|

Financial

Management MGT201

VU

Lesson

41

SHORT

TERM FINANCING, LONG TERM

FINANCING AND LEASE

FINANCING

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics:

�

Financing

(Short Term and Long

Term Financing)

�

Lease

Financing

In

this lecture we shall

continue our discussion of

working capital financing and

will discuss

financing,

short

and long term financing and lease

financing.

Working

Capital Financing:

�

Financial Managers spend

More than 50% of their

time on Working Capital

Financing. This has

been

observed in many companies. In other

words, arrangement for funds to meet

day-to-day

expenses

like inventory, raw material

supplies and miscellaneous expenses has great

significance.

�

Sources

of Financing

Permanent

Financing:

Permanent

Financing comes in two

forms:

�

Long-term Loans / Bonds Duration of

this source is More Than 1

Year. It has

Low

Risk for Firm but

has High Cost

�

Common Equity / Stock -

"Perpetual." By definition. Less

Risk for Firm

but

Highest

Cost.

Recall

here concepts of cost of

debt and cost of equity we

studied in capital structure to

decide

which source of financing is

better for firm and

why?.

Temporary

Financing:

Temporary

financing also has two

forms:

�

Short-term Loan (An

example of working capital

financing) Duration of

this

source

is Less Than 1 Year i.e. 3

months, 6 months, 9 months, etc. Easier to

obtain

than

Long-term Loan as for long

term loans many requirements like

financial

statements

and guarantees need to be

fulfilled. Less costly than

Long-term Loan

due

to lower interest rate generally. But

this interest costs is variable /

uncertain as

you

have to renew it each time and

you are not sure

whether you will get the

same

lower

interest rate as before. So More

risky. Needs to be rolled

over frequently so it

is

less liquid.

�

Spontaneous Financing - Current

Liabilities like Trade

Credit and Accrued

Taxes

(payable)

and Wages payable form

its base. Arise

"Spontaneously" from

day-to-day

operations.

It is in the form of money you have to

pay but have not paid

yet to your

suppliers.

It is free loan or credit on

which you do not have to pay

any interest. As

you

do not know the amount of money

you will have and when, there is

Highest

Uncertainty

/ Risk. It has Least Cost

(can be free!). But you

cannot depend on it for

day-to-day

expenses as this all is just

your rough idea. You are

not sure.

�

Tradeoff

between Liquidity (Risk) &

Profitability (Return)

High Current Assets

means High Liquidity but

Low Profitability. This is due to

more

money

tied in current assets that

have low profitability.

Low Current Assets

means High Profitability but

High Risk. This is due to

money tied

in

fixed assets may not be

available for payments as

they come due.

High Long-term Debt

means Low Risk of

illiquidity but High Cost of

Debt in form of

interest.

High Current Liabilities

(or short-term Spontaneous Financing

like Trade Debt)

means

Low

Cost but High Risk of

illiquidity.

169

Financial

Management MGT201

VU

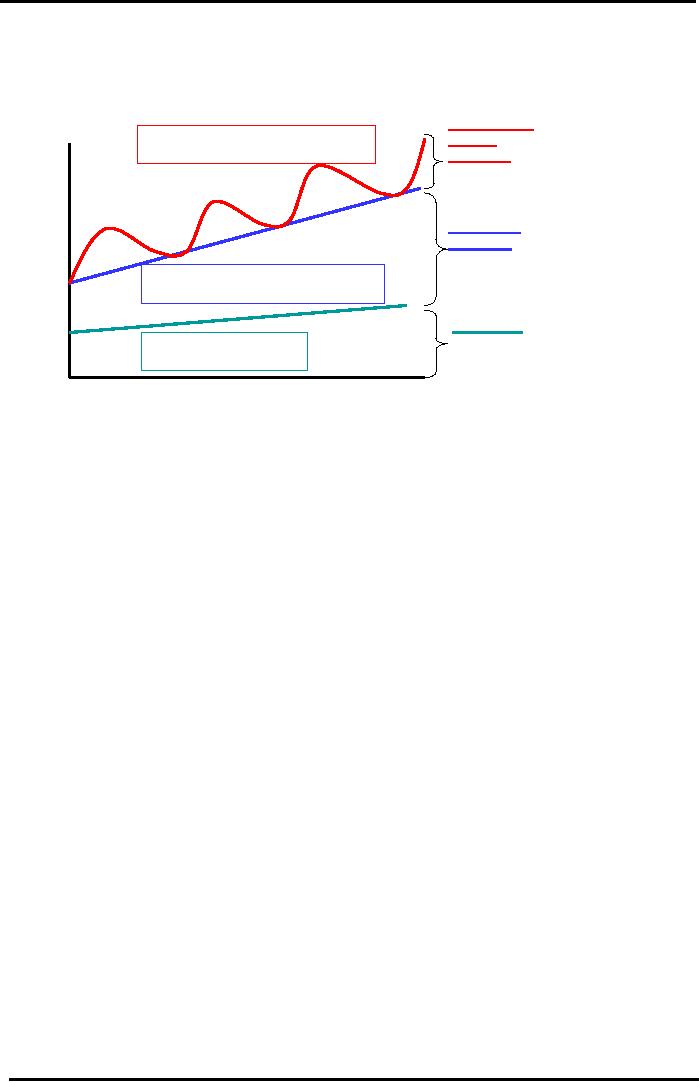

Graphical

View of Financing

Maturity

Matching Principle

Match

the Maturity of Financing to

Usage of Asset

Spontaneous

Value

(Rupees)

TEMPORARY

CURRENT ASSETS

Current

Usage

Less than 1 Year

Liabilities

&

Short

Term

Financing

Short

Term

Financing

&

Long

Term

"PERMANENT"

CURRENT ASSETS

Financing

Usage More than 1

Year

Long

Term

Debt

&

FIXED

ASSETS

Equity

Usage

More than 1 Year

Time

(Months)

If

a firm uses long term

financing it has higher cost

of financing comparatively due to

high

interest

cost of long term loans. Despite of this

high cost you have low

risk here due to surety of

access

to

money for a longer period.

Current liabilities as a source of

financing are not reliable

as you have no

surety

whether you will have same

amount of money available next

month for financing or less

amount

of

money or how much money.

Also, if firm keeps continue

this practice and do not pay

its accounts

payable

will raise so much after a

period that it may go

bankrupt.

How

Much Liquidity to

Keep?

�

Keep enough Liquidity to

meet maturing short term obligations

(i.e. Accounts Payable,

Interest,

etc)

on time. How much firm

should keep of short term loans and how

much of long term

loans?

The decision is made keeping

in view the following

principles:

�

Hedging

Principle (or Principle of

Self-Liquidating Debt or MATURITY

MATCHING)

Match Cash-flow characteristics of

Asset being purchased with the

maturity of the

Source

of Financing used to buy the

asset.

�

Example:

Shoe

Shop Owner can use Current

Liability to finance seasonal

expansion in

inventory

during Eid Time. If he uses

Long-term financing, then

excess / surplus / IDLE

LIQUIDITY

GIVING LOW / NO YIELD BUT COSTING

INTEREST SO LOWER

PROFITS.

Eid

does not come each

month. Shop owner needs

extra money / inventory only

for one month.

He

should take short term loan. If he

decides to take long term

loan he will have to pay for

extra

interest

cost unnecessarily.

�

Another

way of describing the hedging

principle is Permanent Asset Investments

should be

financed

by Permanent Financing. Buy

Temporary Assets through

Temporary Financing.

Permanent

Asset Investments: Fixed

or Movable or EVEN CURRENT

assets (i.e.

Inventory)

that a firm plans to hold

for > 1 Year. The economic

life of such assets

can

be

more or less.

Temporary

Assets: Current

Assets that will be

liquidated within 1 year.

These are a

subset

of current assets. Foe example,

inventory in use for less

than 1 year.

�

Example:

Use

Long Term Loan to buy a

long term asset. Studio

owner should Do NOT

use

short-term

loan (< 1 Year) to buy a sophisticated

professional Sony Digital

Camera costing

Rs.1.5

million which is expected to have an

Economic Life of over 5

years and has a

Payback

Period

of 2 Years. Use Long Term

Loan with Maturity over 2

Years so that there is

sufficient

time

to repay interest from cash

flows of asset (i.e.

Camera).

170

Financial

Management MGT201

VU

Working

Capital Financing

Policies:

Total

Assets = Fixed assets +

Permanent Current assets +

Temporary Current

assets.

Total assets steadily

grow with life of healthy

company.

Temporary Current fluctuates

with time. Extra spontaneous

inventory can be

financed

by

short-term debt financing or

loan

This

will help us to understand which

kind of policy should firm

adopt according to the kind

of

assets

a firm have.

�

3

Policies of Working Capital

Financing (Based on Hedging Principle of

Maturity

Matching)

Aggressive

�

Maximum Short-term financing at

low cost (but risk of

non-renewal)

�

Use short-term financing for

Temporary Current Assets and even

partly to buy

Permanent

Current Inventory

Conservative

�

Maximum Long-term financing.

Safe but higher interest

costs.

�

Use long-term financing

for Fixed Assets, entire

Permanent Assets, and even

part

of Temporary Current

Assets

Moderate

�

Balance of Long and Short-term

Financing. Based on Maturity

Matching

Principle.

�

Long Term permanent Financing

for Fixed assets like

land, building,

warehouse,

machinery and Permanent

Current Assets only.

�

Spontaneous financing or short term

financing is used for short term

portion of

current

assets

Long-term

Debt Financing:

�

What

Affects Financing Decisions (Factors influencing

the choice of long term

finance by

managers)

Capital Structure: match

Actual Capital Structure to Optimum.

"Sticky", non-smooth,

never-ending

process. It is not one day

work.

Maturity Matching (Hedging

Principle): match maturity of

debt to asset usage

time

Interest Rates: get long-term

financing if long-term interest rates

are low

Financial Health &

Credit-worthiness: get long-term

financing while firm is

still

healthy

�

Short-term

Debt

Bank Loans: Maturity

period < 1 Year. Collateral

(security) required i.e.

Property,

inventory,

or a/c receivables.

Commercial Paper: unsecured

promissory note issued by

large, strong firm

�

Long-term

Debt Financing (Maturity Longer than 1

Year)

The

following are the forms of

this loan:

Bank "Term Loans": > 1

Year

Bonds: Debentures vs. Mortgage

vs. Floating Rate

Syndicated Loan: for

large loans, one lead bank

heading team of other banks.

Due to

large

amount of loan one bank alone cannot

take the whole risk and

liability.

Project Financing: for

large international infrastructural

projects i.e. Electric

power

plants,

dams, development of highways.

Group of firms invest equity

capital in a New

Project.

Bank gives loan to New

Project. In return, bank is

repaid from cash flows

of

the

New Project. In fact, Bank

gets the cash inflows first

and then decides what to

do

with

them! No other collateral or security is

provided. So individual assets of

each of

individual

firms is free. So bank

protects itself by keeping

control of all the cash

flows.

Securitization: convert private

debt contract into publicly traded

financial instrument. A

large

loan can be divided into

smaller parts that are traded in the

money markets.

171

Financial

Management MGT201

VU

Lease

Financing

�

Leasing

of Fixed Assets (Financing of Capital

Expenditure in Fixed Assets)

Leasing Company (Lessor) buys and

owns the asset and leases it to the

Lessee

(Borrower)

who can use, operate, and

control the asset. Lessee

pays Lease Rental to

Lessor

in return. Lifespan of lease

can vary from few

days to years.

Like Collateralized Loan

(where the leased asset is the

collateral). Lease Contract

is

just

as serious as a loan agreement.

Failure to pay lease rental

is just like failure to

pay

interest.

Can bankrupt the Lessee

(Borrower). Lessor (Lender or

Leasing Company) can

seize

the leased asset and, if the claim is

larger, also demand up to 1

year lease rental.

Ownership vs.

Control

Between 10-30% of fixed

assets owned by Large

Companies are leased i.e.

Warehouses,

offices,

equipment, machinery, computers,

cars, furniture,

airplanes!

�

General

Advantages from Lessee's (Borrower /

user) Point of

View

It

guides towards when lease financing

should be used:

Less risky than investing

large amount of money in fixed

assets in a new businesses

that

suffer

from Cyclicality i.e.

Airplanes.

More suitable for

hi-tech assets that become

Obsolete quickly like software

houses

When product demand is

uncertain and hence

equipment life is

uncertain.

Lender has to share

portion of operational risk and

maintenance costs e.g. IBM

172

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios