|

VALUING STOCKS:Fundamental Value and the Dividend-Discount Model |

| << THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock |

| RISK AND VALUE OF STOCKS:The Theory of Efficient Markets >> |

Money

& Banking MGT411

VU

Lesson

19

VALUING

STOCKS

Valuing

Stocks

Fundamental

Value and Dividend Discount

Model

Risk

and Value of Stocks

Valuing

Stocks

People

differ in their opinions of

how stocks should be

valued

Chartists

believe that they can

predict changes in a stock's

price by looking at patterns in

its

past

price movements

Behavioralists

estimate the value of stocks

based on their perceptions of investor

psychology

and

behavior

Others

estimate stock values based on a detailed

study of the fundamentals, which can

be

analyzed

by examining the firm's financial

statements.

In

this view the value of a

firm's stock depends both on

its current assets and

estimates of its

future

profitability

The

fundamental value of stocks

can be found by using the

present value formula to

assess how

much

the promised payments are worth, and

then adjusting to allow for

risk

Chartists

and Behavioralists focus instead on estimates of the

deviation of stock prices

from

those

fundamental values

Fundamental

Value and the Dividend-Discount

Model

As

with all financial instruments, a stock

represents a promise to make monetary

payments on

future

dates, under certain

circumstances

With

stocks the payments are in the

form of dividends, or distributions of

the firm's profits

The

price of a stock today is equal to the

present value of the payments the

investor will receive

from

holding the stock

This

is equal to

The

selling price of the stock in one

year's time plus

The

dividend payment received in the

interim

Thus

the current price is the present

value of next year's price

plus the dividend

If

Ptoday is the purchase price of stock,

Pnext year

is the sales

price one year later

and Dnext

year is

the

size

of the dividend payment, we can

say:

D

P

Next

year

+

next

year

=

P

today

(1

+

i

)

(1

+

i

)

What

if investor plans to hold stock for

two years?

D

D

nex

P

+

In

two

P

toda =

+

yea

In

two

(1

+

i)2

(1

+

i

)

(1

+

i)2

Generalizing

for n years:

62

Money

& Banking MGT411

VU

D

D

=

+

+

.....

+

_

year

in

_

two

_

years

next

P

today

(1

+

i

)

(1

+

i

)

2

D

Pn

+

n

_

years

_

_

now

_

years

_

_

now

from

from

(1

+

i

)

(1

+

i

)

n

n

If

a stock does not pay

dividends the calculation can

still be performed; a value of

zero is used

for

the dividend payments

Future

dividend payments can be estimated

assuming that current

dividends will grow at

a

constant

rate of g per year.

D

next

_

year

=

D

today (1 +

g

)

For

multiple periods:

(1

+

g

)n

D

years from now

=

D

n

today

Price

equation can now be

re-written as:

(1

+

g

)

(1

+

g

)

2

D

D

today

today

=

+

+

.....

+

P

today

(1

+

i

)

(1

+

i

)

2

(1

+

g

)

n

D

Pn _

years

_

from

_

now

today

+

(1

+

i

)

n

(1

+

i

)

n

Assuming

that the firm pays dividends

forever solves the problem of

knowing the selling

price

of

the stock; the assumption allows us to treat the stock as we

did a consol

D

today

Ptoday =

i-g

This

relationship is the dividend discount

model

The

model tells us that stock

price should be high

when

Dividends

are high

Dividend

growth is rapid, or

Interest

rate is low

Why

stocks are risky?

Stockholders

receive profits only after the

firm has paid everyone

else, including

bondholders

It

is as if the stockholders bought the firm by

putting up some of their own

wealth and

borrowing

the rest

This

borrowing creates leverage,

and leverage creates

risk

Imagine

a software business that

needs only one computer

costing $1,000 and purchase

can be

financed

by any combination of stocks

(equity) and bonds (debt).

Interest rate on bonds is

10%.

Company

earns $160 in good years and

$80 in bad years with equal

probability

63

Money

& Banking MGT411

VU

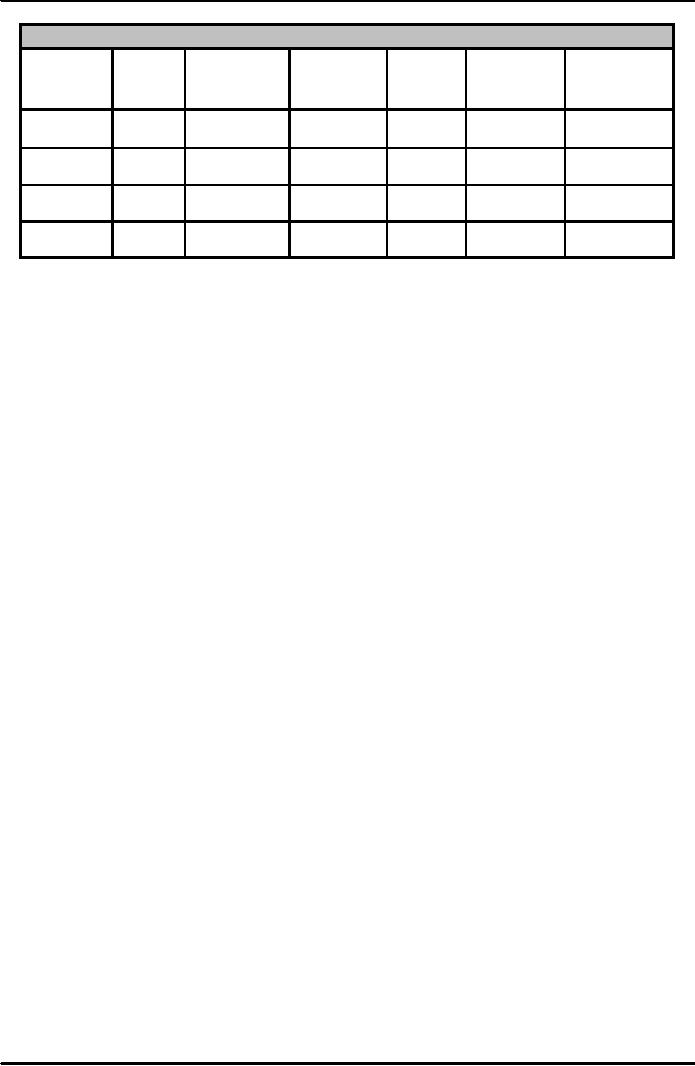

Table:

Returns distributed to debt and equity

holders under different financing

assumptions

Percent

Percent

Required

Payment

to Equity

Expected

St.

Dev. of

Equity

(%) Debt (%) payments on

equity

Return

Equity

Equity

Return

10%

bonds

holders

(%)

Return

(%)

100%

0

0

$80-160

8-16%

12%

4%

50%

50%

$50

$30-110

6-22%

14%

8%

30%

70%

$70

$10-90

3.3-30%

16.67%

13.3%

20%

80%

$80

$0-80

0-40%

20%

20%

If

the firm were only 10%

equity financed, shareholders' liability

could come into

play.

Issuing

$900 worth of bonds means

$90 for interest payments.

If

the business turned out to be bad, the

$80 revenue would not be

enough to pay the interest

Without

their limited liability, stockholders

will be liable for $10

shortfall. But actually,

they

will

lose only $100 investment

and not more and the firm goes

bankrupt.

Stocks

are risky because the

shareholders are residual claimants.

Since they are paid last,

they

never

know for sure how

much their return will

be.

Any

variation in the firm's revenue flows

through to stockholders dollar for

dollar, making their

returns

highly volatile

64

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY