|

Money

& Banking MGT411

VU

Lesson

23

BANKING

Banking

Types

of banks

Balance

Sheet of Commercial Banks

Assets

Liabilities

Banking

Banking

is a combination of businesses designed to

deliver the services

Pool

the savings of and making loans

Diversification

Access

to the payments system

Accounting

and record-keeping

The

intent of banks is to profit

from each of these lines of

business

There

are three basic types of depository

institutions:

Commercial

banks,

Savings

institutions

Credit

unions

Commercial

banks

They

accept deposits and use the

proceeds to make consumer,

commercial and real estate

loans.

Community

banks

Small

local banks focused on

serving consumers and small

business

Regional

and Super-regional banks

They

make consumer, residential, commercial

and industrial loans

Money

center bank

These

banks rely more on borrowing

for their funding

Saving

Institutions

Financial

intermediaries to serve households and

individuals

Provide

mortgage and lending as well as saving

deposit services

Credit

Unions

Nonprofit

depository institutions that

are owned by people with a

common bond

These

unions specialize in making small

consumer loans

The

Balance Sheet of Commercial

Banks

Balance

Sheet Identity

Total

Bank Assets = Total Bank

Liabilities + Bank

Capital

Banks

obtain funds from individual

depositors and business as well as by

borrowing from other

financial

institutions and through the financial

markets.

They

use these funds to make

loans, purchase marketable securities and

hold cash.

The

difference between a bank's assets

and liabilities is the bank's

capital or Net Worth

The

bank's profits come both

from service fees and the

difference between interest earned

and

interest

paid.

74

Money

& Banking MGT411

VU

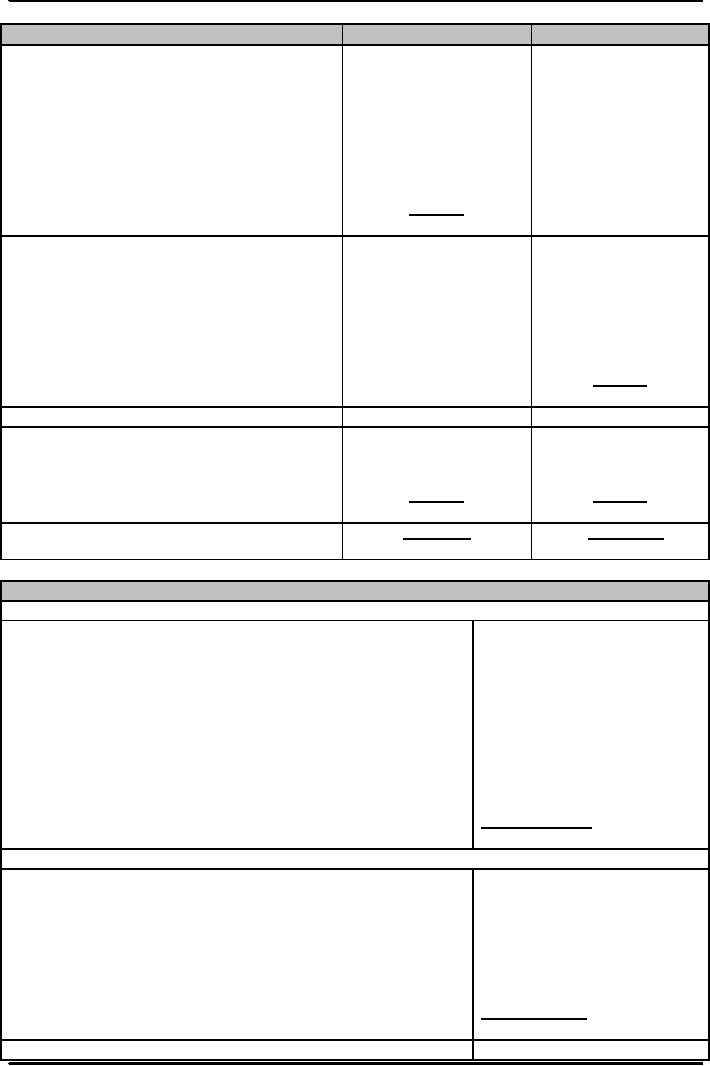

ITEMS

2005

(Rs.000)

2004

(Rs.000)

ASSETS

Cash

and balances with treasury

banks

23,665,549

23,833,253

Balances

with other banks

1,469,333

5,708,323

Lendings

to financial institutions

9,998,828

10,965,297

Investments

net

69,481,487

67,194,971

Advances

net

180,322,753

137,317,773

Other

assets net

5,464,426

6,154,370

Operating

fixed assets

8,182,454

7,999,821

Deferred

tax assets - net

191,967

_________

298,776,797

259,173,808

LIABILITIES

7,566,684

Bills

payable

8,536,674

7,590,864

Borrowings

from financial

institutions

27,377,502

221,069,158

Deposits

and other accounts

229,345,178

1,598,720

Sub-ordinated

loan

1,598,080

----

Liabilities

against assets subject to finance

lease

-----

6,525,999

Other

liabilities

8,611,600

269,499

Deferred

tax liabilities - net

________

275,469,034

244,620,924

NET

ASSETS

23,307,763

14,552,884

REPRESENTED

BY:

3,371,800

Share

capital

4,265,327

5,661,553

Reserves

13,408,005

165,208

Unappropriated

profit

210,662

17,883,994

9,198,561

5,423,769

5,354,323

Surplus

on revaluation of assets - net of

tax

23,307,763

14,552,884

Balance

Sheet of U.S Commercial Banks, August

2004

Assets

in billions of dollars(numbers in parentheses are %age

of total assets)

321.6

(4.1)

Cash

items (including reserves)

1,893.5

(23.9)

Securities

1,1707.7

(14.8)

o

U.S.

Government and agency

722.8

(9.1)

o

State

and local government and

other

5,044.6

(63.7)

Loans

887.1

(11.2)

o

Commercial

and industrial

2,411.6

(30.5)

o

Real

estate (including mortgage)

672.3

(8.5)

o

Consumer

364.7

(4.6)

o

Interbank

708.9

(9.0)

o

Other

655.1

(8.3)

Other

assets

Total

Commercial Bank

Assets

7,914.8

Liabilities

in billions of dollars (numbers in parentheses are

%age of total

liabilities)

645.0

(8.9)

Checkable

deposits

4,487.7

(62.3)

Nontransactions

deposits

3,340.9

(46.3)

o

Savings

deposits and time

deposits

1,146.8

(15.9)

o

Large,

negotiable time

deposits

1,589.0

(22.0)

Borrowings

459.1

(6.4)

o

From

banks in U.S.

1,129.9

(15.7)

o

From

nonbanks in U.S.

487.4

(6.8)

Other

liabilities

Total

Commercial Bank

Liabilities

7,209.1

Bank

assets Bank Liabilities =

Bank Capital

705.7

75

Money

& Banking MGT411

VU

Assets:

Uses of Funds

Cash

Items

Reserves

Cash

items in process of collection

Vault

cash

Securities

Secondary

reserves

Loans

Cash

Items

Reserves

Includes

cash in the bank's vault and

its deposits at the central

bank

Held

to meet customers' withdrawal

requests

Cash

items in the process of

collections

Uncollected

funds the bank expects to

receive

The

balances of accounts that

banks hold at other banks

(correspondent banking)

Because

cash earns no interest, it has a

high opportunity cost. So

banks minimize the amount of

cash

holding

Securities:

Stocks

T-Bills

Government

and corporate bonds

Securities

are sometimes called

secondary reserves because

they are highly liquid and

can be

sold

quickly if the bank needs

cash.

Loans:

The

primary asset of modern commercial

banks;

Business

loans (commercial and industrial

loans),

Real

estate loans,

Consumer

loans,

Inter-bank

loans,

Loans

for the purchase of other

securities

The

primary difference among the various

types of depository institutions is in the

composition

of

their loan portfolios

Commercial

banks make loans primarily to

business

Savings

and loans provide mortgages to

individuals

Credit

unions specialize in consumer

loans

76

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY