|

BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings |

| << SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK |

| TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis >> |

Money

& Banking MGT411

VU

Lesson

16

BONDS

& SOURCES OF BOND

RISK

Bonds and

Risk

Default

Risk

Inflation

Risk

Interest

Rate Risk

Bond

Ratings

Bond

Ratings and Risk

Tax

Effect

Bonds

and Risk

Sources

of Bond Risk

Default

Risk

Inflation

Risk

Interest-Rate

Risk

Default

Risk

There

is no guarantee that a bond

issuer will make the promised

payments

Investors

who are risk averse

require some compensation for

bearing risk; the more risk,

the

more

compensation they demand

The

higher the default risk the

higher the probability that

bondholders will not receive

the

promised

payments and thus, the higher the

yield

Suppose

risk-free rate is 5%

ZEDEX

Corp. issues one-year bond

at 5%

Price

without risk = ($100 +

$5)/1.05 = $100

Suppose

there is 10% probability that

ZEDEX Corp. goes bankrupt,

get nothing

Two

possible payoffs: $105 and $0

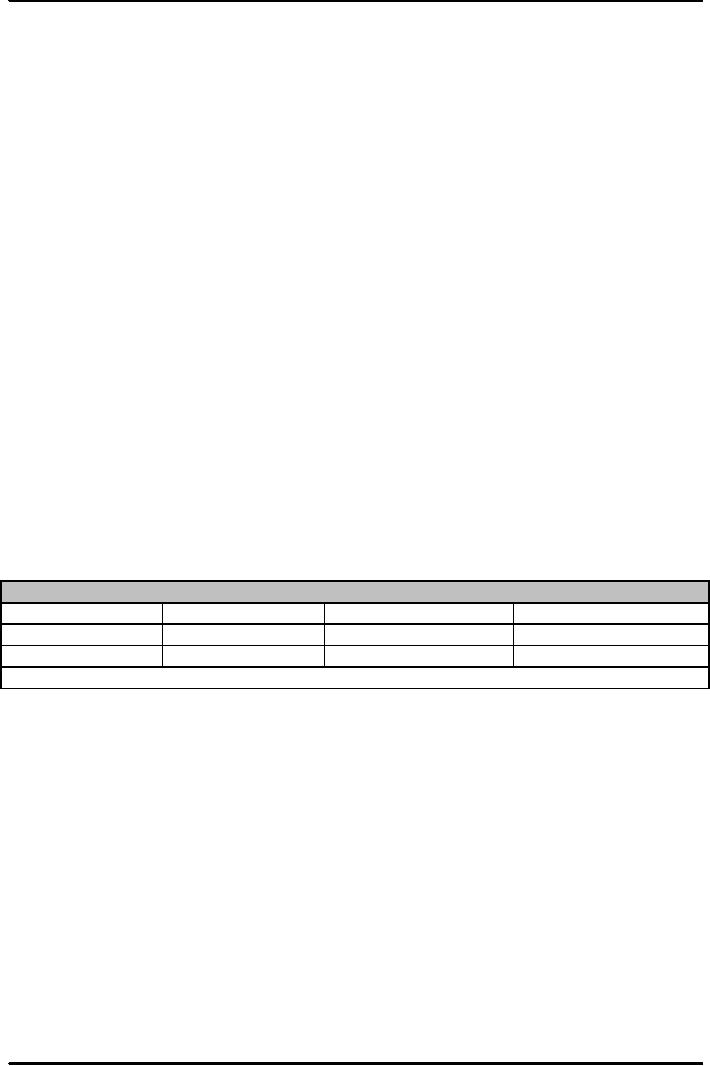

Table:

Expected Value of ZEDEX Bond

Payment

Possibilities

Payoff

Probability

Payoff

� Probabilities

Full

Payment

$105

0.90

$94.50

default

$0

0.10

$0

Expected

Value= Sum of Payoffs times Probabilities

= $94.50

Expected

PV of ZEDEX bond payment =

$94.5/1.05 = $90

If

the promised payment is $105, YTM will be

$105/90 1 = 0.1667 or

16.67%

Default

risk premium = 16.67% - 5% =

11.67%

Inflation

Risk

Bonds

promise to make fixed-dollar payments, and

bondholders are concerned

about the

purchasing

power of those

payments

The

nominal interest rate will be equal to

the real interest rate plus the expected

inflation rate

plus

the compensation for inflation

risk

The

greater the inflation risk, the larger

will be the compensation for it

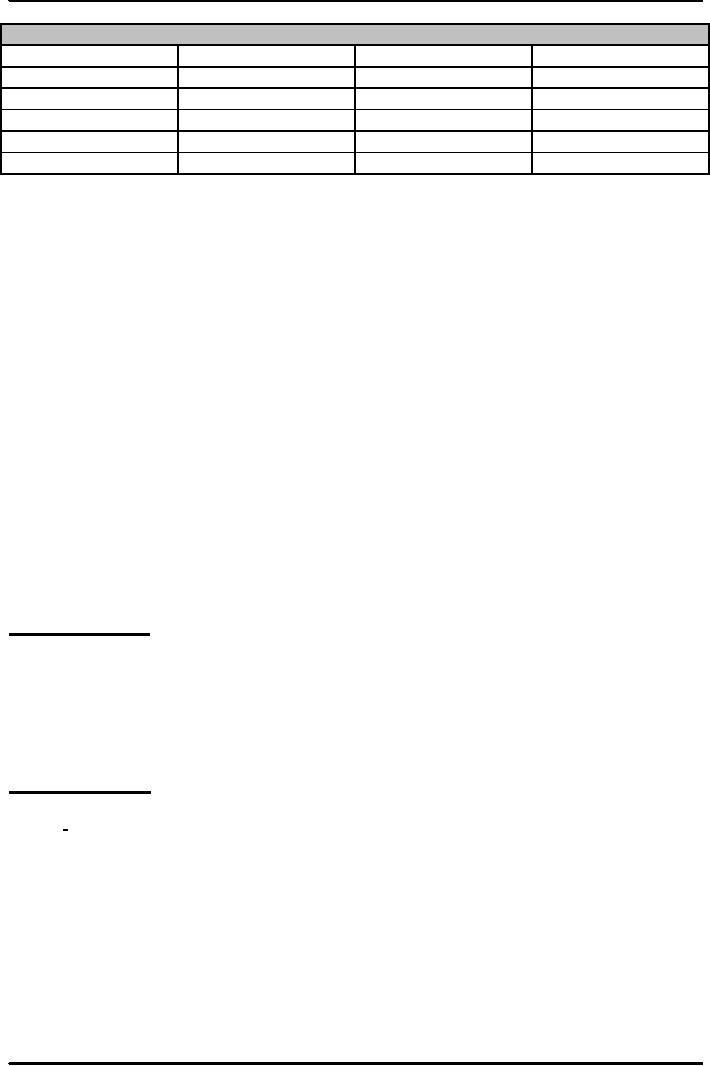

Assuming

real interest rate is 3% with the

following information

51

Money

& Banking MGT411

VU

Probabilities

Inflation

Case

I

Case

II

Case

III

1%

0.50

0.25

0.10

2%

-

0.50

0.80

3%

0.50

0.25

0.10

Expected

Inflation

2%

2%

2%

Standard

Deviation

1.0%

0.71%

0.45%

Nominal

rate = 3% real rate + 2% expected inflation +

compensation for inflation

risk

Interest-Rate

Risk

Interest-rate

risk arises from the fact

that investors don't know the

holding period yield of

a

long-term

bond.

If

you have a short investment horizon and

buy a long-term bond you

will have to sell it

before

it

matures, and so you must

worry about what happens if

interest rates change

Because

the price of long-term bonds

can change dramatically,

this can be an important

source

of

risk

Bond

Ratings

The

risk of default (i.e., that

a bond issuer will fail to

make a bond's promised payments) is one

of

the most important risks a bondholder

faces, and it varies among

issuers.

Credit

rating agencies have come

into existence to assess the default

risk of different

issuers

The

bond ratings are an

assessment of the creditworthiness of the corporate

issuer.

The

definitions of creditworthiness used by

the rating agencies are

based on how likely

the

issuer

firm is to default and the protection

creditors have in the event of a

default.

These

ratings are concerned only

with the possibility of the default.

Since they do not

address

the

issue of interest rate risk, the price of

a highly rated bond may be

quite volatile.

Long

Term Ratings by PACRA

Investment

Grades:

AAA:

Highest

credit quality. `AAA' ratings denote the

lowest expectation of credit

risk.

AA:

Very

high credit quality. `AA'

ratings denote a very low

expectation of credit

risk.

A:

High

credit quality. `A' ratings denote a

low expectation of credit

risk.

BBB:

Good

credit quality. `BBB'

ratings indicate that there is

currently a low expectation

of

credit

risk.

Speculative

Grades:

BB:

Speculative.

`BB'

ratings

indicate that there is a possibility of

credit risk

developing,

B:

Highly

speculative. `B' ratings

indicate that significant

credit risk is present, but

a limited

margin

of safety remains.

CCC,

CC, C: High

default risk. Default is a

real possibility.

52

Money

& Banking MGT411

VU

Short

Term Ratings by PACRA

A1+:

highest

capacity for timely

repayment

A1:

Strong capacity for timely

repayment

A2:

satisfactory capacity for timely

repayment may be susceptible to adverse

economic

conditions

A3:

an adequate capacity for

timely repayment. More susceptible to

adverse economic

condition

B:

timely repayment is susceptible to adverse

changes in business, economic, or

financial conditions

C:

an inadequate capacity to ensure timely

repayment

D:

high risk of default or

which are currently in

default

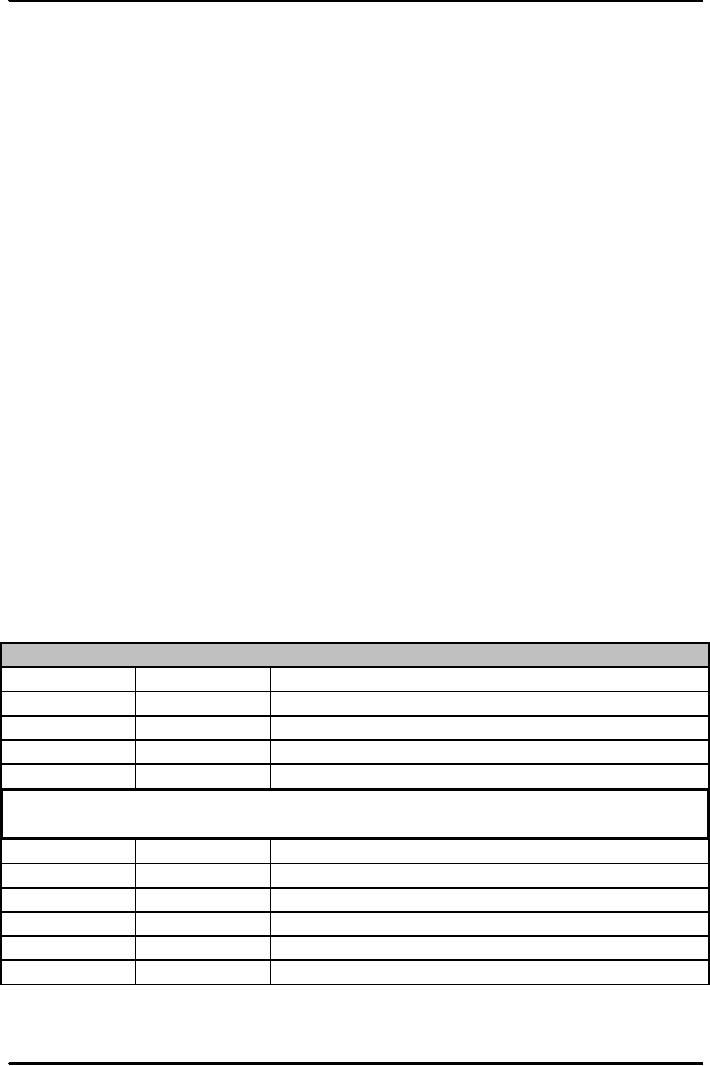

Bond

Ratings and Risk

Bond

Ratings

Moody's

and Standard & Poor's

Ratings

Groups

Investment

Grade

Non-Investment

Speculative Grade

Highly

Speculative

Commercial

Paper Ratings

Moody's

and Standard & Poor's

Rating

Groups

Investment

Speculative

Default

Bond

(Credit) Ratings

S&P

Moody's

What

it means

AAA

Aaa

Highest

quality and credit

worthiness

AA

Aa

Slightly

less likely to pay principal

+ interest

A

A

Strong

capacity to make payments, upper

medium grades

BBB

Baa

Medium

grade, adequate capacity to make

payments

BB

Ba

Moderate

ability to pay, speculative element,

vulnerable

B

B

Not

desirable investment, long term payment

doubtful

CCC

Caa

Poor

standing, known vulnerabilities,

doubtful payment

CC

Ca

Highly

speculative, high default

likelihood, known

reasons

C

C

Lowest

rated class, most unlikely to

reach investment

grades

D

Already

defaulted on payments

NR

No

public rating has been

requested

+

Or -

&1,

2, 3

Within-class

refinement of AA to CCC ratings

The

lower a bond's rating the

lower its price and the

higher its yield.

53

Money

& Banking MGT411

VU

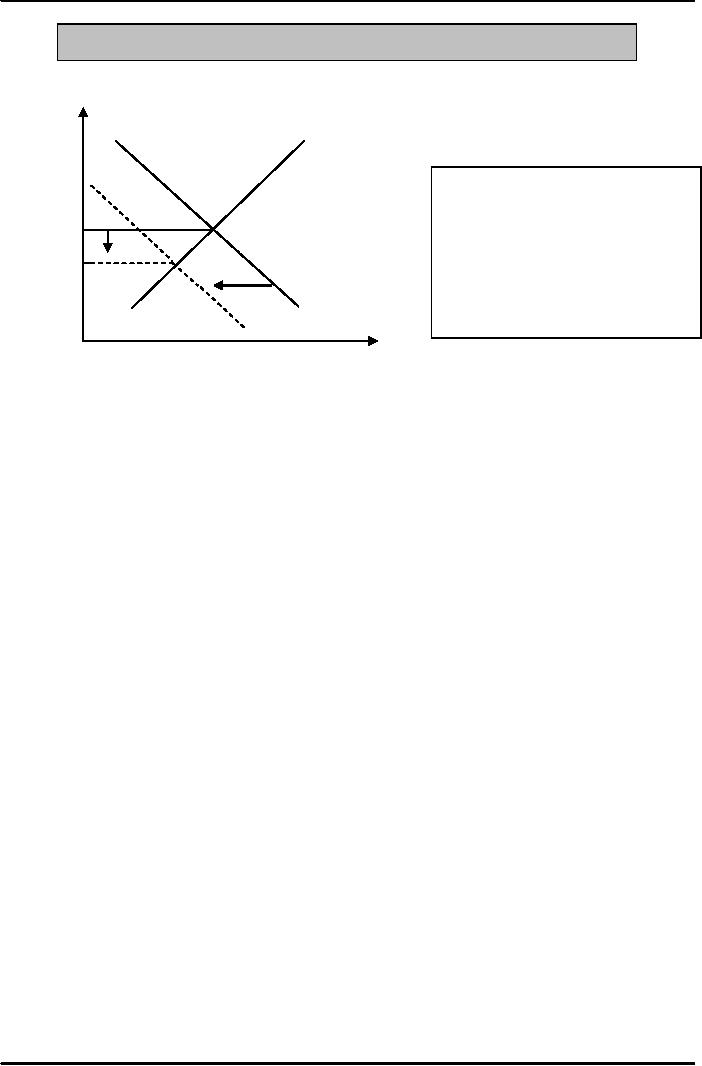

Figure:

The effect of an increase in

risk on equilibrium in the bond

market

S

Increased

risk reduces the demand

for

the

bond at every price,

shifting the

demand

curve to the left from Do

to

Po

Eo

D1.

The result is a decline in

the

equilibrium

price and quantity in the

P1

E1

market.

Importantly, the price

falls

from

Po to P1, so the yield on the

bond

must rise.

Do

D1

Quantity

of Bonds

Increased

Risk reduces Bond

Demand

The

resulting shift to the left

causes a decline in equilibrium

price and an increase in the

bond

yield.

A

bond yield can be thought of

as the sum of two parts:

The

yield on the Treasury bond

(called "benchmark bonds"

because they are close to

being risk-

free)

and

A

risk spread or default risk

premium

If

the bond ratings properly

reflect the probability of default,

then lower the rating of the

issuer,

the

higher the default risk

premium

So

we may conclude that when

Treasury bond yields change,

all other yields will

change in the

same

direction

54

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY