|

Financial

Management MGT201

VU

Lesson

35

NET

INCOME AND TAX SHIELD APPROACHES TO

WACC.

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topic:

�

Net

Income & Tax Shield Approaches to

WACC

In

the last lecture we discussed the impact

of debt on firm value under

Miller Modigliani approach

in

detail with numerical examples. We

also discussed the formulae to

see the impact of debt on

firm

value

under traditionalist real

market concepts. Now we

continue the same discussion

with the help of

an

example under traditionalist

real market views:

Traditionalists

-Real Markets

Example:

The

following example will help

to understand how we can calculate WACC

for a firm in the

real

world:

A

100% Equity Firm (or

Un-levered) has Total Assets

of Rs.1000. It has a WACCU of

21% and

rD,U of

10%. It then adds Rs.400 of

Debt. Financial Risk

increases rD,L of

Levered Firm to 13%. What

is

the

Levered Firm's rE,L and WACCL

? Tax rate is

30%.

Debt

rD(Interest)

rE

EBIT

NI

Equity

Market

Value WACC

(Given

D)

(Given)

(Given)

(Rs.)

(Rs.)

(E=NI/ rE)

(=D+E)

(%)

Rs.0

(=V)

0

21%

300

210

Rs.1000

Rs.1000

21%

Rs.200

10%

(rRF)

22%

300

189

Rs.859

Rs.1059

17.9%

Rs.300

11%

23%

300

187

Rs.813

Rs.1113

16.8%

Rs.400

13%

28%

300

183

Rs.653

Rs.1053

17.4%

Rs.500

14%

33%

300

179

Rs.541

Rs.1041

17.2%

�

Un

levered Case: D=0 ,

rE

= 21%

= WACC,

Market

value of Equity = E = V = Market

value of Firm (due to no

debt) = Rs1000

�

Leverage:

Debt

(and Leverage) is gradually increasing

from Rs.200 to Rs.500. Change

in

Leverage

Changes the Firm's Value.

When Debt = Rs.400 value of

firm has Increased to

Rs.1053

under traditionalist view

whereas we assumed firm

value fixed at Rs.1000 in Pure

MM

Ideal

Market Example. Rise in

value of firm is due to interest

savings.

�

Optimal

Capital Structure occurs

at Debt of Rs.300

(i.e.

xD = D / V = Rs.300 / Rs.1113 =

0.2695). So a Financial Leverage of

26.95% is the Best

Capital

Structure for this Firm.

Here, WACC = 16.8% and value

of the firm at its highest

=

Rs.1113.

�

After

this point value of firm

starts falling and WACC

rising.

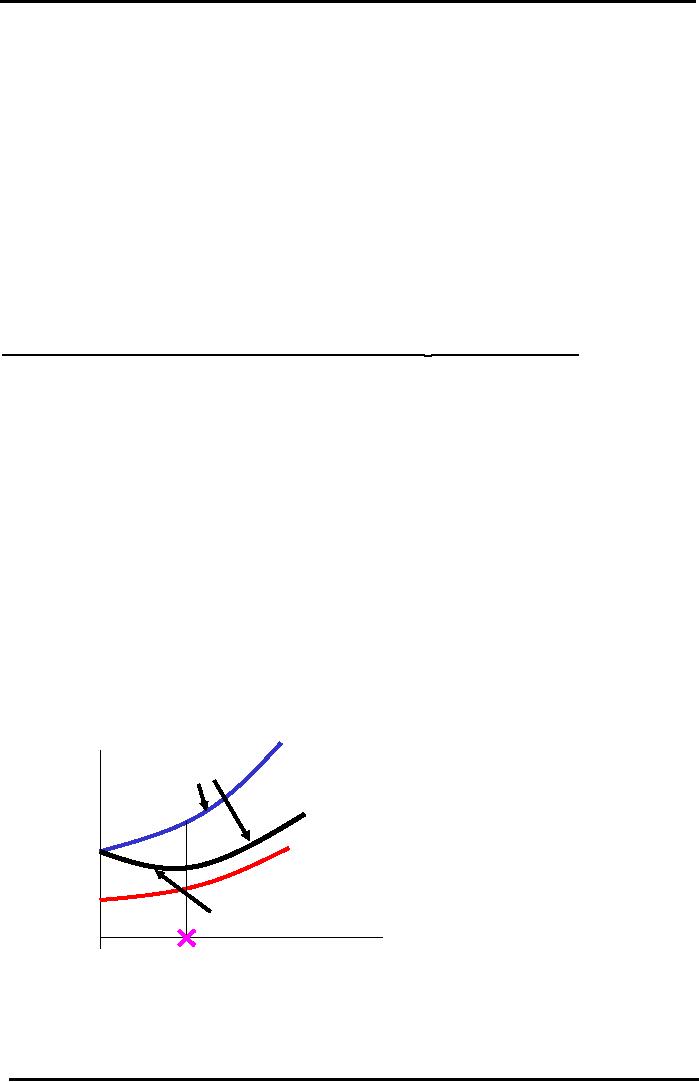

Traditionalist

View - Real Markets

Bankruptcy

Risk

&WACC

Graph

Cost

of

Costs.

Higher

Required

Return on

Capital

rE,L =

Cost of Equity =

Equity.

Steeper Rise.

(%)

WACCU +

xD(WACCU

-rD)

(1-TC)

WACCL =

rD(1-Tc)xD +

rExE

rE

rD =

Cost of Debt

rD

Interest

Tax Shield

Advantage

Debt

/ Equity =

100%

Optimal

Capital

Measure

of Leverage

Equity

Structure

Firm

D/E

= xD / ( 1- xD

)

Minimum

WACC &

Note:

xD = D / (D+E)

Maximum

Market Value

151

Financial

Management MGT201

VU

Here

cost of equity for a levered

firm rises very fast. Also

cost of debt rises. Recall

we have studied this

graph

earlier in previous lectures. Here

point to note is that WACC

line has become curve

with a

minimum

point at its lowest.

Initially it comes down as it

moves away from Y-axis and

then after

reaching

its minimum it starts going

up. The minimum point at

WACC is the best optimal

point for firm

to

operate for it capital structure.

Traditionalists

- Real Markets Effect of Leverage on

WACC:

�

Interest Tax Savings Increase,

Cost of Interest or Mark-up

Increases, and Cost of

Equity

Increase.

Depending on the Rate of Increase, they

can affect computation of

Firm's Market

Value

(V) and WACC in different ways -

either making them Increase or

Decrease.

�

Effect of Increasing Leverage

(as measured by Debt/Equity or

xD =

Debt/Value) on MARKET

VALUE

of Firm (V) is Uncertain.

Based on Combination of EBIT,

Tax Rate, Leverage,

and

Relative

Costs of Debt &

Equity.

�

Practically speaking, Initially

Leverage adds Interest Tax

Savings Benefit so Value (V)

rises but

after

some point the Cost

associated with Financial

Distress and Bankruptcy Risk

makes the

Value

Fall. MARKET VALUE of Firm

(V) typically reaches a MAXIMUM VALUE

where

WACC

is MINIMUM. This is the Optimal Capital

Structure.

NI

Approach for Calculating

Numerical value of WACC of Levered

Firm Example:

�

Starting Point for

Calculating Numerical Value of

WACC suing NI Approach is

EBIT of Firm

=

Rs.100 and Corporate Tax

Rate, Tc = 30%

If the Firm is 100% Equity

(or Un-Levered) and rE =

20% then what is the

WACCU

of

Un-levered

Firm?

�

Net

Income = EBIT - Interest -

Tax

=

100 - 0 - 0.3(100)

=

Rs.70

�

Market

Value of Un-levered Equity =

Eu

=

NI / rE

=

70 / 0.2

=

Rs.350

�

Market

Value of Un-levered Firm =

Vu

=

Equity + Debt

=

350 + 0

=

Rs.350

�

WACC

u = rE,U

=

20%

If

the Firm takes Rs.100 Debt

at 10% Interest or Mark-up

then what is the WACCL

of

Levered

Firm?

�

Net Income (NI)

=

100 - 10 %( 100) -

Tax

=

100 - 10 - 0.3(90)

=

Rs.63

�

Equity

=

NI / rE

=

63 / 0.2

=

Rs.315 (Major Assumption: No

change in rE)

�

VL = Equity + Debt

=

315 + 100

=

Rs.415. (Increasing Debt

ADDS Value!)

�

WACCL

=

rD,L (1-Tc) xD

+ rE,LxE

=

0.1(1-0.3) (100/415) +

0.2(315/415)

=

16.9%

Point

to note is that WACCL is lower than WACCU.

152

Financial

Management MGT201

VU

�

Sequence

of Steps:

(1)

Calculate

NI = EBIT - Interest -

Tax

(2)

Calculate

E = NI / rE

(3)

Calculate

VL = Equity + Debt

(4)

Calculate

WACCL

Tax

Shield Approach (or NOI

Approach) to Calculating WACC of Levered

Firm:

Tax

Shield = corporate tax rate * value of

debt = Tc * D

�

Relationships

between Un-Levered Costs and Levered

Costs of Capital

�

Sequence

of Steps for NOI Approach

for Calculating Numerical

Value of WACC for

Levered

Firm:

Step 1: Starting Point is

Market Value of Levered

Firm

=

VL = Vu + Tc D.

Unrealistic

because VL should NOT keep increasing

with Debt

Step 2: Tc x D = Tax Shield

Advantage from Debt.

Step 3: Market Value of

Equity = E = VL - D.

Step 4: Calculate rE,L = NI / E.

Step 5: Calculate

WACCL =

rD,L(1-Tc) xD +

rE,LxE

Note: WACCL =WACCU (1-Tc)

xD

�

Use

Either NI Approach or Tax

Shield Approach depending on

what Data has been given to

you.

Other

Short-cut Formulas & Link

between Capital Structure &

Betas

�

Cost of Equity (After

Tax) Estimates and STOCK

BETAS

rE,L = WACCU

+ xD (WACCU

-rD)

(1-Tc)

rE,L = rE,U +

Debt/Equity (rE,U -rD)

(1-Tc)

rE,U = rRF

+

BETAE

( rM -

rRF )

Recall

from CAPM Theory

�

WACC (After Tax)

Estimates AND FIRM

BETA

WACCL = rD,L(1-Tc)xD + rE,LxE

WACCL = rRF

+

BETAWACC,L (

rM - rRF

)

Note:

Overall Beta for the

Firm

=

BETAWACC,L = BetaD

xD +

BetaE xE

153

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios