|

Financial

Management MGT201

VU

Lesson

40

CASH

MANAGEMENT AND WORKING CAPITAL

FINANCING

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics:

�

Cash

Management &

�

Working

Capital Financing

Cash

Dividend Payout Decision:

�

Link between Dividend Policy &

Cash Management Cash

Dividends are paid out of

Cash!

�

Cash is an idle asset

that do not generate any

return for the company

�

How should firm decide to

pay Cash Dividend based on

Its Impact on Share Price and

Firm's

Value?

�

Gordon's

Formula:

Dividend

policy issue of the company can be

seen through Gordon's

Formula.

Po (Share Price) = DIV1 / (rE

g)

=

EPS x (DIV1/EPS) / (rE

(Pb x ROE)).

DIV1

= Forecasted dividend in the next

year

rE =

Required rate of return on

equity

g

= Growth rate in dividends

Pb =

Plough back ratio

The

two criteria that can

help to decide about dividend

are ROE and rE.

�

ROE is financial accounting measure

of the firm's ability to internally

generate a return. rE

is

the return that the firm's

shareholders REQUIRE. Firms

try to keep ROE HIGHER

than

rE.

�

If ROE < rE then

firm is not generating

enough return to meet shareholder

requirements so it

is

better to payout the dividend.

Lower ROE means company is not

finding sufficient

projects

to generate enough return

higher than rate of return on

equity.

�

If firm makes Dividend

payout, in this case, share

price Po (and Firm Value)

will RISE as

dividend

announcement has positive impact on

company's share

price.

�

If ROE > rE then

firm is better off to Plough

the Retained Earnings back into the

business

and

investing in Positive NPV

Projects or the Firm's core

business. In this case,

company

is

generating higher return

than the return shareholders

require, so the best use of

internally

generated

retained earnings is to use them as a

cheap source of capital or

financing.

�

In this case of ROE > rE if

firm makes Dividend payout,

share price (and Firm

Value) Po

will

FALL. Here it makes sense

for the company to keep cash and

invest it in investments

as

company is generating positive higher

returns on its projects rather than

paying dividend.

�

If ROE = rE then

dividend payment has no

impact on share price of the

company.

Inventory

Management:

In

the last lecture we studied working

capital and cash management in

detail. Now we discuss

inventory

management,

another part of working

capital.

�

3

Types of Inventories: Raw

Material, Work in Process,

Finished Goods

�

Issues

to Consider in Inventory

Management:

Inventory is acquired BEFORE

sales so estimates must be

accurate. EOQ (Economic

Order

Quantity)

difficult to estimate

otherwise:

�

Shortfall

in

Inventories: interruptions in production

and loss or sales

orders

�

Surplus

Inventories:

high carrying costs,

wastage, and depreciation

Case of Eid Time

Sales: Using Short-term Finance or

Loan to buy extra inventory

can be Risky

because

if you can't sell it,

you will be forced to sell

at a Deep Discount. So sell at a loss.

Cash

trickling

in BUT Retained Earnings being wiped

out. Not enough cash to

pay interest on the

loan.

Possibly default and

bankruptcy.

Inventory Costs:

�

Carrying Costs (cost of

capital, storage / warehouse

rent, insurance premium,

wastage)

as

high as 20 30 % of Inventory

value!

166

Financial

Management MGT201

VU

�

Shipping Costs: Generally

Less than 5% of Inventory

value!

�

Cost of Running Short

Loss of sales, customers, and

goodwill difficult to

estimate.

�

Inventory

Management Policies:

Technology

Based: Dynamic

Systems not only Static EOQ

Software for inventory

but

Dynamic

Computer Software that

considers Usage Growth

Rates. MRP (Material

Resource

Planning)

and ERP (Economic Resource

Planning) Software.

JIT:

Just in Time. Developed by

Toyota. Supplies arrive just

a few hours before they

are

used.

Inventory and Working

Capital is minimized. Improves

overall Efficiency.

Outsourcing:

Instead of making all the

parts yourself, buy them

from outside suppliers at a

lower

cost and avoid any

unionism issues. Example: IT

Divisions of Large

American

MNC's

outsource the writing of computer

software to Pakistani software

houses.

Accounts

Receivables Management:

This

is another area of working capital.

Accounts receivables are created

out of credit sales.

�

Most firms would

prefer to sell for Cash

BUT Competition forces them to

sell on Credit.

Example:

Fabric trading in Pakistan where sellers

offer 1 to 3 months credit

(and even longer).

�

Account

Receivables

=

Credit Sales per day x

Average Number of Days of

Credit

Example:

Account

Receivables

=Rs.10000

/ day x 30 days

=Rs.300000

of fabric "Stuck in the market" or "In

Rolling" at any given

time.

�

A/c Receivables (other than

Profit portion which appears

in Retained Earnings) need to be

Financed

somehow i.e. Short-term

loan, trade credit,

etc.

�

A/c Receivables = Daily Sales x

ACP

ACP = Average Collection

Period

=

weighted average days of

credit. Can be obtained from

Ageing Schedule (Financial

Accounting)

Example: Firm makes

30% of sales on 30 day

credit and 70% on 60 day

credit. So

ACP

=

(0.3x30) + (0.7x60)

=

9 + 42

=

51 Days

Try to Minimize Average

Collection Period and daily

credit sales.

Credit

Policy:

�

Factors

considered for

credit:

Credit Quality Aspect: Proper

Assessment of Credit-worthiness of each

credit customer

(Credit

Quality)

Minimize Time (Credit

Duration or ACP) and Value

(Credit Given)

Creative Credit

Terms

�

Incentivize

Customers to pay cash and to

pay quickly

"Sell on 5/10.net 30 basis". 30

basis Means customer must

pay full cash value

within 30

days.

5/10.net means 5% discount

for customers who pay

within 10 days. So it is an

incentive

for customer to pay cash

quickly.

�

Impose

Carrying Charge on Late

Payments

Example: 2% late payment

Charges if bill is not paid

within 30 days. Means 24%

penal

interest

per year! Example: If customer

does NOT pay Rs.100000 bill

within 1 month,

then

he will have to pay Rs.2000 extra

for every month that he is

late!

Working

Capital Financing

Policies:

It

involves the discussion regarding

how firms should finance

this working capital.

�

Sales

fluctuate with Nature of Business,

Time, Season, State of

Economy:

Economic Growth or Boom:

High inventories and Current

Assets

Economic Recession: Low

inventories and Current

Assets

167

Financial

Management MGT201

VU

�

Never drop to zero

because always need minimal

"Permanent Current Assets."

�

Total

Assets = Fixed + Permanent Current +

Temporary Current.

Total assets steadily

grow with life of healthy

company.

Temporary Current Assets

fluctuate with time. Extra

Spontaneous Inventory can

be

financed

by short-term debt financing or

loan

�

3

Policies for Working Capital

Financing (based on Maturity

Matching Principle)

Aggressive

�

Maximum Short-term financing at

low cost (but risk of

non-renewal of loan)

�

Use short-term financing for

Temporary Current Assets and even

partly to buy

Permanent

Current Inventory

Conservative

�

Maximum Long-term financing.

Safe but higher interest

costs.

�

Use long-term financing

for Fixed Assets, entire

Permanent Assets, and even

part

of Temporary Current

Assets

Moderate

�

Balance of Long and Short-term

Financing.

�

Long Term Financing

for Fixed and Permanent

Current Assets. Use

Short

Term

Financing for Permanent

Current Assets. Use

Spontaneous Current

Liability

Financing for Temporary

Current Assets

�

Advantages

of Short Term Debt or

Loan

Speed of getting finance as

they are short run

Flexibility (not locked

in)

Lower Interest Rates

(generally Upward Sloping or

Normal Yield Curve)

�

Disadvantage

of Short Term Debt is

that cost of debt is

uncertain and variable in

long run.

Non-renewable.

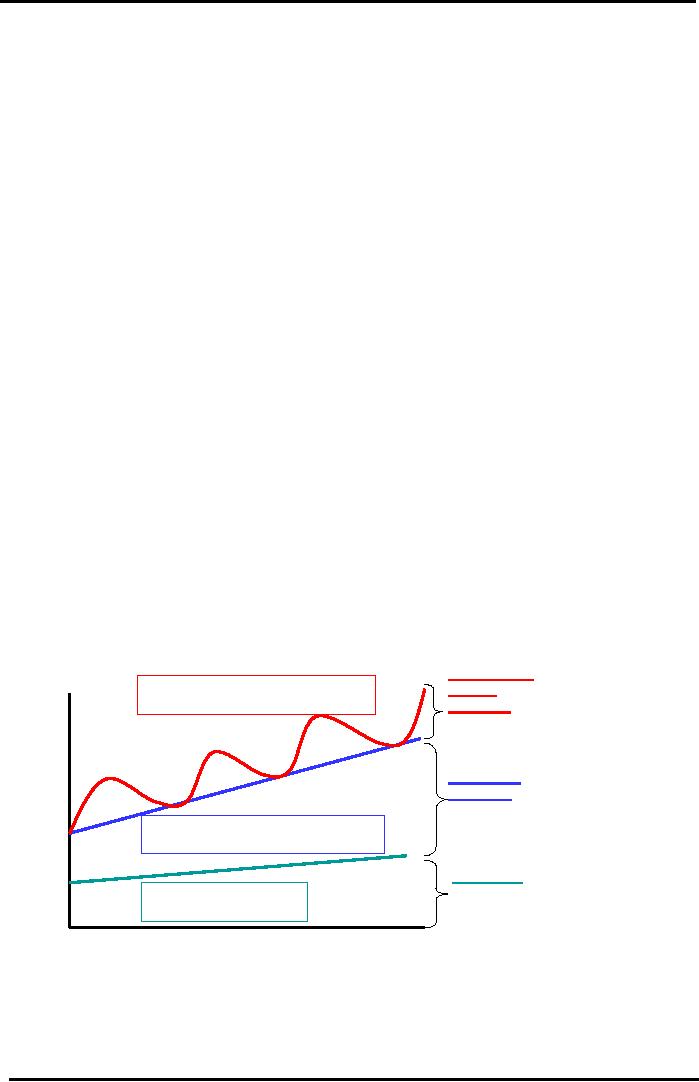

Graphical

View of Financing Maturity

Matching Principle Match the

Maturity of Financing to

Usage

of Asset:

Graphical

View of Financing

Maturity

Matching Principle

Match

the Maturity of Financing to

Usage of Asset

Spontaneous

Value

(Rupees)

TEMPORARY

CURRENT ASSETS

Current

Usage

Less than 1 Year

Liabilities

&

Short

Term

Financing

Short

Term

Financing

&

Long

Term

"PERMANENT"

CURRENT ASSETS

Financing

Usage More than 1

Year

Long

Term

Debt

&

FIXED

ASSETS

Equity

Usage

More than 1 Year

Time

(Months)

Firms

generally pursue moderate

policy of financing. Basic logic

behind this is MATURITY

MATCHING

PRINCIPLE.

168

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios