|

Money

& Banking MGT411

VU

Lesson

17

TAX

EFFECT & TERM STRUCTURE OF

INTEREST RATE

Tax

Effect

Term

Structure of Interest Rate

Expectations

Hypothesis

Liquidity

Premium

Tax

Effect

The

second important factor that

affects the return on a bond is

taxes

Bondholders

must pay income tax on the interest

income they receive from

privately issued

bonds

(taxable bonds), but government

bonds are treated

differently

Interest

payments on bonds issued by

state and local governments,

called "municipal" or

"tax-

exempt"

bonds are specifically exempt

from taxation

A

tax exemption affects a bond's

yield because it affects how

much of the return the

bondholder

gets

to keep

Tax-Exempt

Bond Yield = (Taxable Bond

Yield) x (1- Tax

Rate).

Term

Structure of Interest Rates

The

relationship among bonds with the

same risk characteristics

but different maturities

is

called

the term structure of interest rates.

A

plot of the term structure, with the

yield to maturity on the vertical

axis and the time to

maturity

on the horizontal axis, is called the

yield curve.

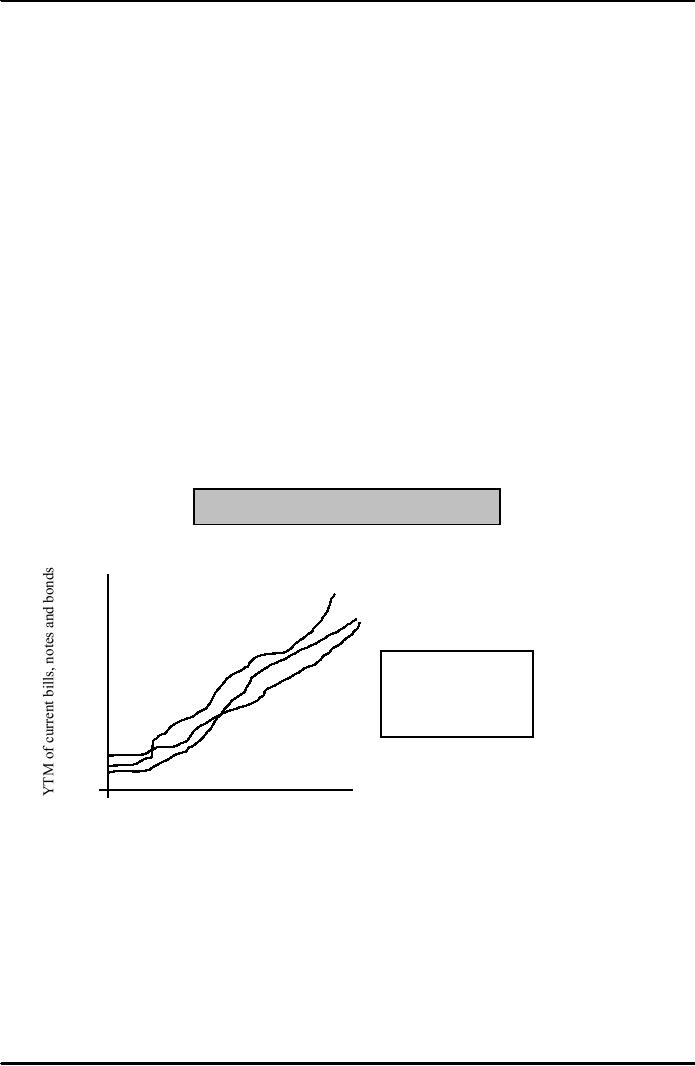

Figure:

The U.S. Treasury Yield

Curve

___Yesterday

6.0%

___1

month ago

___1

year ago

5.0

The

figure plots the

4.0

yields

on Treasury

bills

and bonds for

3.0

August

27, 2004.

2.0

1.0

0

1

3

6

2

5

10

30

Months

Years

________

Maturity________

55

Money

& Banking MGT411

VU

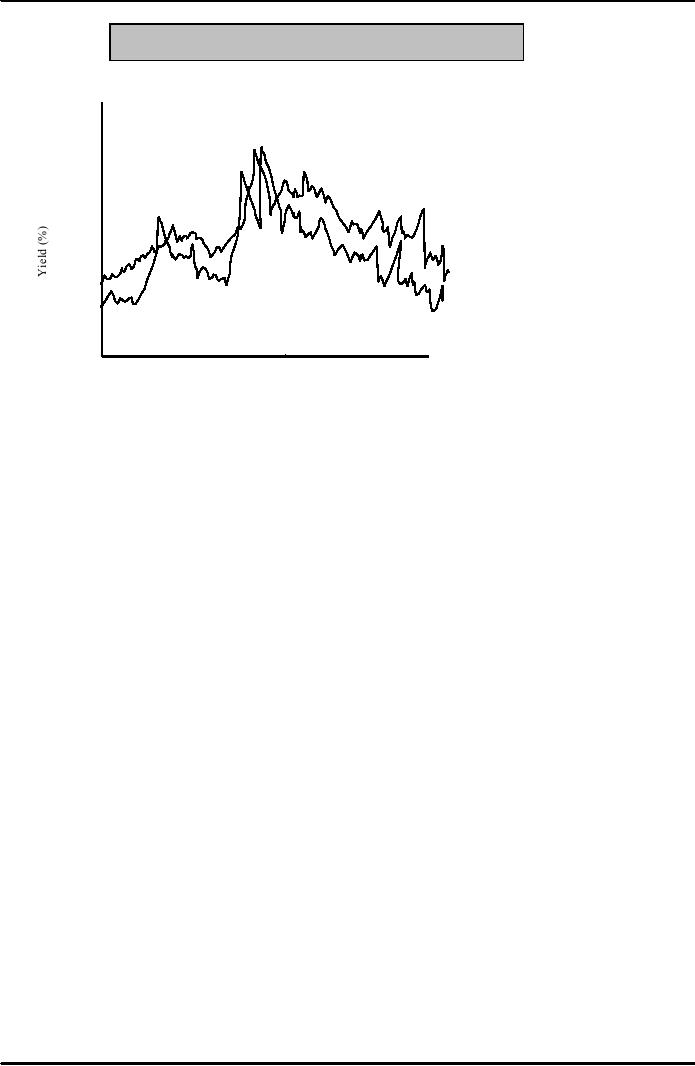

Figure:

The Term Structure of Treasury Interest

Rates

18

16

14

12

10

8

6

4

2

0

1979

1983

1987

1991

1995 1999

1971

11975

2003

___3

months T.Bills_____10 years

T-Bonds

Term

Structure "Facts"

Interest

Rates of different maturities

tend to move together

Yields

on short-term bond are more volatile

than yields on long-term

bonds

Long-term

yields tend to be higher

than short-term yields.

Expectations

Hypothesis

The

risk-free interest rate can be computed,

assuming that there is no uncertainty

about the

future

Since

certainty means that bonds

of different maturities are

perfect substitutes for each

other, an

investor

would be indifferent between

holding

A

two-year bond or

A

series of two one-year

bonds

Certainty

means that bonds of

different maturities are

perfect substitutes for each

other

Assuming

that current 1-year interest rate is

5%. The expectations hypothesis implies

that the

current

2-year interest rate should equal the

average of 5% and 1-year interest rate one

year in

future.

If

future interest rate is 7%, then

current 2-year interest rate will be

(5+7) / 2 = 6%

Therefore,

when interest rates are expected to rise

long-term rates will be

higher than short-term

rates

and the yield curve will

slope up (and vice versa)

56

Money

& Banking MGT411

VU

Figure:

Yield Curve

Yield

curve when interest rates

are expected to

rise

Time

to maturity

From

this we can construct investment

strategies that must have the

same yield.

Assuming

the investor has a two-year

horizon, the investor

can:

Invest

in a two-year bond and hold it to

maturity

Interest

rate will be i2y

Investment

will yield (1 + i2y)

(1 + i2y) two years

later

Invest

in a one-year bond today and a

second one a year from now

when the first one

matures

Interest

rate will be iey+1

Investment

will yield (1 + i1y)

(1 + iey+1) in two years

The

hypothesis tells us that investors will

be indifferent between the two

strategies, so the

strategies

must have the same

return

Total

return from 2 year bonds

over 2 years

(1

+

i

2y )(1 +

i

2y )

Return

from one year bond and then

another one year bond

(1

+

i

1y )(1 +

i

1y )

e

If

one and two year bonds are

perfect substitutes,

then:

(1

+

i

2y )(1 +

i

2y ) =

(1

+

i

1y )(1 +

1y

)

e

Or

i1y +

i1y

2

i

2y =

2

Or

in general terms

i1

t

+

i1et

+

1

+

i1et

+

2

+

....

+

i1et

+

n

-

1

=

i

nt

n

Therefore

the rate on the two-year bond

must be the average of the current

one-year rate and the

expected

future one-year rate

57

Money

& Banking MGT411

VU

Implications

would be the same old

Interest

rates of different maturities

tend to move

together.

Yields

on short-term bonds are more volatile

than those on long-term

bonds.

Long-term

yields tend to be higher

than short-term yields

However,

expectations theory can not

explain why long-term rates

are usually above short term

rates

In

order to explain why the

yield curve normally slopes

upward, we need to extend

the

hypothesis

to include risk

58

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY