|

Financial

Management MGT201

VU

Lesson

09

NET

PRESENT VALUE (NPV) AND INTERNAL RATE OF

RETURN (IRR)

Learning

Objective:

In

this lecture, we will

discuss in detail the previous

lecture topics that

are

�

Net

Present value

(NPV)

�

Internal

Rate of Return (IRR)

Net

Present value

(NPV):

The

most important skill in this

course is to understand the NPV equation

and to calculate NPV

as

reliably as possible. It is also the most

important criteria in capital

budgeting. It is very difficult

to

calculate

because different inputs

used in Net present value

equation are based upon a

forecast, which

may

or may not be accurate e.g.

future cash flows and

sales. Similarly, when we

talk about the life

of

the

project, again we are

estimating the duration of the project.

We also have to choose subjectively

the

discount

rates to be used, including

cost of capital, opportunity

cost & required rate of return in

the

calculation

of Net present value. We

will discuss how to choose

the interest rate when we would

talk

about

risk. In NPV the idea is to

bring back each cash flow to

the present and then to add

or subtract

them

on present time. The project

or investment, which is offering the

highest NPV, gets the

highest

rank.

Formula:

NPV

= -Io + CFt /

(1+i)t

= -Io +

CF1/(1+i) + CF2/(1+i) 2 +

CF` /(1+i) 3

+..

Importance

of NPV in terms of objectives of

Financial Management:

The

objective of FM is to maximize the

shareholders wealth. Now, there is a

direct link between

shareholder

wealth maximization & NPV. It is

mentioned earlier that the

value of an asset is

determined

by

the future cash flows it

generates. We used these

future cash flows &

discount them to present

and

we

call that the NPV. Hence,

there is a direct link between NPV and

future cash flows.

When

the management of the company invest in the

+ve NPV projects, they

increase the economic

value

added (E.V.A) and they

also increase market value

added (M.V.A). It should be clear by

now that

when

company invest in +ve NPV projects

they brings in value to the

company. Increase in the value

of

the

company implies increase in shareholders'

wealth.

Example:

Let

us suppose that you invest

Rs 100,000 in a Savings Certificate.

After 1 Year you

will

receive

a coupon payment (or profit)

of Rs 12,000 and you also

reclaim your initial

investment

(principal).

Solution:

Step

1: Identify the Variables: Io = Rs

100,000 CF1=Rs 12,000 Life =

n=1year Required Rate

of

Return = i =10% (assumed),

Annual compounding. CF I1 = Rs

100,000

Here,

we assume that i=10 because

which is the opportunity cost as

you can place that money

in

a

bank and can earn 10%. Do

not forget that you get back

your principal investment

after 1 Year. This

is

a positive cash flow and

must be discounted back to the present

just like any other

future cash flow).

Step

2: Solve the NPV

Equation

NPV

=

-Io

+

CF1 /

(1+ i) +

CF

I1 / (1+ i)

=

-100,000 + 12,000/ (1+0.10) +

100,000/ (1+0.10)

=

-100,000 +

10,909

+

90,909

=

+ Rs 1,818 NPV positive so

investment acceptable

NOTE:

PV = NPV + Io =

1,818 + 100,000 = Rs

101,818

45

Financial

Management MGT201

VU

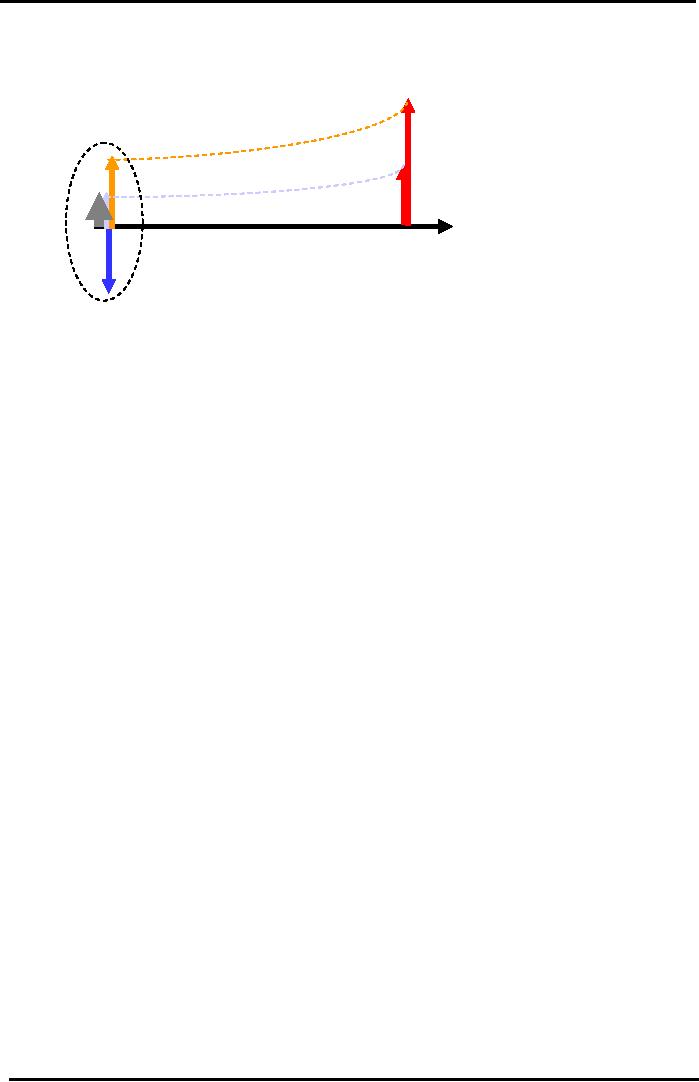

NPV

Cash Flow Diagram

Savings

Certificate Example

CFI1

= Rs

100,000

Rs

90,909

Rs

10,909

CF1=

Rs

NPV

=

12,000

i

= 10%

Rs.1,818

Yr

0 (Today)

Yr

1

Io

= Rs 100,000

In

diagram initial downward

sloping arrow shows the cash

out flow and after

one year two

upward

pointing arrows (1. profit

2.return of initial investment) show the

cash inflows.

Now

let us talk about the

Internal Rate of Return or

IRR.

Internal

Rate of Return or IRR:

IRR

is a very commonly used

criterion for capital

budgeting. It is popular with the

managers

because

it gives a very simple

answer in the form of annual

percentage and you can

compare it to the

inflation

rate, cost of capital or financing or to

the certain financial accounting

ratios. The formula

uses

trial

& error method. We talk

about the interpretation of IRR in the

coming lectures.

The

formula is similar to

NPV

CFt /

(1+IRR)t

= -Io +

CF1/(1+IRR) + CF2/(1+IRR) 2 +

..

NPV

= 0 = -Io +

The

value of i where NPV is zero is the

value of IRR.

IRR

represents the Break-even Return on

Investment, but the important

thing to remember is the

difference

between IRR & NPV. When

you are ranking different

projects the ranking you get from

NPV

may

be different from the ranking

you get from IRR, because,

there is a major difference of

interpretation

of i between NPV and IRR.

The

difference is that in the case of

NPV; we are externally

specifying the discount rate

based

on

required rate of return. In NPV

calculations, you have an idea of

your opportunity cost for

the capital

&

you use it as `i'. As

mentioned earlier that rate

given by the banks on account is

considered as

opportunity

cost of your capital &

you will invest in any

project, which earns more

than the rate offered

by

a bank. However, in IRR

i

is

derived from the cash flow

pattern of the project. Remember

that in

IRR

project, we do not externally

specify the interest rate but we calculated it

from the cash flows.

Therefore,

in the IRR it is what you

called forecasted rate of return or an

intrinsic rate of return. This

is

an

important difference to keep in mind

between NPV & IRR.

Example:

Consider

the Same Savings Certificate example

for IRR calculation. The

only difference is

that

this

time, we will not assume

any value for "i" as we had

done in the NPV calculation.

We

set the NPV = 0 and solve the

equation for "i"

(or IRR).

NPV

= 0 = -Io

+

[CF1 / (1+IRR)] + [CFI1 /

(1+IRR)]

We

add Rs 12,000 & Rs 10,000 as both

appearing at the same

time.

0

= -100,000 +

[(CF1 +

CFI1) /

(1+IRR)]

0

= -100,000 +

[(12,000+100,000)

/ (1+IRR)]

IRR=

(112,000 / 100,000) - 1

(No

need for trial & error

because you have one variable & one

unknown)

=

1.12 - 1.00 = 0.12 = 12 % per

annum

Is

that a good IRR, a high

IRR or low IRR? These

things we will discuss in

this & in the next

lecture.

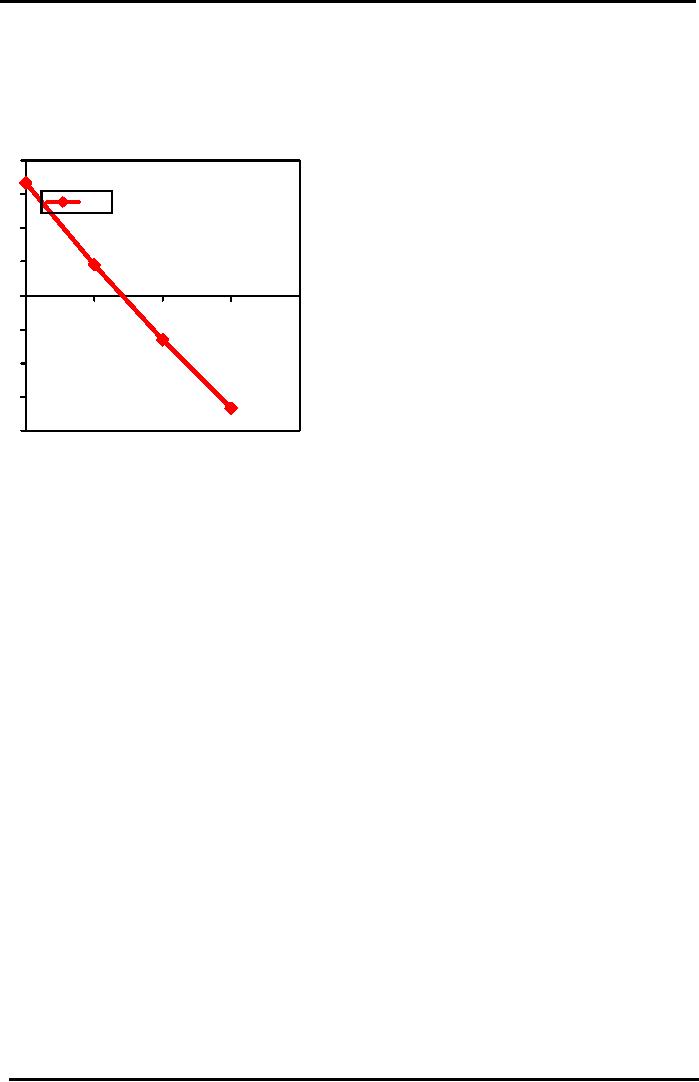

Now, one very important

thing, which you need to

consider when you are

evaluating an

investment

proposal, is to look at NPV & to

see how it changes as you

change the discount rate

.This is

known

as NPV Profile (See Fig.).

Logically, when you increase

the discount rate, the denominator

46

Financial

Management MGT201

VU

becomes

larger & you net present

value becomes smaller. What

you find as a result is a

downward

sloping

line. The point where the

NPV is zero would be the IRR

for the project.

Graphical

IRR

Estimation

Using

"NPV PROFILE"

8000

6000

NPV

4000

2000

IRR=12%

0

i=10%

i=15%

i=20%

-2000=5%

i

-4000

-6000

-8000

Using

a low and a high value for

"i", plot two points on the

graph and extend the NPV

line. Where the

line

cuts the horizontal x-axis

would be reflect the value of the

IRR.

Use

this Graphical Technique

when:

1.

The investment or project

life is longer than 2

years.

2.

Graphical technique very

useful in IRR calculations as there

are polynomial equations that

are

time

consuming to solve algebraically in terms

of "i".

3.

Comparing the NPV's of 2 or more investments, to

study how sensitive the NPV's of

the

different

investments are to the discount rate

"i"

The

next issue is the ranking of

different projects, which means

given a choice of more than one

investment,

which project is the best to

invest in.

RANKING TWO DIFFERENT

INVESTMENTS:

Which

Investment is better?

Let

us rank two Mutually

Exclusive & Independent Investments

using NPV and IRR

criteria

Mutually

Exclusive: means

that you can invest in

ONE of the investment choices and

having chosen

one

you cannot choose

another.

Independent:

implies

that the cash flows of the

two investments are not

linked to each other

Example:

Let

us consider two investment opportunities.

One Investment is the Savings Certificate

(which

we

described earlier) and the

second investment is a Bank

Deposit of Rs 100,000 at 10%

interest

compounded

annually for two

years.

NPV

& IRR Numerical

Comparing

the 2 Investments

Since

we have calculated the NPV and IRR

for the Savings Certificate, we would

calculate the

NPV

and IRR only for the Bank

deposit rate.

Bank

Deposit Example

FV

= PV (1+i) n

=

100,000 x (1.10)2 =

121,000

47

Financial

Management MGT201

VU

NPV

= -100,000 + 10,000/ (1.1) +

11,000/ (1.1)2

+

100,000/(1.1)2

=

100,000 + 9,090 + 91,736 = +

Rs

826

IRR:

NPV = 0 = -100,000 + 10,000/

(1+IRR) + 111,000/

(1+IRR)2

... by

trial & error IRR =

10.5%

Compare

the Investment 1 (Savings Certificate) to

Investment 2 (Bank

Deposit):

Bank

Deposit

Savings

Certificate

NPV

(i=10% pa)

+

Rs 1,818

+

Rs 826

IRR

12%

pa

10.5%

pa

Savings

Certificate appears to be a better

investment because it offers

both a higher NPV and a

higher

IRR.

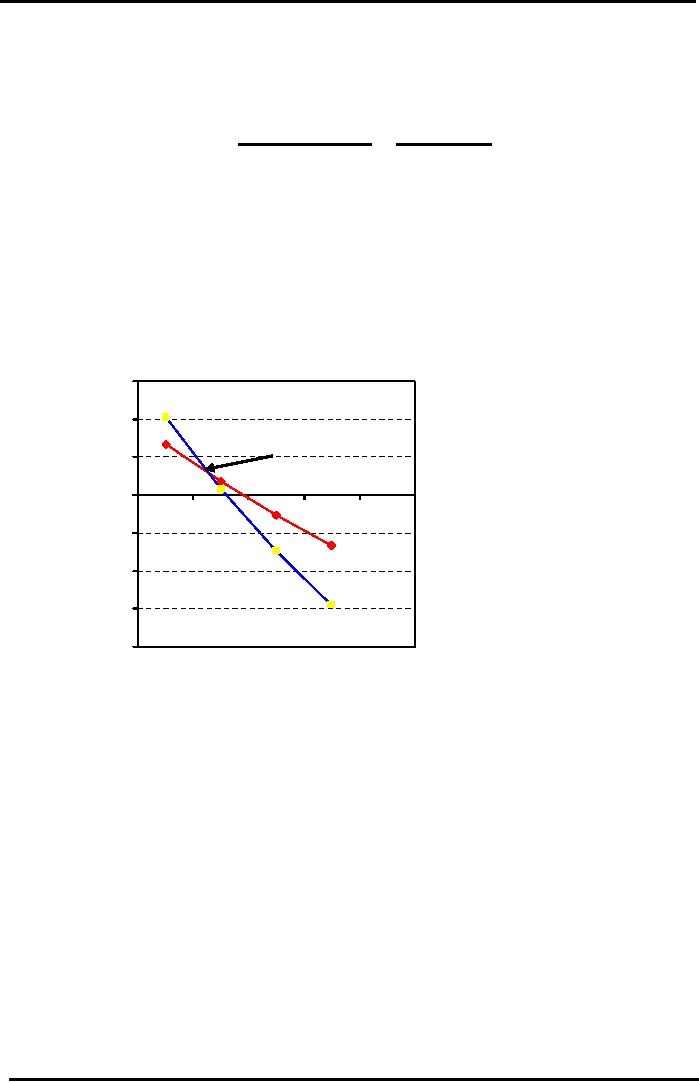

Graphical

Comparison

of

2

Investments

"CROSS-OVER

IRR"

15000

10000

Cross

Over Point

5000

0

i=10%

i=15%

i=20%

-5000

i=5%

-10000

-15000

-20000

The

above diagram shows NPV

Profiles of investments intersect at the Cross

Over Point. Slope

of

Bank Deposit investment is

steeper because larger cash

flows (Rs 111,000) are

taking place later

in

time (2 years instead of 1 year

for Saving Certificates).

Size of the Discounting Factor

grows

exponentially

with time so NPV graph

falls much faster. The

IRR at this Point is

8.8%.

At

this point, the NPV of both

the investments is equal at about +Rs

2,950

When

IRR is less than 8.8%

(Cross-over IRR) then the NPV of

Bank Deposit is

higher!

Investment

Criteria

IRR

Interpretation - How high is

high.

Macro

Aspects

Inflation:

An

IRR, which is considered low

for a medium inflation

country like Pakistan, may

be

considered

high for a low inflation

country like USA, Japan,

and Singapore where inflation is

below

5%.

Risk

Free Rate of Return:

Recall

our discussion from earlier

lecture on Interest Rates and

Money Markets.

In

Pakistan, we use the Government T-Bill

rate, which varies from 7% to 12% per

annum

depending

on the Money Market. Considering the

risk-free rate of return the IRR on

investment is

not

very good. We will talk more

about this after we study

RISK.

48

Financial

Management MGT201

VU

Investment

Criteria

IRR

Interpretation (Micro

Aspects)

ROA

& ROE:

If

the Investor has an existing

running business that

generates cash flows, then

any new project

that

matches or exceeds the returns of the

existing business is worth

considering.

Problem:

ROA

& ROE are Financial Accounting Ratios

based on Net Income (not

cash) &

Historical

Cost or Book Value (not

market value) whereas IRR is

based on Cash and Forecasted

Market

Value.

The financial ratios are

calculated based on the profit

reported in the income statement,

whereas

the

IRR takes into account the

cash flows rather than the

accounting profit in the

calculations.

Weighted

Average Cost of Capital

(WACC) or Hurdle

Rate:

If

the Investors an existing operating

business that runs on

borrowed money (or

financing)

then

the Investor (the borrower)

bears the cost of interest, say

18% pa in Pakistan. Obviously, the rate

of

cash

generation should exceed the rate of

interest payment. The IRR of a new

project should exceed

the

WACC.

We will discuss this in

detail when we study Capital

Structuring. When IRR is above

the

WACC,

the excess return represents surplus

that increases shareholders' wealth.

The details on WACC

would

be further discussed in Capital Structure

determination.

49

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios