|

Financial

Management MGT201

VU

Lesson

04

TIME

VALUE OF MONEY

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

concepts.

·

Main

Concepts of FM.

·

Time

Value of Money

·

Interest

Theory and its

determinants

·

Yield

curve theory and its

dynamics

FM

Concepts:

There

are certain financial

management concepts that

should be kept in mind,

while making an analysis

of

a financial decision. The

one-liners given here would

help you in committing these

concepts to your

memory.

·

A rupee today is worth more than a

rupee tomorrow.

Time

Value of Money &

Interest

·

A safe rupee is worth more

than a risky rupee.

-

Risk

and Return

·

Don't compare apples to

oranges

-

Discounting

& NPV

·

Don't put all your

eggs in one basket.

-

Portfolio

Diversification

·

Get insurance because you

will break some

eggs.

-

Hedging

& Risk Management

Time

Value of Money:

The

first concept, time value of

money, says that a rupee in

your hand today is worth more

than

the

rupee that you are

going to get tomorrow or the day

after. This is because if

you have a rupee in

hand,

you can put it into a

bank (invest it) and can

earn interest (return) on it, and

tomorrow you are

going

to have more than rupee one, which of

course, is more desirable than having

just one rupee.

Risk

and Return:

Investors

want to earn maximum return

on their investment; however,

risk is a constraint to

this

objective.

Investors dislike risk-bearing,

unless they are adequately

compensated for that. Now

the risk

and

return concept states that a

safe rupee in your hand is better

than a risky rupee which is

not in your

hand.

This may imply that the

investors would be willing to bear

risk if they are offered

more than a

rupee

i.e., a certain premium for

risk bearing. However, in the

absence of this additional

compensation,

a

safe rupee is better than a

risky rupee. The details

about the concepts of risk and

return would be

discussed

in the middle of the course.

Discounting

& Net Present Value

(NPV):

The

third concept is of discounting and net

present value of money. This

is a fundamental

mathematical

concept and students need to

practice it to perfection. Whether

discounting for an asset

or

a

company, we have to see what

cash flow would it generate

during its future life

and then we bring

back

those future cash flow to

the present, i.e., we discount the

future cash flows to obtain

their present

value.

This exercise is done to make comparison

of cash flows occurring in

different time periods,

i.e.,

comparing

apples to apples, rather than

oranges. This concept is

relentlessly used throughout the

course

in

comparing different investment

options in different time

periods.

Portfolio

Diversification:

The

fourth concept is of portfolio

diversification i.e. how to

select different investment

options

so

as to reduce risk of losing the

invested money. For instance

if an investor has a million

rupees and he

invests

his total wealth in a single

company's share, he would be

exposed to greater risk. If the

company

goes

out of business or faces

serious loss, the investor is

likely to lose all his

investment. However, if

that

investor puts his total

wealth into shares of ten

different companies, the chances

that all the ten

companies

would face loss is

comparatively lesser and hence the

risk for the investor is

diversified and

reduced.

The rule of finance says do

not put all your

eggs in one basket, because

if you drop the

basket

accidentally,

you are likely to lose

all the eggs.

19

Financial

Management MGT201

VU

Hedging

& Risk Management:

Finally,

there is this fifth concept of

hedging and risk management.

Hedging is a strategy of

risk

management that is employed by investors

to reduce or minimize the chances of

loss. Insurance is

said

to be an effective tools used to

manage risk. The concept of

hedging and risk management

says that

whether

you put your eggs in one

basket or in different baskets,

chances are there that you

will break

your

eggs so it is better to get the eggs

insured Insurance is the best way to

avoid loss so that even if

the

loss

occurs you may get a claim

on your damages.

Now,

let's discuss the concept of interest in

detail, first major &

technical area in

financial

management.

Remember, that the basic objective in

financial management is to maximize

shareholders

wealth.

Interest

Theory:

·

Economic

Theory:

Interest

rate is an equilibrium price, expressed

in percentage terms, at which

demand and

supply

of funds (or capital) meet,

i.e., the rate at which the lenders are

ready to lend and buyers

are

ready

to buy. But equilibrium

price (Interest rate) varies from one

market to another. For

example,

the

"price" of capital in the

property market is different

from the "price" of capital

in the cotton

market.

Markets have different interest rates

guided by the supply & demand of

funds in that market.

Although

the interest rates in different markets

may differ, however, all the

markets in the country

and

the interest rates prevailing there are

interlinked.

Now,

we come to the factors that determine the interest

rates. It is important to understand

the

factors

that make up an interest rate in the

present day business

environment. In business when we

talk

about

the interest, we usually refer to nominal

rate of interest which is determined with

the help of

following

factors.

Factors

i

= iRF + g + DR + MR + LP + SR

i is the nominal interest rate generally

quoted in papers. The "real"

interest rate = i g

Here

i = market interest rate

g

= rate of inflation

DR

= Default risk

premium

MR

= Maturity risk

premium

LP

= Liquidity preference

SR

= Sovereign Risk

The

explanation of these determinants of interest

rates is given as

under:

Risk

Free Interest Rate (RF):

Factually

speaking, there is no such thing as a

risk-free rate of return because no

investment can

be

entirely risk-free. All the investments

and securities include a certain amount

of risk. A company

may

go bankrupt or close down.

However, if we talk about the

relevant risk involved in

different

securities,

the government-issued securities are considered as

risk-free, since the chances of

default of a

government

are minimal. These

government issued securities provide a

benchmark for the

determination

of interest rates. Internationally the US

T-Bills are considered as risk

free rate of return.

In

Pakistan, Government of Pakistan T-Bills

can be used as a proxy for

risk free rate of return,

however,

since

Pakistan faces some sovereign

risk, the T-bills would not

be considered entirely risk-free in

the

true

sense.

Inflation

(g):

The

expected average inflation over the

life of the investment or security is

usually inculcated in

the

nominal interest rate by the issuer of

security to cover the inflation

risk. For instance, consider

a

bond

with a maturity of 5 years. If the

inflation rate in Pakistan is 8 % and the bond is

also offering 8%

percent

interest rate, the investors would not be

willing to invest in the bond

since the gains from the

interest

rate would be exactly offset by the

inflation rate which is actually

eroding the wealth of the

investor.

To secure the investor against inflation

the issuers, while quoting

nominal interest rates, add

the

rate of inflation to the real interest

rate.

Default

Risk Premium

(DR):

Default

risk refers to the risk that the company

might go bankrupt or close

down & bonds, or

shares

issued by the company may collapse.

Default Risk Premium is charged by the

investor, as

compensation,

against the risk that the company might

goes bankrupt. Companies may

also default on

20

Financial

Management MGT201

VU

interest

payments, something not very unusual in the corporate

world. In USA, rating

agencies like

Moody's

and S&P grade securities (debt

and equity instruments) according to

their financial health

and

thus

identify those companies

which have a good ability to

pay off their principal

lending and interest

charges

and those which might

default on the payments. The rating

from best to worst is: AAA,

AA, A,

BBB,

BB, B, CCC, CC, C. In Pakistan, Pakistan Credit

Rating Agency (PACRA) and

Vital Information

Services

(VIS) are actively

conducting analysis of corporate securities and

grading them.

Maturity

Risk Premium

(MR):

The

maturity risk premium is

linked to the life of that

security. For example, if

you purchase the

long

term Federal Investment Bonds issued by the

government of Pakistan, you are

assuming certain

risk,

because changes in the rates of

inflation or interest rates would

depreciate the value of your

investment.

These changes are more

likely in the long term and

less likely in the short term.

Maturity

Risk

Premium is linked to life of the

investment. The longer the

maturity period, the higher the

maturity

risk

premium.

Sovereign

Risk Premium

(SR):

Sovereign

Risk refers to the risk of

government default on debt

because of political or economic

turmoil,

war, prolonged budget and trade

deficits. This risk is also

linked to foreign exchange

(F/x),

depreciation,

and devaluation. Now-a-days the

individuals as well as institutions

are investing

billions

of

rupees globally. If a bank

wants to invest in Pakistan, it will have

to take view of Pakistan's

political,

economic,

and financial environment. If the bank

sees some risk involved it

would be willing to lend

at

a

higher interest rate. The interest rate

would be high since the bank

would add sovereign risk

premium

to

the interest rate. Here it may be

clarified that Pakistan is not considered

as risky as many

other

countries

of Africa and South

America.

Liquidity

Preference (LP):

Investor

psychology is such that they

prefer easily encashable securities.

Moreover, they charge

the

borrower for forgoing their

liquidity. A higher liquidity preference

would always push the

interest

rates

upwards.

Yield

Curve Theory:

Term

Structure and Yield

Curve:

Interest

rates for any security

vary across time horizon.

The supply & demand for

funds vary

depending

on how long the funds are

required. Normally, short term interest

rates are lower than

long

term

rates, or we can say that

the interest rates depend on their term structure.

Based on the maturity, the

securities

can be classified into three

categories, although, these

classes have been loosely

defined.

Short

Term: Short

term means for the period of one

year or less.

Medium

Term: For

the period of any where between one

year to five years.

Long

Term: Any where between

15 years to 20 years some

people say that medium term

is

from

5 year to ten years and long term

from 10 years to 20 years and

plus.

Nominal

or upward sloping yield

curve:

The

supply & demand of funds or

capital varies depending upon

how long funds are

required. For

example,

today the supply and demand

for short term money might be

different from supply

and

demand

of the long term money. In another words, the number

of borrowers to take loan

for one week

may

be different from the borrowers of

loan for one year. Short

term interest may be different than

the

long

term interest; normally, short term interest

rates are lower than

long term than interest

rates

because

investors think that inflation is

going to increase. This phenomenon

results in nominal

or

upward

sloping yield

curve.

Abnormal

or downward sloping yield

curve:

Sometimes,

the reverse is true. This is

known as the Abnormal (or

Downward Sloping)

Yield

Curve.

It is the case where the short term raters

are higher than long term

interest tares. You can

also

16

have

a mixed or Humped Back

Curve.

12

N

o rm a l

8

A

bno rm a l

4

0

Yr

1

Yr

3

Yr

5

Y

r 10

Yr

20

21

Financial

Management MGT201

VU

Now,

we go into the reason why the

curves have either upward slope or

downward slope. Following

are

some

of the factors that determine the slope of the

yield curves.

Expectations

Theory:

Investors

normally expect inflation (and interest)

to rise with time thereby

giving rise to a

normal

shaped yield curve.

Liquidity

Preference Theory:

Investors

prefer easily encashable securities

with short maturities. The

only problem is that

short

term securities are easy to encash

but at maturity there is no guarantee

that you can renew it

.so,

you

can find a security today

which will give you 25

%or 30% per annum they are

not always

renewable

hence unpredictable.

Market

Segmentation:

The

demand/supply for Short Term

securities is different from that of

Long Term securities.

This

can easily give rise to an

Abnormal Yield Curve.

Now

let's talk about the

practical types of interest there three kinds of

interest we will talk

about

1-simple

interest

2-discrete

compound interest

3-continuous

compound interest

1.

Simple Interest (or Straight

Line):

Simple

interest incurs only on the principal.

While calculating simple interest we keep

the

interest

and principal separately,

i.e., the interest incurred in one year

is not added to the principal

while

calculating

interest of the next period. Simple

interest can be calculated using the

following formula.

F

V = PV + (PV x i x n)

Example:

Assume

that you have Rs 100 today

and you want to invest the

amount with a bank for

five

years.

The bank is offering an interest

rate of 7 percent. We can obtain the

simple interest on the

investment

using the aforementioned

formula

F

V = PV + (PV x i x n)

Here

FV is the simple interest accrued

for the term of the investment

PV

is the amount invested, i.e., Rs 100 in

our example

i

stands for the interest rate offered by

the bank, i.e., 7 % =

0.07

n

is the term of the investment, which is

assumed to be 5 years

Putting

these values in the formula, we

get

FV

= 100 + (100 x 0.07 x

5)

FV

= 100 + (7 x 5)

FV

= 100 + (35)

FV

= Rs 135

Here

Rs 135 is the future value of

investment after five years

and Rs 35 is the interest accrued

during

five

years on the initial investment of Rs

100.

2.

Discrete Compound

Interest:

Discrete

compound interest is the most commonly

used tool in Financial

Management

Discounting

and NPV calculations. Unlike

simple interest, compound interest

takes into account

the

principal

as well as interest accrued for a term,

while calculating interest incurred

during the next term.,

i.e.,

interest incurred for one year

would be added to the principal to

calculate the interest for the

next

period.

However, this compounding of interest

takes place in a discrete manner, i.e., the

compounding

takes

place yearly, semi-annually, quarterly,

or monthly. For computing the

annual compounding, we

use

the following formula

Annual

(yearly) compounding:

F

V = PV x (1 + i) n

However,

a slight modification in the formula is

need if the compounding takes place

monthly.

Such

a compounding would be calculated

using the following

formula.

F

V = PV x (1 + (i / m) m x n

Here

`m' refers to the compounding intervals

during the term of the investment. In

order to

calculate

monthly compounding, the value of

`m' would be 12; however,

for quarterly

compounding

calculation

m would be equal to 4

22

Financial

Management MGT201

VU

Example:

Assume

that the investor in our

previous example is offered a compound

return (interest) on his

same

investment,

at the same interest rate and term. The

future value of the investment is

given as under

F

V = PV x (1 + i) n

FV

= 100 x (1+0.07)5

FV

= 100 x (1.07)5

FV

= 100 x (1.40255)

FV

= 140.255

Here

the interest accrued on the five year

investment is more than what we

found out in simple

interest.

However

if the compounding is done every month

the future value of investment

would be

F

V = PV x (1 + (i / m)) m x n

FV

= 100 x (1 + (0.07/12)) 12 x 5

FV

= 100 x (1 + 0.005833)) 60

FV

= 100 x (1.005833) 60

FV

= 100 x 1.4176

FV

= 141.76

With

more frequent compounding, the wealth of

the investor increases to a greater

degree.

3.

Continuous (or Exponential) Compound

Interest:

The

other type of compound interest is

exponential compound interest. In this compound

interest an

infinite

number of times per year at intervals of

microseconds.

F

V (Continuous compounding) = PV x e

i

x n

Here

e is a constant the derived value of

which is 2.718

Example:

Assume

that the same investor has

now the opportunity of investing at

continuous compounding

with

the

same term and interest rate. His future

wealth after five years is

given as under

F

V = PV x e i x n

FV

=

100 x

2.718(0.07x5)

FV

= 100 x 1.419

FV

= 141.9

We

can see that the wealth of

the investor is the highest, when he

decided to invest in a scheme

which

offers

continuous compounding.

The

difference between simple and compound interest

can increase manifold if the term of

the

investment

is increased. As we see in the following

example

Example:

Suppose

you deposit Rs 10 in a bank

today. The bank offers

you 10% per annum (or per

year)

interest.

How much money will

you have in the bank after 15

years?

If

the bank is offering simple

interest:

F

V = PV + (PV x i x n) = 10+ (10x0.10x15)

= Rs. 25

If

the bank is offering discrete

compounding:

F

V = PV x (1+ i) n

= 10 x

(1+0.10)15

= Rs.

42

approx.

Banks

do not offer continuous

compounding but if they

did:

F

V = PV x e ixn

= 10 x

(2.718) 0.10x15

= Rs.

45

approx

23

Financial

Management MGT201

VU

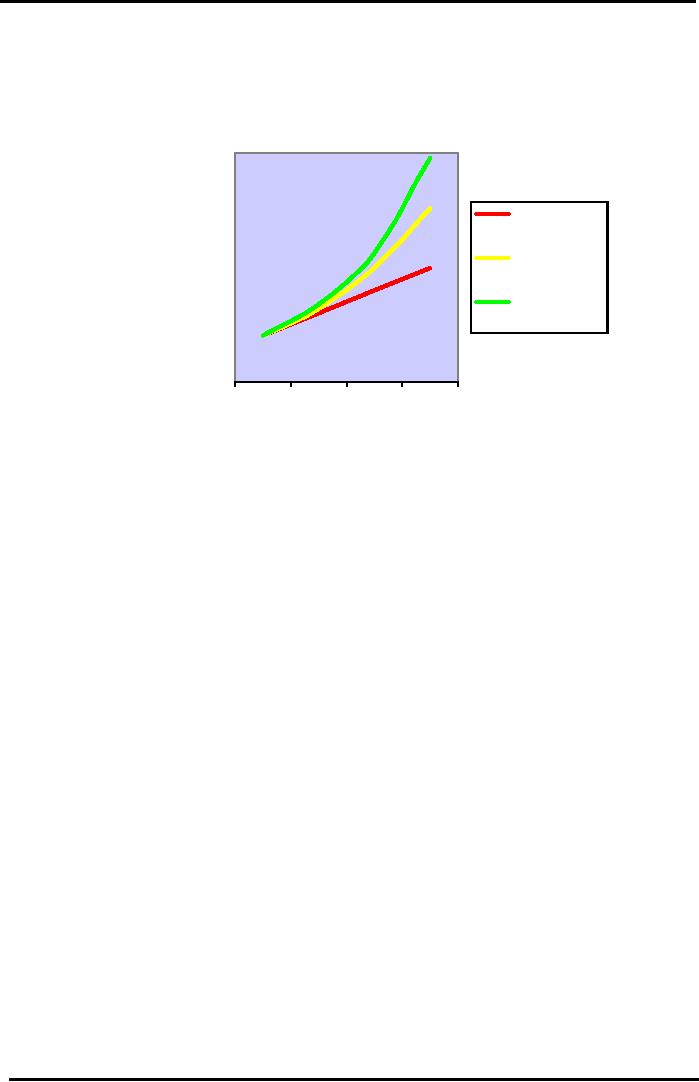

Graphical

View of Compounding

The

miracle of compounding you

earn interest

on

interest

&

principal!

50

Simple

Amount

Discre

te

(Rupees)

25

Compound

Continuous

Compound

0

Yr

1

Yr

5

Yr

10

Yr

15

Note:

After 15

years, Continuous Compounding

gives you almost two

times more money

than

Simple Interest. Compound

Interest gives you about

one-and-a-half times as

much!

24

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios