|

Money

& Banking MGT411

VU

Lesson

12

EVALUATING

RISK

Sources

of Risk

Idiosyncratic

Systematic

Reducing

Risk through

Diversification

Hedging

Risk

Spreading

Risk

Bond

and Bond Pricing

How

to Evaluate Risk

Lets

go back to our previous example where

$1,000 yields either $1,400

and $700 with equal

probability

If

we think about this

investment in terms of gains and

losses, this investment

offers an equal

chance

of gaining $400 or loosing

$300

Should

you take the risk?

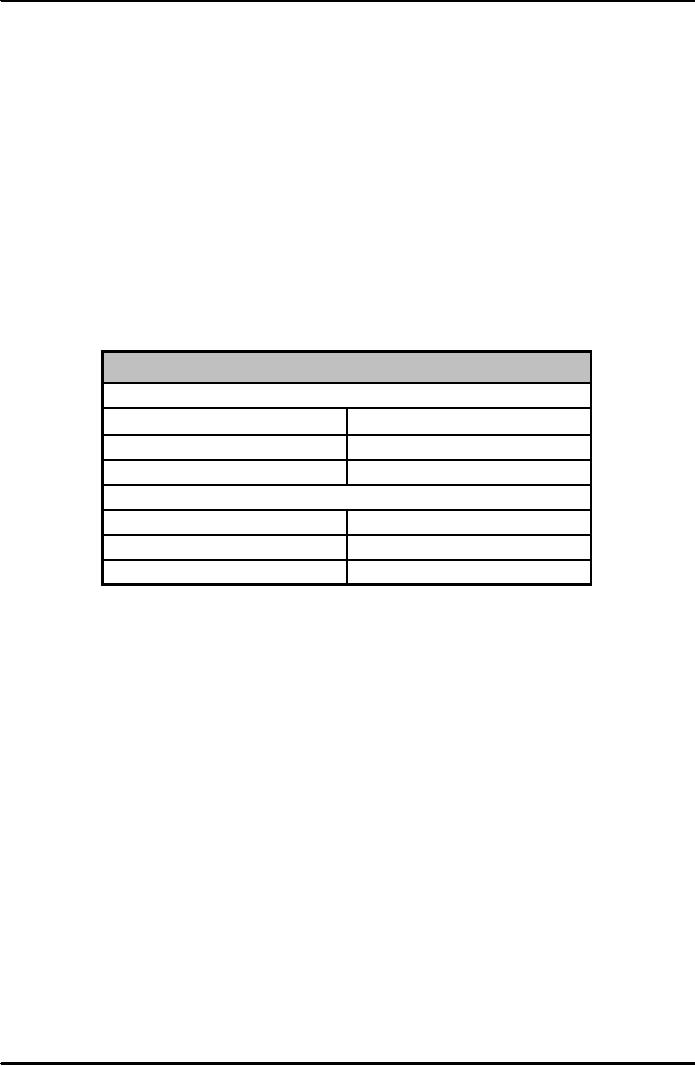

Table:

Evaluating the Risk of a

$1,000 investment

A.

The Gain

Payoff

Probability

+

$400

�

$0

�

B.

The Loss

Payoff

Probabilities

$0

�

-

$300

�

Deciding

if a risk is worth

taking

List

all the possible outcomes or

payoffs

Assign

a probability to each possible

payoff

Divide

the payoffs into gains and

losses

Ask

how much you would be

willing to pay to receive the

gain

Ask

how much you would be

willing to pay to avoid the

loss

If

you are willing to pay more

to receive the gain than to

avoid the loss, you should

take the risk

Sources

of Risk

Risk

is everywhere. It comes in many

forms and from almost every

imaginable place

Regardless

of the source, risks can be classified as

either idiosyncratic or

systematic

Idiosyncratic,

or unique, risks affect only a

small number of

people.

Systematic

risks affect everyone.

In

the context of the entire

economy,

Higher

oil prices would be an

idiosyncratic risk and

Changes

in general economic conditions would be

systematic risk.

37

Money

& Banking MGT411

VU

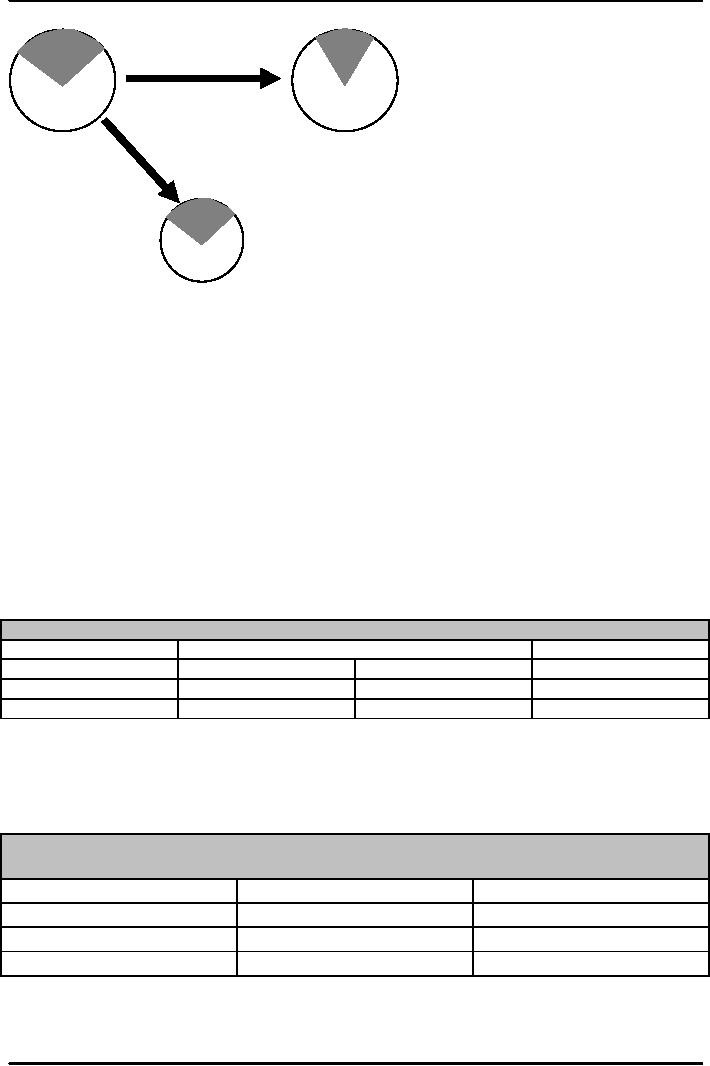

ABC's

ABC's

Share

Share

Idiosyncratic

Risk

ABC's

share of

existing

market

shrinks

Systematic

Risk

ABC's

Share

Total

Automobile market

Reducing

Risk through Diversification

Risk

can be reduced through

diversification, the principle of holding

more than one risk at a

time.

Holding

several different investments reduces the

overall risk that an

investor bears

A

combination of risky investments is often

less risky than any

one individual

investment

There

are two ways to diversify

your investments:

You

can hedge risks or

You

can spread them among the many

investments

Hedging

Risk

Hedging

is the strategy of reducing overall risk

by making two investments with

opposing risks.

When

one does poorly, the other

does well, and vice

versa.

So

while the payoff from each

investment is volatile, together

their payoffs are

stable.

Table:

Payoffs on Two Separate Investments of

$100

Payoff

from Owning Only

Possibility

ABC

Electric

XYZ

Oil

Probability

Oil

price rises

$100

$120

1/2

Oil

price falls

$120

$100

1/2

Let's

compare three strategies for

investing $100, given the

relationships shown in the table:

Invest

$100 in ABC Electric

Invest

$100 in XYZ Oil

Invest

half in each company $50 in

ABC and $50 in XYZ

Table:

Results of Possible Investment

Strategies:

Hedging

Risk, Initial Investment =

$100

Investment

Strategy

Expected

Payoff

Standard

Deviation

ABC

Only

$110

$10

XYZ

Only

$110

$10

�

and �

$110

$0

38

Money

& Banking MGT411

VU

Spreading

Risk

Investments

don't always move

predictably in opposite directions, so

you can't always

reduce

risk

through hedging

You

can lower risk by simply

spreading it around and finding investments

whose payoffs are

completely

unrelated

The

more independent sources of risk

you hold the lower your

overall risk

Adding

more and more independent sources of risk

reduces the standard deviation

until it

becomes

negligible.

Consider

three investment strategies:

a.

ABC

Electric only,

b.

EFG

Soft only, and

c.

Half

in ABC and half in

EFG

The

expected payoff on each of these

strategies is the same:

$110.

For

the first two strategies,

$100 in either company, the

standard deviation is still

10, just as it

was

before.

But

for the third strategy, $50

in ABC and $50 in EFG, the

analysis is more complicated.

There

are four possible outcomes,

two for each stock

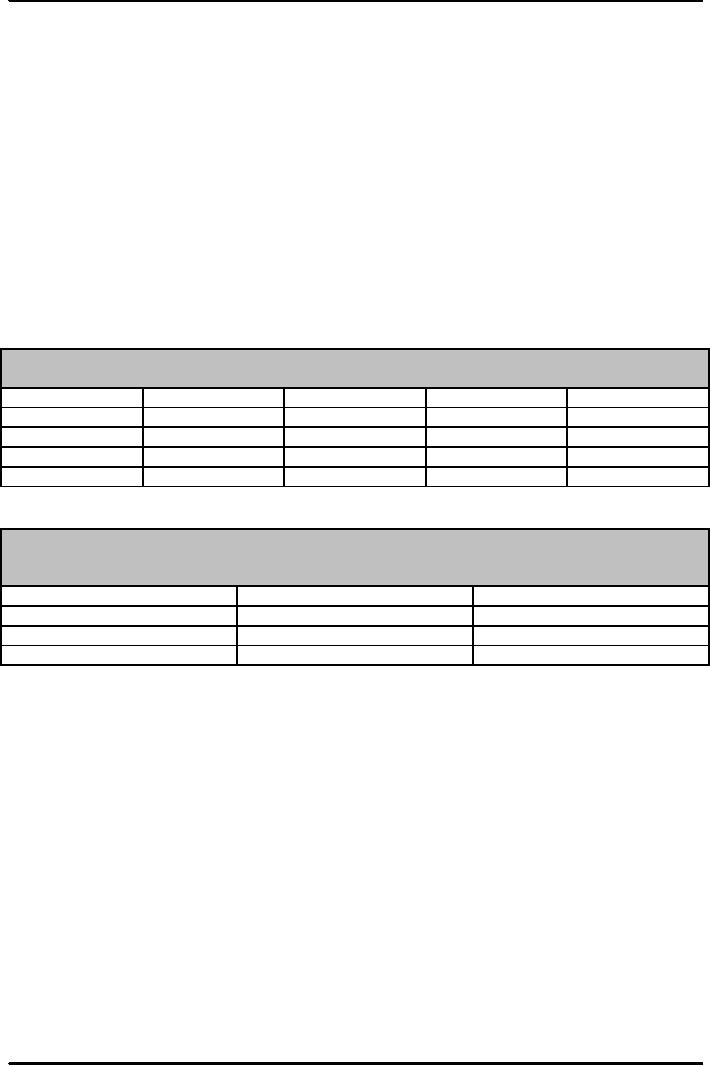

Table:

Payoffs from Investing $50 in

each of two

Stocks

Initial

Investment = $100

Possibilities

ABC

EFG

Soft

Total

Payoff

Probability

#1

$60

$60

$120

�

#2

$60

$50

$110

�

#3

$50

$60

$110

�

#4

$50

$50

$100

�

Table:

Results of Possible Investment

Strategies:

Spreading

Risk

Initial

Investment = $100

Investment

Strategy

Expected

Payoff

Standard

Deviation

ABC

$110

$10

EFG

Soft

$110

$10

�

and �

$110

$7.1

39

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY