|

Financial

Management MGT201

VU

Lesson

07

DISCOUNTING

CASH FLOW ANALYSIS, ANNUITIES AND

PERPETUITIES

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

concepts.

�

Discounted

Cash Flows (DCF Analysis)

�

Annuities

�

Perpetuity

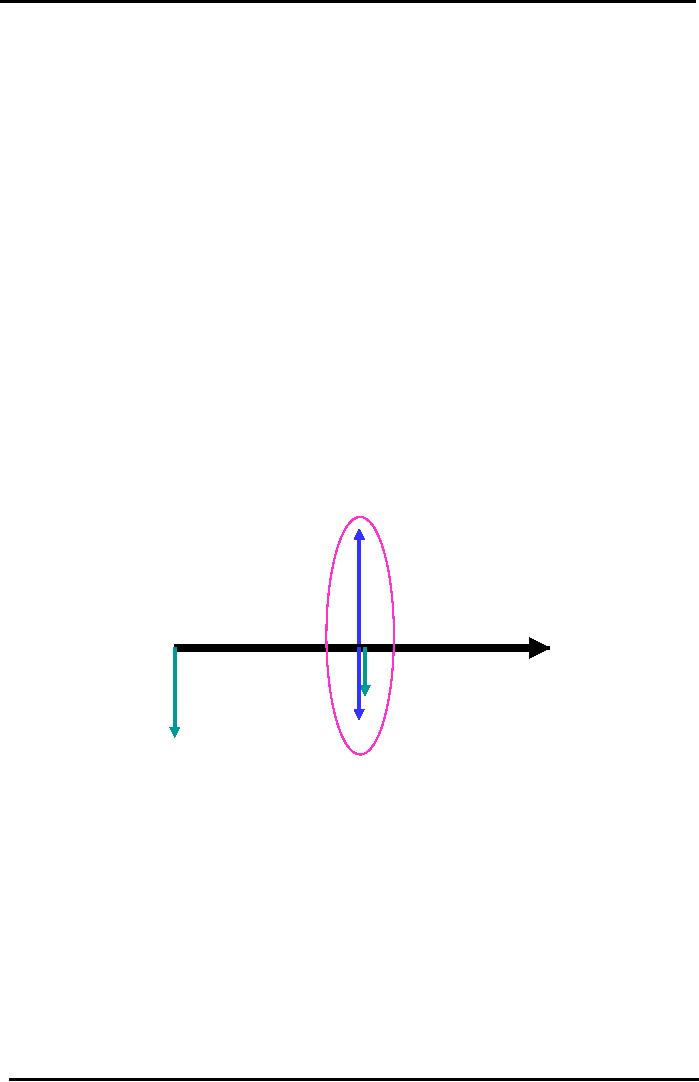

This

lecture is continuation of the previous

lecture's topics. In the previous

lecture, we had

discussed

the calculation of the Net Present

Value (NPV) and the use of

the value of interest rate or

Opportunity

cost in the process. Bank

Interest on the PLS Account

represents the Minimum

Opportunity

Cost

of our investment. A good

investment opportunity should,

however, offer a higher

return than the

Bank

Interest rate. We also used the

time & arrow diagram to show the

cash flows forecast. In the

diagram,

we used upward pointing

arrow to represent the cash

inflows & downward pointing

arrow are

used

to represent the cash outflows. You

can simplify that diagram by

arithmetically solving the

upward

&

down ward pointing arrows at

same point in time by

showing it with one arrow.

(see Fig)

Cash

Flow Diagram

Recap

of Caf� Example

Use

Downward Pointing Arrows to

show Cash Outflows (Cash

Payments or Expenses

or

Investments). Use Upward

Pointing Arrows to show Cash

Inflows (Cash

Receipts

ie.

Cash Revenue or

Income)

Receipts

= Rs. 200,000

Year

1: 3 Cash Flow Arrows

at

one point in time can

be

simplified

into 1 Net Cash

Flow

Arrow: 200,000

50,000

30,000 = +120,000

Interest:

10% pa

Yr

0

Yr

1

Future

Investment = Rs 30,000

Payments

= Rs 50,000

Initial

Investment = Rs 100,000

The

arrows in time-and-arrow diagram can be

added and subtracted when

they are on same

point

in time but when these

arrows are at the different point of

time these cannot be added or

subtracted.

Now,

let's talk about some common

cash flow patterns the most

common is called annuity.

Annuity:

An

annuity

is a

series of fixed payments, which

might be over a fixed number of

years, or over

the

lifetime of an individual, or both.

The commonly known types of

annuities we see are the

monthly

rent,

and monthly mortgage payments, or insurance

premiums.

There

are two types of

annuities

1.

Ordinary Annuity

An

ordinary annuity, also known

as deferred annuity, consists of a

series of equal payments at the end

of

each

period.

2.

Annuity Due

An

annuity due consists of a series of

equal payments at the beginning of

each period.

34

Financial

Management MGT201

VU

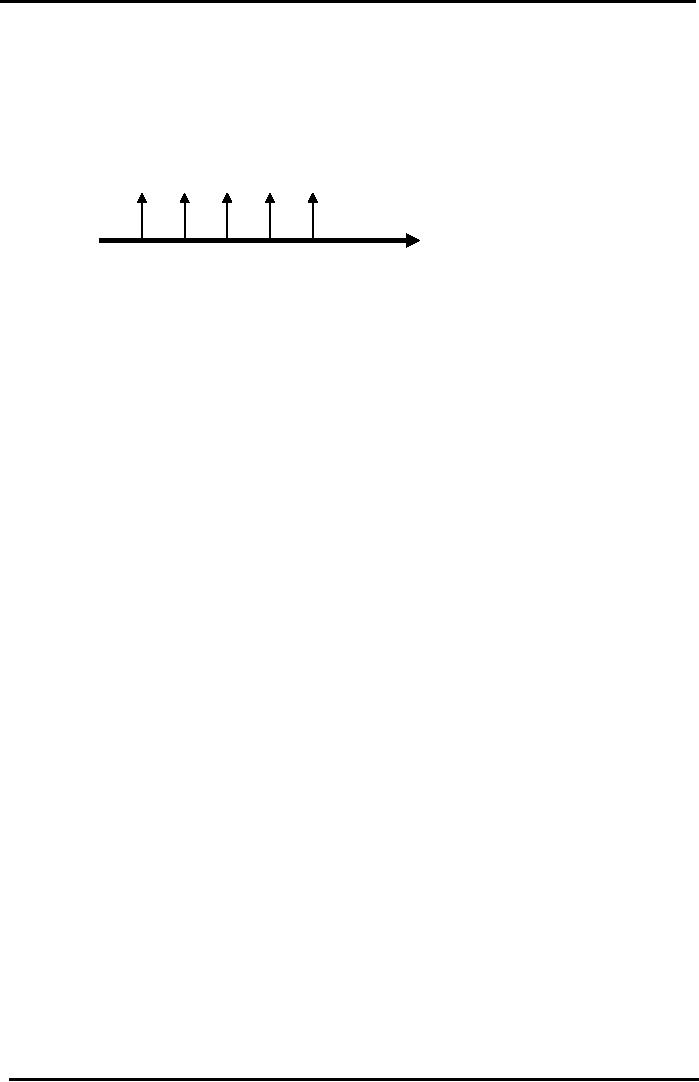

Value

of Annuity depends on the Constant

Cash Flows (CCF) (over a

limited or finite

period

of time) and

the Discount Factor (which

is different for Annual or

Multiple

Compounding)

CCF

CCF

CCF CCF CCF

Ordinary

Five Year Annuity

Time

Line (Years)

Yr

1 Yr 2

Yr

3 Yr 4 Yr 5

Annual

Compounding (at end of every

year):

FV

= CCF (1 + i)

n

- 1

For

example, the payment of Rs.10,000 as

monthly rental to the land

lord is an annuity

which

gives

birth to an annuity stream.

Future value of an annuity

can be seen as

follows:

Future

value of annuity =constant

cash flows x (1+i) n-1/i

Where,

i=interest rate

n=no.

of years

We

can write this formula in

smaller compounded form which describes a

compounding cycle given

as

under:

Multiple

Compounding:

Future

Value of annuity =CCF

(constant cash flow)*(1+

(i/m) m*n-1/i/n

Once

we have calculated the future value of the

annuity, it is very easy to calculate the

present

value

using the well-known interest rate

formula.

Annual

Compounding (at end of every

year)

PV

=FV / (1 + i ) n .

n = life of Annuity in number of

years

Multiple

Compounding:

PV

=FV /

[1 + (i/m)] mxn

i

= % interest per year

More than once per

year i.e. Monthly (m =12),

Quarterly (m=4), Six-monthly

(m=2).

n

= number of years

Now

let's talk about another

kind of cash flow pattern

called perpetuity.

The

difference between Annuity and Perpetuity

is that the Perpetuity is an ongoing

concern, it is never

ending

stream of annuities, whereas an

annuity is for a limited

period.

Perpetuity:

"It

is defined as an annuity with an

infinite life making

continual payments."

In

real life, we see the

example of perpetuity in the retirement

plan. For Example, you

might

plan

to save a sufficient amount of money

& invested in a particular security

or investment that will

give

you

steady & consistent rate of return on

every month or quarter and

this represents a constant

cash flow

amount

that we can assume to go as

long as you live. Since we

are not sure how

far we are going to

live

and

we make an infinite series of

annuities the formula of Future

value of Perpetuity is simpler

than that

of

annuity:

Future

value of perpetuity=constant cash flow/interest

rate

As

we assume that, it is never

ending and on going so time is

irrelevant and is simply

dropped

out

of the equation.

35

Financial

Management MGT201

VU

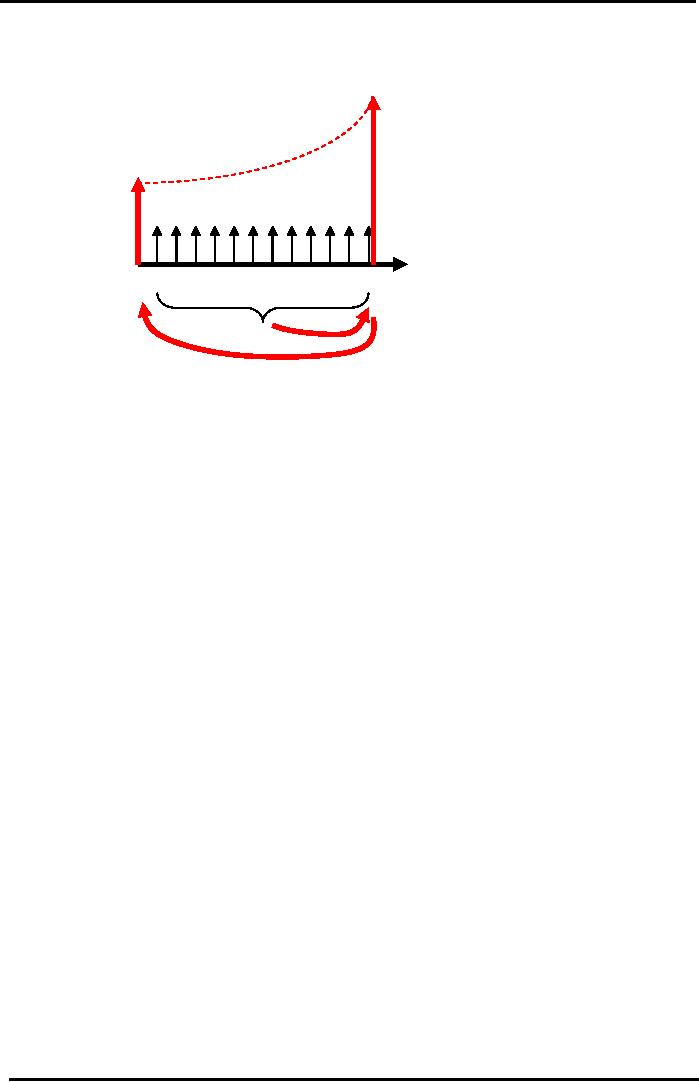

Common

Cash Flow

Patterns

Perpetuity

�

Perpetuity

Never-ending

Annuity.

It is a Perpetual or

Infinite

stream of Constant Cash

Flows

(CCF)

at

regular intervals.

PV

= CCF

i

CCF

CCF

CCF CCF CCF

CCF

CCF

Infinity

Yr

1 Yr 2

Yr

3 Yr 4 Yr 5 Yr 6

Note:

For Perpetuity whose CCF is

growing at constant

annual

growth rate % "g" :

PV =

CCF / (i - g)

Let's

do a simple numerical example

which will help us what an

annuity calculation is

like

Example:

Assume

that we need to make a basic

financial decision, whether to

purchase a particular

asset

or

to get it on lease (installments).

A

car has a Market Value

today of Rs 150,000. If you get the

car on Lease Financing, then

you

are

required to pay a fixed

regular rental at a fixed interest

rate to the Leasing Company. You

are

allowed

to use the car but the

ownership of the car stays in the

name of the Leasing Company

until you

complete

all your rental payments.

The

question is whether

you should Lease the car or

Buy it?

The

Leasing Company quotes Rs

120,000 every year for 2

years in the form of Car

Lease

Rental

at a Nominal rate of interest (APR

interest rate) of 20% pa. Then

what is the total Future

Value

you

would have paid after 2

years? You would be paying

approximately Rs 240,000 if you do

not take

into

account the time value of

money.

Now

we calculate the present value of the

investment by using Time

value of money concept.

First,

we need to calculate the future value by

using annuity formula

FV

=CCF [(1+i) n

- 1]/

i

=120,000[(1+0.2)2

-1]/0.2

=

Rs 264,000 (yearly

compounding)

If

we deposit the amount annually in a bank

at the rate of 20 percent, we would be able to get

Rs

264,000

at the end of the second year. Now we

will calculate what the present

value of this future

value

is

going to be, and for this,

we will use the old interest rate

formula

PV

= FV / (1+i) n

=

264,000 / (1+0.2)2

=

Rs 183,333

The

resulting amount is about Rs 33,000 more

than what we would have

originally paid if we

had

bought the car rather than

lease it

The

above calculation, however, was

not based on realistic

assumptions because car

lease

rentals

are generally paid monthly,

rather than annual payments. In fact,

you pay Rs 10,000 per

month

for

2 years. We use periodic interest rate

(i/m). Now, what is the

future value after 2 years?

Our cash

flow

diagram should present the

monthly installments & not

annual Payments.

36

Financial

Management MGT201

VU

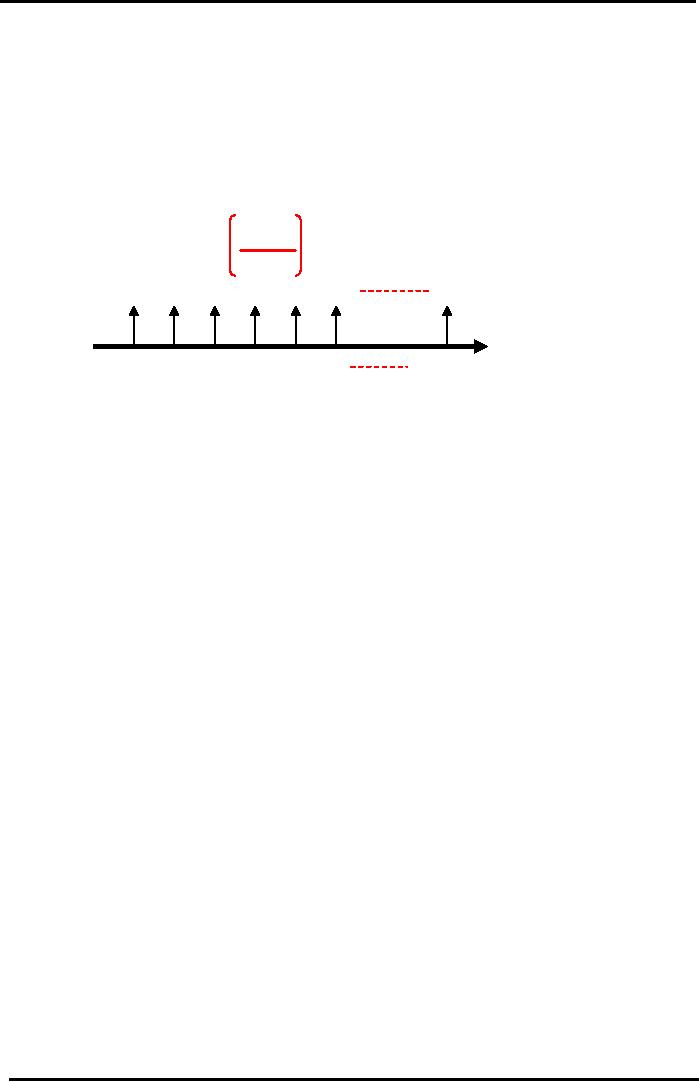

Monthly

Lease Rentals Example

Annuity

- Cash

Flow Diagram

FV2

= Rs 292,150

PV

= Rs 196,481

CCF

= Monthly Rentals

=

Rs 10,000

Interest

= 20% pa

Time

Line (Years)

Step

1: Bring All the Cash

Yr

0

Yr

1

Yr

2

Flows

Forward to Year 2

(because

formula is written

Step

1

in

terms of FV).

Step2:

Discount the

Step

2 (24 jumps back)

Combined

Cash Flow at

Year

2 back to the Present

It

can be argued that by paying a

rental of 10,000 monthly, we

are actually paying Rs

120,000

in

a year, so there hardly any

difference. But, by not

realizing the difference, one is

violating the time

value

of money because cash flows

occurring at different points of

time cannot be subtracted or

added.

It

is the cardinal principle of Time

value of money.

If

we have to calculate the future value of the

annuity on a monthly basis, we

would use the

following

formula.

=CCF

X {[(1+i/m) nxm-1]/ (i/m)}

Now

the m= 12 compounding cycle in a

year

Putting

the values in the formula, we obtain the

result as under.

FV2=Rs

292,150

Now,

we can calculate the present value of the

future value of

annuity

PV

= FV / (1+i) n

=292150/(1+.2/12)2x12

=196,481

The

present value of annuity can

also be called the intrinsic

value of the annuity.

The

aforementioned technique allows us to

compare the amount of money we are

paying to

leasing

company with the market value of car. It

helps you to decide whether you

should buy the car on

market

price or to get it leased. The

cost of leasing at 20% p.a.

tell us that you have to pay

20% interest

&

you have to pay more money in

leasing as compare to the decision if

you buy it .

Perpetuity

Example -

Retirement Planning

You

would like to retire at the

age of 60 and receive an income of Rs.

200,000 every year

from

your

Bank Account for as long as

you live. How much

money do you need to deposit

in the Bank

Account

offering 10% pa so that the

Account will pay you Rs

200,000 of interest income every

year

forever

(even though you will

not live forever)!

�

PV = CCF / i = 200,000 / 0.10 = Rs

2,000,000

This

also implies that you

would be receiving Rs 200,000

every year for the rest of

your life and

the

money would neither finish

nor decrease in amount. This

would happen so, because

what you would

be

receiving at the end each year

would be interest accrued on the

investment that you have

made. The

money

that you are getting is

not a part of the investment; instead, it

is the yield on your

investment.

This

may sound like a `big

idea' for making money,

but in fact, it is not so.

Inflation, a macroeconomic

syndrome

erodes the value of money

constantly. If the prevailing inflation

rate is 5 percent, then your

real

return on investment is not 10 percent.

If we consider the real rate of return,

which is interest rate

rate

of inflation, you would see

that you need to invest

twice as much to guard

yourself against inflation.

37

Financial

Management MGT201

VU

Another

example for perpetuity is

Consol Bonds. Consol Bonds were issued by

the British

Government

in 18th century

to pay off the smaller bonds

that were issued to fund the

wars against

France.

Since the purpose of the bond was to

consolidate the past debts, it

was named as Consol.

These

bonds

were just like other bonds

issued by the government, with the

difference that it had no maturity.

It

implies

that the holder of the bond

was to receive regular interest payments

for an endless

period.

Now

if we have to invest in such a bond we

need to know the price or the

present value of the

bond.

Dividing the interest payment that a

Consol bondholder would

receive, by the interest rate, we

can

find

the present value of a Consol

bond. Suppose that the

interest rate is at 10 percent and the promised

interest

payments to be received are �

1,000 every year, the price

of the bond can be calculated as

under

�

PV = CCF / i = 1,000/ 0.10 = �

10,000

With

this example, the discussion on

discounted cash flows, annuities,

and perpetuities is

concluded.

We would study the capital

budgeting techniques in the next

lecture.

38

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios