|

Financial

Management MGT201

VU

Lesson

34

APPLICATION

OF MILLER MODIGLIANI AND OTHER CAPITAL

STRUCTURE

THEORIES

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics:

�

Applicability

of the Miller Modigliani Capital

Structure theory, Modified Miller

Modigliani

Capital

Structure Theory and other theories to

the Real World to see the Impact of

Debt on Firm

Value

& WACC Graphs

Effect

of Leverage on Cost of Debt & Cost of

Equity:

We

need to know both of these

effects to see the impact of leverage on

WACC.

�

Effect

of Financial Leverage (or Debt) on

Cost of Debt (rD):

At low leverage, increase in

leverage leads to slight

increase in overall risk and

return

of

firm.

At higher leverage, there is risk

of financial distress & bankruptcy.

Therefore, banks

raise

interest rate charges as now company

has become more risky. Cost

of debt raises

faster

and required rate of return (ROR) of

firm's debt holders (rD)

raises faster. So, as

a

result

of leverage financial risk of

firm rises and its cost of

debt also go up.

�

Effect

of Financial Leverage (or Debt) on

Cost of Equity (rE):

Firm's total risk

rises slowly at low leverage

and

Firm's total risk

rises faster when leverage

becomes excessive and risk

of financial

distress

arises. Also, firm's stock

beta rises and firm's stock

required ROR (rE)

rises,

and

cost of equity goes up.

From the Capital asset

pricing model, we know

whenever

the

risk of the firm raises, its

required rate of return also

rises and as a result cost

of

stock

will also go up.

Effect

of Leverage on WACC:

�

WACC

= rDxD +

rExE (assuming

no Preferred Equity) where

xD =

Fraction of Debt

xE =

Fraction of Equity

�

Effect

of Debt on WACC Changes with the

theory choice:

Effect

under Pure MM View (Ideal Efficient

Markets): Its

assumptions are No

Taxes

and No Bankruptcy Costs so Debt

increases Risk BUT is also

cheaper than

Equity.

Change in Debt has no effect

on WACC and Value of the

firm. WACC curve is

flat.

Effect

under Traditionalist View (Tradeoff

Theorists, Real Markets): Combined

Effect

of Taxes and Financial

Distress / Bankruptcy Costs

are a Flat U-Shaped

WACC

Curve

with a Minimum Point which

represents the Optimal Capital Structure

(i.e. Best

Debt

Ratio for the Firm).

Now

we discuss these effects in detail.

First we shall discuss

Effect of Debt on WACC

under

MM

ideal market theory in

detail and then later we

will discuss it under

traditional view.

Effect

of Debt on WACC under MM ideal market

theory:

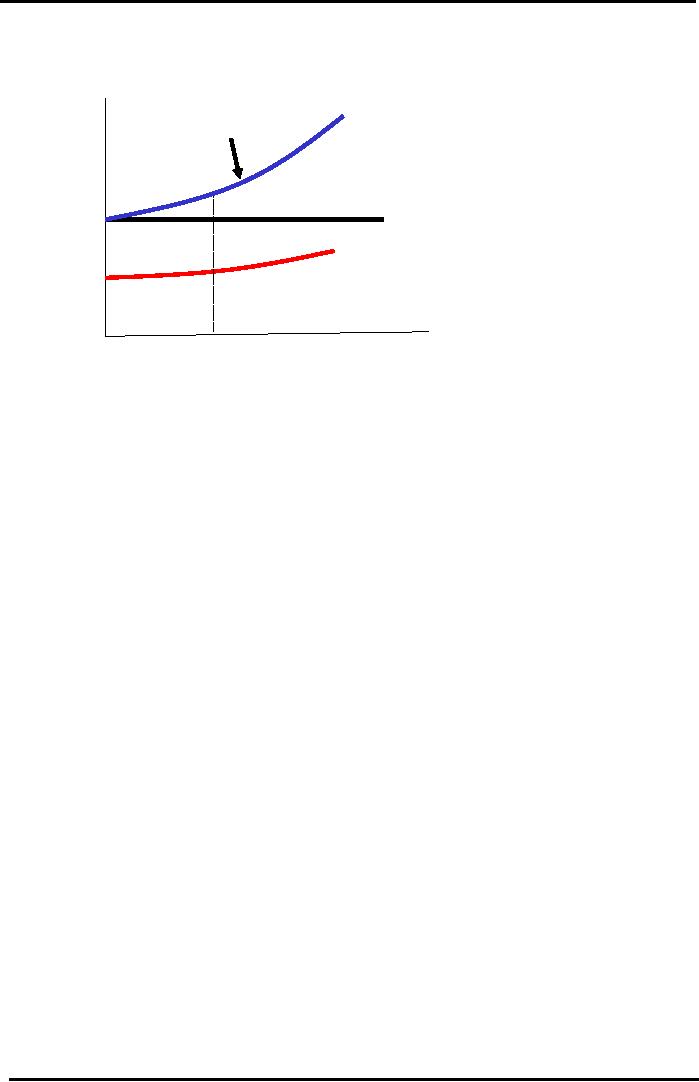

Visualize

the following graph keeping in

view ideal Miller Modigliani

Capital Structure theory

conditions

and assumptions of no taxes and

bankruptcy costs and equal

information available to

all:

146

Financial

Management MGT201

VU

Pure

MM Theory - Ideal Markets

WRisk.CC

Graph

A

Financial

Cost

of

rE =

Cost of Equity

Higher

Required

Capital

Return

on Equity.

=WACC+D/E

(WACC-rD)

Higher

rE

(%)

WACC

=

rE

rDxD

+ rExE

rD =

Cost

rD

of

Debt

Debt

/ Equity =

100%

D/E

= xD / ( 1- xD

)

Equity

Firm

On

the Y-axis we have cost of capital

and on the X-axis Debt to

equity ratio is proportional

to

financial

leverage. WACC is constant shown by

WACC line starting from

point rE on

Y-axis and going

straight

flat along X-axis. We know

WACC

= rDxD +

rExE.

When Debt to equity ratio is

zero at the

origin,

the firm is un levered or 100%

equity firm. As there is no debt the

cost of equity of the firm

is

equal

to its WACC at this point.

The straight line WACC

curve shows there is no change in

WACC

even

after debt under pure MM

ideal markets. As the leverage increases,

cost of debt and cost of

equity

rises

but WACC remains

unaffected.

MM

View - Ideal Markets

Numerical Example:

Now

we do a numerical example to calculate

these impacts just discussed

above:

�

A 100% Equity Firm (or

Un-levered) has Total Assets

of Rs.1000. It has a weighted

average

cost

of capital for un levered

firm (WACCU)

of 21% and Cost of debt for

un levered firm

(

rD,U ) of 10%. It then adds

Rs.400 of Debt. Financial

Risk increases Cost of debt

(rD,L

) of

Levered

Firm to 13%. What is the

Levered Firm's cost of

equity rE,L and WACCL

?

�

Assuming

Pure MM View - Ideal Markets:

Total

Market Value of Assets of

Firm (V) is

UNCHANGED.

Value of un levered firm =

Value of levered firm. Also,

WACC remains

UNCHANGED

by Capital Structure and Debt.

�

WACCU =

WACCL

=

21%

�

Now

we come to the cost of equity of

levered firm

rE,L =WACC

+ Debt/Equity (WACCL -

rD,L)

=

21% + 400/600 (21% -

13%)

=

26.3%

rE,L=

(WACC - rD,L

xD)/

xE

=

(21% - 13% (400/1000)) /

(600/1000)

=

26.3%

�

Cost

of Equity for Levered

Firm

=

rE,L = Risk Free Interest

Rate + Business Risk Premium +

Financial Risk Premium.

rE,L increases

because required ROR for stock

increased because of financial

risk.

147

Financial

Management MGT201

VU

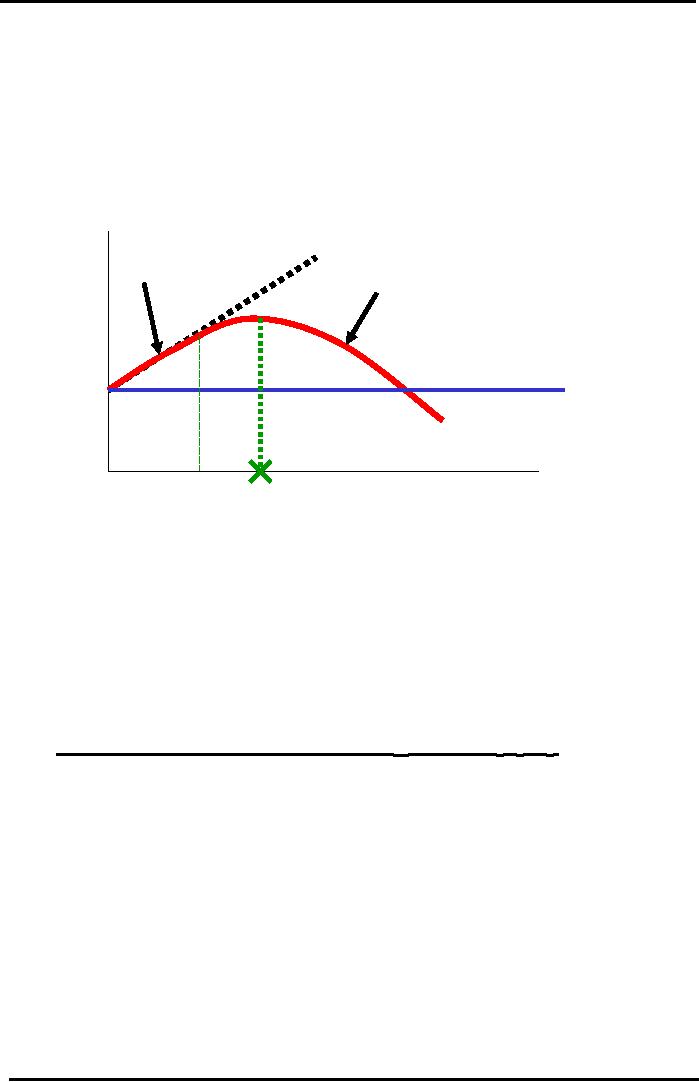

This

is the case of pure MM theory where there

are no taxes and bankruptcy

costs. But in case of

trade

off

theory in reality initially

value of the firm rises as there is

interest tax saving but

with excessive

leverage,

value of the firm starts

declining as interest cost goes

very high due to bankruptcy

risk. This

can

be shown in the following graph:

Tradeoff

Theory Graph

Linked

to Traditionalist Theory of

Leverage

& Optimal Capital Structure

Slightly

Leveraged Firm: Interest

Tax

Shield

Benefit. Total Return to Investors

Excessively

Leveraged Firm:

Rises

so Stock Value Rises.

Total

Return

Threat

of Bankruptcy has Real

=

Net Income (paid to Shareholders)

+

Value

of

Costs.

Less Investor

Interest

(paid to Debt Holders)

Firm

or

Confidence

and Lower Share

Price.

Price

of

Stock

Firm

Remains 100%

Equity

(Un-Levered)

Financial

Leverage =

OPTIMAL

Capital

Debt

/ Assets =

Structure

- MAXIMUM

D/(D+E)

VALUE

& MINIMUM

WACC

Here

maximum value point of the

firm is also the minimum

point of WACC. It is the

best

capital

structure for the firm to operate.

Pure

MM Ideal Markets

Example:

We

know the basic objective of the

firm is to maximize shareholder's

worth.

�

Example: Assuming Pure MM

Theory with Ideal Efficient

Markets where Total

MARKET

VALUE

of Assets of Firm (V =Debt +

Equity) is UNCHANGED by the Capital

Structure (and

Leverage).

Given the following Data on Leverage and

Cost of Capital:

Debt

(D)

Interest

(rD)

Equity

Cost

of Equity

(E

= V-D)

(rE =

(WACC- rD

xD)/

xE)

Rs.0

(=V)

0

Rs.1000

21%

(=WACC) Un-Levered

Rs.200

10%

(rRF)

Rs.800

(21%

- 10% (0.2))/0.8 =

23.75%

Rs.300

11%

Rs.700

(21%

- 11% (0.3))/0.7 =

25.3%

Rs.400

13%

Rs.600

(21%

- 13% (0.4))/0.6 =

26.3%

Rs.500

15%

Rs.200

(21%

- 15% (0.8))/0.2 =

45%

As

the level of debt increases

from Rs.0 to Rs.500 the cost

of equity rises from 21% to

45%.

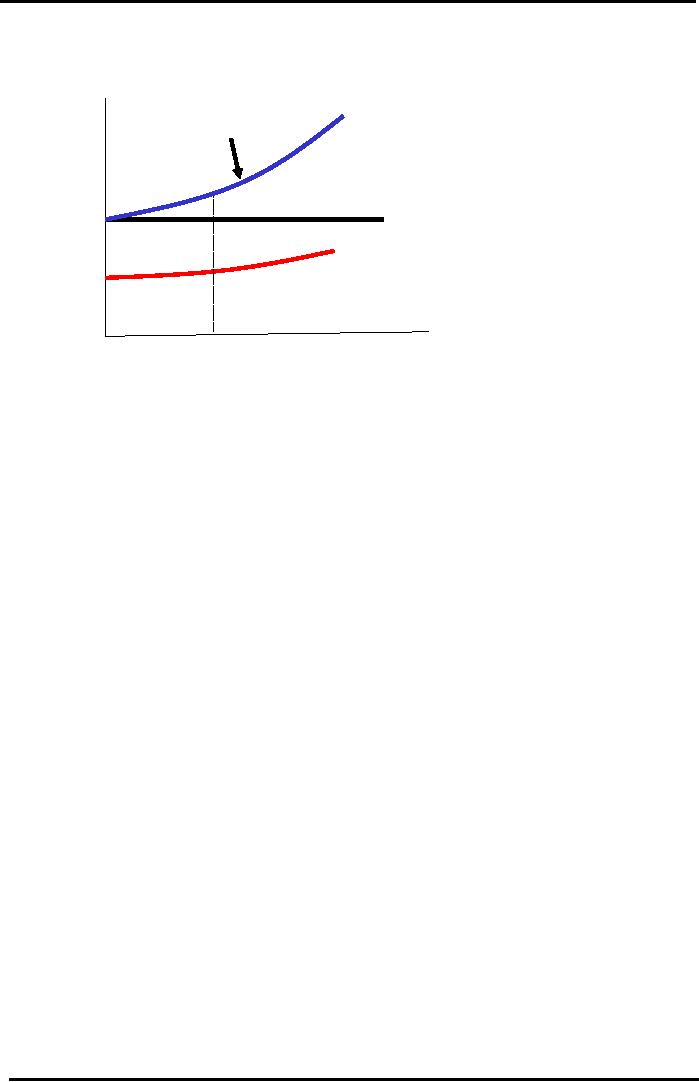

Consider

the graph we discussed above

again:

148

Financial

Management MGT201

VU

Pure

MM Theory - Ideal Markets

WRisk.CC

Graph

A

Financial

Cost

of

rE =

Cost of Equity

Higher

Required

Capital

Return

on Equity.

=WACC+D/E

(WACC-rD)

Higher

rE

(%)

WACC

=

rE

rDxD

+ rExE

rD =

Cost

rD

of

Debt

Debt

/ Equity =

100%

D/E

= xD / ( 1- xD

)

Equity

Firm

On

the Y-axis we have cost of capital

and X-axis Debt to equity

ratio= Financial leverage.

When

Debt

to equity ratio is zero at the

origin, the firm is un levered or

100% equity firm. As there is no

debt

the

cost of equity of the firm is

equal to its WACC. The

straight line WACC curve

shows there is no

change

in WACC after debt under

pure MM ideal markets. As firm

takes more debt, the line slope at

top

in

the graph increases at an accelerating rate,

this is due to very high

debt that has raised

bankruptcy risk

of

the firm.

�

Problem

of the theory: In Real

Markets, Total Market Value

of Firm (V) DOES CHANGE

as

Leverage

Increases. We have made above

calculations very simply

under ideal

conditions.

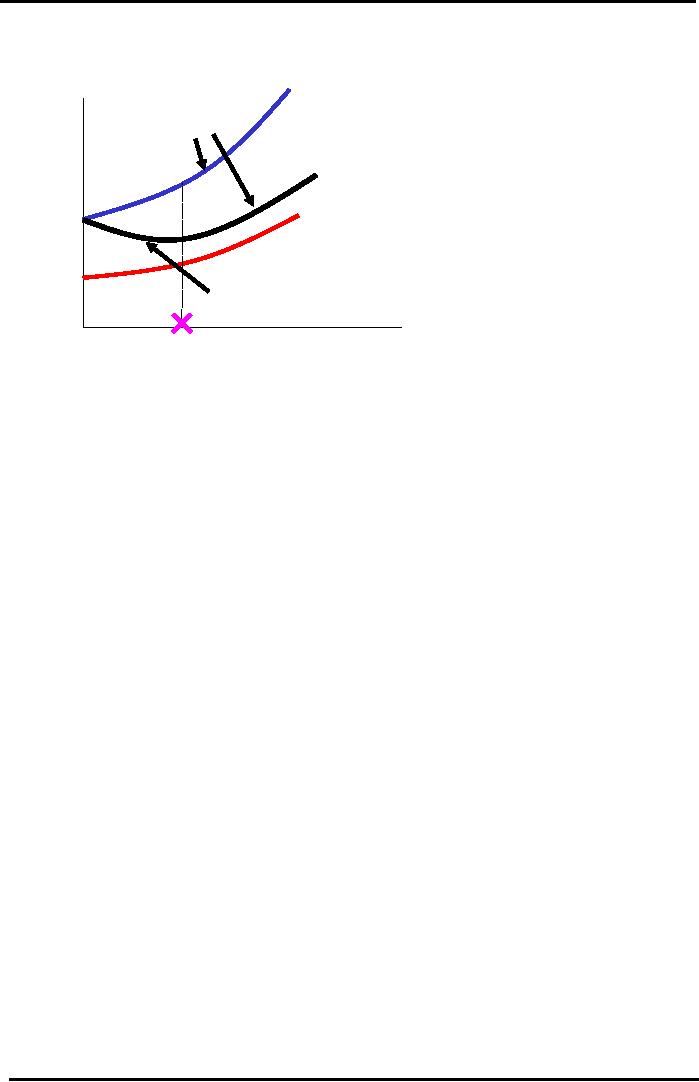

So

we have a traditional view to take

real effects into account. The

following is the same graph

with

traditional

views. Here cost of equity

for a levered firm rises

very fast. Also cost of debt

rises. Another

point

to note is that WACC line

has become curve with a

minimum point at its lowest.

Initially it comes

down

s it moves away from Y-axis

and then after reaching

its minimum it starts going

up. The

minimum

point is the best optimal

point for firm to operate

for it capital structure.

149

Financial

Management MGT201

VU

Traditionalist

Theory - Real Markets

Bankruptcy

Risk

& ACC

Graph

W

Costs.

Higher

Cost

of

Required

Return on

Capital

rE,L =

Cost of Equity =

Equity.

Steeper Rise.

(%)

WACCU +

xD(WACCU

-rD)

(1-TC)

WACCL =

rD(1-Tc)xD + rExE

rE

rD =

Cost of Debt

rD

Interest

Tax Shield

Advantage

100%

Debt

/ Equity =

Optimal

Equity

Capital

D/E

= xD / ( 1- xD

)

Firm

Structure

Note:

xD = D / (D+E)

Traditionalist

View Example:

�

We are using same

example with some additional

information to incorporate the effects of

real

world:

A 100% Equity Firm (or

Un-levered) had total assets of Rs.1000.

It had a WACCU

(Weighted

average cost of capital of un

levered firm) of 21%. It

then added Rs.400 at a cost

of

debt

rD,L (for Levered Firm) of

13%. What is the Levered

Firm's rE,L and

WACCL

(Weighted

average

cost of capital of levered

firm)? Given Data for

rE,

Corporate

tax rate of 30% on Earnings before

Tax, and EBIT = Rs.300.

�

Traditionalist View is based on

Practical Reality. Leverage provides

interest tax savings (or

shield)

but also increases financial

risk. Excessive leverage

leads to bankruptcy risk.

Increases

in

risk will change value of

firm and WACC.

�

Now rE is based on Observed Data and

Equity Value (E) is based on

Simple Income

Statement

Formulas.

�

Traditionalists Formulas for

Equity:

E

= Net Income (NI)/ Cost of

Equity for levered firm

(rE,L)

Note

that

NI

= EBIT - Interest - Tax =

EBT Tax

NI

= (EBIT - xD rD) (1 -

Tc)

rE,L =

WACCU

+ xD (WACCU

- rD ) (1 -

Tc).

�

Traditionalists Formula for

WACC:

WACCL =

xD rD

(1 - Tc) +

xE rE.

(1-Tc)

is the Tax Discount

Factor.

Note:

Value

of firm = Debt +

Equity

xD =

Debt /Value = Debt/ (Debt +

Equity)

xD +

xE = 1

V

= Market Value of Firm D =

Market Value of Debt

E

= Market Value of

Equity

xD =

Fraction of Debt = A Measure of

Leverage

In

the next lecture we shall

continue this discussion and

do more examples to see the impact

of

capital

structure on value of firm.

150

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios