|

BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability |

| << BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds |

| BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk >> |

Money

& Banking MGT411

VU

Lesson

24

BALANCE

SHEET OF COMMERCIAL

BANKS

Balance

Sheet of Commercial Banks

Assets:

uses of funds

Bank

Capital and Profitability

Off-Balance-Sheet

Activities

Bank

Risk

Liquidity

Risk

Credit

Risk

Interest

Rate Risk

Trading

Risk

Other

Risks

Liabilities:

Sources of Funds

Checkable

Deposits

Non-transactions

Deposits

Borrowings

Discount

loans

Federal

funds market

Checkable

deposits:

A

typical bank will offer 6 or

more types of checking accounts.

In

recent decades these

deposits have declined because the

accounts pay low interest

rates

Nontransactions

Deposits:

These

include savings and time deposits

and account for nearly

two-thirds of all

commercial

bank

liabilities.

When

you place your savings in a Certificate

of Deposit (CD) at the bank, it is as if

you are

buying

a bond issued by that

bank

CDs

can vary in terms of their

value, the large ones can be

bought and sold in financial

markets

Borrowings:

Banks

borrow from the central bank

(discount loans)

They

can borrow from other

banks with excessive

reserves in the inter-bank money

market.

Banks

can also borrow by using a

repurchase agreement or repo,

which is a short-term

collateralized

loan

A

security is exchanged for cash,

with the agreement that the parties

will reverse the transaction

on

a specific future date

(might be as soon as the next

day)

77

Money

& Banking MGT411

VU

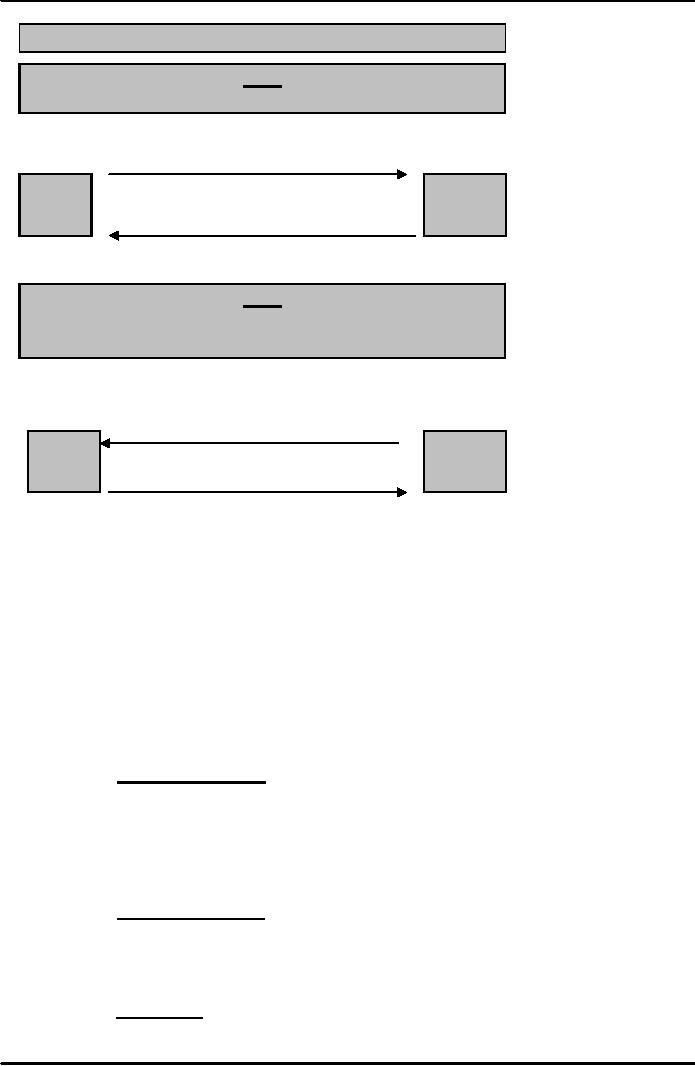

Mechanics

of an Overnight Repurchase

Agreement

Day

1

Bank

sells U.S. Treasury bill to

pension fund in exchange for

cash

U.S

Treasury bill to pension

fund

Pension

Bank

Fund

Cash

to bank

Day

2

Bank

repurchases U.S. Treasury bill

from the pension fund in

exchange

for

cash plus

interest

U.S.

Treasury bill returned to

bank

Pension

Bank

Fund

Cash

+ interest paid to pension

fund

Bank

Capital and

Profitability

The

net worth of banks is called

bank capital; it is the owners'

stake in the bank

Capital

is the cushion that banks have against a

sudden drop in the value of

their assets or an

unexpected

withdrawal of liabilities

An

important component of bank capital is

loan loss reserves, an amount the

bank sets aside to

cover

potential losses from

defaulted loans

It

is reduced by the defaulted loans

written-off

There

are several basic measures of

bank profitability

Return

on Assets,

ROA

= Net profit after

taxes

Total

bank assets

It

is a measure of how efficiently a

particular bank uses its

assets

A

manager can compare the

performance of bank's various lines of

businesses by looking at

different

units' ROA

The

bank's return to its owners is

measured by the Return on

Equity

ROE

= Net profit after

taxes

Bank

capital

ROA

and ROE are related to

leverage

A

measure of leverage is the ratio of

bank assets to bank capital.

Multiplying ROA by this

ratio

yields

ROE

ROA

x Bank Assets

Bank

Capital

78

Money

& Banking MGT411

VU

=

Net profit after taxes x

Bank Assets

Total

bank assets

Bank

Capital

=

Net profit after

taxes

=

ROE

Bank

Capital

Return

on equity tends to be higher

for larger banks, suggesting the existence of

economies of

scale

Net

interest income is another measure of

profitability;

It

is the difference between the interest the bank

pays and what it

receives

It

can also be expressed as a

percentage of total assets to

yield (net interest margin). It is

the

bank's

interest rate spread

Well

run banks have high net interest income

and a high net interest margin.

If

a bank's net interest margin is currently

improving, its profitability is

likely to improve in the

future.

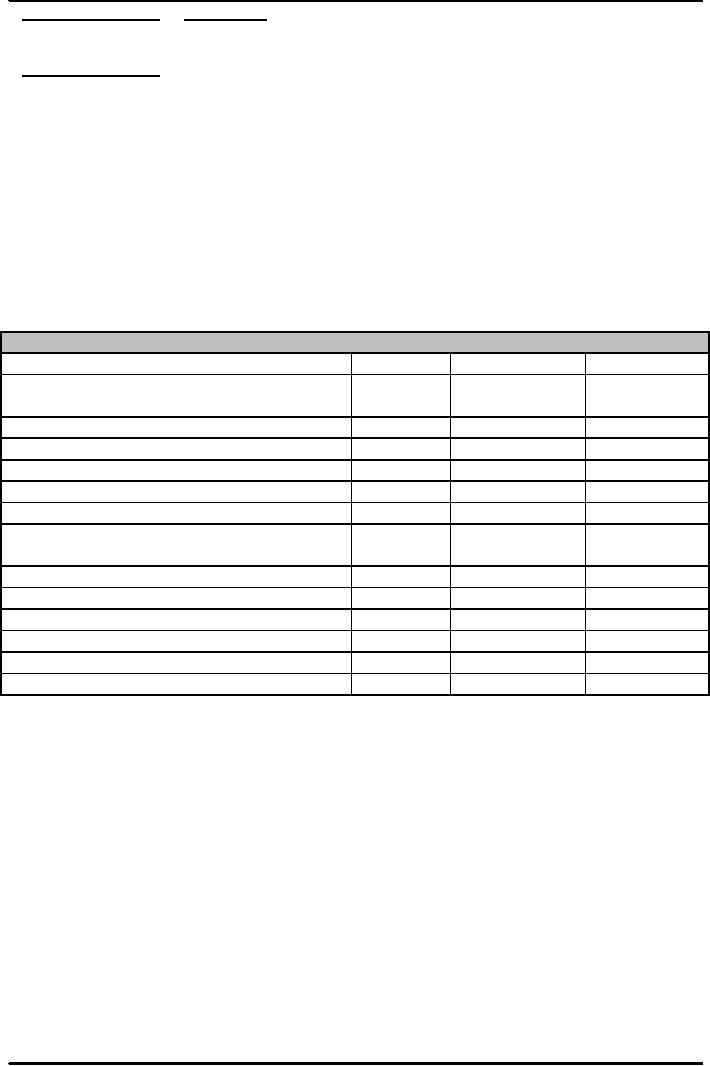

Table:

Profitability of U.S. Commercial Banks(

in millions of $, except bottom

four rows)

Items

1991

1996

2001

A.

Interest

income-interest expense

(Net

$121,,288

$161,172

$210,809

interest

income)

B.

Other

revenue

58,482

92,515

153,734

C.

Operating

costs

124,233

159,241

218,706

D.

Gross

profit (A+B-C)

55,537

94,446

145,837

E.

Loan

losses(provisions)

34,128

15,483

41,008

F.

Net

operating profit

(D-E)

21,409

78,963

104,829

G.

Realized

capital gains from sale of

real

2,971

530

4,434

estate

H.

Net

profits before taxes

(F+G)

24,380

79,493

109,263

I.

Assets

3,420,381

4,554,234

6,454,543

Net

interest margin (A/I)

0.0355%

0.0354%

0.0327%

Return

on assets (H/I) (ROA)

0.0071

0.0175

0.0169

Return

on equity (ROE)

0.1258

0.2147

0.1860

Net

interest income/ Total

income [A/(A+B)]

0.6747

0.6353

0.5782

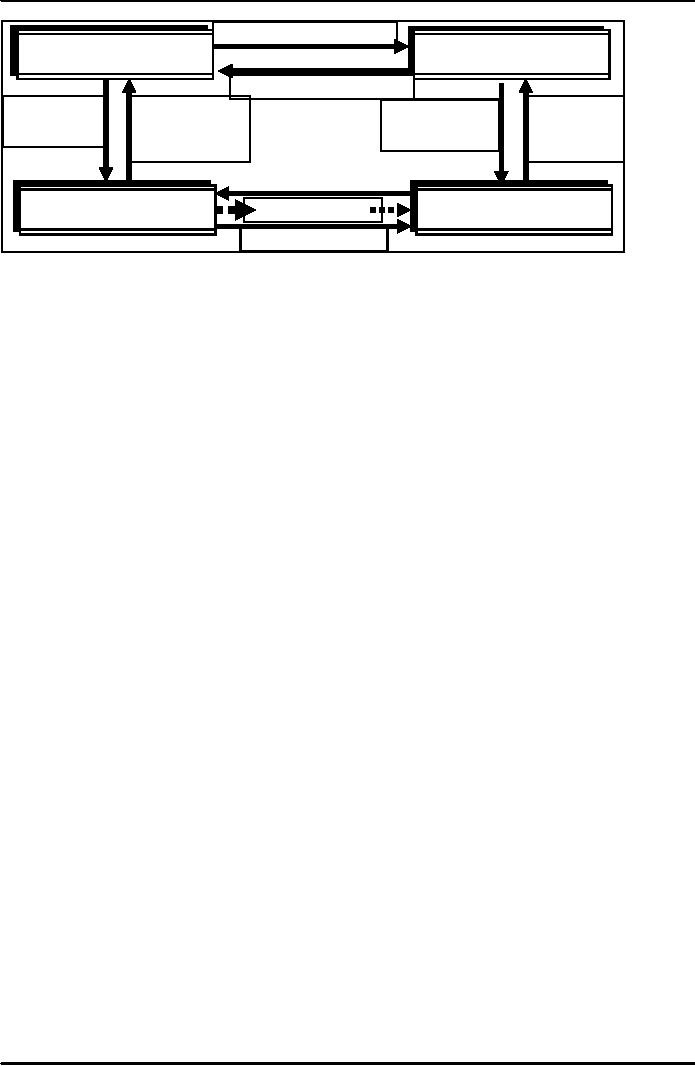

Off-Balance-Sheet

Activities

Banks

engage in these activities in

order to generate fee income;

these activities

include

providing

trusted customers with lines of

credit

Letters

of credit are another important

off-balance-sheet activity; they

guarantee that a

customer

will

be able to make a promised

payment.

In

so doing, the bank, in exchange

for a fee, substitutes its

own guarantee for that of

the

customer

and enables a transaction to go

forward

79

Money

& Banking MGT411

VU

Sale

Contract

Buyer

Seller

(Importer)

(Exporter)

Deliver

Goods

Request

Documents

Deliver

Present

for

Credit

&

Claim for

Letter

of

Documents

Payment

Credit

Present

Documents

Importer's

Bank

Exporter's

Bank

Payment

(Issuing

Bank)

(Advising

Bank)

Send

Credit

A

standby letter of credit is a form of

insurance; the bank promises that it

will repay the lender

should

the borrower default

Off-balance-sheet

activities create risk for

financial institutions and so have come

under

increasing

scrutiny in recent

years

80

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY