|

YIELD TO MATURIRY:Current Yield, Holding Period Returns |

| << BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans |

| SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK >> |

Money

& Banking MGT411

VU

Lesson

14

YIELD

TO MATURIRY

Yield

to Maturity

Current

Yield

Holding

Period Returns

Bond

Supply & Demand

Factors

affecting Bond Supply

Factors

affecting Bond Demand

Yield

to Maturity: General

Relationships

General

Relationships

If

the yield to maturity equals the coupon

rate, the price of the bond is the same

as its face value.

If

the yield is greater than the coupon

rate, the price is lower;

if

the yield is below the coupon rate, the

price is greater

If

you buy a bond at a price

less than its face

value you will receive

its interest and a capital

gain,

which is the difference between the price

and the face value.

As

a result you have a higher

return than the coupon

rate

When

the price is above the face

value, the bondholder incurs a capital

loss and the bond's

yield

to

maturity falls below its

coupon rate.

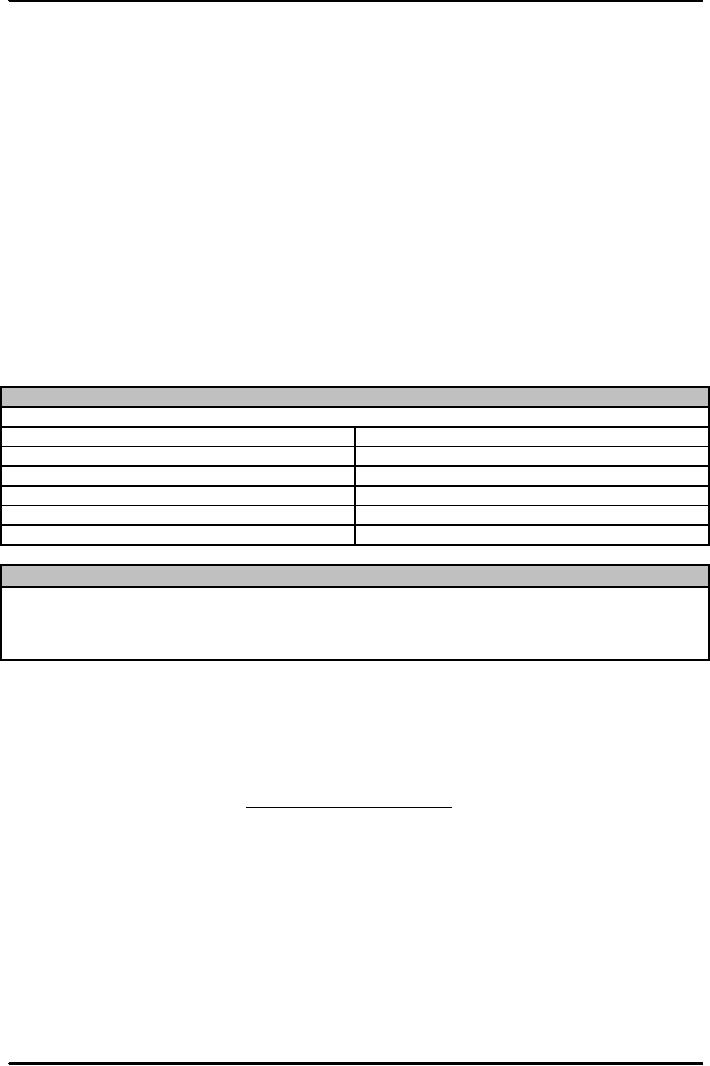

Table:

Relationship between Price and Yield to

Maturity

YTM

on a 10% Coupon rate bond maturing in

ten years (Face Value =

$1,000)

Price

of Bond ($)

Yield

to Maturity (%)

1,200

7.13

1,100

8.48

1,000

10.00

900

11.75

800

13.81

Three

Interesting Facts in the above

Table

1.

When

bond is at par, yield equals

coupon rate

2.

Price

and yield are negatively

related

3.

Yield

greater than coupon rate

when bond price is below par

value

Current

Yield

Current

yield is a commonly used, easy-to-compute

measure of the proceeds the

bondholder

receives

for making a loan

It

is the yearly coupon payment

divided by the price

Yearly

Coupon Payment

Yield

=

Current

Price

Paid

The

current yield measures that

part of the return from

buying the bond that arises

solely from

the

coupon payments;

It

ignores the capital gain or loss

that arises when the bond's

price differs from its

face value

Let's

return to 1-year 5% coupon

bond assuming that it is

selling for $99.

Current

yield is 5/99 = 0.0505 or

5.05%

YTM

for this bond is calculated

to be 6.06% through the following

calculations

43

Money

& Banking MGT411

VU

$5

$100

+

=

$99

(1

+

i)

(1 +

i)

If

you buy the bond for

$99, one year later you get

not only the $5 coupon

payment but also a

guaranteed

$1 capital gain, totaling to

$6

Repeating

this process for the bond

selling for $101, current

yield is 4.95% and YTM is

3.96%

The

current yield moves

inversely to the price;

If

the price is above the face value, the

current yield falls below

the coupon rate.

When

the price falls below the

face value, the current

yield rises above the coupon

rate.

If

the price and the face value

are equal the current yield

and the coupon rate are

equal.

Since

the yield to maturity takes

account of capital gains (and

losses),

When

the bond price is less than

its face value the yield to

maturity is higher than the

current

yield,

If

the price is greater than face

value, the yield to maturity is

lower than the current

yield, which

is

lower than the coupon

rate

Relationship

between a Bond's Price and its Coupon

Rate, Current Yield and

Yield to Maturity

Bond

Price < Face Value:

Coupon

Rate < Current Yield <

Yield to Maturity

Bond

Price = Face Value:

Coupon

Rate = Current Yield = Yield

to Maturity

Bond

Price > Face Value:

Coupon

Rate > Current Yield >

Yield to Maturity

Holding

Period Returns

The

investor's return from

holding a bond need not be

the coupon rate

Most

holders of long-term bonds plan to

sell them well before they

mature, and because the

price

of the bond may change in the

time since its purchase, the

return can differ from the

yield

to

maturity

The

holding period return the

return to holding a bond and

selling it before

maturity.

The

holding period return can

differ from the yield to

maturity

The

longer the term of the bond, the greater

the price movements and associated

risk can be

Examples:

You

pay for $100 for a

10-year 6% coupon bond with

a face value of $100, you

intend to hold

the

bond for one year,

i.e. buy a 10 year bond

and sell a 9 year bond an

year later

If

interest rate does not change

your return will be $6/100 =

0.06 = 6%

If

interest rate falls to 5% over the year

then through using bond

pricing formula we can see

that

You

bought a 10-year bond for

$100 and sold a 9-year bond

for $107.11

Now

the one year holding return

has two parts

$6

coupon payment and

$7.11

capital gain

So

now, one year holding Period

return =

$107

.11 -

$100

$13.11

$6

+

=

=

.1311

$100

$100

$100

Or

13.11%

If

the interest rate in one year is

7%...

44

Money

& Banking MGT411

VU

One

year holding Period return

=

$93.48

-

$100

-

$.52

$6

+

=

=

-.0052

$100

$100

$100

Or

-0.52%

Generalizing,

1-year holding return

is

Yearly

Coupon Payment Change in Price of

the Bond

=

+

Price

Paid

Price

of the Bond

=

Current

Yield +

Capital

Gain (as a %)

Bond

Market and Interest

Rates

To

find out how bond

prices are determined and

why they change we need to

look at the supply

and

demand in the bond

market.

Let's

consider the market for existing

bonds at a particular time

(the stock of bonds) and

consider

prices and not interest

rates.

One

Year Zero-coupon (discount)

Bond

- P

$

100

$

100

P =

i =

or

1 +

i

P

Bond

Supply, Demand and

Equilibrium

Bond

Supply

The

Bond supply curve is the

relationship between the price and the

quantity of bonds

people

are

willing to sell, all other

things being equal.

From

the point of view of investors, the

higher the price, the more tempting it is

to sell a bond

they

currently hold.

From

the point of view of companies seeking

finance for new projects, the

higher the price at

which

they can sell bonds, the more

advantageous it is to do so.

For

a $100 one-year zero-coupon bond, the

supply will be higher at $95

than it will be at

$90,

all

other things being

equal.

Bond

Demand

The

bond demand curve is the

relationship between the price and

quantity of bonds

that

investors

demand, all other things

being equal.

As

the price falls, the reward

for holding the bond rises,

so the demand goes up

The

lower the price potential

bondholders must pay for a

fixed-dollar payment on a future

date,

the

more likely they are to buy

a bond

The

zero-coupon bond promising to pay

$100 in one year will be more

attractive at $90 than it

will

at $95, all other things

being equal.

45

Money

& Banking MGT411

VU

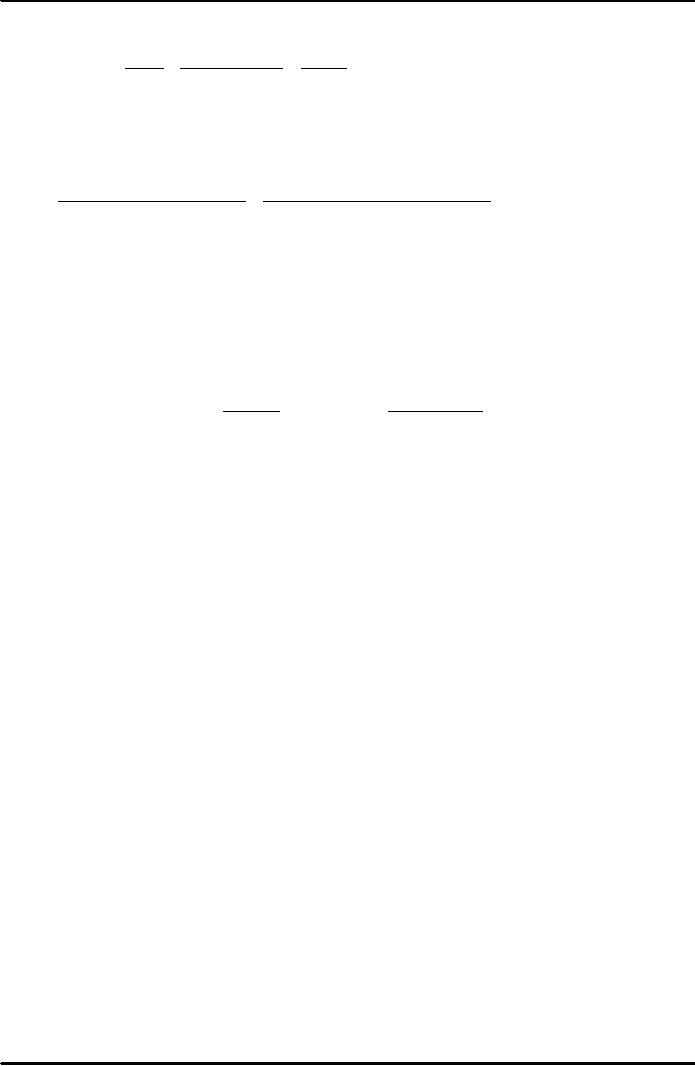

Figure:

Supply, demand and

equilibrium in the bond

market

The

supply of bonds from

the

borrowers slopes up

S

and

the demand for bonds

from

the lenders slopes

down.

Equilibrium in the

E

Po

bond

market

is

determined

by

the

interaction

of supply and

demand.

D

Qo

Quantity

of Bonds

Equilibrium

in the bond market is the point at

which supply equals

demand.

If

the price is too high (above

equilibrium) the excess supply of

bonds will push the price

back

down.

If

the price is too low (below

equilibrium) the excess demand

for bonds will push it

up

Over

time the supply and demand

curves can shift, leading to

changes in the equilibrium

price

Factors

that shift Bond

Supply

Changes

in government borrowing

Any

increase in the government's borrowing

needs increases the quantity of

bonds outstanding,

shifting

the bond supply curve to the

right.

This

reduces price and increases the interest

rate on the bond.

Changes

in business conditions

Business-cycle

expansions mean more investment

opportunities, prompting firms to

increase

their

borrowing and increasing the supply of

bonds

As

business conditions improve, the

bond supply curve shifts to

the right.

This

reduces price and increases the interest

rate on the bond.

By

the same logic, weak economic

growth can lead to rising

bond prices and lower

interest rates

Changes

in expected inflation

Bond

issuers care about the real

cost of borrowing,

So

if inflation is expected to increase then

the real cost falls and the

desire to borrow

rises,

resulting

in the bond supply curve

shifting to the right

This

reduces price and increases the interest

rate on the bond.

Table:

Factors that increase Bond

Supply, lower Bond Prices,

and Raise Interest

Rates

Change

Effect

on Bond Supply, Bond Prices,

and

Interest

Rates

An

increase in the government's

desired

Bond

Supply shifts to the right,

Bond prices

expenditure

relative to its revenue

decrease

and interest rates

increase

An

improvement in general business

conditions

Bond

Supply shifts to the right,

Bond prices

decrease

and interest rates

increase

An

increase in expected inflation, reducing

the real Bond Supply shifts

to the right, Bond

prices

cost

of repayment

decrease

and interest rates

increase

46

Money

& Banking MGT411

VU

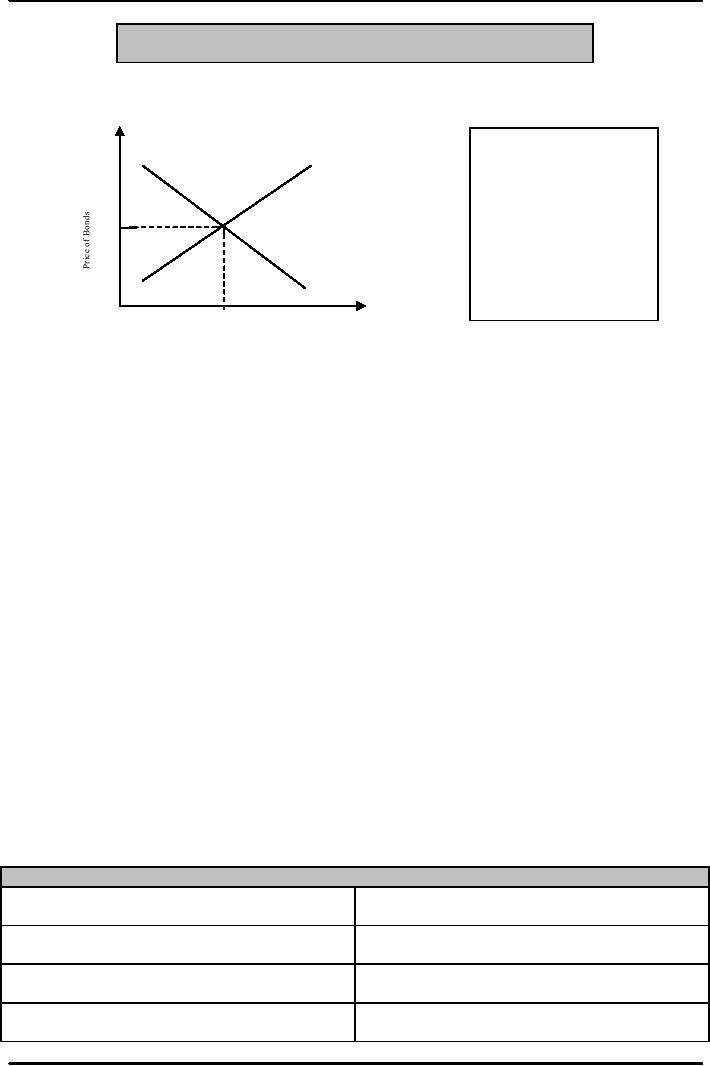

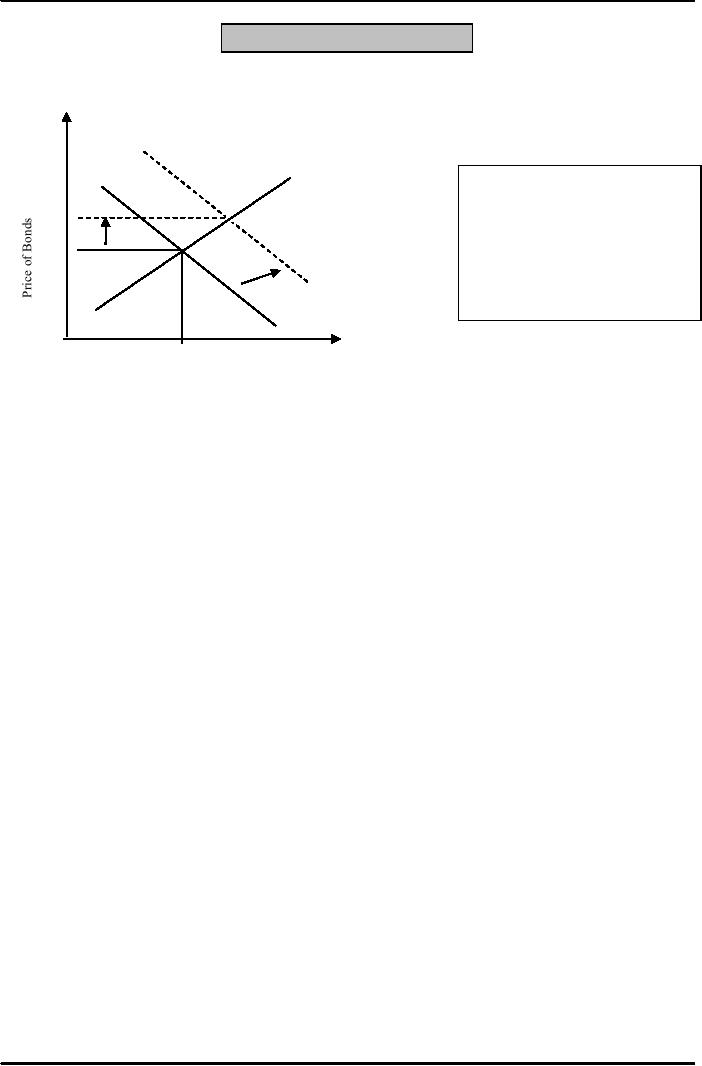

Figure:

A shift in the supply of

bonds

So

S1

Eo

When

borrower's desire for

Po

funds

increases, the bond

E1

supply

curve shifts to the

P1

right,

lowering bond prices

and

raising interest rates.

D

Qo

Quantity

of Bonds

Factors

that shift Bond

Demand

Wealth

An

increase in wealth shifts the

demand for bonds to the

right as wealthier people

invest more.

This

will happen as the economy grows during an

expansion.

This

will increase Bond Prices

and lower yields.

Expected

inflation

A

fall in expected inflation shifts the

bond demand curve to the

right, increasing demand at

each

price

and lowering the yield and increasing the

Bond's price.

Expected

return on stocks and other

assets

If

the return on bonds rises

relative to the return on alternative

investments, the demand for

bonds

will rise.

This

will increase bond prices

and lower yields.

Risk

relative to alternatives

If

a bond becomes less risky

relative to alternative investments, the

demand for the bond

shifts

to

the right.

Liquidity

of bonds relative to

alternatives

When

a bond becomes more liquid

relative to alternatives, the demand

curve shifts to the

right

Table:

Factors that increase Bond

demand, raise Bond Prices,

and lower Interest Rates

Change

Effect

on Bond demand

An

increase in wealth increases

demand for all

assets,

Bond

demand shifts to the right,

Bond prices

including

bonds

increase

and interest rates

decrease

A

reduction in expected inflation makes

bonds with

Bond

demand shifts to the right,

Bond prices

fixed

nominal payments more desirable

increase

and interest rates

decrease

An

increase in expected return on the bond

relative to

Bond

demand shifts to the right,

Bond prices

the

expected return on alternatives makes

bonds more

increase

and interest rates

decrease

attractive

A

decrease in the expected future interest rate

makes

Bond

demand shifts to the right,

Bond prices

bonds

more attractive

increase

and interest rates

decrease

A

fall in the riskiness of the bond

relative to the

Bond

demand shifts to the right,

Bond prices

riskiness

of alternatives makes bonds more

attractive.

increase

and interest rates

decrease

An

increase in the liquidity of the bond

relative to the

Bond

demand shifts to the right,

Bond prices

liquidity

of alternatives makes bonds more

attractive

increase

and interest rates

decrease

47

Money

& Banking MGT411

VU

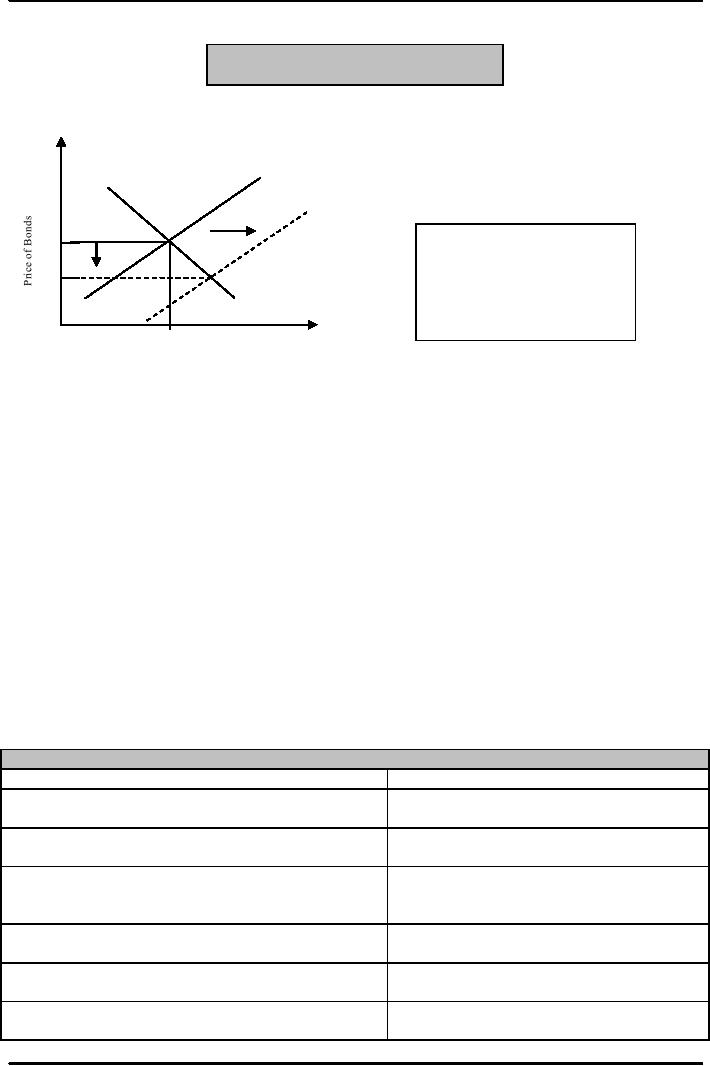

Figure:

A shift in Bond Demand

S

When

there is an increase in

E1

investor's

willingness to hold

P1

bonds,

the bond demand curve

Eo

Po

shifts

to the right, increasing bond

prices

and reducing interest

rates.

D1

Do

Qo

Quantity

of Bonds

48

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY