|

Financial

Management MGT201

VU

Lesson

30

BUSINESS

RISK FACED BY FIRM,

OPERATING LEVERAGE, BREAK

EVEN POINT&

RETURN

ON EQUITY

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

�

Business

Risk faced by FIRM

�

Operating

Leverage (OL)

�

Breakeven

Point & ROE

In

this lecture, we are going

to continue our discussion on

weighted average cost of

capital and we

will

begin our discussion on the

concept of operating leverage.

Both of these concepts are

of the area

which

we have stated in the previous lecture

called capital structure.

In

capital structure we decide what the

distribution of debt and equity

should be in the firm and it

is

decided by the board of directors of the firm or

company. The job of deciding

what amount of debt

and

equity one has is

difficult.

So,

the first thing is to calculate the cost

of capital. so, the company has the

option that it may

either

go into money market or into

the capital market to raise

money either through debt or

through

equity

. Now, you might think the

equity the company might raise

has no cost. We all know

that when a

company

takes a loan it has to pay

interest or mark up on it but often

people think when it raise

fund

through

equity in stock exchange then there is no

cost attached to it because

they are not paying

any

fixed

rate of interest with regular intervals

.but that is mistake because there is

cost attached to it in

form

of

required rate of return which

your stock holder expects to

receive that and if company does

not pay

that

then the stock holder will

sell their shares and the

price of the share will go

down .Therefore it is

important

to calculate the cost of equity.

Now,

let's combine all the

cost associated with the

debt, preferred stock and

equity and

calculate

the weighted average cost of

capital (WACC) of company that

raise capital in all

three

possible

ways.

Example:

Suppose

company ABC has equal

amounts of debts, common stocks and

preferred equity 1/3

each

.in previous lecture, we

calculated what the cost of

debt was that was

11.2% then we calculated

the

cost

of preferred equity that was

16.7% and we also calculated the cost of

common equity which

was

22.7%

it was the most difficult

part of the WACC calculation

now, it is easy because we

are to apply

the

%of three different forms of

capital.

WACC=

rDxD+rExE+rPEp

=11.2

%( 1/3) +16.5 %( 1/3) +22.7

%( 1/3)

=16.9%

Now,

this is over all cost

for a company .what does it

mean? It means that it is the

average cost

that

company has to bear in order to

use the capital of investors. The

cost of debt or bond,

preferred

equity

and common stock this is the average of

all three securities cost.

It

means that the company should

invest in a project where the rate of

return is higher than

16.9%

because it should be higher

than the cost that it has to

pay to the investors. Let's see the

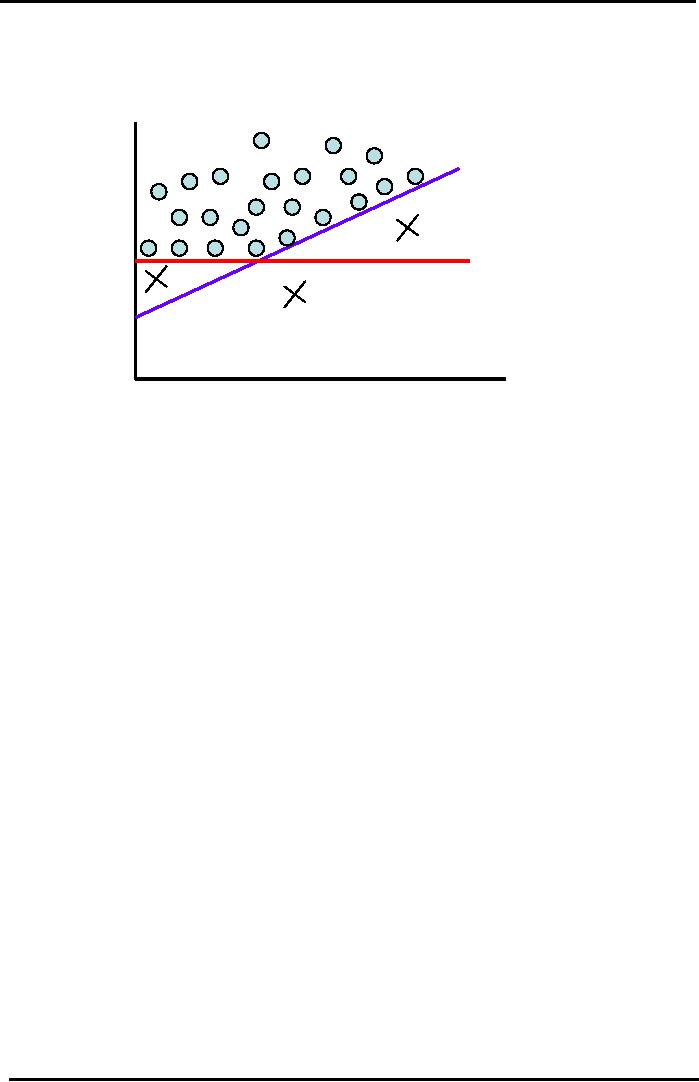

graph of

weighted

average cost of capital

compared to the security market

line we discussed in capital

asset

pricing

model (CAPM).

It

is important to understand this graph

because it combines the market factors in

the form of

SML

as well as the company's internal

cost in the form of WACC. It

shows that what combinations

of

the

risk & return for a

particular company to invest in or

not.

128

Financial

Management MGT201

VU

SML

WACC Graph

Required

FEASIBLE

REGION (where

SML

Line

ROR

rCE

(%)

IRR

of investment or

(EXTERNAL

project

is more than SML

MARKET

and

WACC)

criterion)

IRR

< SML

1

WACC

Firm's

own

WACC

3

IRR

< WACC

2

(INTERNAL

rRF

= T-

IRR

<WACC < SML

criterion)

Bill

rate

Beta

Risk

The

graph is a combine presentation of CAPM

and WACC.it shows the expected

return against

the

market risk or beta. In graph, the

upward sloping line is SML and it is the

requirement for bond

and

stocks

in efficient markets where there are

rational investors that are

maintaining fully

diversified

portfolio

and where knowledge spread

very quickly through the

markets. The risk and

return

combinations

of all securities should lie on

SML. The horizontal line is

WACC which is fixed at

16.9%

we

have just calculated it .This represents

required rate of return. In other words,

if the company invests

in

any new project it should

give a rate of return which is

higher than 16.9% you

see that the only

feasible

reason where that company made

investment is the area which I have shown

filled up with dots

and

this is higher then the SML

and WACC. I have also made

three crosses which represents

that why

will

not company invest in these

areas? The first cross on

right side X1 is showing rate of

return which

is

higher than WACC but

lower than SML the company will

not invest because it is not

giving as much

rate

of return as efficient market is

offering .The second cross

x2 is lower than WACC and SML

and

cross

three x3 is lower than WACC

but it is on the SML again the company

will not invest in these

two

projects

or regions.

It

will invest only in dots

regions on these two regions the cost is

higher and the return is

lower.

Debt

vs

Equity

from

Firm's Point of

View

Remember,

that it is mentioned that

generally speaking companies want to keep

the balance

both

in form of debt and equity. We have

also mentioned that debt

has a risk attached with it

because

when

we have to service the regular loan mark

up or interest which will eat

away your income and the

result

will be net loss. you know

that in income statement we deduct

certain financial charges

.it may be

due

to many reasons because the company

has to serve the debt .the

other reason is that if the

company

do

not pay interest it may

close down so, then

why do companies take debt

?

Issuing

Debt (or Leverage)

Advantages

of Issuing Debt::

Limited

fixed Interest payment - no

share in profits

Limited

Life

Interest

Payment is an Expense i.e. Tax

Deductible

Can

Improve (or Amplify) the

Return on Equity

(ROE)

Disadvantages:

Debt

adds to Company-specific

Risk

If

company doesn't pay Interest, it

can be closed down

Issuing

Equity (generally Common Equity or

Ownership)

129

Financial

Management MGT201

VU

Advantages

of

Issuing Equity:

Not

required to pay fixed

regular Dividends

Capital

Structure is a Firm's Mix of Debt &

Equity

Risks

Faced by Firm:

Total

Stand-Alone Risk of a Stock

(from Risk and CAPM

Theory):

Stock's

Total Stand Alone Risk =

Diversifiable + Market

Company-specific

Risk: Unique,

Diversifiable

Market

Risk: Systematic, Not

Diversifiable

Total

Stand-Alone Risk of a FIRM

(New)

Firm's

Total Stand Alone Risk =

Business + Financial

Business

Risk:

It

is defined as the Risk of All Assets

& Operations (without debt). Includes

both

Company-Specific

(and Diversifiable) & Market

Risks.

Financial

Risk:

Additional

Risk faced by Common Stockholders if Firm

takes Debt. It is a pure

debt-

related

Risk.

Financial

Risk (Investor's

Point of View):

Suppose

firm ABC had a Capital Structure of

100% Common Equity. Then

the

Management

and Board of Directors of firm

ABC then decide to reduce

half of the equity

and

take

a loan (or Debt) instead.

This affects the distribution of risk

& return to the common

equity

holders (or Owners). In other words, the

Management of firm ABC has

added a new kind

of

investor. The debt holder

faces almost no risk because he is

"guaranteed" the Interest

payment

at all costs whether or not

the firm is making profit or

whether or not the equity

owners

are

paid dividend. Debt holders

eat away at the owners' (or

equity holders') money at

almost

no

risk. So, naturally, the

risk faced by equity holders increases

because same Business Risk

is

now

shouldered by fewer Equity Shares.

Risk per Share Increases.

Generally Speaking,

Increasing

Debt Shifts More Risk

Upon the Shareholders. Therefore required

ROR demanded

by

the Common Equity Holder also

increases (based on CAPM

Theory).

Firm's

Total Stand Alone Risk (Uncertainty

in ROA & ROE):

Firm's

Total Stand Alone Risk

measured by the Uncertainty or

Fluctuations in Possible

outcomes

for

Firm's Future overall

ROR.

If

Business has Debt & Equity

(i.e.

levered firm):

Firm's

Overall ROR = ROA = Return on

Assets = Return to Investors /

Assets = (Net

Income

+ Interest) / Total

Assets

Note:

Total Assets = Total

Liabilities = Debt +

Equity

If

Business is 100% Equity (or

un-levered firm)

No

Debt and No Interest.

Firm's

Overall ROR = Net Income /

Total Assets. For 100%

Equity Firm, Total Assets

=

Equity.

So Overall ROR = Net Income /

Equity = ROE!

Note:

Net Income is also called

Earnings.

Note:

ROE does not equal rE (Required Rate of Return).

ROE is Expected book return on

Equity.

Used

in Stock Valuation Formula to calculate

"g" & "PVGO"

Fluctuations

in ROE = "Basic Business

Risk"

You

should review Financial

Accounting Ratios for better

understanding of the above

mentioned

concepts.

Basic

Business Risk (Not

Considering Debt):

Causes

of High "Basic Business Risk" or

Uncertainty or Volatility or

"Instability" or "Shocks"

Large

changes in Customers' Demand

(seasonality)

Unstable

Selling Price (unstable markets and

retailers)

Uncertainty

in Input Costs (raw

material, labor,

utilities)

Inability

of Management to Change Operational

Tactics and Strategy to Meet

Changing

Environment

Ineffective

Price Stabilization

Poor

Product R&D and Planning

High

Operating Leverage

(OL)

130

Financial

Management MGT201

VU

Many

other causes

Operating

Leverage (OL):

Formula

= Fixed Costs / Total

Costs

Concept:

High OL Increases Risk:

Customer Demand Falls but

Fixed Costs remain high.

So,

Small

Decline in Sales Can Cause

Large Decline in ROE.

Fixed

Costs Across Different

Industries:

Plant,

Machinery, Equipment i.e. Power

Plant, Cement, Steel, Textile

Spinning

New

Product Development, R&D Costs i.e.

Pharma, Auto, IT

Highly

Specialized & Skilled Workers i.e.

IT

OL

used in Capital Budgeting &

Capital Structuring Decisions

Operating

Leverage Application to Capital

Budgeting

Example:

Comparing

2 Types of Technologies for

Cement Manufacturing:

(1)

Wet Process and (2)

Dry Process. Different Total

& Fixed Costs, Different

OL.

Applications

to Capital Budgeting

Different

OL's, Different Breakeven Points,

Different Risks,

Different

Required ROR's

So,

Different Discount Rates for

2 Technologies.

Affects

Computation of NPV Investment

Criterion

Breakeven

Point: Quantity of Sales at

which EBIT = 0 therefore ROE =

0.

EBIT

= Op Revenue - Op Costs = Op Revenue - Variable

Costs - Fixed

Costs

= PQ - VQ - F. Where P= Product Price (Rs), Q=

Quantity or #

Units

Sold, V= Variable Cost (Rs),

F= Fixed Cost (Rs). So IF

EBIT = 0

then

PQ-VQ-F = 0 so Breakeven Q = F / (P -

V)

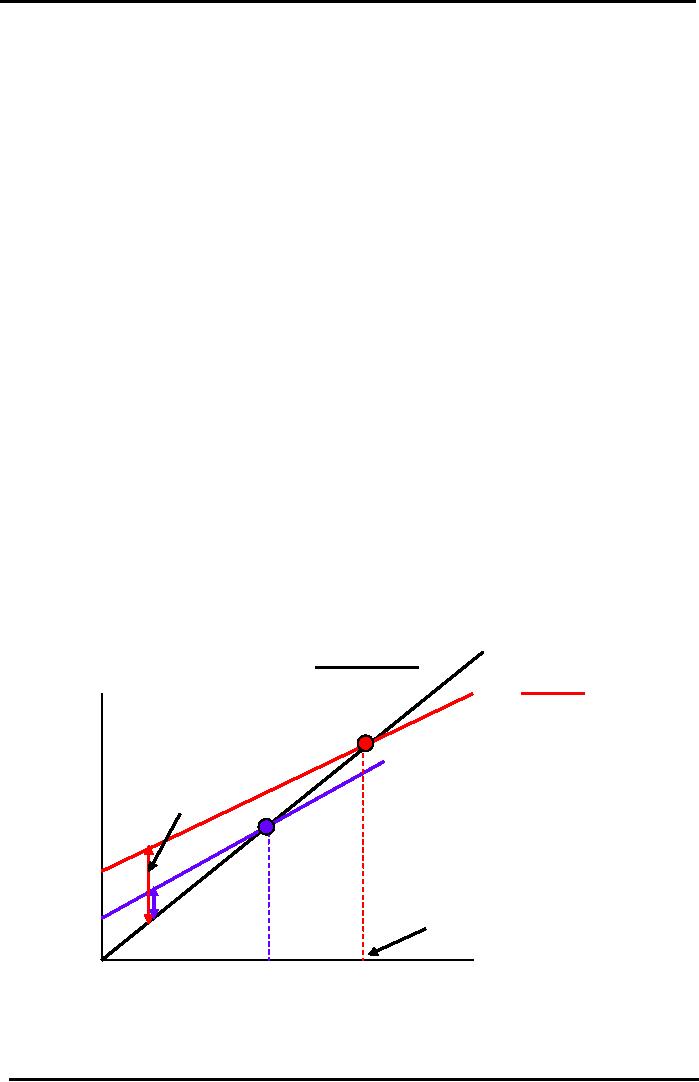

Visualizing

Operating Leverage

(OL)

Impact

on Breakeven Point & Capital

Budgeting

Revenues

&

Sales

REVENUE Line

Costs

(Rupees)

Total

COST Line

Technology

A:

Technology

A: Larger

Higher

OL

OPERATING

LOSS

(Cost

> Revenue).

Total

COST Line

More

Risky

Technology

B

Fixed

Costs A

Breakeven

A: Higher.

More

Risky

Fixed

Costs B

Sales

Quantity

(#

of Units)

*

*

QB

QA

Operating

Leverage Application to Capital

Structure

Applications

to Capital Structure

131

Financial

Management MGT201

VU

Example

of 2 Types of Cement Manufacturing

Technologies: Different OL's

has 2

Impacts:

Different

Risks so Different Betas (CAPM

Approach to Cost of Equity

Capital),

Different

WACC's for 2 Technologies.

Affects Choice of Capital Mix

(or Capital

Structure)

Different

Fixed Costs, Different EBIT

& NI, Different ROE's so

Different

Dividend

Growth Rates "g,"

(Gordon-Dividends Approach to Cost of

Equity

Capital).

So Different WACC's Affects

Choice of Capital Mix.

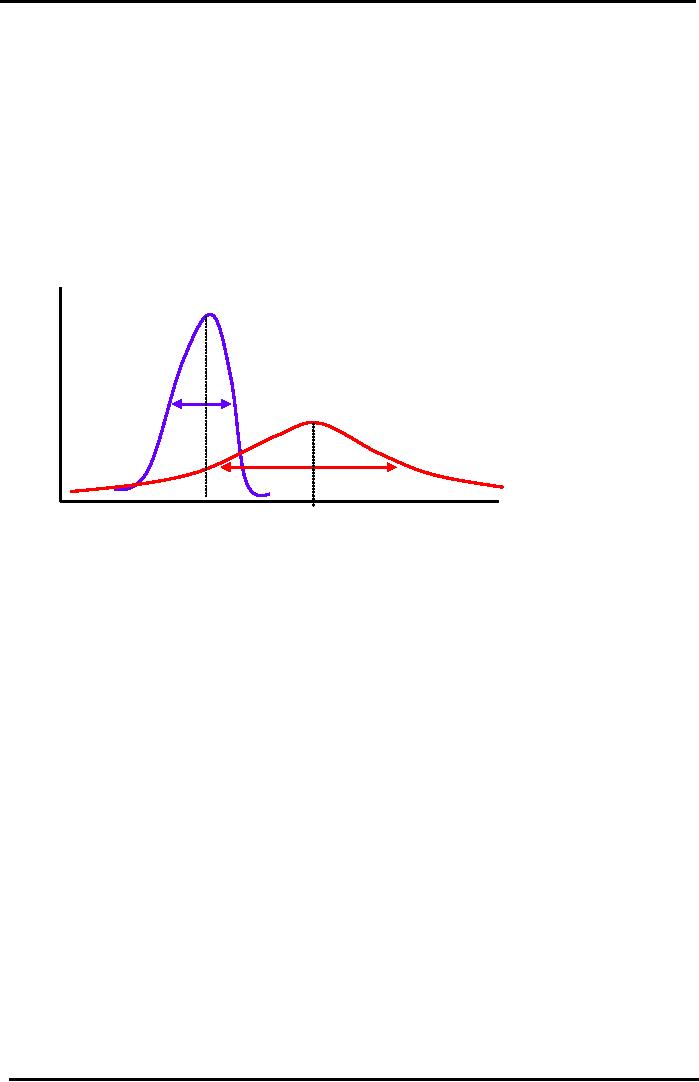

Visualizing

Operating Leverage (OL)

Impact

on ROE & Capital Structure

Technology

B: Lower

OL:

Pro

Low

Risk & Low ROE

bab

ility

Technology

A: High

OL,

(p)

High

Risk & High

ROE.

Risk

B

Higher

WACC

Risk

A

Expected

ROE

Expected

ROE

=

<ROE>B

=

<ROE>A

Return

on Equity (ROE) %

Now,

let's talk in more detail

about the operating leverage

.in financial management the term

leverage

refers

to the little change in the amount of

sales or quantity of sale

that will affect the over

all earning of

the

company .

Operating

leverage (OL)

=FIXED

COSTS /TOTAL

COSTS

A

company supposes has operating

leverage of suppose 50% or

0.5 it is considered to a high

leverage.

Generally,

it is more risky for a firm

and the fixed cost does

not change. So, the

companies that has

high

leverage

are considered to be more risky .Now, the

companies have to hire the skilled

people and

technicians

specially ,in the capital

intensive industries .now,

let's talk about the

operating

leverage

.let's take the example of

cement industry there are

two ways of technology if you

want to set

a

cement plant one is the old

technology and the other is drying

process new technology

.these two

types

have different costs .we have

learnt that NPV formula is

best for investment decisions in

which

discount

rate r is used which is the required rate

of return .when OL associated

with a firm is higher

then

the risk also becomes higher

.we need to understand the impact of

operating leverage

both

numerically

,and graphically .please go over the

concepts of WACC and

NPV.

132

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios