|

RISK AND VALUE OF STOCKS:The Theory of Efficient Markets |

| << VALUING STOCKS:Fundamental Value and the Dividend-Discount Model |

| ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings >> |

Money

& Banking MGT411

VU

Lesson

20

RISK

AND VALUE OF STOCKS

Stocks

Risk

and the Value of Stocks

Theory

of Efficient Markets

Investing

in Stocks for Long

Run

Stock

Markets' Role in the

Economy

Financial

Intermediation

Role

of Financial Intermediaries

Risk

and value of

stocks

The

dividend-discount model must be adjusted

to include compensation for a stock's

risk

Return

to Holding Stock for One

Year =

-

Ptoday

D

next

P

next

_

year

_

year

+

Ptoday

Ptoday

Since

the ultimate future sale

price is unknown the stock is

risky,

The

investor will require compensation in the

form of a risk

premium

Required

Stock Return (i) = Risk-free

Return (rf)

+ Risk Premium (rp)

The

risk-free rate can be thought of as the

interest rate on a treasury security with a

maturity of

several

months

Our

dividend discount model

becomes:

D

today

=

P

today

rf

+

rp

-

g

Risk

and value of

stocks

Stock

Prices are high

when

Current

dividends are high (Dtoday is

high)

Dividends

are expected to grow quickly (g is

high)

The

risk-free rate is low

(rf is

low)

The

risk premium on equity is

low (rp is

low)

The

S&P 500 index finished the

year 2003 at just over

1,100. was this level

warranted by

fundamentals?

Risk

free real interest rate is about 2% or

rf =

0.02

Risk

premium is assumed to be 4% or rp =

0.04

Dividend

growth rate is around 2% or g =

0.02

The

owner of a $1,000 portfolio

would have received $30 in

dividends during 2003

Substituting

the information in our adjusted dividend

discount model:

$30

Ptoday =

=

$750

0.02

+

0.04

- 0.02

But

the actual stock prices were substantially

higher than this calculated

figure

This

may be due to wrong assumption on

risk premium. The investors

may have been

demanding

lower risk premium in

2003.

To

compute it, we use the same

equation

65

Money

& Banking MGT411

VU

$30

1,10

=

-

0.02

(0.02+rp)

The

answer is approximately

2.75%

The

Theory of Efficient

Markets

The

basis for the theory of

efficient markets is the notion

that the prices of all

financial

instruments,

including stocks, reflect

all available

information

As

a result, markets adjust immediately and

continuously to changes in fundamental

values

When

markets are efficient, the

prices at which stocks

currently trade reflect all

available

information,

so that future price

movements are

unpredictable.

If

the theory is correct then no one

can consistently beat the

market average; active

portfolio

management

will not yield a return

that is higher than that of

a broad stock-market index

If

managers claim to exceed the

market average year after

year, it may be

because

They

must be taking on

risk,

They

are lucky,

They

have private information (which is

illegal), or

Markets

are not efficient

Investing

in Stocks for the Long

Run

Stocks

appear to be risky, and yet

many people hold substantial

proportions of their wealth

in

the

form of stock

This

is due to the difference between the short term and

the long term;

Investing

in stocks is risky only if

you hold them for a short

time

In

fact, when held for the

long term, stocks are less

risky than bonds.

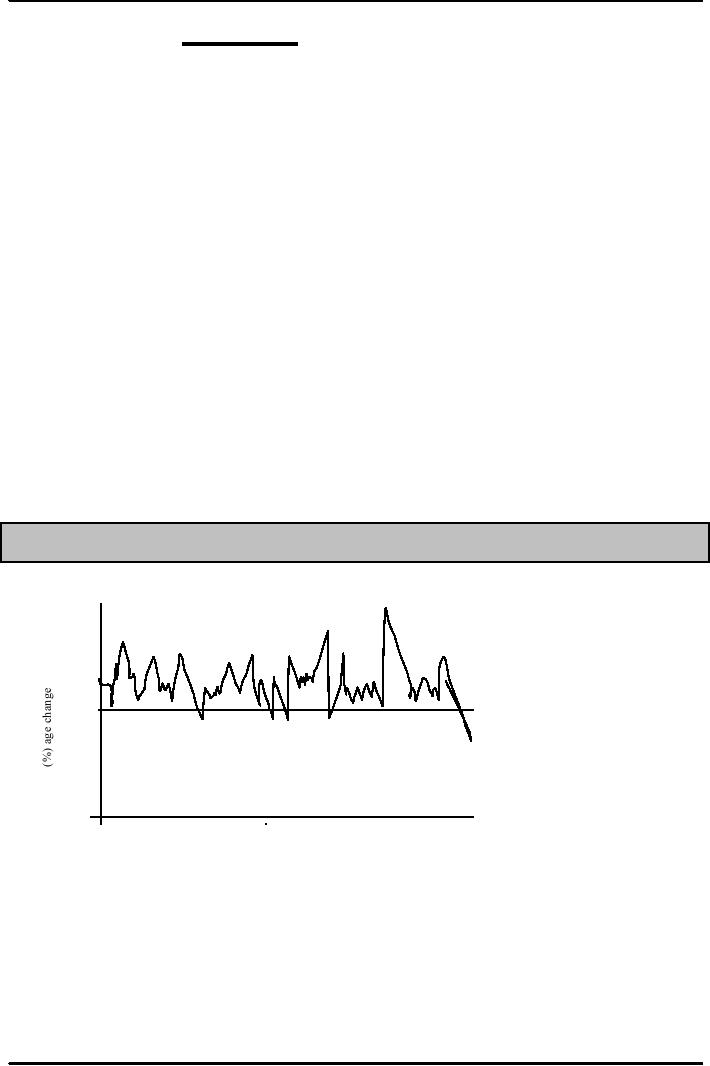

Figure:

S&P 1-Year Stock Returns, 1871 to

2003(Returns are Real, Adjusted for

Inflation using

the

CPI)

60

40

20

0

-20

-40

-60

1895

1907

1919

1931

1943 1955

1871

1967

1883

197

1991

200

Years

66

Money

& Banking MGT411

VU

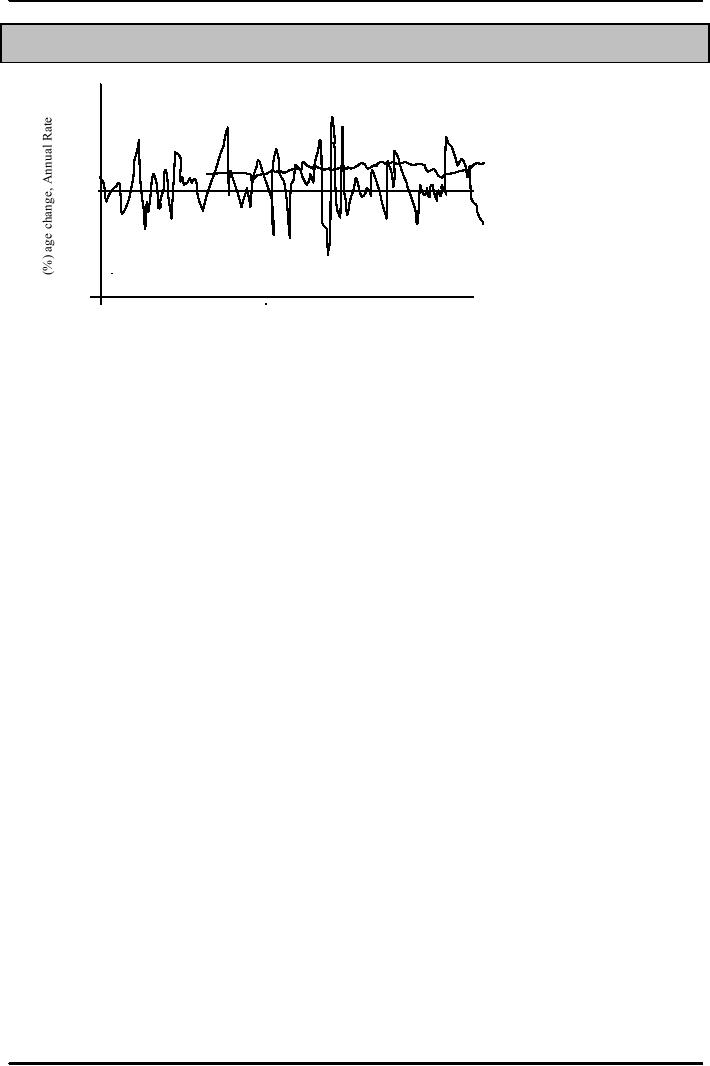

Figure:

S&P Long-Run Stock Returns, 1871 to

2003(Returns are Real, adjusted for

inflation

using

the CPI)

60

40

20

0

-20

-40

-60

1895

1907

1919

1931

1943 1955

1871

11883

1967

197

1991

200

____1-Year

Returns

____25

year Returns

The

Stock Market's Role in the

Economy

The

stock market plays a crucial

role in every modern capitalist

economy.

The

prices determined there tell us the

market value of companies,

which determines the

allocation

of resources.

Firms

with a high stock market

value are the ones

investors' prize, so they have an

easier time

garnering

the resources they need to

grow.

In

contrast, firms whose stock value is

low have difficulty financing

their operations

So

long as stock prices accurately reflect

fundamental values, this resource

allocation

mechanism

works well.

At

times, however, stock prices deviate

significantly from the fundamentals and

prices move in

ways

that are difficult to

attribute to changes in the real interest

rate, the risk premium, or the

growth

rate of future dividends.

The

Stock Market's Role in the

Economy

Shifts

in investor psychology may

distort prices; both euphoria and

depression are contagious

When

investors become unjustifiably exuberant

about the market's future

prospects, prices rise

regardless

of the fundamentals, and such mass

enthusiasm creates bubbles.

Bubbles

Bubbles

are persistent and expanding gaps between

actual stock prices and those warranted

by

the

fundamentals.

These

bubbles inevitably burst, creating

crashes.

They

affect all of us because

they distort the economic decisions

companies and

consumers

make

If

bubbles result in real investment

that is both excessive and

inefficiently distributed,

crashes

do

the opposite; the shift to excessive

pessimism causes a collapse in investment

and economic

growth

When

bubbles grow large enough and

result in crashes the stock market

can destabilize the

real

economy

Financial

Intermediation

Economic

well-being is essentially tied to the

health of the financial intermediaries

that make up

the

financial system.

67

Money

& Banking MGT411

VU

We

know that financial

intermediaries are the businesses

whose assets and liabilities

are

primarily

financial instruments.

Various

sorts of banks, brokerage firms,

investment companies, insurance

companies, and

pension

funds all fall into

this category.

These

are the institutions that

pool funds from people and

firms who save and lend them

to

people

and firms who need to

borrow

Financial

intermediaries funnel savers' surplus

resources into home

mortgages, business loans,

and

investments.

They

are involved in both

Direct

finance--in which borrowers

sell securities directly to lenders in the

financial markets

Indirect

finance--in which a third

party stands between those

who provide funds and those

who

use

them

Intermediaries

investigate the financial condition of

the individuals and firms who

want

financing

to figure out which have the

best investment

opportunities.

As

providers of indirect finance,

banks want to make loans

only to the highest-quality

borrowers.

When

they do their job correctly,

financial intermediaries increase

investment and economic

growth

at the same time that they

reduce investment risk and economic

volatility

Role

of Financial Intermediaries

As

a general rule, indirect finance

through financial intermediaries is

much more important

than

direct

finance through the stock and bond

markets

In

virtually every country for

which we have comprehensive data, credit extended by

financial

intermediaries

is larger as a percentage of GDP

than stocks and bonds

combined

Around

the world, firms and individuals

draw their financing

primarily from banks and

other

financial

intermediaries

The

reason for this is

information;

Just

think of an online

store

You

can buy virtually EVERYTHING

from $5 dinner plates to $300,000

sports car

But

you will notice an absence

of financial products, like student loans,

car loans, credit

cards

or

home mortgages

You

can not bonds on which

issuer is still making payments,

nor can you have the

services of

checking

account.

Why

such online store does

not deal in

mortgages?

Suppose

a company needs a mortgage of $100,000

and the store can (if at

all) establish a system

in

which 100 people sign up to

lend $1,000 each to the

company

But

the store has to do more

Collecting

the payments

Figuring

out how to repay the

lenders

Writing

legal contracts

Evaluating

the creditworthiness of the company and

feasibility of the mortgaged

project

Can

it do it all?

Financial

intermediaries exist so that

individual lenders don't have to worry

about getting

answers

to all of the important questions

concerning a loan and a

borrower

Lending

and borrowing involve transactions

costs and information costs, and

financial

intermediaries

exist to reduce these

costs

Financial

intermediaries perform five

functions:

1.

They

pool the resources of small

savers;

2.

They

provide safekeeping and accounting

services as well as access to the

payments

system;

3.

They

supply liquidity;

4.

They

provide ways to diversify risk;

and

5.

They

collect and process information in ways

that reduce information

costs

68

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY