corporation

(HBFC)

Khushhali

Bank

88

Money

& Banking MGT411

VU

Summary

of the financial industry

structure

Financial

Primary

Primary

uses

Services

provided

intermediary

sources

of

of

funds

funds

(assets)

(liabilities)

Cash

-Pooling

of small savings to provide

large

Checkable

Depository

Loans

loans

deposits

institution

Saving

and time securities

-Diversified,

liquid deposit

accounts

(Banks)

-Access

to payments system

deposits

Screening

and monitoring of borrowers

Borrowing

from

other

banks

Expected

claims Corporate bonds -Pooling

of risk

Insurance

-Screening

and monitoring of policy

Government

Company

holders

bonds

Stocks

Mortgages

-Management

of asset pools

Short

term loans Commercial

-Clearing

and settling trades

paper

Securities

Firm

Bonds

-Immediate

sale of assets

Investment

Bank

-Access

to spectrum of assets,

allowing

diversification

-Evaluation

of firms wishing to

issue

securities

-Research

and advice for investors

Shares

sold to Commercial

-Pooling

of small savings to provide

access

Mutual-Fund

customers

paper

to

large, diversified portfolios,

which can

Company

Bonds

be

liquid

Mortgages

Stocks

Real

estate

Bonds

Mortgages

-Screening

and monitoring of borrowers

Finance

Bank

loans

Consumer

Company

Commercial

loans

paper

Business

loans

Commercial

Mortgages

-Access

to financing for borrowers

who

Government-

Farm

loans

paper

cannot

obtain it elsewhere

Sponsored

Bonds

Enterprises

Student

loans

Loan

guarantees

Banking

Crisis

Banking

crises are not a new

phenomena; the history of commercial banking

over the last two

centuries

is replete with period of

turmoil and failure.

By

their very nature, financial

systems are fragile and

vulnerable to crisis

89

Money

& Banking MGT411

VU

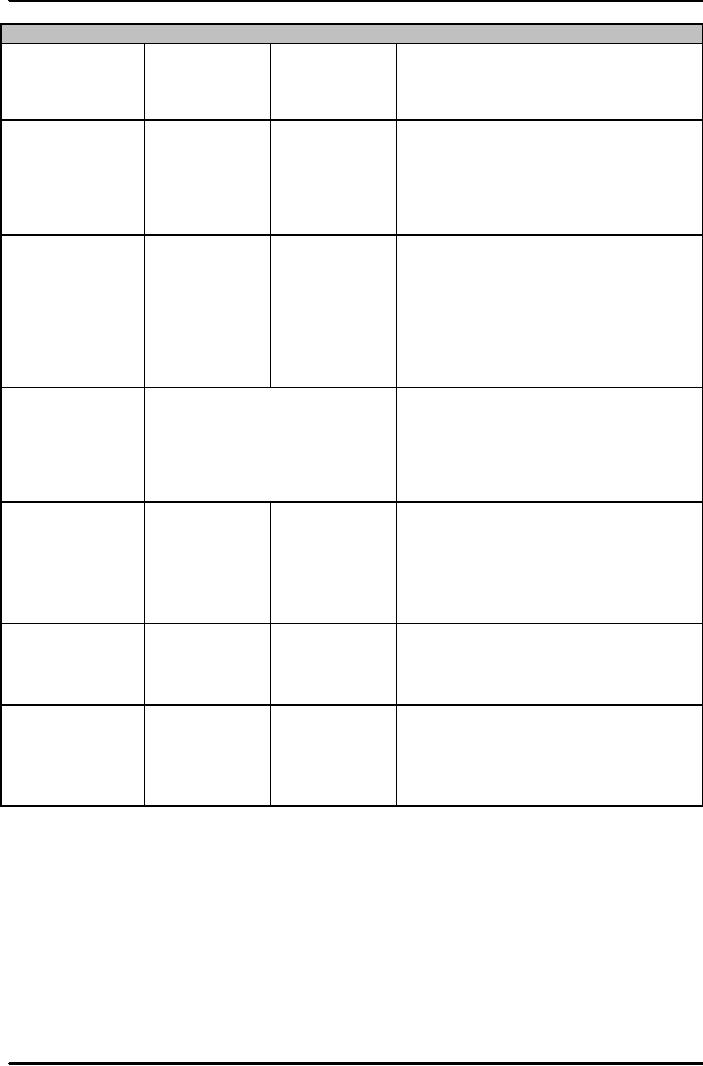

Table:

Worst Banking Crises since

1980

Country

Crises

Dates

Estimated

cost of

Resolution

(as %age of

GDP)

Argentina

1980-82

55%

South

Asian

Indonesia

1997-98

55%

Crises

China

1990s

47%

Jamaica

1994

44%

Chile

1981-83

42%

Thailand

1997

35%

Macedonia

1993-94

32%

Israel

1977-83

30%

Turkey

2000

30%

Uruguay

1981-84

29%

Korea

1998

28%

Cote

d'ivoire

1988-91

25%

Japan

1990s

24%

Uruguay

1981-84

24%

Malaysia

1997-98

20%

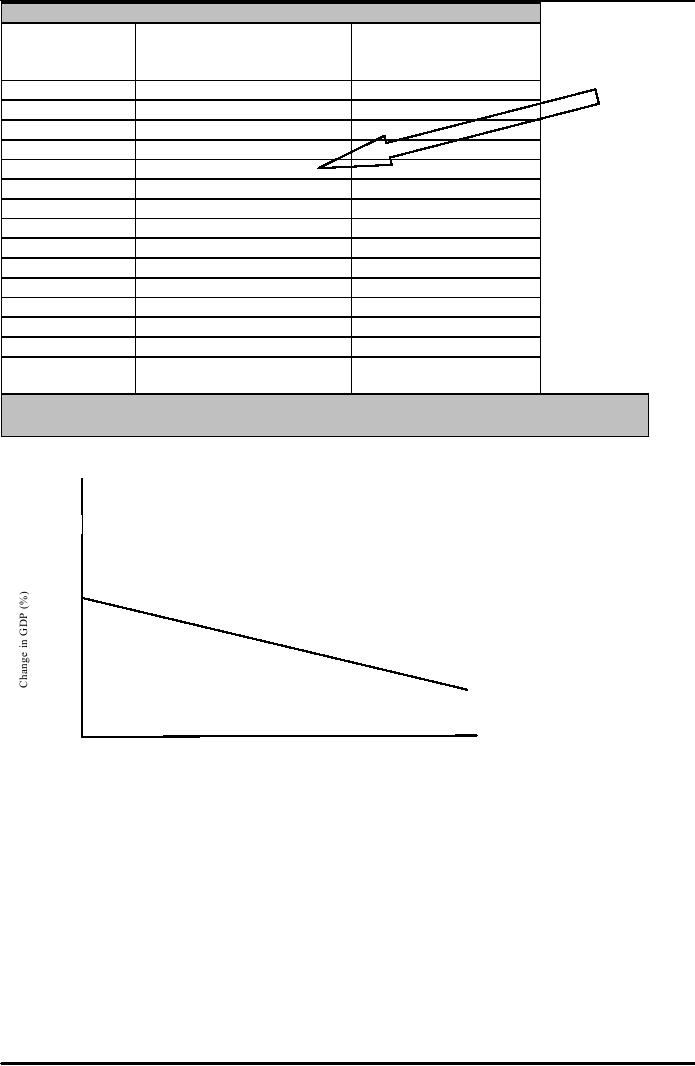

Figure:

Relationship between size of a financial

crises and change in GDP

Growth

15

10

Ghana

5

1982-89

�

�

Norway

Mexico

1990-93

0

Bulgaria

1994-2000

1996-97

�

�

Argentina

�

Jamaica

1980-82

�

1996-2000

�

-5

Finland

1991-94

�

Malaysia

-10

1997-2001

�

�Indonesia

Uruguay

1997-2002

1981-84

-15

10

20

30

40

50

60

0

Fiscal

Cost as percentage of GDP (%)

The

Sources and Consequences of Runs,

Panics, and

Crises

In

a market based economy, the

opportunity to succeed is also the

opportunity to fail!

Banks

serve some essential

functions in the economy

Access

to payment system

Screen

and monitor borrowers to reduce

information problems

So

if bank fails, we lose

ability to make financial transactions.

Collectively, the economy is

endangered.

Banks'

fragility arises from the

fact that they provide

liquidity to depositors, allowing them

to

withdraw

their balances on demand, on a

first-come, first-served

basis

If

bank can not meet

this promise of withdrawal, because of

insufficient funds, it will

fail

Reports

that a bank has become

insolvent can spread fear

that it will run out of

cash and close

its

doors;

90

Money

& Banking MGT411

VU

Depositors

will rush to convert their

balances into cash

Such

a run on a bank can cause it

to fail

What

matters during a bank run is

not whether a bank is

solvent but whether it is

liquid

Here

solvency means that the

value of the bank's assets

exceeds its liabilities

(positive net

worth)

Liquidity

refers to the sufficient reserves of the

bank to meet withdrawal

demands

False

rumors that a bank is insolvent

can lead to a run which

renders it illiquid

When

a bank fails, depositors may

lose some or all of their

deposits, and information about

borrowers'

creditworthiness may disappear;

For

this reason, governments take

steps to try to minimize the

risk of failure

A

single bank failure can

also turn into a system-wide

panic; this is called

contagion

While

banking panics and financial

crises can result from false

rumors, they can also occur

for

more

concrete reasons;

Anything

that affects borrowers' ability to

repay their loans or drives

down the market price

of

securities

has the potential to imperil the

bank's finances

Recessions

have a clear negative impact on bank's

balance sheet

Low

profitability of firm makes

debt repayment much harder

People

lose jobs and cant pay

their loan

With

the rise of default risk, bank's

assets lose value and

capital drops

With

less capital, banks are

forced to contract the balance sheet

making fewer loans.

The

overall business investment

falls and bank failure is more

possible

Historically,

downturns in the business cycle

put pressure on banks, substantially

increasing the

risk

of panics

Financial

disruptions can also occur

whenever borrowers' net worth

falls, as it does

during

deflation

91

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY