|

Financial

Management MGT201

VU

Lesson

27

RISK

AND PORTFOLIO THEORY, CAPM,

CRITICISM OF CAPM AND APPLICATION

OF

RISK

THEORY

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

�

Risk,

Portfolio Theory, CAPM

�

Criticisms

of CAPM

�

Applications

of Risk Theory

Today

we will review some concepts

about risk portfolio theory

and capital asset pricing

model.

There

is saying in English that

fortune favours the

brave.

Summary

of Single Stock (Stand

Alone) Risk &

Return:

The

first thing that we studied

was how to calculate the expected rate of

return or risk for a

single

stock that is what we call

stand alone investment.

Uncertainty comes along as we

are not what is

price

of the stock will be at any time in

future? Because of this

uncertainty there are possible

outcomes

of

such investment and we attach

probability or their likely

hood and we calculate a weighted

average in

order

to come up with expected rate of return

on the investment.

Expected

Return Formula (Weighted

Average of Many Possible

Future Outcomes for Returns

of that

one

Stock)

<r>=

∑

(p i

x

r

i)

(where p = probability of future outcome

and r is the rate

of

return from that

outcome

So,

if there are three possible outcomes

attached with it the formula

will be

<r>=PArA+PBrB+PCrC

Where,

p=possible outcomes. There is a

probablity distribution of such

outcomes and this

distribution

is the measure of the spread or range of possible

values or uncertainty. if we a look at

the

graph

of the normal distribution curve

then the width of the curve is the

measure of the risk or

uncertainty.

We measure risk mostly by

standard deviation.

Stand

Alone Total Risk Formula

(Standard Deviation or Spread of

Distribution of Possible

Future

Returns)

Sigma

= σ

=

(

∑

( r

i

- < r

i

>

)2

p

i

))

0.

5 =

(Var) 0.

5

This

formula which represents the

total risk of a single stock

can be used for the

portfolio of

stocks.

Portfolio

Risk & Return:

We

then spoke about the

collection of many stocks.

Why do sensible people

invest in many

stocks

the logic is very simple

that do not put all

your eggs in one basket. The

experimental studies have

shown

that if some one has 40

different stocks or investments which

are not correlated to each

other

then

half of the risk can be

eliminated. What kind of

risk has been eliminated?

This is the company's

specific

risk that has been

eliminated because of company's random

events in the life of the

company.

So,

the diversification or investment in increasing number

of stocks reduces the overall or

total risk and

even

if you diversified in 7 uncorrelated

stocks it is possible to reduce the large

portion of the

company's

own risk .once you have

known the return of the individual stock

you have known about

the

portfolio

stock in collection of investments. Expected rate of

return for 3 stocks on a

portfolio is:

Expected

Portfolio Return Formula

(Weighted Average of Returns of

Stocks in the Portfolio)

rP * =

rA xA

+ rB xB

+ rCxC

+ (for a

3-Stock Portfolio)

Portfolio

Risk Formula

σp

=

XA 2σ

+

XB2 σ

+

2 (XA XB

σ

Aσ

ρ

2

2

)

(2

Stocks)

B

AB

If

2 stocks move in the same

direction together then correlation

coefficient is 1.0. if the

exactly

move

in the opposite direction then the

correlation coefficient -1.0 and if there

is no relation between the

movement

of the stocks then the correlation

coefficient is zero.

If

More than 2 Stocks, then use

RISK MATRIX

116

Financial

Management MGT201

VU

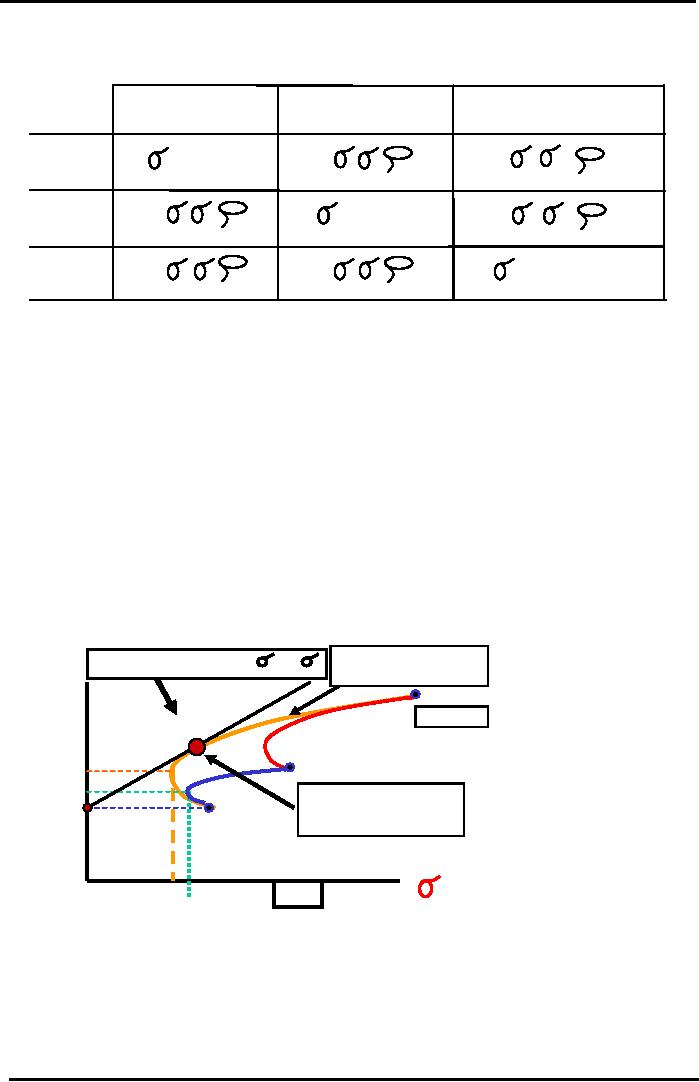

3-Stock

Portfolio Risk

Formula

3

x 3 Matrix Approach

Stock

A

Stock

B

Stock

C

XA2

2

Stock

XA

XB

XA

XC

A

A

B

AB

A

C

AC

A

XB2

2

Stock

XB

XA

XB

XC

B

A

BA

B

B

C

BC

B

XC2

2

Stock

XC

XA

XC

XB

C

A

CA

C

B

CB

C

C

The

portfolio theory told us there is

direct relationship between risk and the

return and as risk of the

investment

goes up then return also

increase .it is mentioned

that if correlation co-efficient is

less then

or

equal to zero (ve) then

the risk and return relationship between

2 stocks exhibits shaped

curve what

it

tells us is that it is possible that

when we added the 3rd stock then it not only

increase the overall

return

but

it also reduce the total

risk of the portfolio and

that is ideal . We found the

parachute curve for

the

portfolio

which consist of more then 2

stocks and this large

hook is the efficient frontier

which

represents

the most efficient combination of the

different stocks in that

portfolio. By adding stock C we

came

up with parachute curve and

we also came up with curve

that envelops both of these

curves which

is

known as the efficient frontier.

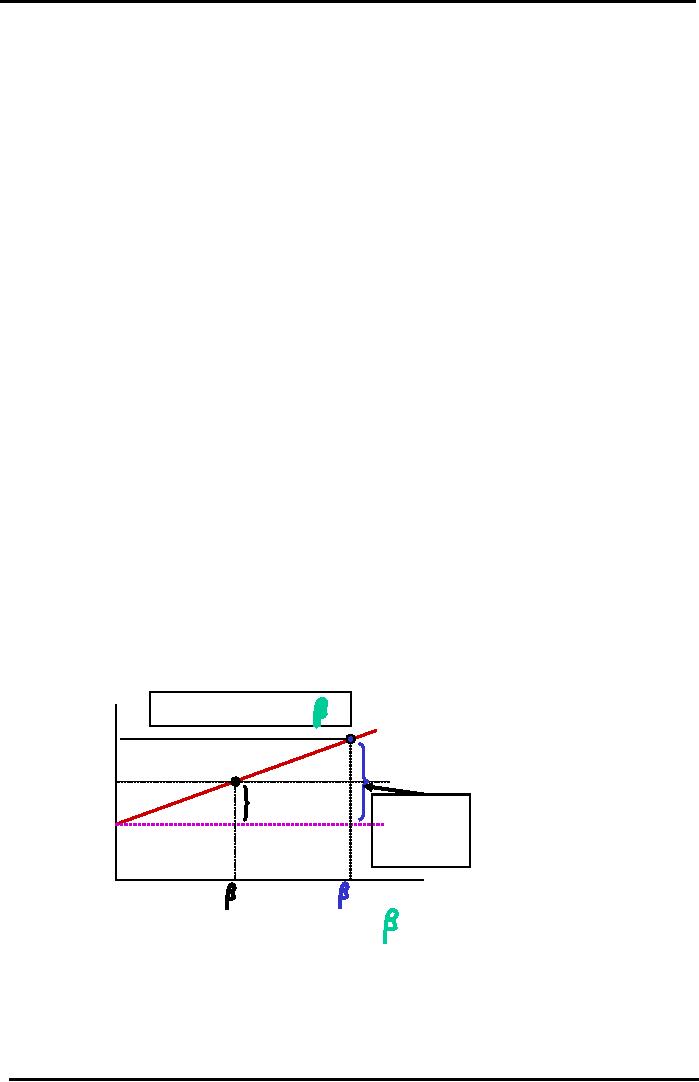

So, let's see how

can we derive CML or the capital

market line and

the

equation of CML from this

efficient market curve

.portfolio return is with y-

axis and risk

along

with

x-axis we see the line from

risk free rate of return

which is assumed to be 10% and is

represented

by

rRF .

Picking

the Most Efficient

Portfolio

Capital

Market Line (CML) & T-Bill

Portfolio

P

Efficient

Frontier

rP* =

rRF + [ (rM

- rRF)

/

M]

rP*

for

3-Stock Portfolio

Portfo

30%

Capital

Market Line

Stock

C

lio

"The

Parachute"

Retur

Stock

A

20%

n

Optimal

Portfolio Mix

(50%A,

30% B, 20%C) if

10%=

Stock

B

rRF

Risk

Free T-Bill ROR =

10%

40%

20%

2.5%

P

Portfolio

with Negative

Risk

3.4%

or

Zero Correlation

Coefficient

Parachute

Graph and

Efficient Frontier (Hook

Shaped Curve) shows ALL possible

Risk-Return

Combinations

for ALL combinations of stocks in the

Portfolio whether efficient or

not.

CML

Straight Line Equation (T-Bill

Portfolio and Optimal Portfolio Mix on

Efficient Frontier

Curve)

connects

rRF (Risk-free or T-Bill

return) to the Tangent Point on the

Efficient Frontier

Curve.

117

Financial

Management MGT201

VU

It

represents all Risk-Return

Combinations for Efficient

Portfolios

in the

Capital Market. We

assume

easy access to risk-free

T-Bill Portfolio. Portfolio

Risk measured using Standard

Deviation.

There

is an optimal point of the line

where

Stock

A=50%

Stock

B=30%

Stock

C=20%

Summary

of Beta:

Market

Risk and Beta Coefficient

(CAPM)

Single

Stock Beta (=Slope of Best

Fit Regression Line which

passes through data

points)

=

Percent Change in Stock ROR /

Percent Change in Market

Index ROR

Portfolio

Beta Risk Formula (Weighted

Average Formula)

Stock

Beta Formula in terms of Stock Standard

Deviation & Covariance

=

σ

A

σ

M

ρ

AM

/ σ 2

M

=

σ

A

ρ

AM

/ σ M

= market

risk

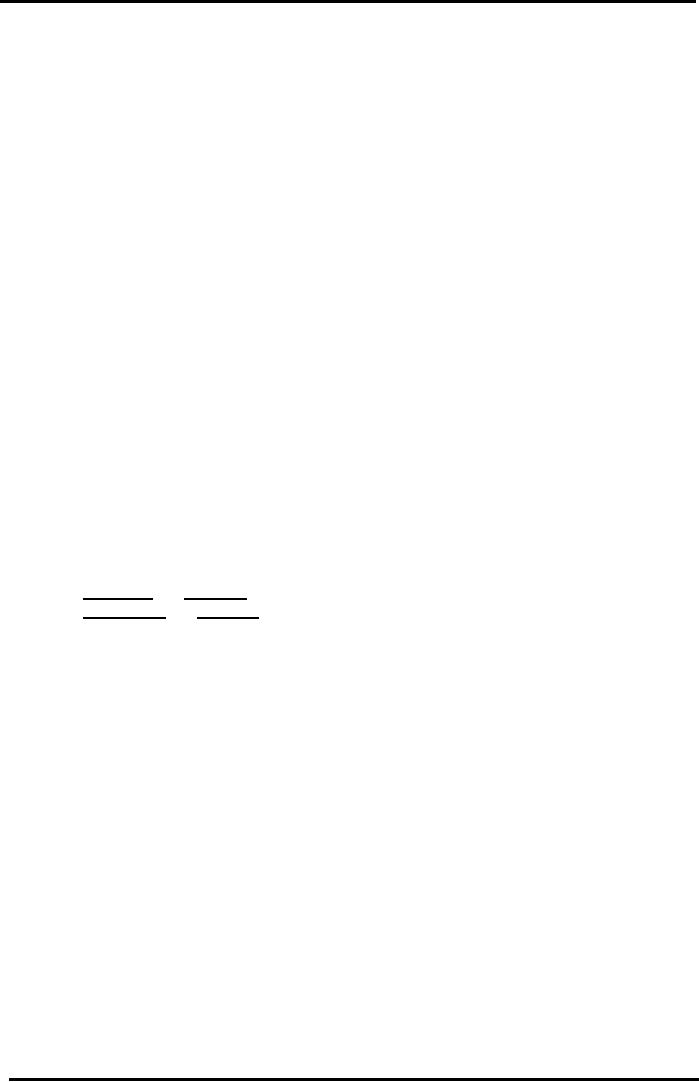

Security

Market Line (SML)

SML

(Security Market Line) -

Cornerstone of CAPM:

It

represents all Risk-Return

Combinations for ALL

Efficient Stocks in the

Capital Market. Stock

risk

measured using Beta. Market Price of a

Stock is determined by Required

Return on Stock which

depends

on Market Risk (not Total

Risk).You can not expect to receive

extra return (or

compensation)

for

taking on Company-Specific Risk

which Rational Investors have

eliminated! Efficient

Market

Prices

are based on Market Risk

Only and NOT Total

Risk.

The

Efficient Market will only

offer you a Return (and a

Share Price) which is the bare

minimum acceptable

to

rational diversified

Investors.

Required

ROR vs Expected

ROR

SML

Linear Equation & Graphical

Interpretation

Security

Market Line (SML)

ALL

Efficient Stocks in Efficient

Markets

Required

rA =

rRF +

(rM -

rRF )

Return

(r*)

A.

rA= 30%

Security

Marketrket

Risk

Line

rM=

20%

Ma

Premium

for

Risky

Stock A's

Avg

Stock = 10%

rRF= 10%

Total

Risk

Premium

=

30-10

= 20%

A

=+ 2.0

M

=+ 1.0

Beta

Risk (

)

Criticisms

of CAPM & Alternatives:

Weakness

in SML:

�

Not All Investors are

rich or well-informed enough to

hold Fully Diversified

Portfolios

therefore

Market Risk (and Betas) is

NOT the only relevant factor

in estimating Required

Return

and Stock Prices. Other

Efficient Market

Assumptions.

118

Financial

Management MGT201

VU

�

Taxes

and Brokerage Costs that

affect Investor's analysis and estimation

of Returns have

been

ignored

Weakness

in CML:

Not

All Investors are influential enough to

be able to Borrow at the T-Bill

Rate. Generally the

Borrowing

Rate is higher than the

Lending Rate.

Fama

& French:

CAPM

ignores 2 important determinants of Higher

Required ROR (1) smaller firms and

(2)

Low

Market-to-Book Ratio.

Arbitrage

Pricing Model:

Accounts

for several factors that affect

risk i.e. Tax, inflation,

oil price,...

Financial

Management Applications of Risk-Return

Theory (CAPM):

�

Practical

Real Asset Investment Decisions and

Capital Budgeting

The most important

NPV

(and PV) Equations uses

REQUIRED ROR (and NOT

Expected

ROR)

�

Actual

Share Pricing and

Investment in Securities

Gordon's

Formula for

Share Pricing uses PV of

Dividends which uses

REQUIRED

ROR

Risk

& Return - Must Consider

both:

In

this course we have studied the

following concepts of financial

management.

�

First Part of this

Course - Valuation or Calculating

NPV and PV which are

measures of

Return.

We ignored Risk and origins

of Required ROR.

�

Second Part of this

Course Application of PV Concept to

Valuation or Pricing of Bonds

(Debt)

and Shares (Equity). Again we

ignored Risk and origins of

Required ROR.

�

Part 3 of the Course Introduced

Risk and how it determines the Required

Return used in

NPV

and Share Price Formulas.

�

In Perfect Markets, Value depends

on Required Return which

depends on Market Risk

(and

not

Total Risk).

�

BUT, in Real Markets which

are Imperfect and

Inefficient, Total Risk is

important. It can

be

calculated using the Sigma (Standard Deviation)

Formulas, probabilities, and Expected

Return.

�

Total Risk and Expected Return

must BOTH be considered in Comparing

Investments.

�

Market Risk and Required

Return are Related to one another

Common

Life Applications of Risk

and Return

Theory:

Concepts

of Risk & Return Theory have

Wide Practical Applications that

require a Creative

Mind.

Expected

Value or Expected ROR or Expected

Payoff

Total

Risk or Standard Deviation (based on

Spread or Range of Breadth of

Possible ROR

outcomes)

= Unique + Market

Risk

Systematic

(or Market or No diversifiable)

Risk (= Beta A x Sigma M). Individual

Risk relative

to

Market or Industry.

�

Think

Out of the Box:

Social

Cost-Benefit Analysis of Power

Plant:

Environmental

and Village Relocation Risk,

Uncertain Savings

Court

Case Payoff: Claims &

Penalties

Uncertain

likelihood of success and Opponent,

Uncertain Payoff

Likelihood

of War: Capability & Intent (Game

Theory)

Magnitude

of Capability vs Uncertainty of

Intent

119

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios