|

Introduction

To Public

AdministrationMGT111

VU

LESSON

27

BUDGET

At the

end of the lecture students

will:

-

Understand

the concept of budget

-

Examine

the Revenue raising of the government

(taxes Vs. Fee)

-

Examine

the purpose, quality of good

taxation, types of taxation, impact of

taxation and

objectives

and impact of public

spending

First

of we will see and try to

explain the budget as a concept. A budget is a

statement of income

and

expenditure. By normal standards the expenditure should

equal expenditure, so that the economic

unit

(house-hold,

government, firm etc.) stays in

its mean. We will look at

the example below to understand

the

concepts

involved in budget.

Example

In

this example we have taken a household

whose income is Rs. 7000

per month and its

family

members

are four. Let us see

their budget for one month.

This is given below

Expenditure

Income

Salary

5000

Food

3000

Rent

on

Education

3000

Property

1000

Health

1000

Overtime

1000

Loan

Repayment

2000

Installment

2000

Other

2000

Total

7000

Total

13000

What

we see here is that the expenditure

exceeds income. When

expenditures exceed income in

a

given

period of time, the budget is in deficit.

What we observe in the example is

that household has

borrowed

money and loan is repaid

every month. This loan was

taken for creating asset,

like a house, or a

piece

of land, or motorbike etc. Another

form of loan for which

Rs.2000 installment is paid was also

taken

to

create another asset.

Expenditures

are usually incurred to create

assets or maintain assets like

for education, health

etc.

On

the other hand an income is either the

wages for labour or rent on

property or return on assets.

From

budget

we can analyze where to

reduce expenditure or increase

income.

Why

Organizations Need Budget

A

household is a small economy, which

uses inputs and gives output

in the form of services that

it

provides.

Likewise organizations use inputs and

process inputs to give outputs. Organizations need

to

control

the use of resources to ensure

that these are utilized

for the purpose of achieving the

goals of

organization.

Budgets also indicate what the

organizations plan to do in

future.

Budget

For

any organization financial resources

are an important input to the

running of organization.

Organization

generates resources to make

expenditures to produce goods &

services. Private

organization

price their product or

services on the basis of value of the

product or service and cost

in

producing

product and in this way

generate income. But

organizations also create

assets to produce

output

which

are source of income.

Definition

of Budget

Budget

is an instrument of financial control and

management. It is summary of

intended

expenditures

along with proposals for how

to meet this expenditure.

97

Introduction

To Public

AdministrationMGT111

VU

It

is also detailed plan of

income and expenses expected

over a period of time. It provides

guidelines

for managing future investment

and expenses.

Components

of Public Income

Just

as households have income,

governments also have source

of income. The source of

income

for

the government is taxes. Taxes are of

various types. Besides taxes

government have non tax

receipts.

Following

are the component of government

income:

Tax

Receipt: can be divided into

direct and indirect taxes.

Direct tax is levied on income.

Indirect

tax

is not directly on income but is paid

through a product or service being

consumed by user. You

might

have

purchased a bottle of Coca

Cola or some other drink on

which the rice is written

plus sales tax.

The

sales

tax is indirect tax.

Non

Tax Receipt: Non tax

receipts comprise Income

from Property & Investment

and Receipt

from

civil administration.

Use

of Taxes

During

the Moghul period and later

British period government pursued the

policy of laissez-faire

(leave

alone) which

meant that government chooses

not to interfere with the

economy or society. The

taxes

that

were collected were for the

purpose of defence or law

and order and the welfare

concept was non

existent

Principle

purpose of taxation

The

governments of today have many

sources of income but taxes

remain an important source

of

income.

Today government's expenditures

have also increased

manifold. The main expenditure

purpose is:

1.

Redistribution of income (from

rich to poor) or help

finance welfare activities

and

2.

To achieve economic objectives

such as control of inflation,

economic growth, employment

and

reduction

of balance of payment

deficit.

Principles

of good Taxation

Since

the foundation of modern economy was

laid, there has been many

changing ideas and

philosophy

on the role of government. Along side the

idea and principle of good

taxation has also

evolved.

Adam

Smith the economist who

wrote Wealth

of Nation in

1776 said that a good tax

has following four

principles:

1.

A

good tax should be equal: an individual

should be called upon to pay tax

according to his/

her

ability to pay tax. This is

called progressive taxation, where the

rich pay the higher

percentage

of taxation then

poor;

2.

A

good tax should be certain: people are

certain about how the tax

works and how

much

has

to be paid as well as when to

pay;

3.

A

good tax should be convenient: People should be

able to pay without any

inconvenience.

The

Pay as You Earn (PAYE)

system of income tax complies

with this principles and

4.

A

good tax should be economical: the cost

of collecting and administering should not

exceed

revenues

There

are several other principles of modern

taxation. These are:

a.

Tax

should be impartial, two citizen who earn

equal income and have

same size of family

should

be taxed the same;

b.

It

should not be disincentive to hard work

and therefore should not penalize

for hard work

i.e.

that those who work hard

and earn income should not

be heavily taxed.

c.

The

tax should be consistent with government

policy. If for example the government

is

trying

to reduce inflation, it should not

pursue the policy of taxation

which increases

demand

too

much in the economy

98

Introduction

To Public

AdministrationMGT111

VU

Types

of Taxation

Taxes

tend to fall in two

categories: direct and indirect

taxation. Direct taxation is a tax

levied

directly

on individual's income. Whereas

indirect taxation is levied on consumers'

expenditure or outlay.

Following

are the types of taxation:

1.

Direct

Taxes

Income

Tax

Wealth

Tax

Workers

Welfare Tax

Capital

tax

2.

Indirect

Taxes

Custom

Duty

Sales

tax

Excise

Duty

3.

Non-

tax Revenue

Income

from Property and Enterprise

Profit

from Railways

Profit

from PTCL

Profit

from Post office

Miscellaneous:

Foreign travel, passport fee,

airport tax, sale proceed on

oil and tax etc.

The

government of Pakistan levies all the

above type of taxes.

Advantages

of Direct Taxes

Direct

taxes tend to be progressive.

People in the higher income groups

pay greater taxes than

poor

people,

i.e. income tax is graduated so

that high income earner

pays a larger tax. Also

projected wealth tax

would

apply to those owing more

than a certain level of wealth

It

is cheap and easy to

collect. Consider for

example PAYE system which is

used to collect

income

tax

from wages and salary

earner

Impact

of Taxation

Taxes

have variety of impact of

following:

On

income: Higher

taxes reduce disposable

income (what people have to spend after

taxation). Direct

taxes

by directly reduce the

income.

On

savings and investment:

Higher

direct taxes reduce individuals'

and firms' ability to save

and invest.

To

a certain extent it depends on how

much of the increase in taxes is financed

from savings and

how

much

from consumption.

On

prices: Higher

direct taxes have deflationary effect on

prices by reducing demand.

However trade

unions

may ask for higher wages to

compensate for higher taxes

and effect of this will be

inflationary.

99

Introduction

To Public

AdministrationMGT111

VU

On

economy: Higher

taxation will, other things being

equal, reduce demand in the

economy which will

have

deflationary effect on the

economy.

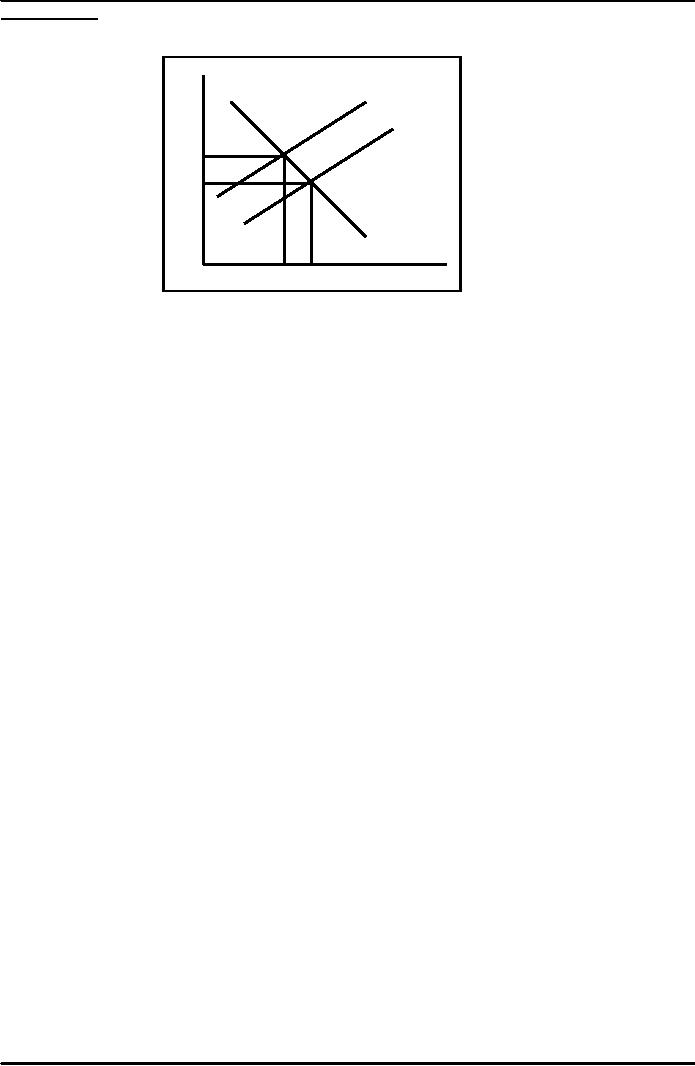

P

D

S

S

a

a

S

S

a

a

Output

The

affect of taxes is shown in figure 1

below. On the vertical axis is shown

price and on

horizontal

axis

is shown output. With price

`a' the demand for output is

`b'. When demand decreases

the output will

also

decrease. So the tax increases price

and reduce demand which

reduces out put and

which reduces

investment.

Concepts

Budget:

a

document showing income and expenditure

in case of

household;

and an instrument of financial control

and future

plans

in case of organization.

Taxes:

levies

charged by government as its source of

income.

Non

tax

Revenue:

fee,

penalties, user charge etc.,

which constitute the income of

government

100

Table of Contents:

- INTRODUCTION:Institutions of State, Individualism

- EVOLUTION OF PUBLIC ADMINISTRATION:Classical School, The Shovelling Experiment

- CLASSICAL SCHOOL OF THOUGHTS – I:Theory of Bureaucracy, Human Relation Approach

- CLASSICAL SCHOOL OF THOUGHTS – II:Contributors of This Approach

- HUMAN RELATIONS SCHOOLS:Behavioural School, System Schools

- POWER AND POLITICS:Conflict- as Positive and Negative, Reactions of Managers, Three Dimensional Typology

- HISTORY OF PUBLIC ADMINISTRATION – I:Moghul Period, British Period

- HISTORY OF PUBLIC ADMINISTRATION – II

- CIVIL SERVICE:What are the Functions Performed by the Government?

- CIVIL SERVICE REFORMS:Implementation of the Reforms, Categories of the Civil Service

- 1973 CONSTITUTION OF PAKISTAN:The Republic of Pakistan, Definition of the State

- STRUCTURE OF GOVERNMENT:Rules of Business, Conclusion

- PUBLIC AND PRIVATE ADMINISTRATION:The Public Interest, Ambiguity, Less Efficient

- ORGANIZATION:Formal Organizations, Departmentalization

- DEPARTMENTALIZATION:Departmentalization by Enterprise Function, Departments by Product

- POWER AND AUTHORITY:Nature of Relationship, Delegation of Functional Authority

- DELEGATION OF AUTHORITY:The Art of Delegation, Coordination

- PLANNING – I:Four Major Aspects of Planning, Types of Plans

- PLANNING – II:Planning ProcessThree principles of plans

- PLANNING COMMISSION AND PLANNING DEVELOPMENT:Functions, Approval Authority

- DECISION MAKING:Theories on Decision Making, Steps in Rational Decision Making

- HUMAN RESOURCE MANAGEMENT (HRM):Importance of Human Resource, Recruitment

- SELECTION PROCESS AND TRAINING:Levels at Which Selection takes Place, Training and Development

- PERFORMANCE APPRAISAL:Formal Appraisals, Informal Appraisals

- SELECTION AND TRAINING AND PUBLIC ORGANIZATIONS:Performance Evaluation,

- PUBLIC FINANCE:Background, Components of Public Finance, Dissimilarities

- BUDGET:Components of Public Income, Use of Taxes, Types of Taxation

- PUBLIC BUDGET:Incremental Budget, Annual Budget Statement, Budget Preparation

- NATIONAL FINANCE COMMISSION:Fiscal Federalism Defined, Multiple Criteria

- ADMINISTRATIVE CONTROL:Types of Accountability, Internal Control, External Control

- AUDIT:Economy, Effectiveness, Objectives of Performance Audit, Concepts

- MOTIVATION:Assumptions about Motivation, Early ViewsThree Needs

- MOTIVATION AND LEADERSHIP:Reinforcement Theory, Leadership, The Trait Approach

- LEADERSHIP:Contingency Approaches, Personal Characteristics of Employees

- TEAM – I:Formal & Informal teams, Functions of Informal Groups, Characteristics of Teams

- TEAM – II:Team Cohesiveness, Four ways to Cohesiveness, Communication

- COMMUNICATION – I:Types of Communication, How to Improve Communication

- COMMUNICATION – II:Factors in Organizational Communication, Negotiating To Manage Conflicts

- DISTRICT ADMINISTRATION:The British Period, After Independence, The Issues

- DEVOLUTION PLAN – I:Country Information, Tiers or Level of Government

- DEVOLUTION PLAN – II:Aim of Devolution Plan, Administrative Reforms, Separation of powers

- POLITICAL REFORMS:District, Tehsil, Functions of Union Council, Fiscal Reforms

- NEW PUBLIC MANAGEMENT (NPM):Strategy, Beginning of Management Approach

- MANAGERIAL PROGRAMME AGENDA – I

- MANAGERIAL PROGRAMME AGENDA – II:Theoretical Bases of Management, Critique on Management