|

FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value |

| << TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM |

| MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income >> |

Money

& Banking MGT411

VU

Lesson

2

FIVE

CORE PRINCIPLES OF MONEY AND

BANKING

1.

Time has Value

Time

affects the value of financial

instruments.

Interest

payments exist because of

time properties of financial

instruments

Example

At

6% interest rate, 4 year loan of $10,000

for a car

Requires

48 monthly installments of $235

each

Total

repayment = $235 x 48 = $11,280

$11,280

>

$10,000

(Total

repayment)

(Amount

of loan)

Reason:

you are compensating the lender

for the time during which

you use the funds

2.

Risk Requires Compensation

In

a world of uncertainty, individuals

will accept risk only if

they are compensated in

some

form.

The

world is filled with

uncertainty; some possibilities

are welcome and some are

not

To

deal effectively with risk

we must consider the full range of

possibilities:

Eliminate

some risks,

Reduce

others,

Pay

someone else to assume

particularly onerous risks,

and

Just

live with what's

left

Investors

must be paid to assume risk,

and the higher the risk the higher the

required payment

Car

insurance is an example of paying for

someone else to shoulder a

risk you don't want

to

take.

Both parties to the transaction

benefit

Drivers

are sure of compensation in the event of

an accident

The

insurance companies make profit by

pooling the insurance premiums and investing

them

Now

we can understand the valuation of a

broad set of financial

instruments

E.g.,

lenders charge higher rates if there is a

chance the borrower will

not repay.

3.

Information is the basis for

decisions

We

collect information before

making decisions

The

more important the decision the more

information we collect

The

collection and processing of information

is the basis of foundation of the

financial system.

Some

transactions are arranged so that

information is NOT

needed

Stock

exchanges are organized to

eliminate the need for

costly information gathering and

thus

facilitate

the exchange of securities

One

way or another, information is the

key to the financial

system

4.

Markets set prices and

allocate resources

Markets

are the core of the economic system; the

place, physical or virtual,

Where

buyers and sellers

meet

Where

firms go to issue stocks and

bonds,

Where

individuals go to purchase

assets

Financial

markets are essential to the

economy,

Channeling

its resources

Minimizing

the cost of gathering

information

Making

transactions

Well-developed

financial markets are a

necessary precondition for

healthy economic growth

The

role of setting prices and

allocation of resources makes

the markets vital sources

of

information

Markets

provide the basis for the

allocation of capital by attaching

prices to different stocks

or

bonds

3

Money

& Banking MGT411

VU

Financial

markets require rules to operate properly

and authorities to police

them

The

role of the govt. is to ensure

investor protection

Investor

will only participate if

they perceive the markets

are fair

5.

Stability improves welfare

To

reduce risk, the volatility

must be reduced

Govt.

policymakers play pivotal

role in reducing some

risks

A

stable economy reduces risk

and improves everyone's

welfare.

By

stabilizing the economy as whole monetary

policymakers eliminate risks that

individuals

can't

and so improve everyone's

welfare in the process.

Stabilizing

the economy is the primary function of

central banks

A

stable economy grows faster than an unstable

one

Financial

System Promotes Economic

Efficiency

The

Financial System makes it

Easier to Trade

Facilitate

Payments - bank checking

accounts

Channel

Funds from Savers to

Borrowers

Enable

Risk Sharing - Classic

examples are insurance and

forward markets

1.

Facilitate Payments

Cash

transactions (Trade "value for

value"). Could hold a lot of

cash on hand to pay for

things

Financial

intermediaries provide checking

accounts, credit cards,

debit cards, ATMs

Make

transactions easier.

2.

Channel Funds from Savers to

Borrowers

Lending

is a form of trade (Trade "value

for a promise")

Give

up purchasing power today in exchange for

purchasing power in the future.

Savers:

have more funds than they

currently need; would like to

earn capital income

Borrowers:

need more funds than they

currently have; willing and

able to repay with interest

in

the

future.

Why

is this important?

A)

Allows

those without funds to

exploit profitable investment

opportunities.

Commercial

loans to growing businesses;

Venture

capital;

Student

loans (investment in human

capital);

Investment

in physical capital and new

products/processes to promote economic

growth

B)

Financial

System allows the timing of income and

expenditures to be decoupled.

Household

earning potential starts

low, grows rapidly until the

mid 50s, and then declines

with

age.

Financial

system allows households to borrow

when young to prop up

consumption (house

loans,

car loans), repay and then

accumulate wealth during

middle age, then live

off wealth

during

retirement.

4

Money

& Banking MGT411

VU

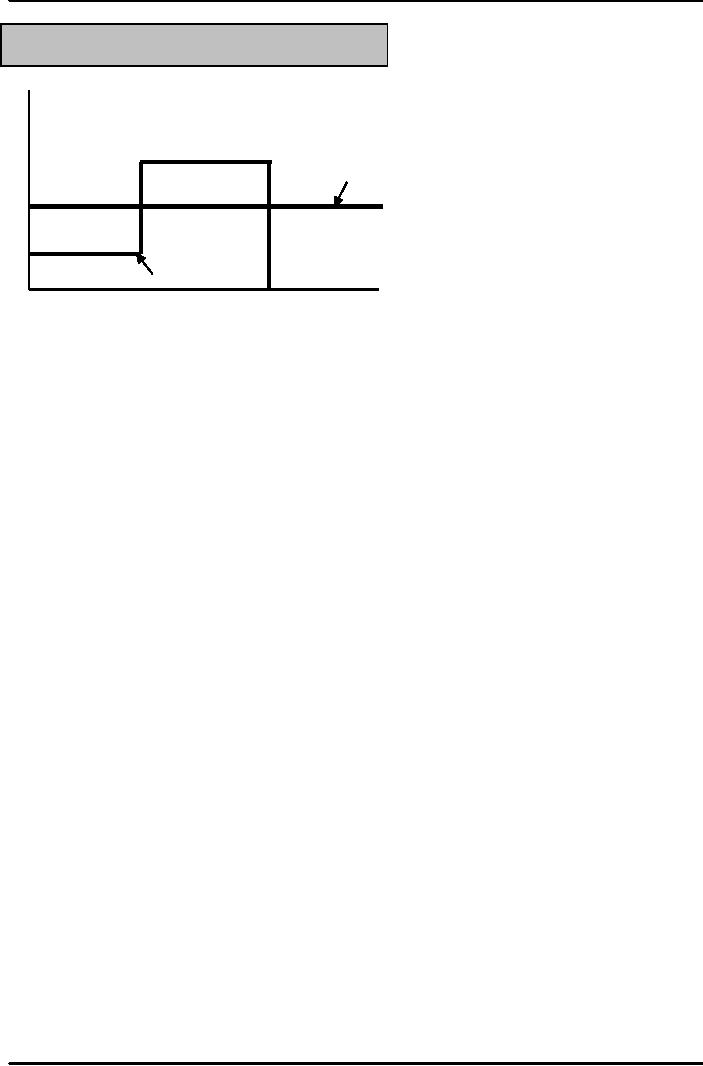

Figure: Channel Funds

from Savers to Borrowers

$

Consumption

Dissavings

Dissavings

Income

Time

Retirement

Begins

3.

Enable Risk

Sharing

The

world is an uncertain place. The

financial system allows trade in

risk. (Trade "value for

a

promise")

Two

principal forms of trade in risk are

insurance and forward contracts.

Suppose

everyone has a 1/1000 chance

of dying by age 40 and one would

need $1 million to

replace

lost income to provide for

their family.

What

are your options to address

this risk?

Summary

Five

Core Principles of Money and

Banking

Time

has Value

Risk

Requires Compensation

Information

is the basis for decisions

Markets

set prices and allocate

resources

Stability

improves welfare

Financial

System Promotes Economic

Efficiency

Facilitate

Payments

Channel

Funds from Savers to

Borrowers

Enable

Risk Sharing

5

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY