|

BOND PRICING & RISK:Valuing the Principal Payment, Risk |

| << APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates |

| MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion >> |

Money

& Banking MGT411

VU

Lesson

10

BOND

PRICING & RISK

Bond

Pricing

Real

Vs Nominal Interest

Rates

Risk

Characteristics

Measurement

Bond

Pricing

A

bond is a promise to make a series of

payments on specific future

date.

It

is a legal contract issued as part of an

arrangement to borrow

The

most common type is a coupon

bond, which makes annual

payments called

coupon

payments

The

percentage rate is called the coupon

rate

The

bond also specifies a maturity

date (n) and has a final

payment (F), which is the

principal,

face

value, or par value of the

bond

The

price of a bond is the present

value of its payments

To

value a bond we need to

value the repayment of principal and the

payments of interest

Valuing

the Principal

Payment

A

straightforward application of present

value where n represents the maturity of

the bond

Valuing

the Coupon Payments:

Requires

calculating the present value of the

payments and then adding

them; remember,

present

value is additive

Valuing

the Coupon Payments plus

Principal

Means

combining the above

Payment

stops at the maturity date.

(n)

A

payment is for the face

value (F) or principle of the

bond

Coupon

Bonds make annual payments

called, Coupon Payments (C),

based upon an interest

rate,

the coupon rate (ic),

C=ic*F

A

bond that has a $100

principle payment in n years.

The present

Value

(PBP)

of this is now:

F

$

100

=

=

P

BP

(1

+

i

)

(1

+

i

)

n

n

If

the bond has n coupon

payments (C), where C=

ic *

F, the Present Value (PCP)

of the coupon

payments

is:

C

C

C

C

P

CP =

+

+

+

......

+

(1

+

i

)

1

(1

+

i

)

2

(1

+

i

)

3

(1

+

i

)

n

29

Money

& Banking MGT411

VU

Present

Value of Coupon Bond

(PCB)

= Present value of Yearly

Coupon Payments (PCP) +

Present Value

of

the Principal Payment (PBP)

C ⎤

⎡ C

C

C

F

+

PCB =

PCP +

PBP = ⎢

+

+

+

......

+

⎥

(1

+

i)

n

⎦ (1

+

i)

n

⎣

(1

+

i)

(1 +

i)

(1

+

i)

3

1

2

Note:

The

value of the coupon bond

rises when the yearly coupon

payments rise and when the

interest

rate

falls

Lower

interest rates mean higher

bond prices and vice

versa.

The

value of a bond varies inversely

with the interest rate used to discount

the promised

payments

Real

and Nominal Interest

Rates

So

far we have been computing the

present value using nominal

interest rates (i), or interest

rates

expressed in current-dollar

terms

But

inflation affects the purchasing power of a

dollar, so we need to consider the real

interest

rate

(r), which is the inflation-adjusted

interest rate.

The

Fisher equation tells us that the

nominal interest rate is equal to the

real interest rate plus

the

expected rate of inflation

Fisher

Equation:

i=r+

e

Or

r

= i - �e

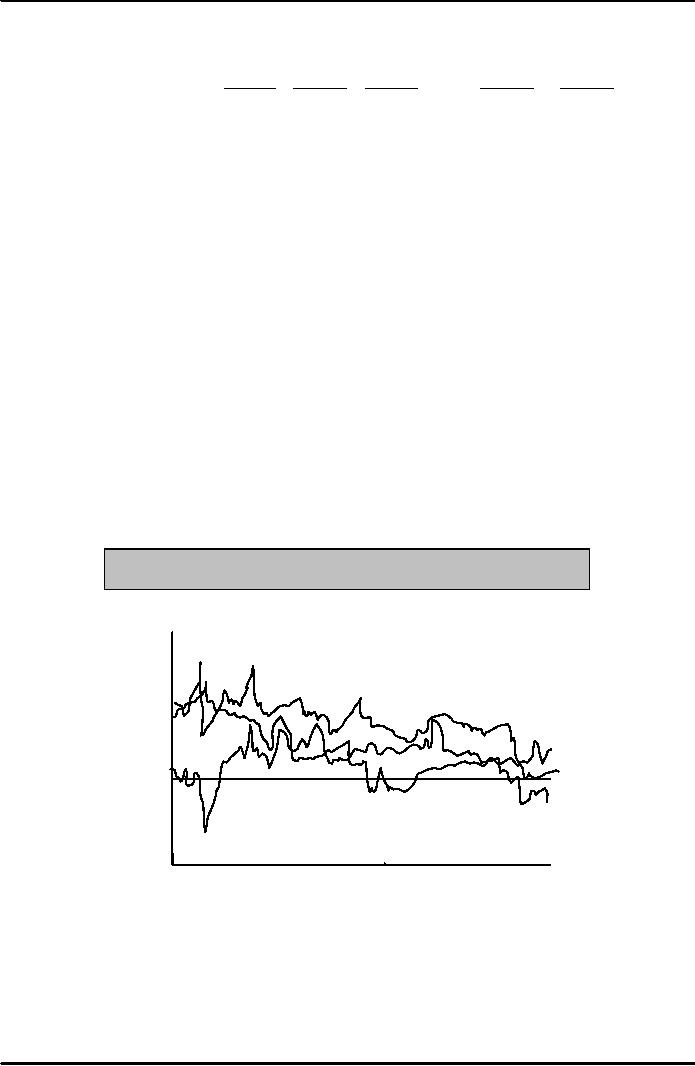

Figure:

Nominal Interest rates, Inflation,

and real interest

rates

20

15

10

5

0

-5

-10

1982

1985

1988

1991

1994

1997 2000

1979

2003

30

Money

& Banking MGT411

VU

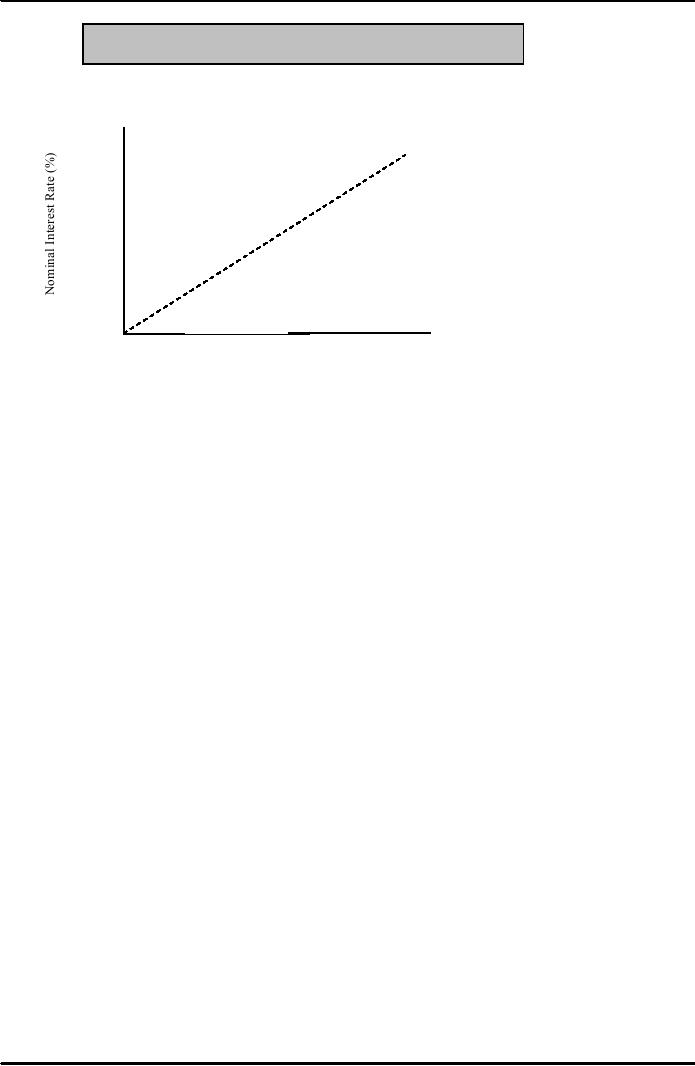

Figure:

Inflation and Nominal Interest

Rates, April 2004

30

Turkey

45�

line

�

25

20

Brazil

Russia

�

�

15

10

South

Africa

5

US

UK

15

25

20

5

10

30

0

Inflation

(%)

Risk

Every

day we make decisions that involve

financial and economic risk.

How

much car insurance should we

buy?

Should

we refinance the home loan

now or a year from

now?

Should

we save more for retirement, or

spend the extra money on a

new car?

Interestingly

enough, the tools we use

today to measure and analyze risk were

first developed to

help

players analyze games of

chance.

For

thousands of years, people have

played games based on a

throw of the dice, but they

had

little

understanding of how those

games actually worked

Since

the invention of probability theory, we

have come to realize that

many everyday events,

including

those in economics, finance, and even

weather forecasting, are best

thought of as

analogous

to the flip of a coin or the throw of a

die

Still,

while experts can make

educated guesses about the

future path of interest rates,

inflation,

or

the stock market, their predictions

are really only

that--guess.

And

while meteorologists are fairly

good at forecasting the weather a day or

two ahead,

economists,

financial advisors, and business gurus have

dismal records.

So

understanding the possibility of various

occurrences should allow

everyone to make

better

choices.

While risk cannot be eliminated, it

can often be managed

effectively.

Finally,

while most people view

risk as a curse to be avoided

whenever possible, risk

also

creates

opportunities.

The

payoff from a winning bet on one hand of

cards can often erase the

losses on a losing hand.

Thus

the importance of probability theory to

the development of modern financial

markets is

hard

to overemphasize.

People

require compensation for taking risks.

Without the capacity to measure

risk, we could

not

calculate a fair price for

transferring risk from one

person to another, nor could

we price

stocks

and bonds, much less sell

insurance.

The

market for options didn't

exist until economists learned

how to compute the price of an

option

using probability

theory

We

need a definition of risk

that focuses on the fact

that the outcomes of

financial and

economic

decisions are almost always unknown at

the time the decisions are

made.

Risk

is a measure of uncertainty about the

future payoff of an investment,

measured over some

time

horizon and relative to a

benchmark.

31

Money

& Banking MGT411

VU

Characteristics

of risk

Risk

can be quantified.

Risk

arises from uncertainty

about the future.

Risk

has to do with the future

payoff to an investment, which is

unknown.

Our

definition of risk refers to an

investment or group of

investments.

Risk

must be measured over some

time horizon.

Risk

must be measured relative to

some benchmark, not in

isolation.

If

you want to know the risk

associated with a specific

investment strategy, the most

appropriate

benchmark

would be the risk associated

with other investing

strategies

Measuring

Risk

Measuring

Risk requires:

List

of all possible outcomes

Chance

of each one occurring

The

tossing of a coin

What

are possible outcomes?

What

is the chance of each one

occurring?

Is

coin fair?

Probability

is a measure of likelihood that an even

will occur

Its

value is between zero and

one

The

closer probability is to zero,

less likely it is that an

event will occur.

No

chance of occurring if probability is

exactly zero

The

closer probability is to one, more likely

it is that an event will

occur.

The

event will definitely occur

if probability is exactly one

Probabilities

can also be expressed as

frequencies

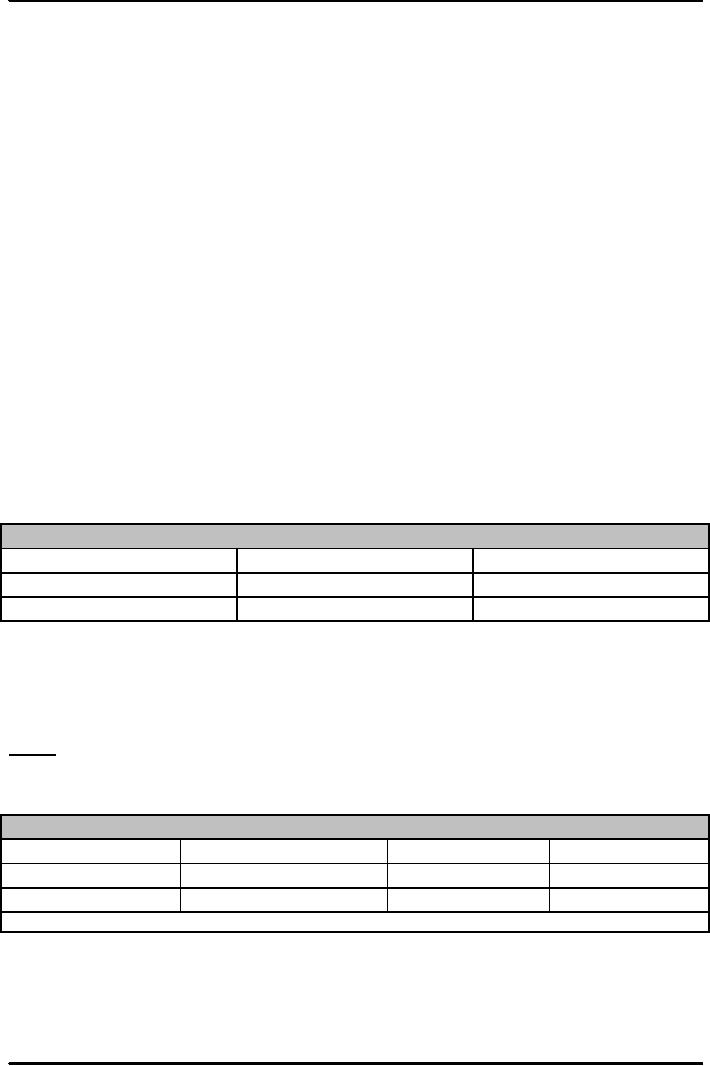

Table:

A Simple Example: All

Possible Outcomes of a Single

Coin Toss

Possibilities

Probability

Outcome

#1

1/2

Heads

#2

1/2

Tails

We

must include all possible

outcomes when constructing

such a table

The

sum of the probabilities of all the

possible outcomes must be 1, since

one of the possible

outcomes

must occur (we just don't

know which one)

To

calculate the expected value of an investment,

multiply each possible payoff by

its

probability

and then sum all the

results. This is also known

as the mean.

Case

1

An

Investment can rise or fall in

value. Assume that an asset

purchased for $1000 is

equally likely to

fall

to $700 or rise to $1400

Table:

Investing $1,000: Case

1

Possibilities

Probability

Payoff

Payoff

�Probability

#1

1/2

$700

$350

#2

1/2

$1,400

$700

Expected

Value = Sum of (Probability

times Payoff) =

$1,050

32

Money

& Banking MGT411

VU

Expected

Value = � ($700) + � ($1400) =

$1050

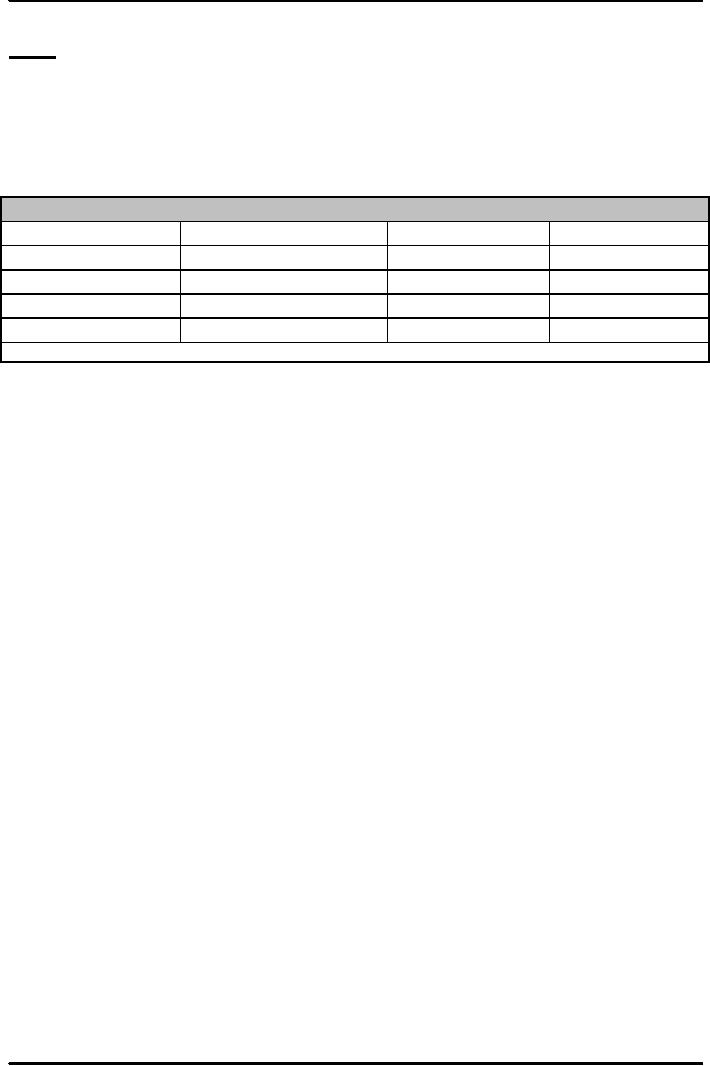

Case

2

The

$1,000 investment might pay

off

$100

(prob=.1) or

$2000

(prob=.1) or

$700

(prob=.4) or

$1400

(prob=.4)

Table:

Investing $1,000: Case

2

Possibilities

Probability

Payoff

Payoff

�Probability

#1

0.1

$100

$10

#2

0.4

$700

$280

#3

0.4

$1,400

$560

$200

#4

0.1

$2,000

Expected

Value = Sum of (Probability

times Payoff) =

$1,050

Investment

payoffs are usually

discussed in percentage returns instead of in

dollar amounts; this

allows

investors to compute the gain or loss on the

investment regardless of its

size

Though

both cases have the same expected

return, $50 on a $1000

investment, or 5%, the

two

investments

have different levels or

risk.

A

wider payoff range indicates more

risk.

33

Table of Contents:

- TEXT AND REFERENCE MATERIAL & FIVE PARTS OF THE FINANCIAL SYSTEM

- FIVE CORE PRINCIPLES OF MONEY AND BANKING:Time has Value

- MONEY & THE PAYMENT SYSTEM:Distinctions among Money, Wealth, and Income

- OTHER FORMS OF PAYMENTS:Electronic Funds Transfer, E-money

- FINANCIAL INTERMEDIARIES:Indirect Finance, Financial and Economic Development

- FINANCIAL INSTRUMENTS & FINANCIAL MARKETS:Primarily Stores of Value

- FINANCIAL INSTITUTIONS:The structure of the financial industry

- TIME VALUE OF MONEY:Future Value, Present Value

- APPLICATION OF PRESENT VALUE CONCEPTS:Compound Annual Rates

- BOND PRICING & RISK:Valuing the Principal Payment, Risk

- MEASURING RISK:Variance, Standard Deviation, Value at Risk, Risk Aversion

- EVALUATING RISK:Deciding if a risk is worth taking, Sources of Risk

- BONDS & BONDS PRICING:Zero-Coupon Bonds, Fixed Payment Loans

- YIELD TO MATURIRY:Current Yield, Holding Period Returns

- SHIFTS IN EQUILIBRIUM IN THE BOND MARKET & RISK

- BONDS & SOURCES OF BOND RISK:Inflation Risk, Bond Ratings

- TAX EFFECT & TERM STRUCTURE OF INTEREST RATE:Expectations Hypothesis

- THE LIQUIDITY PREMIUM THEORY:Essential Characteristics of Common Stock

- VALUING STOCKS:Fundamental Value and the Dividend-Discount Model

- RISK AND VALUE OF STOCKS:The Theory of Efficient Markets

- ROLE OF FINANCIAL INTERMEDIARIES:Pooling Savings

- ROLE OF FINANCIAL INTERMEDIARIES (CONTINUED):Providing Liquidity

- BANKING:The Balance Sheet of Commercial Banks, Assets: Uses of Funds

- BALANCE SHEET OF COMMERCIAL BANKS:Bank Capital and Profitability

- BANK RISK:Liquidity Risk, Credit Risk, Interest-Rate Risk

- INTEREST RATE RISK:Trading Risk, Other Risks, The Globalization of Banking

- NON- DEPOSITORY INSTITUTIONS:Insurance Companies, Securities Firms

- SECURITIES FIRMS (Continued):Finance Companies, Banking Crisis

- THE GOVERNMENT SAFETY NET:Supervision and Examination

- THE GOVERNMENT'S BANK:The Bankers' Bank, Low, Stable Inflation

- LOW, STABLE INFLATION:High, Stable Real Growth

- MEETING THE CHALLENGE: CREATING A SUCCESSFUL CENTRAL BANK

- THE MONETARY BASE:Changing the Size and Composition of the Balance Sheet

- DEPOSIT CREATION IN A SINGLE BANK:Types of Reserves

- MONEY MULTIPLIER:The Quantity of Money (M) Depends on

- TARGET FEDERAL FUNDS RATE AND OPEN MARKET OPERATION

- WHY DO WE CARE ABOUT MONETARY AGGREGATES?The Facts about Velocity

- THE FACTS ABOUT VELOCITY:Money Growth + Velocity Growth = Inflation + Real Growth

- THE PORTFOLIO DEMAND FOR MONEY:Output and Inflation in the Long Run

- MONEY GROWTH, INFLATION, AND AGGREGATE DEMAND

- DERIVING THE MONETARY POLICY REACTION CURVE

- THE AGGREGATE DEMAND CURVE:Shifting the Aggregate Demand Curve

- THE AGGREGATE SUPPLY CURVE:Inflation Shocks

- EQUILIBRIUM AND THE DETERMINATION OF OUTPUT AND INFLATION

- SHIFTS IN POTENTIAL OUTPUT AND REAL BUSINESS CYCLE THEORY