|

FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios |

| << INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals |

Financial

Management MGT201

VU

Lesson

45

FINAL

REVIEW OF ENTIRE COURSE ON FINANCIAL

MANAGEMENT.

Outline

of 5 Major Areas of FM:

1-

Interest Rates

Compounding

(money

grows with time)

Discrete

Annual (FV=PV (1+r) t)

vs.

Discrete

Multiple / Fractional (FV = PV

(1+ (r/m)) mn)

"n"

number of years,

"r"

is the Discount Rate or Opportunity

Cost of Capital or WACC

depending on your

perspective

"m"

times a year interest is compounded

Discounting

(or Reverse-Compounding)

PV

= FV / (1+r) t

Annuity

and Perpetuity

FV

Annuity = CCF [(1+r) n -1]

/ i. Limited time

period.

PV

Perpetuity = CCF / r.

Yield

Curves and Term

Structure

�

Normal Yield Curve is

Upward Sloping. Interest

Rates rise with maturity or

life

of

Bond.

Geometric

Average:

�

(1 + 2Yr Bond YTM)

=

(1 + 1Yr Bond YTM 1st year)

x (1 + 1Yr Bond YTM in 2nd

Year).

�

Nominal i = Real i + Inflation +

Risk Premiums (i.e.

Liquidity Risk + Maturity

Risk

+

Sovereign Risk)

Financial

Statements and Ratios

�

Balance Sheet, Profit and

Loss Account (Income Statement) and

Cash flow

statement

�

DuPont = Profit Margin x Asset

Turnover x (Assets/Equity),

�

Margin = Net Income/Sales

�

Turnover = Sales /

Assets

�

Important

ratios: ROA,

ROE, EPS, P/E, Plough back Pb,

Current ratio,

Debt/Capitalization,

TIE

�

ROA ( = (NI + Interest) / Total

Assets) and ROE (= NI /

Equity)

�

EPS (= NI / No. of Shares

Outstanding) and P/E and

Plough back (Pb = g /

ROE

where "g" is Dividend growth rate

%)

�

Current Ratio (=Current

Assets / Current Liabilities),

Debt/Capitalization or

Leverage

Ratio, TIE

184

Financial

Management MGT201

VU

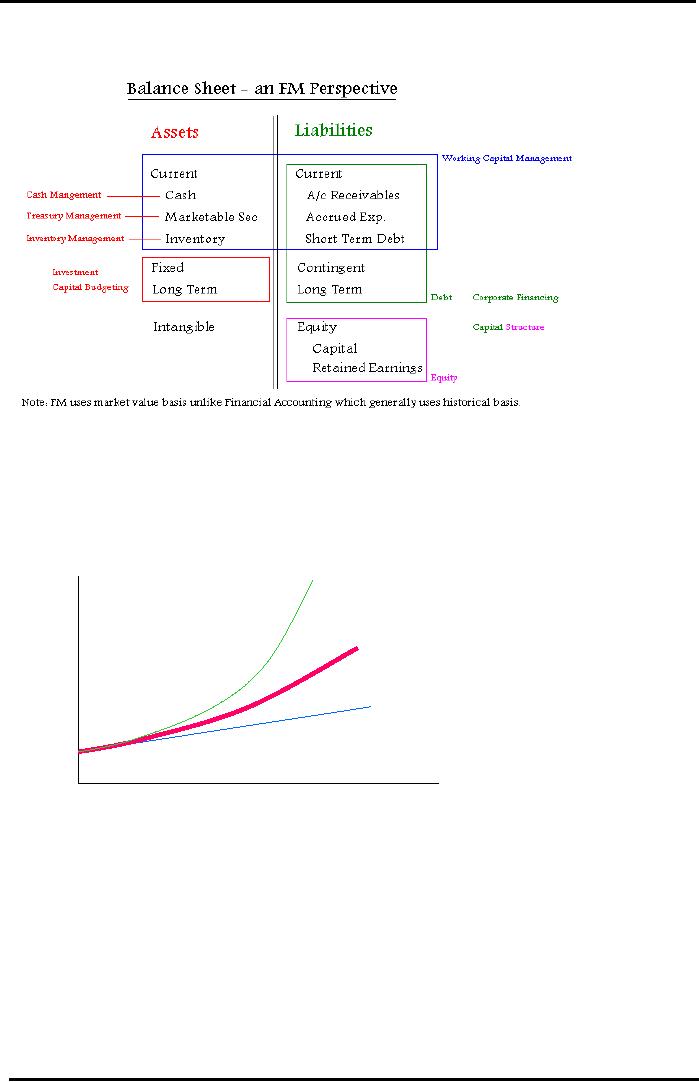

FM

Perspective of Balance Sheet

Own

Stock

Issued

by

Company

to

Raise

Cash

Copyright:

M. S. Humayun

4

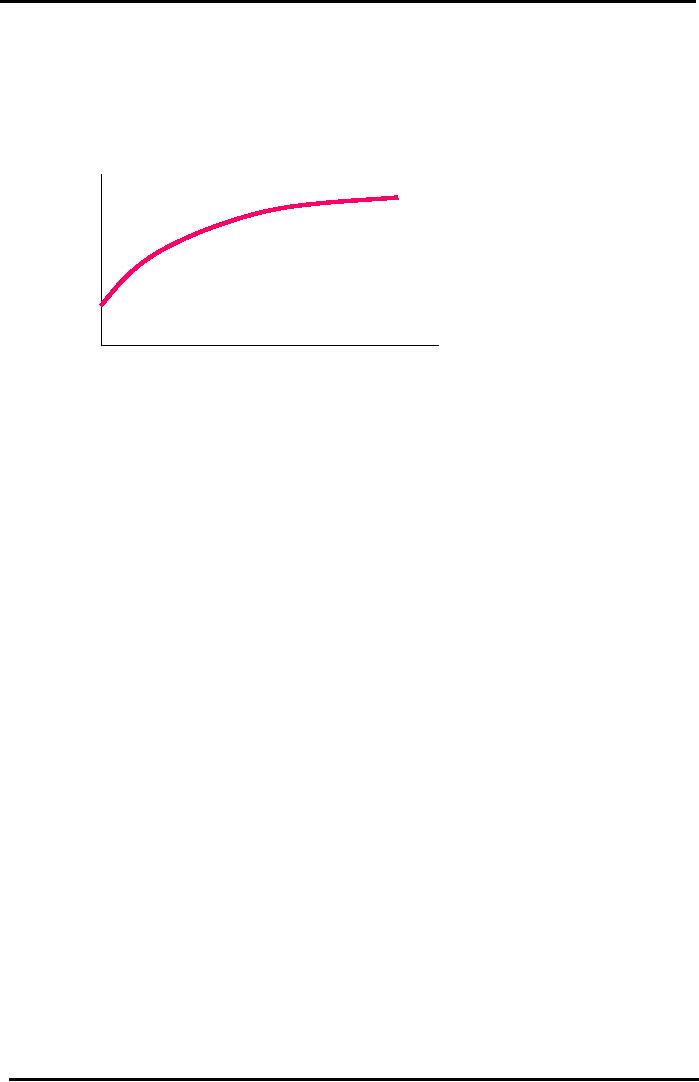

Graphical

View of

Simple,

Discrete Compound, &

Continuous

Interest - Important

Future

Value (FV)

CONTINUOUS

COMPOUNDING

in

Rupees

DISCRETE

COMPOUNDING

SIMPLE

INTEREST

Time

(Years)

185

Financial

Management MGT201

VU

Yield

Curve for Bonds

Term

Structure of Interest

rates

Annualized

Interest

Rate %

(Bond

Yield)

Time

(Years)

Now

1

Year

5

Years

10

Years

2-

Capital Budgeting and Investment

Decisions to Rank Projects - Fixed

assets Side of

Balance

Sheet

Objective

of Financial Management: Maximization

of Shareholders' (Owners')

Wealth.

Maximization of Value of Firm.

Maximization of Value of Shares of the

Firm.

Cash

Flows = CF

=Net

After Tax Incremental Cash

Flows

=

NOI + Depreciation + Cost Savings

Extra Taxes + Any Salvage

Value

Cash

Flow Diagrams / Time Line:

Cash Inflows (Upward

Arrows)

NPV

or DCF (Best

Criterion) Highest NPV

Project is Best.

NPV

uses Discount Rate

=

Required ROR or WACC which

can be changed for every

year and varies depending

on

the Investor's Risk

Profile.

NPV=

PV - Io

=

-Io + CF1/ (1+r) + CF2/

(1+r) 2 + CF3/ (1+r) 3 +

...,

For

comparison of projects with Unequal Lives

use Adjusted

NPV

=

NPV x EAA where EAA Factor = [i x (1+i)

n / (1+i) n

-1]

IRR

(%) -

Higher IRR is better. Fixed

throughout life of

project,

If

Multiple IRR then use

(1+MIRR) n =

FV Inflows / PV Outflows.

FV

= Future Value and PV =

Present Value

Capital Rationing Limited

Budget, % Budget

Utilization

186

Financial

Management MGT201

VU

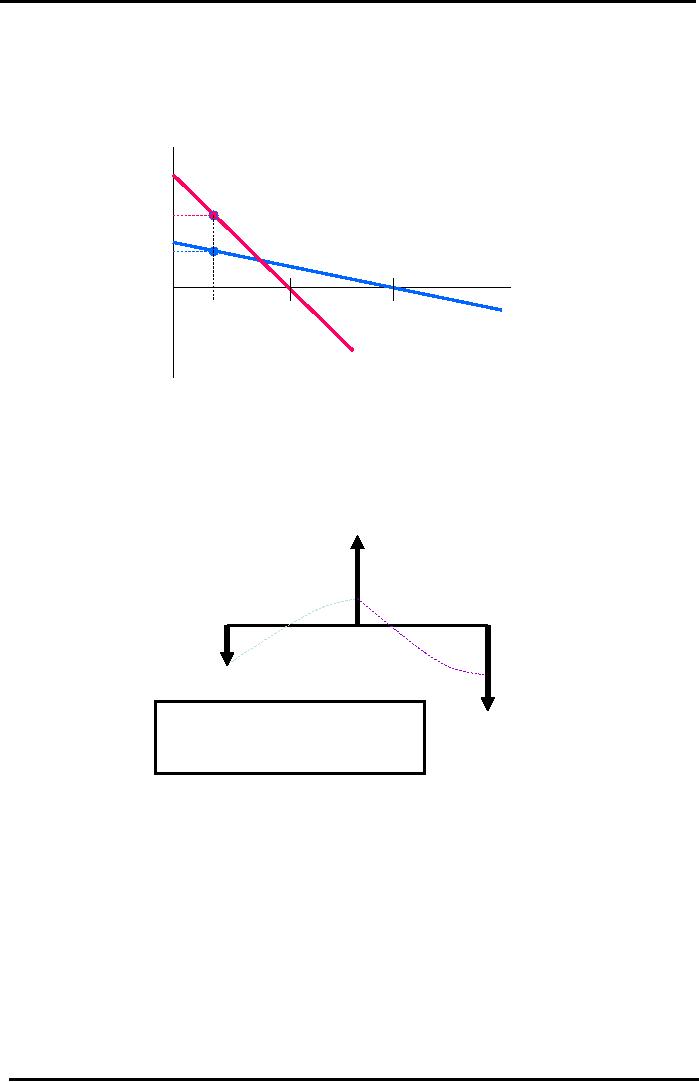

NPV

IRR Diagram

Combined

Use of NPV & IRR

to

Compare 2 Projects - Important

NPV

(Rs)

PROJECT

A: LOWER IRR BUT

HIGHER

NPV BECAUSE

ACTUAL

"r"

IS VERY LOW.

PROJECT

B: HIGHER IRR BUT

LOWER

NPV

NPV

A

NPV

FAVORS PROJECT A

SO

PROJECT A IS BETTER.

NPV

B

Discount

Rate

% (r)

ACTUAL

IRR

IRR

Required

Project

B

Project

A

Return

or

WACC

for

Investor

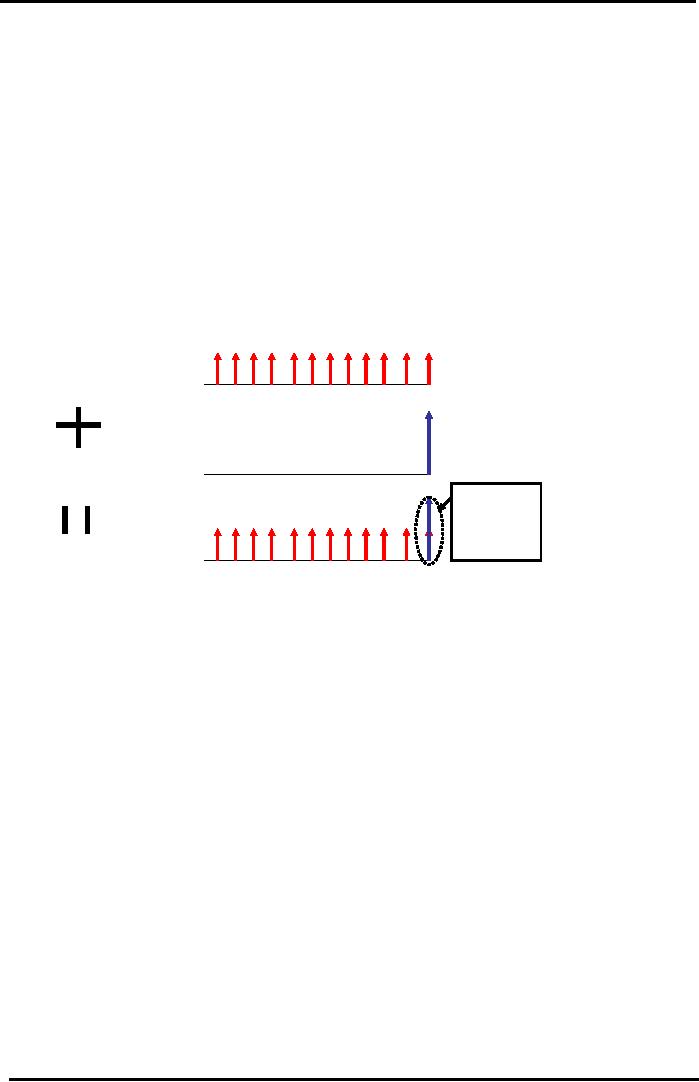

Non-Normal

Cash Flow

Diagram

Multiple

IRR Example

(1+MIRR)n =

(FV Cash Inflows) / (PV

Cash Outflows)

CF

1 = +Rs 500

Sign

Change #1

Yr

0

Yr

1

Yr

2

Sign

Change #2

Io

= - Rs 500

Note:

More

than 1 Sign

Change

CF

2 = -Rs 500

in

Direction of Cash

Flow

Arrows

suggests Multiple

IRR's

3-

Securities Valuation

Fair

vs. Market Value - PV

Formula gives Fair

(Intrinsic)Value

Market Value is determined by

Investors in Market and

buying /selling of securities.

Bond

Pricing and YTM -

Bond is Legal Paper representing

Debt

�

Use PV Formula to Calculate

Bond Price:

PV

= CF1 / (1+rD)

+ CF2 / (1+rD) 2 + ... +

PAR value / (1+rD)

n

�

Cash Flows = CF =

Coupon

=

Coupon Rate (%) x Par

Value

�

Coupon Rate (fixed)

vs. Discount Rate (rD Required Return

for

Bond

Investor)

�

YTM = IRR for Bond.

Set PV = 0 and solve for

"rD"

using Iteration.

�

Bond Ratings of FIRMS by Moodys

and S&P.

Share

Pricing and

Yields:

187

Financial

Management MGT201

VU

Stock

is Legal Paper representing

Ownership

�

Market Price of Share = Po = EPS x

P/E

�

Gordon's Formula is IMPORTANT:

rE =

Required Return on Equity

for

Shareholders

=

(DIV1 / Po) + g = Dividend Yield +

Capital Gains Yield.

Note:

DIV1 is expected future Dividend NEXT

year. Po is price THIS

year.

�

Earnings Approach: Po = (EPS /

rE)

+ PVGO.

PVGO = NPV1/(rE -

g) =[-Io +(C/rE

)] / (rE -g)

Io = Value of Reinvestment = Pb x

EPS where Pb=

Plough back = 1 -

Payout

= 1 - (DIV/EPS)

�

Shareholders' Required ROR (=

rE)

vs. ROE (= NI / Equity)

Bond

Cash Flow Diagram

Savings

Certificate Example

Rs

1,000

Coupon

Annuity :

(Monthly)

Time

(Months)

12

01

2

6

Rs

100,000

Par

Receipt :

(at

Maturity)

0

12

2

Cash Flow

Arrows

at

SAME

point in

time

can be

Combined

added.

Time

(Months)

12

Cash

Flow Diagram 0 1

2

6

4-

Risk and Return

Securities

�

Single Stock Risk = Standard

Deviation

Single

Stock Return: measured

by Share Price or Capital Gain

or

Return

(rE)

Single Stock Risk = Standard

Deviation = Sq. Root of

Variance in the

Expected

Return

Total Risk

=

Diversifiable (Company Specific)

Risk + Market Risk

�

Portfolio

Theory and CML

Portfolio Return - Weighted

Average Formula

Portfolio Risk: Risk

Matrix , Covariance of each stock

with entire

Market

, Correlation Coefficient

Risk Return Graph:

Hook-shaped Curve, Efficient

Frontier, T-Bill

Portfolio

and CML

Portfolio of Stocks Return:

Weighted Average

Formula.

2-Stock

Portfolio's Expected Return

=

rP * = xA

rA +

xB rB

Portfolio Risk: Measured by Sigma P

(standard deviation).

2

Stocks:

P

= XA2 σ

A 2 + XB2

σ

B 2 + 2 (XA

XB σ

A σ

B ρ

AB).

188

Financial

Management MGT201

VU

Risk

Matrix , Covariance of each stock

with entire Market ,

Correlation

Coefficient

Risk

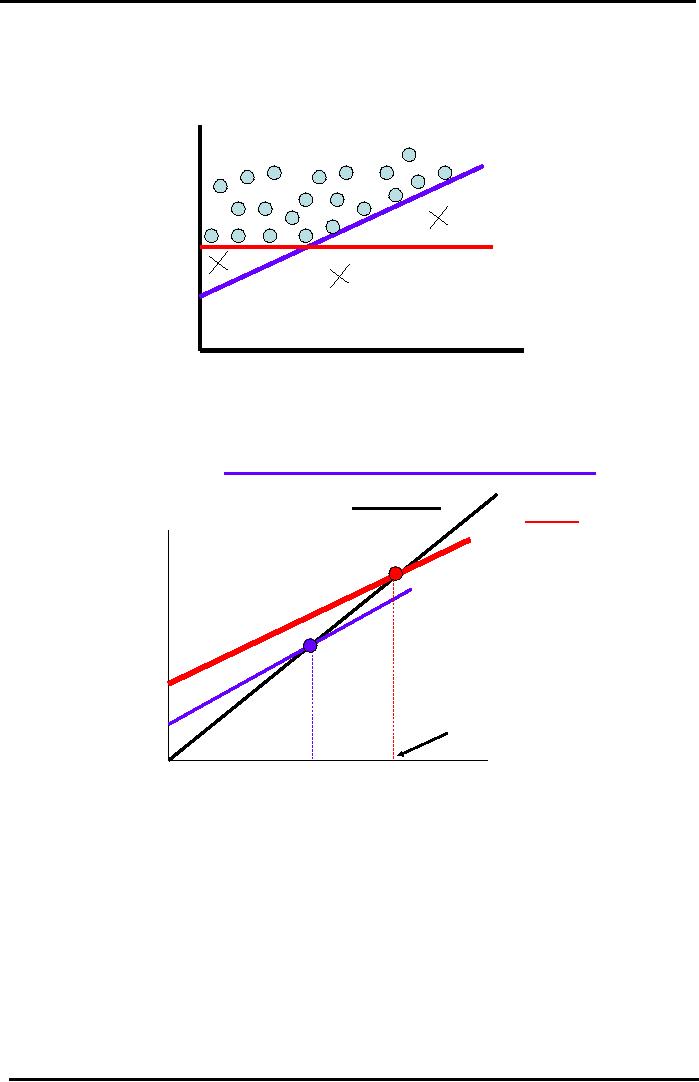

Return Graph for

Portfolio of Stocks

Hook-shaped

Curve: possible to

reduce risk and raise

return

together

Efficient

Frontier shows

all possible efficient

portfolios

"Risk

Free" T-Bill Portfolio is

always available to all

investors

CML

connects Risk Free Return

and Tangent to Efficient

Frontier

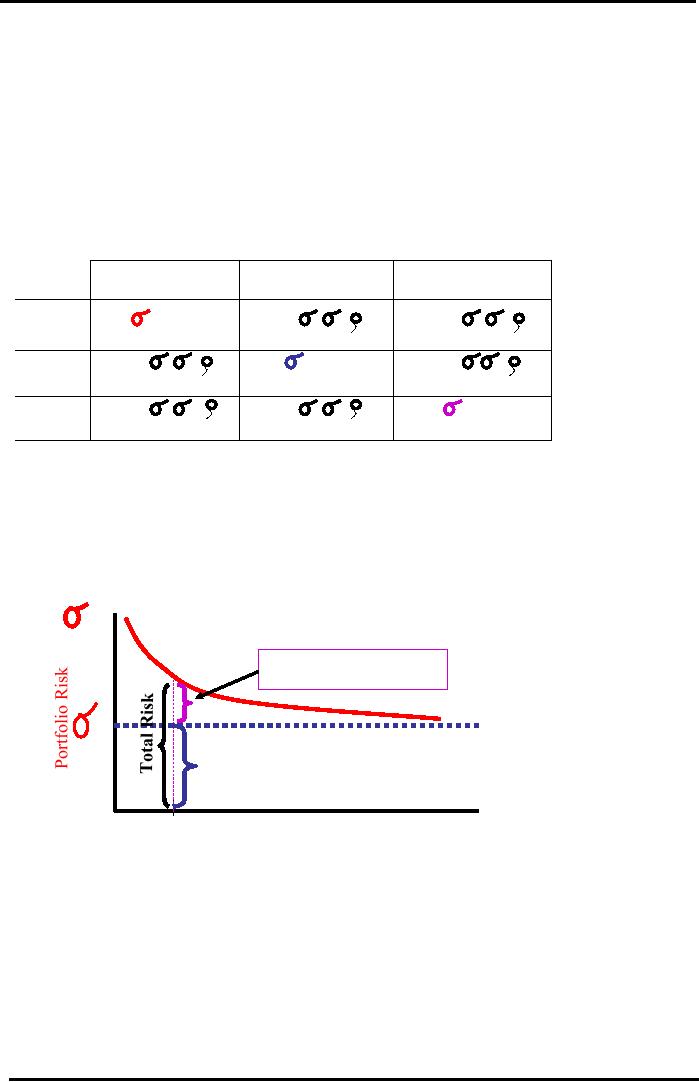

3-Stock

Portfolio Risk Formula

RISK

MATRIX

S

to ck A

S

to ck B

S

to ck C

S

to ck X A2

A 2

XA

XB

XA

XC

A

B

AB

A

C

AC

A

X

B2

2

S

to ck X

B

X A

B

XB

XC

A

BA

B

B

C

BC

B

X

C2

2

S

to ck X C

X A

C

XC

XB

A

CA

C

B

CB

C

C

Portfolio

Size vs Risk Graph

P

Unique

or

Diversifiable

or

Specific

or Non-Systematic

Risk

M

Market

or Systematic or

Non-

Diversifiable

or Beta

Risk

=

Minimum

Possible Portfolio Risk

n

7

20

40

Number

of Investments (Stocks) in the

Portfolio

Note:

About

100%

of the Diversifiable Risk (and

50%

of the Total

Risk)

can be removed by Diversification across 40

stocks.

Just

7

carefully

chosen Un-Correlated Stocks might be

enough to remove

30%

of the Total Risk.

�

CAPM

and SML -Efficient Markets, Beta,

Non-diversifiable Market

Risk,

Risk

Premium, Required ROR on Equity

(rE =

rRF + (rM

rRF)Beta)

�

CV (Coefficient of Variation) =

Risk / Return

Criterion

combines BOTH Risk and

return in deciding which is the

Best Investment

(Capital

Budgeting)

189

Financial

Management MGT201

VU

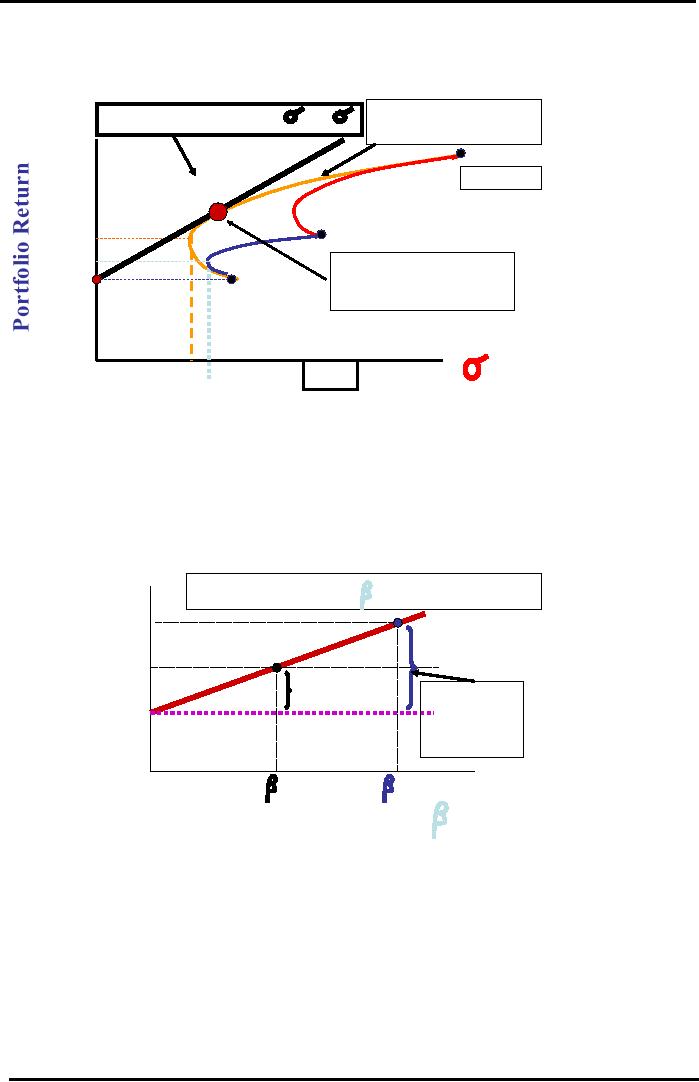

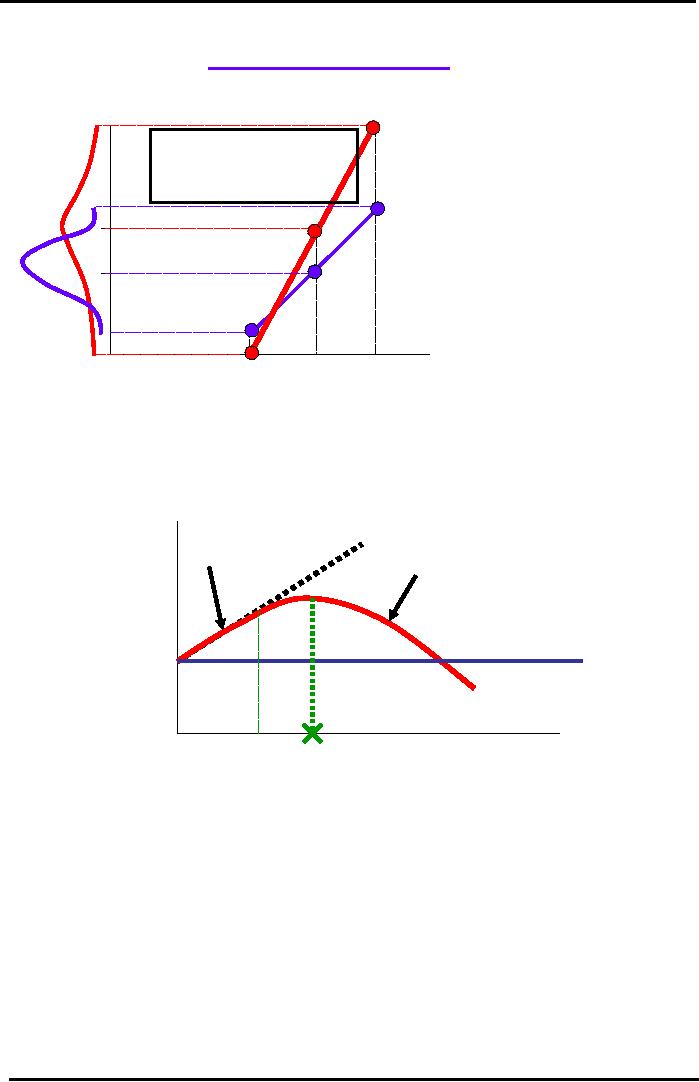

Portfolio

Efficient Frontier & CML -

Important

P

Efficient

Frontier for

rP* =

rRF + [ (rM

- rRF) / M

]

rP*

3-Stock

Portfolio

e

Lin

30%

t

rke

Stock

C

a

lM

"The

Parachute"

a

pit

Ca

Stock

A

20%

Optimal

Portfolio Mix

(50%A,

30% B, 20%C) if

10%=

Stock

B

rRF

Risk

Free T-Bill ROR =

10%

40%

20%

2.5%

P

Portfolio

with Negative

Portfolio

Risk

3.4%

or

Zero Correlation

Coefficient

Security

Market Line (SML)

ALL

Efficient

Stocks in

Efficient Markets

Important

Required

rA =

rRF +

(rM -

rRF )

.

IMPORTANT

Return

(r*)

A

rA= 30%

ne

i

et

L

rk

a

ty

M

rM=

20%

Market

Risk

uri

Sec

Premium

for

Risky

Stock A's

Avg

Stock = 10%

rRF= 10%

Total

Risk

Premium

=

30-10

= 20%

A

=+ 2.0

M

=+ 1.0

Beta

Risk (

)

190

Financial

Management MGT201

VU

Combined

Risk & Return

Graphical

Comparison of

Investments

T-Bill

B: Low

Risk

&

Low Return

Project

C:

High

Risk

B

Risk

& High Return

Risk

C

Exp

Return C

Exp

Return B

Rate

of Return ( r ) %

Entire

Firm

�

Return - ROA = (NI + Interest) /

(D+E) or ROE = NI / E

�

Risk - Standard Deviation in ROE

(stand alone), FIRM BETAS

(market Risk)

�

Firm's Overall Level of

Risk = Business Risk +

Financial Risk

Business Risk caused by

changes in price and cost of

raw materials and

products

and Operating Leverage

Business Risk and Operating

Leverage

(OL = Fixed Costs /

Total Cost). OL can be good if

Sales > Breakeven

Point

Financial Risk, Financial

Leverage:

Financial Risk caused by

Financial Leverage or

Debt

(FL = Debt / Total

Assets = D / (D+E)). FL can be

good if EBIT / Total

Assets

> Cost of Debt

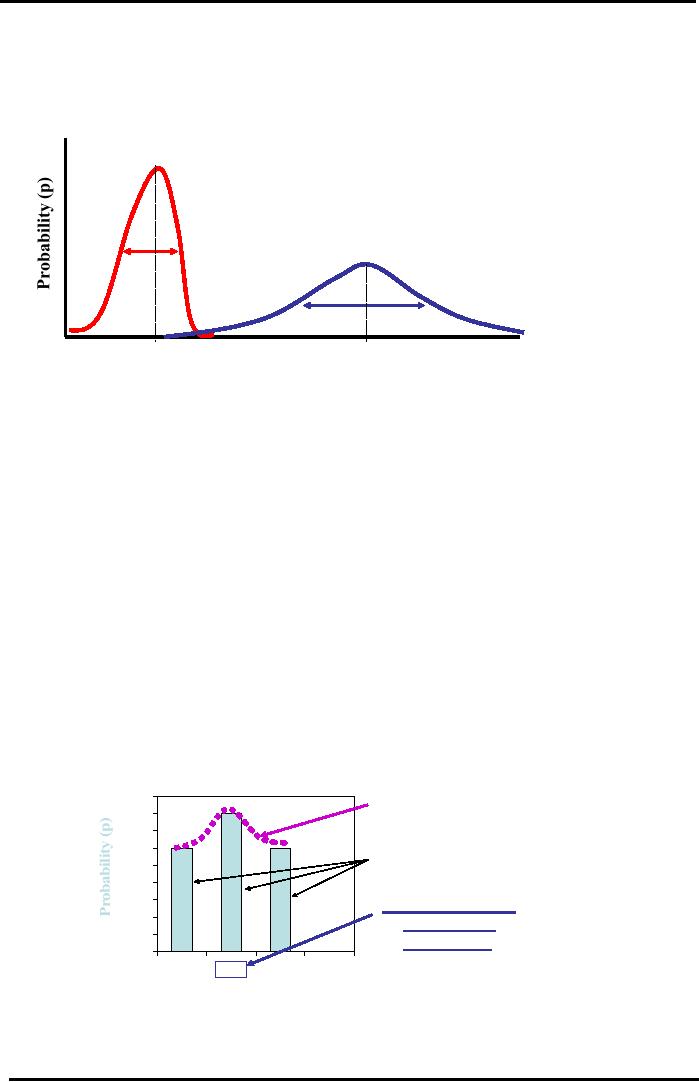

Probability

Distribution

Many

Possibilities for Forecasted Returns

of

Single

Stock Uncertainty & Risk

"BELL"

0.45

Curve

0.4

0.35

0.3

Possible

0.25

Outcomes

0.2

0.15

"Expected

ROR"

0.1

or

Most Likely

0.05

or

Mean ROR =

0

10%

-20

10

40

Rate

of Return After 1 Year < r

>

5-

Capital Structure and Corporate

Financing - Long Term

LIABILITIES Side of Balance

Sheet

191

Financial

Management MGT201

VU

Maturity

Matching or Hedging Principle

of

Financing Important

Value

(Rs)

Spontaneous

Financing

ie.

A/c

Receivables

Spontaneous

Current

Short

Term

Assets

Loans

Temporary

Current Assets

Permanent

Financing

ie.

Equity & Long

Term

Loans

/ Bonds

Fixed

or Permanent Assets :

Life

/ usage more than 1

Yr

Time

Buy

Permanent Fixed Assets with

Permanent Financing. IMPORTANT

Objective:

To maintain best balance of

Debt & Equity

Capital

Cost

vs. Required Return- Net

Proceeds, After-Tax Cost of

Debt , Source of

Equity

�

Compute Cost using Net

Proceeds: NP = Market Price (Po)

Issuance Costs

�

After-Tax Cost of Debt:

rD (1-Tc)

�

Source of Equity: Retained Earnings

cheaper than Fresh Stock

Issuance in

Stock

Market

WACC (%) - Use MARKET

VALUES of Debt and

Equity,

FIRMS TRY TO MINIMIZE THEIR COST OF

CAPITAL

�

WACC = rDxD +

rExE. IMPORTANT

FORMULA

rD and

rE are "Costs" of Debt &

Equity respectively. INTEREST is

the

cost

paid by Firm to Investors

who hold Firm's Debt.

DIVIDEND is

cost

paid by Firm to Investors

who hold Firm's

Equity.

xD and

xE based on MARKET VALUES of

Debt and Equity,

Firm Value = Value =

Debt + Equity

=

Share Price x Number of Shares

Outstanding

Two

ways to compute:

NI

(or EBIT) Approach (E = NI /

rE

V

= E+D) and Tax Shield (or

NOI) Approach (VL =

VU + Tc D

EL rE

WACC)

VL

is Value of Levered Firm. VU is

Value of Un levered Firm. Tc is

Corporate Tax %. D is

Debt.

192

Financial

Management MGT201

VU

SML

WACC Graph

Important

Required

FEASIBLE

REGION (where

SML

Line

ROR

rCE (%)

IRR

of investment or project

(EXTERNAL

is

more than SML

and

MARKET

WACC)

criterion)

IRR

< SML

1

WACC

Firm's

own

WACC

3

IRR

< WACC

2

(INTERNAL

rRF

=

T-

IRR

<WACC < SML

Bill

rate

criterion)

Beta

Risk

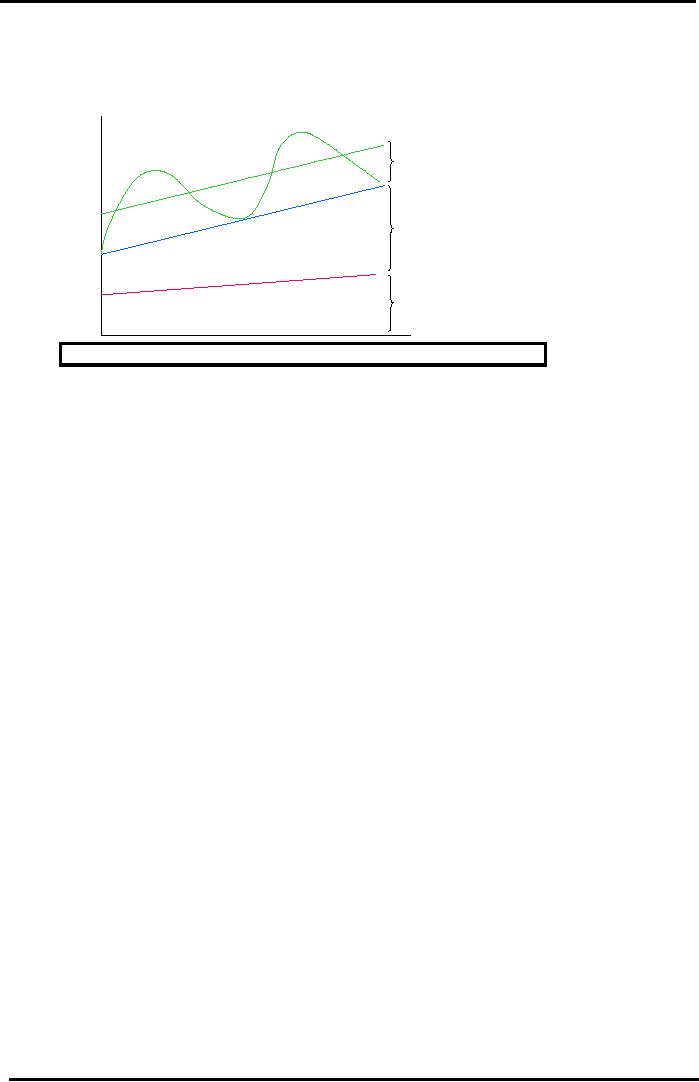

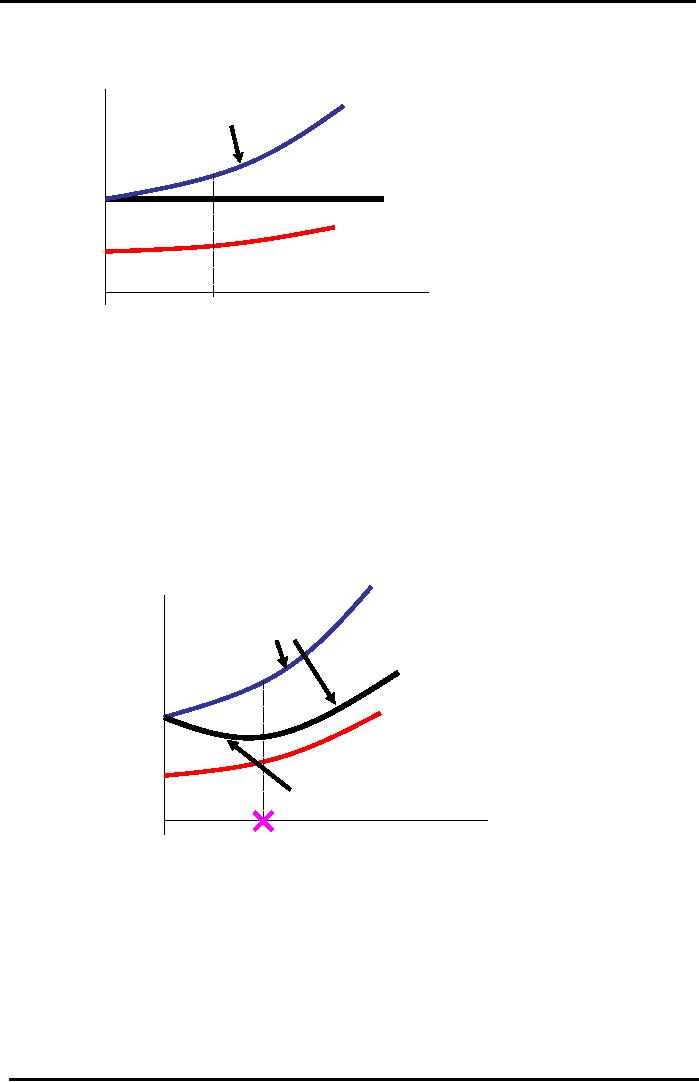

Visualizing

Operating Leverage

(OL)

Impact

on Breakeven Point & Capital

Budgeting

Revenues

&

Sales

REVENUE Line

Total

COST Line

Costs

(Rupees)

Company

A:

OL

= Fixed Cost /Total

Cost

Higher

OL So

Higher

Breakeven

Total

COST Line

Company

B

Breakeven

A is Higher.

A

is More Risky. As

Fixed

Costs A

long

as Sales >

Breakeven,

OL is Good.

Fixed

Costs B

Sales

Quantity

(#

of Units)

QB*

QA*

193

Financial

Management MGT201

VU

Visualizing

Financial Leverage

(FL)

Impact

on ROE & Capital Structure

LEVERED

(Debt

ROE

(%)

&

Equity) Firm:

77%

Higher

Slope.

FL

IS GOOD IF EBIT /

ROE

more

ASSETS

> COST OF

sensitive

to

42%

DEBT.

changes

in EBIT

35%

= <ROE>L

UN-LEVERED

(100%

Equity)

21%

= <ROE>UL

Firm.

Safer

Capital

Structure

3.5%

at

Low EBIT's

0%

EBIT

(Rs)

Tradeoff

Theory Graph

LeveSlahgeeve&geOiptiImeaTaxCapital

Structure

rig

tly L ra d F rm: nter st l

Shield

Benefit. Total Return to

Investors

Excessively

Leveraged Firm:

Rises

so Stock Value Rises.

Total

Return

Threat

of Bankruptcy has

Real

=

Net Income (paid to

Shareholders) +

Value

of

Costs.

Less Investor

Interest

(paid to Debt

Holders)

Firm

or

Confidence

and Lower Share

Price.

Price

of

Stock

Firm

Remains 100%

Equity

(Un-Levered)

Financial

Leverage =

OPTIMAL

Capital

Debt

/ Assets =

Structure

- MAXIMUM

D/(D+E)

VALUE

& MINIMUM

WACC

Capital

Structure Theories:

Tradeoff Theory: Little

Debt reduces WACC. High

Debt Bankruptcy Risk

Signaling Theory: Raising

New Debt carries Positive

signal to market. Fresh

Equity

carries

Negative Signal

Agency Theory: Managers'

Personal Motives clash with

Shareholders' (Owners')

Interest

Capital

Structure Models

Miller

Modigliani

(Without

Taxes: rE = WACCU

+ (D/E

(WACCU

-rE),

194

Financial

Management MGT201

VU

Pure

MM Theory - Ideal Markets

WAFinancialGraph

- Important

CC

Risk.

Cost

of

rE =

Cost of Equity

Higher

Required

Capital

Return

on Equity.

=WACC+D/E

(WACC-rD)

Higher

rE

(%)

WACC

=

rE

rDxD

+ rExE

rD =

Cost

rD

of

Debt

Debt

/ Equity = A

Measure

of Leverage =

100%

D/E

= xD / ( 1- xD

)

Equity

Firm

Market

Value of Firm = V = EBIT /

WACC. As Debt Increases,

Risk Increases so rD and rE

and

WACC

should increase. BUT Debt is

cheaper than equity (recall

Risk Theory) so as

Debt

Increases,

WACC should decrease! Net

Effect is No Change in WACC and No

Change in

Value.

CAPITAL BUDEGTING is Independent of

Corporate Finance / Capital

Structure.

DEBT

HAS NO BEARNING ON A FIRM'S

VALUE!

Traditionalist

Theory - Real Markets

WACC

Graph - Important

Bankruptcy

Risk

&

Cost

of

Costs.

Higher

Capital

Required

Return on

rE,L =

Cost of Equity =

Equity.

Steeper Rise.

(%)

WACCU +

xD(WACCU

-rD)

(1-TC)

WACCL =

rD(1-Tc)xD +

rExE

rE

rD =

Cost of Debt

rD

Interest

Tax Shield

Advantage

Debt

/ Equity = A

100%

Optimal

Capital

Measure

of

Structure

= Minimum

Equity

Leverage

= D/E = xD

WACC

and

Firm

Maximum

Value

/

( 1- xD )

Note:

xD = D / (D+E)

Traditionalists

Formulas (WACCL =

rD (1-Tc) xD

+ rExE)

FIRM'S

VALUE = EBIT / COST OF CAPITAL. MORE

LEVERAGE (OR DEBT)

MEANS

MORE RISK WHICH MEANS

HIGHER COST OF CAPITAL AND

THEREFORE

LOWER VALUE

Traditionalist

View is based on Practical Reality.

Leverage provides Interest

Tax

Savings

(or Shield) but also

Increases Financial Risk.

Excessive Leverage leads

to

Bankruptcy

Risk. Increases in Risk will

Change Value of Firm and

WACC.

195

Financial

Management MGT201

VU

Practical

Capital Structure Management- Target

Ratios i.e. TIE of 2.5. TIE

and Debt /

Capitalization

Dividend

Policy Theories - MM, Signaling, and

Agency,

DIV1

= DIVo (1+g) , g = Pb x ROE , If ROE < rE then

better to give Dividends

than to

Retain

Earnings

MM: Dividend Policy and Debt

are Irrelevant to a Firm's

Value. What matters

is

the Cash Flows from

Underlying Assets and NOT

how you divide or split

up

the

Cash Outflows i.e.

Dividends. IMPORTANT.

Signaling Theory: Issuing

New Debt (or taking

new loan) gives positive

signal

to

Investors. Issuing Fresh

Stock / Equity in Stock

Market gives negative

signal.

Agency Theory: Management's

Personal Motives often clash

with Owner /

Shareholders

Objectives

Impact

of Dividend Announcement and Ex-Dividend

Date on Share Price

Dividend

Payout restricted by Capital Expenditure

Requirement, Target Debt

Ratio, and

restrictions

placed by Debt Contracts

DIV1

= Future Dividend

If

ROE < rE then better to pay

out Dividends rather than keep

cash as Retained Earnings

because

company is unable to generate an ROE high

enough to satisfy the

Shareholder's

Required Return (rE).

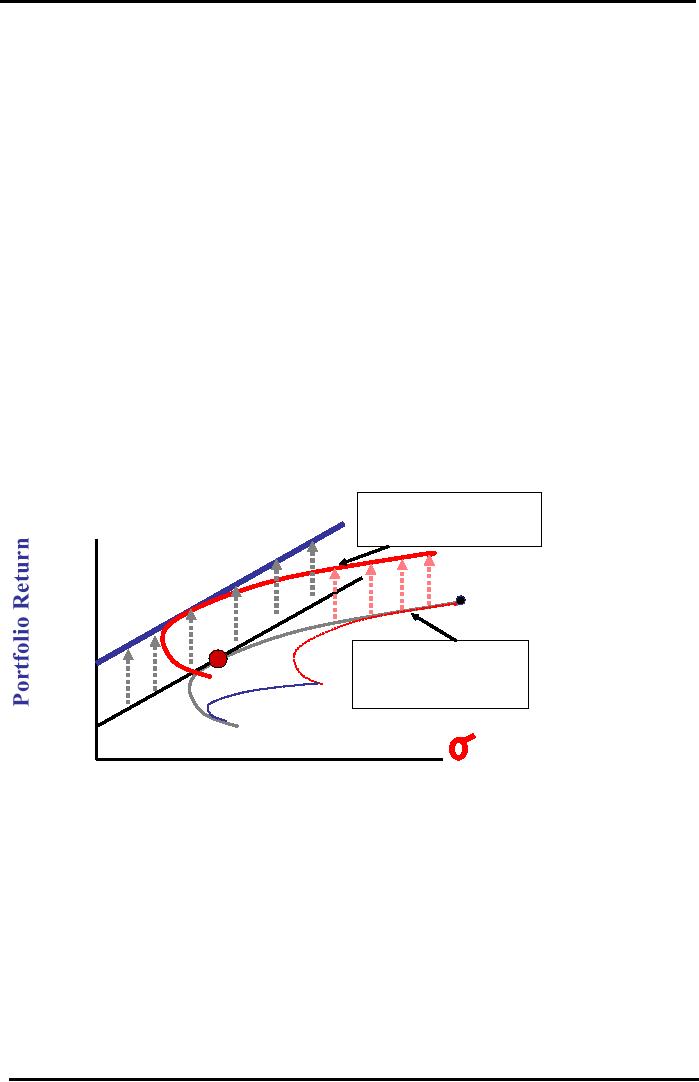

Global

Investing Makes the

Efficient Frontier

and

the

CML (Capital Market Line)

Rise Up

Higher

Return for Same Level of

Risk

Efficient

Frontier (for

)

rP*

nts

Global

Investments)

e

stm

ve

l

In

ba

s)

ent

o

Gl

stm

r

e

(fo

Inv

ML

y

ntr

C

u

Co

Efficient

Frontier

le

ing

S

(for

Investment in

r

(fo

rRF

L

Single

Country)

CM

P

Risk

Outline

of 4 Minor Areas of FM:

1-

Working Capital and Short

Term Financing

Current Assets Management:

Cash, Marketable Securities,

Inventory.

�

Current Assets necessary

for safe liquidity but

earn no / little return on

cash,

inventory

�

Fat Cat vs. Lean Mean , C/F

Synchronization and Cheques Float

,

Current Liabilities and Short

Term Financing: Accounts Payable and

Short Term Loans.

"Spontaneous"

and unpredictable source of

financing.

Types of Financing

�

Permanent (Equity & Long

Term Loan) vs. Temporary

(Short-Term Loan)

vs.

Spontaneous Financing (Current

Liabilities). IMPORTANT.

196

Financial

Management MGT201

VU

�

Hedging

Principle or Self-Liquidating Debt or

Maturity Matching:

Buy

Permanent

Assets with Permanent

Financing. IMPORTANT.

2-

Lease Financing

Financing Lease, Operating

Lease, Sale & Lease

Back

Ownership vs. Control

Valuation of Lease Finance: NAL

(modified NPV) and IRR

(%)

3-

Mergers and Acquisitions (M&A) and

Valuation of Firms

Mergers, Acquisitions,

LBO's

Merger Valuation using

DCF (NPV) or MMA Short-cut

Formulas

Impact of Merger on Share Price and

Value of Firm

4-

International Finance

Impact on Major Areas of FM:

Capital Structure and Corporate

Financing, Financial

Accounting,

Capital Budgeting

Foreign Exchange (F/x)

�

Markets: Spot, Forward, Futures,

Options

�

Relationships: PPP, Fischer Effect,

IRP

�

European Convention & Cross

Rates

----------------------------THE

END----------------------

197

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios