|

Money

& Banking MGT411

VU

Lesson

11

MEASURING

RISK

Measuring

Risk

Variance

and Standard Deviation

Value

at Risk (VAR)

Risk

Aversion & Risk Premium

Measuring

Risk

Most

of us have an intuitive sense for

risk and its

measurement;

The

wider the range of outcomes the greater the

risk

A

financial instrument with no

risk at all is a risk-free

investment or a risk-free

asset;

Its

future value is known with

certainty and

Its

return is the risk-free rate of

return

If

the risk-free return is 5 percent, a

$1000 risk-free investment

will pay $1050, its

expected

value,

with certainty.

If

there is a chance that the payoff

will be either more or less

than $1050, the investment

is

risky.

We

can measure risk by measuring the

spread among an investment's possible

outcomes. There

are

two measures that can be

used:

Variance

and Standard Deviation

Measure

of spread

Value

at Risk (VAR)

Measure

of riskiness of worst case

Variance

The

variance is defined as the probability

weighted average of the squared

deviations of the

possible

outcomes from their expected

value

To

calculate the variance of an investment,

following steps are

involved:

Compute

expected value

Subtract

expected value from each possible

payoff

Square

each result

Multiply

by its probability

Add

up the results

Compute

the expected value:

($1400

x �) + ($700 x �) = $1050.

Subtract

this from each of the

possible payoffs:

$1400-$1050=

$350

$700-$1050=

$350

Square

each of the

results:

$3502 =

122,500(dollars)2

and

($350)2 =

122,500(dollars)2

Multiply

each result times its

probability and adds up the

results:

�

[122,500(dollars)2]

+ � [122,500(dollars)2]

=

122,500(dollars)2

34

Money

& Banking MGT411

VU

More

compactly;

Variance

= �($1400-$1050)2 +

�($700-$1050)2

=

122,500(dollars)2

Standard

Deviation

The

standard deviation is the square

root of the variance,

or:

Standard

Deviation (case 1)

=$350

Standard

Deviation (case 2)

=$528

The

greater the standard deviation, the

higher the risk

It

more useful because it is measured in the

same units as the payoffs

(that is, dollars and

not

squared

dollars)

The

standard deviation can then

also be converted into a

percentage of the initial

investment,

providing

a baseline against which we can measure

the risk of alternative

investments

Given

a choice between two investments with the

same expected payoff, most

people would

choose

the one with the lower

standard deviation because it

would have less risk

Value

at Risk

Sometimes

we are less concerned with

the spread of possible outcomes than we

are with the

value

of the worst outcome.

To

assess this sort of risk we

use a concept called "value

at risk."

Value

at risk measures risk at the

maximum potential

loss

Risk

Aversion

Most

people don't like risk and

will pay to avoid it;

most of us are risk

averse

A

risk-averse investor will always

prefer an investment with a

certain return to one with

the

same

expected return, but any amount of

uncertainty.

Buying

insurance is paying someone to

take our risks, so if someone

wants us to take on risk

we

must

be paid to do so

Risk

Premium

The

riskier an investment the higher

the compensation that investors require

for holding it

the

higher the risk

premium

Riskier

investments must have higher expected

returns

There

is a trade-off between risk and expected

return;

You

can't get a high return

without taking considerable

risk.

35

Money

& Banking MGT411

VU

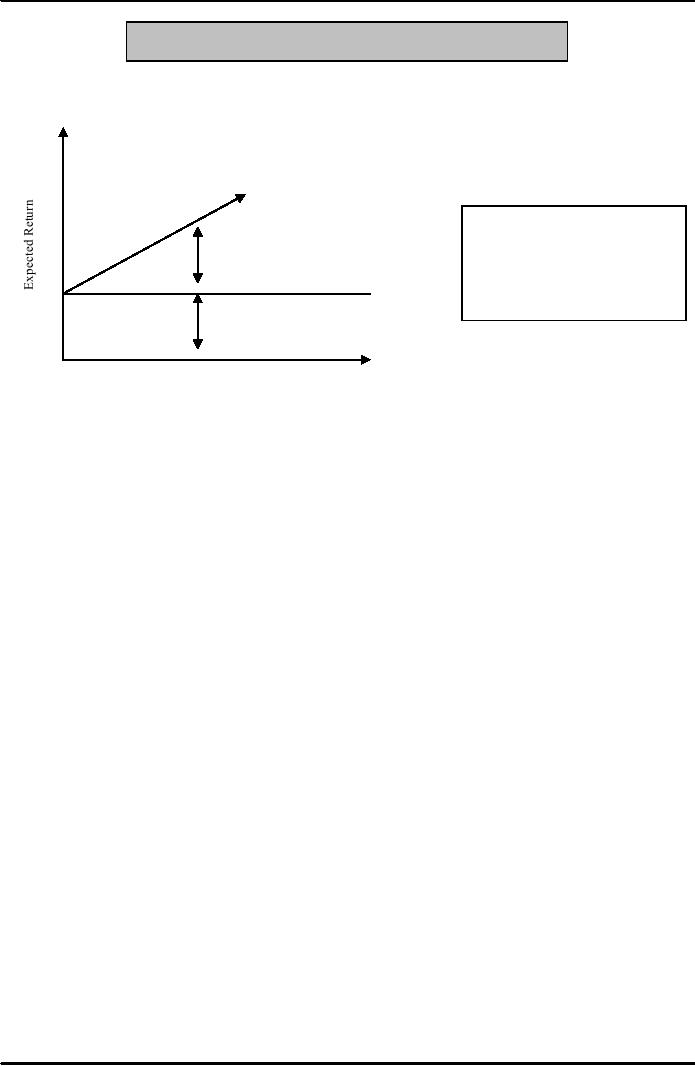

Figure:

The Trade-off between Risk

and Expected

Return

Higher

Risk=Higher Expected Return

The

higher the risk, the

higher

the

expected return. The

risk

Risk

Premium

premium

equals the expected

return

on the risky investment

minus

the risk-free return.

Risk-

Free Return

Risk

36

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY