|

Introduction

to Business MGT 211

VU

Lesson

05

PARTNERSHIP AND

ITS CHARACTERISTICS

PARTNERSHIP

Partnership

is the second stage in the

evolution of forms of business

organization. It means

the

association of two or more

persons to carry on as co-owners,

i.e. a business for profit.

The

persons

who constitute this

organization are individually

termed as partners and

collectively

known

as firm; and the name

under which their business

is conducted is called "The

Firm

Name".

In

ordinary business the number

of partners should not

exceed 20, but in case of

banking

business

it must nor exceed 10.

This type of business

organization is very popular

in

Pakistan.

DEFINITION

1.

According to

Section 4 of Partnership Act,

1932

"Partnership

is the relation between

persons who have agreed to

share the profits of

a

business

carried on by all or any of

them acting for

all."

2.

According to

Mr. Kent

"A

contract of two or more

competent persons to place

their money, efforts, labour

and skills,

some

or all of them, in a lawful

commerce or business and to

divide the profits and

bear the

losses

in certain proportion."

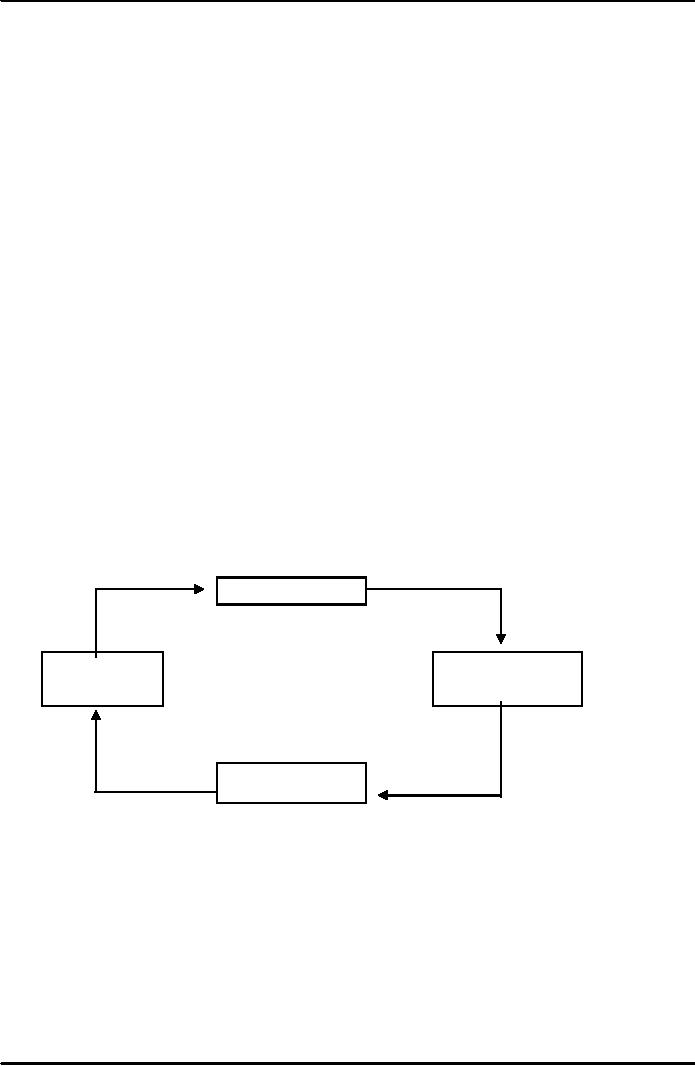

Structural

Diagram:

Association

Profit

& Loss

Money,

Labour

PARTNERSHIP

And

Other Skills

Lawful

Business

CHARACTERISTICS

The

main characteristics of partnership

may be narrated as

under:

1.

Agreement

Agreement

is necessary for partnership.

Partnership agreement may be

written or oral. It is

better

that the agreement is in

written form to settle the

disputes.

2.

Audit

If

partnership is not registered, it

has no legal entity. So

there is no restriction for

the audit of

accounts.

23

Introduction

to Business MGT 211

VU

3.

Agent

In

partnership every partner

acts as an agent of another

partner.

4.

Business

Partnership

is a business unit and a

business is always for

profit. It must not include

club or

charitable

trusts, set up for

welfare.

5.

Cooperation

In

partnership mutual cooperation

and mutual confidence is an

important factor.

Partnership

cannot

take place with

cooperation.

6.

Dissolution

Partnership

is a temporary form of

business.

It

is dissolved if a partner leaves,

dies or

declared

bankrupt.

7.

Legal Entity

If

partnership is not registered, it

has no legal entity.

Moreover, partnership has no

separate

legal

entity from its members

and vice versa.

8.

Management

In

partnership all the partners

can take part or participate

in the activities of

business

management.

Sometimes, only a few

persons are allowed to

manage the business

affairs.

9.

Number of Partners

In

partnership there should be at

least two partners. But in

ordinary business the

partners

must

not exceed 20 and in case of

banking business it should

not exceed 10.

10.

Object

Only

that business is considered as

partnership, which is established to

earn profit.

11.

Partnership Act

In

Pakistan, all partnership

businesses are running under

Partnership Act,

1932.

12.

Payment of Tax

In

partnership, every partner

pays the tax on his

share of profit, personally or

individually.

13.

Profit and Loss

Distribution

The

distribution of profit and

loss among the partners is

done according to their

agreement.

14.

Registration

Many

problems are created in case

of unregistered firm.

So,

to avoid these

problems

partnership

firm must be

registered.

15.

Relationship

Partnership

business can be carried on by

all partners or any of them

can do the business

for

all.

16.

Share in Capital

According

to the agreement, every

partner contributes his

share of capital. Some

partners

provide

only skills and ability to

become a partner of business

and earn profit.

17.

Transfer of Rights

In

partnership no partner can

transfer his shares or

rights to another person,

without the

consent

of all partners.

24

Introduction

to Business MGT 211

VU

18.

Unlimited Liability

In

partnership the liability of

each partner is unlimited. In

case of loss, the private

property of

the

partners is also used up to

pay the business

debts.

ADVANTAGES

AND DISADVANTAGES OF

PARTNERSHIP

ADVANTAGES

OF PARTNERSHIP

Following

are the advantages of

partnership:

1.

Simplicity in Formation

This

type of business of organization

can be formed easily without

any complex legal

formalities.

Two or more persons can

start the business at any

time. Its registration is

also

very

easy.

2.

Simplicity in Dissolution

Partnership

Business can be dissolved at

any time because of no legal

restrictions.

Its

dissolution

is easy as compared to Joint

Stock Company.

3.

Sufficient Capital

Partnership

can collect more capital in

the business by the joint

efforts of the partners

as

compared

to sole proprietorship.

4.

Skilled Workers

As

there is sufficient capital so a

firm is in a better position to

hire the services of

qualified and

skilled

workers.

5.

Sense of Responsibility

As

there is unlimited liability in

case of partnership, so every

partner performs his

duty

honestly.

6.

Satisfaction of Partners

In

this type of business

organization each partner is

satisfied with the business

because he

can

take part in the management

of the business.

7.

Secrecy

In

partnership it is not compulsory to

publish the accounts. So,

the business secrecy

remains

within

partners. This factor is

very helpful for successful

operation of the

business.

8.

Social Benefit

Two

or more partners with their

resources can build a strong

business. This factor is

very

helpful

in solving social problems

like unemployment.

9.

Expansion of Business

In

this type of business

organization, it is very easy to

expand business volume by

admitting

new

partners and can borrow

money easily.

10.

Flexibility

It

is flexible business and

partners can change their

business policies with the

mutual

consultation

at any time.

11.

Tax Facility

Every

partner pays tax

individually. So, a firm is in a

better position as compared to

Joint

Stock

Company.

25

Introduction

to Business MGT 211

VU

12.

Public Factor

Public

shows more confidence in

partnership as compared to sole

proprietorship. If a firm is

registered,

people feel no risk in

creating relations with such

business.

13.

Prime Credit

Standing

The

liabilities of partners are

unlimited, so the banks and

other financial institutions

provide

them

credit easily.

14.

Minority Protection

In

partnership all policy

matters are decided with

consent of each

partner.

This

gives

protection

to minority partners.

15.

Moral Promotion

Partnership

is the best business for

small investors. It promotes

moral courage of

partners.

16.

Distribution of Work

There

is distribution of work among

the partners according to

their ability and

experience. This

increases

the efficiency of a

firm.

17.

Combined Abilities

Every

partner possesses different

ability, which helps in

running the business

effectively, when

combined

together.

18.

Absence of Fraud

In

partnership each partner can

look after the business

activities. He can check the

accounts.

So,

there is no risk of

fraud.

DISADVANTAGES

OF PARTNERSHIP

The

disadvantages of partnership are

enumerated one by one as

under:

1.

Unlimited Liability

It

is the main disadvantage of

partnership. It means in case of

loss, personal property of

the

partners

can be sold to pay off

the firm's debts.

2.

Limited Life of

Firm

The

life of this type of

business organization is very

limited. It may come to an

end if any

partner

dies or new partner enters

into business.

3.

Limited Capital

No

doubt, in partnership, capital, is

greater as compared to sole

proprietorship, but it is

small

as

compared to Joint Stock

Company. So, a business

cannot be expanded on a large

scale.

4.

Limited Abilities

As

financial resources of partnership

are limited as compared to

Joint Stock Company, so it

is

not

possible to engage the

services of higher technical

and qualified persons. This

causes the

failure

of business, sooner or

later.

5.

Limited number of

Partners

In

partnership, the number of

partners is limited, so the

resources are also limited.

That is why

business

cannot expand on large

scale.

6.

Legal Defects

There

are no effective rules and

regulations to control the

partnership activities. So, it

cannot

handle

large-scale production.

26

Introduction

to Business MGT 211

VU

7.

Lack of Interest

Partners

do not take interest in the

business activities due to

limited share in profit and

limited

chances

of growth of business.

8.

Lack of Public

Confidence

As

there is no need by law to

publish accounts in partnership, so

people lose confidence

and

avoid

dealing and entering into

contract with such

firm.

9.

Lack of Prompt

Decision

In

partnership all decisions

are made by mutual

consultation. Sometimes, delay in

decisions

becomes

the cause of loss.

10.

Lack of Secrecy

In

case of misunderstandings and

disputes among the partners,

business secrets can

be

revealed.

11.

Chances of Dispute among

Partners

In

partnership there are much

chances of dispute among the

partners because all the

partners

are

not of equal mind.

12.

Expansion Problem

Partnership

business may not be expanded

due to limited number of

partners, limited

capital

and

unlimited liability.

13.

Frozen Investment

It

is easy to invest money in

partnership but very

difficult to withdraw

it.

14.

Risk of Loss

There

is a risk of loss due to

less qualified and less

experienced people.

15.

Transfer of Rights

In

partnership no partner can

transfer his share without

the consent of all other

partners.

CONCLUSION

From

the above-mentioned findings, we

come to this point that

despite the above

disadvantages,

partnership is an important from of

business organization. This is

because its

formation

is very easy and due to

unlimited liabilities, partners

take great interest in

business,

because

in case of loss they are

personally responsible.

27

Table of Contents:

- INTRODUCTION:CONCEPT OF BUSINESS, KINDS OF INDSTRY, TYPES OF TRADE

- ORGANIZATIONAL BOUNDARIES AND ENVIRONMENTS:THE ECONOMIC ENVIRONMENT

- BUSINESS ORGANIZATION:Sole Proprietorship, Joint Stock Company, Combination

- SOLE PROPRIETORSHIP AND ITS CHARACTERISTICS:ADVANTAGES OF SOLE PROPRIETORSHIP

- PARTNERSHIP AND ITS CHARACTERISTICS:ADVANTAGES AND DISADVANTAGES OF PARTNERSHIP

- PARTNERSHIP (Continued):KINDS OF PARTNERS, PARTNERSHIP AT WILL

- PARTNERSHIP (Continued):PARTNESHIP AGREEMENT, CONCLUSION, DUTIES OF PARTNERS

- ORGANIZATIONAL BOUNDARIES AND ENVIRONMENTS:ETHICS IN THE WORKPLACE, SOCIAL RESPONSIBILITY

- JOINT STOCK COMPANY:PRIVATE COMPANY, PROMOTION STAGE, INCORPORATION STAGE

- LEGAL DOCUMENTS ISSUED BY A COMPANY:MEMORANDUM OF ASSOCIATION, CONTENTS OF ARTICLES

- WINDING UP OF COMPANY:VOLUNTARY WIDNIGN UP, KINDS OF SHARE CAPITAL

- COOPERATIVE SOCIETY:ADVANTAGES OF COOPERATIVE SOCIETY

- WHO ARE MANAGERS?:THE MANAGEMENT PROCESS, BASIC MANAGEMENT SKILLS

- HUMAN RESOURCE MANAGEMENT:Human Resource Planning

- STAFFING:STAFFING THE ORGANIZATION

- STAFF TRAINING & DEVELOPMENT:Typical Topics of Employee Training, Training Methods

- BUSINESS MANAGER’S RESPONSIBILITY PROFILE:Accountability, Specific responsibilities

- COMPENSATION AND BENEFITS:THE LEGAL CONTEXT OF HR MANAGEMENT, DEALING WITH ORGANIZED LABOR

- COMPENSATION AND BENEFITS (Continued):MOTIVATION IN THE WORKPLACE

- STRATEGIES FOR ENHANCING JOB SATISFACTION AND MORALE

- MANAGERIAL STYLES AND LEADERSHIP:Changing Patterns of Leadership

- MARKETING:What Is Marketing?, Marketing: Providing Value and Satisfaction

- THE MARKETING ENVIRONMENT:THE MARKETING MIX, Product differentiation

- MARKET RESEARCH:Market information, Market Segmentation, Market Trends

- MARKET RESEARCH PROCESS:Select the research design, Collecting and analyzing data

- MARKETING RESEARCH:Data Warehousing and Data Mining

- LEARNING EXPERIENCES OF STUDENTS EARNING LOWER LEVEL CREDIT:Discussion Topics, Market Segmentation

- UNDERSTANDING CONSUMER BEHAVIOR:The Consumer Buying Process

- THE DISTRIBUTION MIX:Intermediaries and Distribution Channels, Distribution of Business Products

- PHYSICAL DISTRIBUTION:Transportation Operations, Distribution as a Marketing Strategy

- PROMOTION:Information and Exchange Values, Promotional Strategies

- ADVERTISING PROMOTION:Advertising Strategies, Advertising Media

- PERSONAL SELLING:Personal Selling Situations, The Personal Selling Process

- SALES PROMOTIONS:Publicity and Public Relations, Promotional Practices in Small Business

- THE PRODUCTIVITY:Responding to the Productivity Challenge, Domestic Productivity

- THE PLANNING PROCESS:Strengths, Weaknesses, Threats

- TOTAL QUALITY MANAGEMENT:Planning for Quality, Controlling for Quality

- TOTAL QUALITY MANAGEMENT (continued):Tools for Total Quality Management

- TOTAL QUALITY MANAGEMENT (continued):Process Re-engineering, Emphasizing Quality of Work Life

- BUSINESS IN DIGITAL AGE:Types of Information Systems, Telecommunications and Networks

- NON-VERBAL COMMUNICATION MODES:Body Movement, Facial Expressions

- BUSINESS ORGANIZATIONS:Organization as a System

- ACCOUNTING:Accounting Information System, Financial versus Managerial Accounting

- TOOLS OF THE ACCOUNTING TRADE:Double-Entry Accounting, Assets

- FINANCIAL MANAGEMENT:The Role of the Financial Manager, Short-Term (Operating) Expenditures