|

Financial

Management MGT201

VU

Lesson

26

SML

GRAPH AND CAPITAL ASSET PRICING

MODEL

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics.

�

SML

Graph & CAPM

We

will continue our discussion

on risk. It is very important in

our daily life .we

are always

concerned

with risky situation. There

is risk that you can

not watch this lecture due

to the power failure.

We

have to know that how we can

measure and control the risk in

every day life. We are

going to see

that

how we can use required rate

of return that we calculated by using the

SML equation and use

that

required

rate of return for the calculation we

have been doing in the first

two parts of this course. In

first

part

we did capital budgeting and

NPV calculations and in the

NPV formula the `r' we are

using is the

required

rate of return not he expected rate of

return. We can use the value

of required return from

SML

equation

in stock or bond pricing. We have studied

that in the efficient markets the

required rate of

return

is come from the market

return. There are two

methods for the calculation of

risk.

First

approach the experimental cost base in

this approach we use expected rate of

return and market

index.

Then we plot these points on

the graph and we join them with a

straight line called

regression line

and

slope of this line is called

beta co- efficient.

The

second approach for its

calculation is called theoretical

beta of stock:

Beta

Stock A = σ

A

σ

M

ρ

AM

/ σ 2

M

=

σ

A

ρ

AM

/ σ M

Extent

to which Actual Stock Return

Data lies on Regression

Line

Total

Risk = Market Risk + Random

Company Specific Risk If the

experimental data

points

All

lies exactly on the regression

line then this particular stock

has only market

risk.

Theoretical

Market Risk of a

Stock:

Market

Risk of Stock A = β

A

σ

M

= σ A

ρ AM

Extent

to which Actual Stock Return

Data lies on Regression

Line

The

third formula which we

discussed is very important and

cornerstone of the CAPM.

Security

Market Line (SML) and

Required Rate of Return (rA):

It

allows us that the value

which we have calculated for the

beta and from that

calculate

the

required rate of return of the stock and

then we use for stock

pricing. So, then the

required rate of

return

for any stock A is equal

to

rA =

rRF + (rM

- rRF )

β

A

.

In

Efficient Markets, Stock Price

(and Value) depends on

Required Return which

depends on Market

Risk

(not the Total Risk).

The

required rate of return in efficient

markets depends upon the

risk premium which depends

only

upon

the market risk and not on the

total risk. We do not have to

worry about company's risk

because

we

assume that investors are

rational and maintain diversified

portfolio. Now, let's take a

look at the

security

market line graphically .It

is important to understand this graph and

many things that it tells

us.

112

Financial

Management MGT201

VU

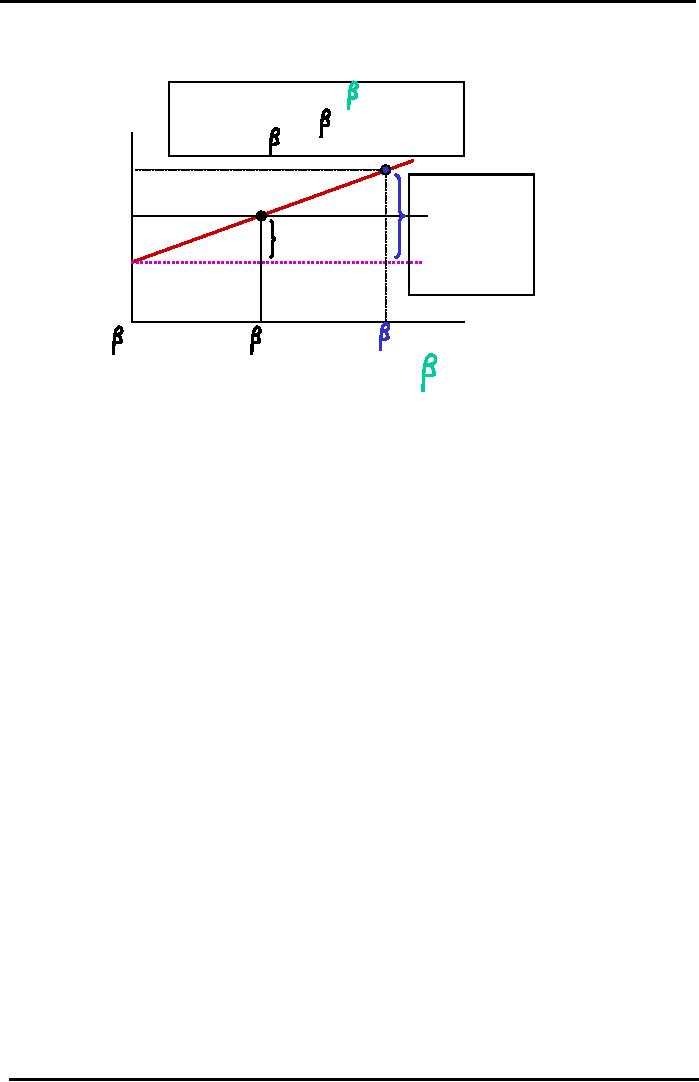

Security

Market Line (SML)

For

Efficient Stocks

rA =

rRF +

(rM -

rRF )

yA

.c + mx

where x = and m = Slope

=

Required

=

(rM -

rRF) / ( M -

0) = (rM -

rRF) /1

Return

(r*)

rA= 30%

Risky

Stock A's

Security

Market Line

Risk

Premium

=

rM=

20%

Market

Risk

30-10

= 20.

Premium

for

Based

on Market

Avg

Stock =

rRF= 10%

Risk

(not Total

10%

Risk)

A

=+ 2.0

M

=+ 1.0

RF

= 0

Beta

Risk (

)

The

graph represents the SML in the efficient

stock market. On y axis we have

required rate of

return

r* for the stock A for and risk

free rate of return and on the x- axis is

beta risk which

represents

the

market risk. SML is straight

line and it tells us the

relationship between the market risk and

the

required

return. it starts on the left hand

side from risk free rate of

return and it passes through

a point

ion

the middle which is the overall

market point. This point is

located at the beta of +1.0 and at

the

required

return of 20%.This means

that the market offers a rate of

return which is higher then

the risk

free

rate of return. Because the market

fluctuates it has a risk of

1.0 and not 0. if we extend

the line it

passes

through the point where the beta is

+2.0 and the required return

is 30%.because this point

lies on

the

SML it means that stock A has no company

risk & what is the risk

premium ?

Risk

premium=rA-rRF=30%-10%=20%.

It

is directly proportion to market

risk of stock.

Please

note that slope of this line

is = (rM-rRF)/

(betaM-0) = (rM-rRF)/1.

This is the measure

tendency

of the average investors in the market to

take risk. If the SML line is

steeper the investors will

not

take unnecessary risk. In

other words they are risk

aversive as the slope increase the avoidance

for

the

risk also increases in the

market as whole. It is very

important to formulate the equation

for SML

You

should be able understand the various

points that lie on the SML

line including the risk free

rate of

return

or T-BILL return as well as the

market point and you should

also understand that the slope of

SML

line is=(rM-rRF)/(betaM-0)=(rM-rRF)/1.Beta

coefficient was the slope of the line

for different graph

that

graph shows the stock rate of

return on y-axis and market rate of

return on x-axis. But over

there

we

are not talking about the

required rate of return we were talking

about the expected rate of return

so;

do

not confuse these two

different graphs. SML exist

for only the efficient

markets or perfect

capital

markets.

SML tells us in detail that

rational investor will

eliminate the company's specific

risk and the

total

risk of the company will be equal to the

market risk of the company. SML

line is an ideal case

and

in

efficient markets all the

stocks lie on the SML line. If stock is

not on SML then according to

market

equilibrium

it will come back on SML. If

any stock is not on SML then

forces of market

equilibrium

will

bring it on the security market

line. If risk and return

combination of any stock is above SML

it

means

that it is offering the higher rate of

return as compare to efficient stock.

The people will rush

to

buy

such stock when the demand

will increase the return

will decrease.

If

any stock is lying below the SML

line the price will come

down it will offer as

much

potential

as the efficient stock offers. The

supply for such stock will

increase and it will offer

higher

return

in form of capital gain. So,

the market forces will throw

these points on the SML.

Markets are not

risk

free .markets index

fluctuate .The investors expect that

market return will be more

than the average

expected

return.

113

Financial

Management MGT201

VU

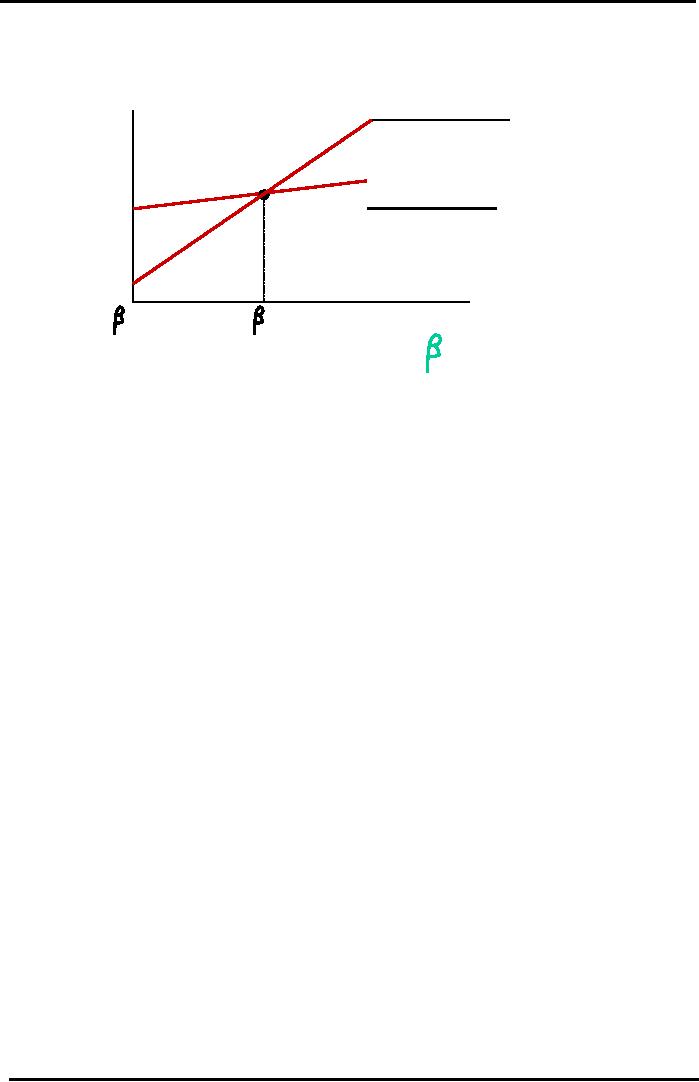

Security

Market Line (SML)

Slope

& Risk Taking

Required

Steep

Slope SML

Return

(r*)

Most Investors

Avoid

Investors

rM=

20%

Low

Slope SML

Most

Investors in

rRF= 10%

this

Market are

Gamblers

M

=+ 1.0

RF

= 0

Beta

Risk (

)

Even

Markets and Market Returns

Fluctuate because of Macro Systematic

Factors. So the Fully

Diversified

Market Portfolio consisting of

all shares is NOT Risk

Free. The Market has a

Risk

Premium

over the Risk Free ROR. This

Market Risk Premium represents

100% Market Risk and

No

Company-Specific

or Diversifiable Risk. Efficient

Stock combinations of Risk &

Return in Efficient

Market

Equilibrium must lie ON the

SML.

Any

Stock whose (Risk, Return)

Pair lies ABOVE THE SML is

offering Excessive Return

(above the

Market).

So, all rational investors

will rush to Buy it.

The present Price would Rise

and the Return (as

measured

by Capital Gain Yield = ( Pn

-Po) / Po) would Fall until

it comes back on SML Any Stock

whose

(Risk, Return) Pair lies

BELOW THE SML is offering a

Return that is lower than

the Market. So,

Rational

Investors will rush to sell

it. The Stock Price would

Fall and the Return would

Rise until it

comes

back on the SML.

Now

, we will calculate the required rate of

return using GORDON FORMULA

.so, we need to

calculate

required rate of return to understand the

risk so, let's use SML

formula for required rate

of

return

by plugging it into the GORDON

FORMUL A. price valuation

formula by GORDON:

Share

A is being traded in the Karachi Stock

Exchange (KSE) at a Market Price of Rs

12. You need to

calculate

the Expected Theoretical Fair Price of a

Stock A before you can

decide whether to buy it or

not.

Given the following

Data:

DIV1

= Rs 2 (i.e.

Forecasted Dividends in the upcoming

year on a share of Face

Value = Rs 10)

g

= 10% pa (i.e.

Forecasted Constant Growth Rate in

Dividends)

rRF =

10% pa (i.e.

T-Bill Rate of Return or PLS

Bank Account ROR)

rM =

20% pa (i.e.

The Karachi Stock Exchange's

historical average ROR based on the

value of the

KSE

100 Index)

Beta

of Stock A = 2.0 (i.e.

Stock A has historically

been twice as volatile or

risky as the KSE 100

Index)

Use

the Gordon-SML Equation to Estimate Fair

Price of Stock A:

Po*

= DIV1 / [ (rRF + (rM

- rRF ) A

) - g]

=

2 / [10% + (20% - 10%)

(2.0)) - 10%]

=

2 / [30% - 10%] = 2 / 20% = Rs

10

The

Required Rate of Return for

Stock A was calculated to be

30% which is higher than

the

Market

(20%). The Market is

offering a 10% extra return

as a Risk Premium because Stock A

(Beta =

2.0)

is twice as risky as the market

(Beta = 1.0).

The

Fair Price of Stock A (Rs

10) is LESS than the Market

Price (Rs 12) which means

that the Market

Speculators

have Overvalued Stock A and you

should NOT buy

it.

114

Financial

Management MGT201

VU

So,

what does our answer

mean? We see that expected

fair price of the share is

Rs.10 which is lower

than

the market price which is Rs.12.keep in

mind that price for the

share is imperfect market

depends

upon

the investor psychology , speculation and

gambling that is taking place in the

stock market .so,

when

fair price is lower as in

our example and market price

is higher it means that the

shares price or

stock

has been over valued and the

rational investor will not

purchase it .other thing to

note is that we

calculated

share premium and required rate of

return in our formula is

30%.it is higher than the

over all

market

risk .because it is twice

risky as the market beta

A=+2.0therfore it is giving extra

return to the

investors

for the compensation.

NPV

Calculations & Capital Budgeting:

Application

of SML (CAPM):

In

the beginning of this course

while studying capital

budgeting and investment criteria we

used

the

NPV and PV formulas for

calculating required rate of return and

not for expected rate of

return.

Required

rate of return is attached to the

individual investors. we forecast our

dividends and they

are

not

true cash flows so we

discount them to the present .we

calculate the standard deviation for

over

all

industry. NPV

(and PV) Calculation

which is the Heart of Investment

Criteria and Capital

Budgeting

uses required return (and

NOT Expected ROR). This is

why Share Pricing also

uses

Required

Rate of Return because Share

Price was derived from the PV

Equation for Dividend

Cash

Flows.

We

can apply our Probabilistic

Risk Analysis to Entire

Companies or Real Projects or Assets

and

focus

on the Volatility or Uncertainty of their

Net Cash Flows. We can

compare that to the

Volatility

of the Cash Flows of the Industry

that the Company is a part of to

come up with a Beta

Coefficient

for the Assets of a Company as a

whole. We can then use the

Asset Beta to calculate

the

Overall Required Rate of

Return for a Company (i.e.

All Assets - both Equity and

Debt).

Risk

& Return - Must Consider

both:

In

Perfect Markets and Efficient

Markets where Rational Investors have

Diversified Away ALL

Company

Specific Risk, Value (and

Stock Price) depends on Required

Return which depends on

Market

Risk

(and not Total Risk).In most

Real Markets where Investors are

not fully Diversified, Total

Risk is

important.

It can be calculated using the Sigma (Standard

Deviation) Formulas, probabilities,

and

Expected

Return. Total Risk and expected

Return must both be considered in

Comparing Investments.

Market

Risk and required return are

related to one another in Efficient

Markets according to the SML

equation.

Required Return depends on the

Individual Investor's Psychological

Risk Profile and

Opportunity

Cost of Capital.

Betas:

Stock

Beta vs. Real Asset

Beta

Objective

in FM is to maximize stock holders' (or

Owners') Wealth

Negative

Side Effect - Treasury Managers of

Listed Corporations in USA and

Europe spend too

much

time manipulating Stock

Prices.

Real

Assets have Risky Revenue Cash

Flows:

Asset

Beta = Revenue Beta x [1 + PV (Fixed Costs)/PV

(Assets)]

A

Stock's Beta or Risk Relative to the

Market can change with

time. If the Company's

business

operations

or environment change, its

responsiveness to the Market can

alter i.e. if it buys another

business,

implements a Total Quality Management

program, makes an R&D technological

discovery,

takes

on Debt, etc.

Notes

on Measuring Uncertainty

Standard

Deviation vs. Beta

For

Example, Oil Drilling Companies: possible

to have High Standard Deviations in

Forecasted

Earnings

and Returns but Low Betas or

Stock Price volatility relative to

Market

Volatility

vs. Risk:

Seasonal

or macro volatility in Earnings does

NOT necessarily signify Risk

BUT High Stock

Price

volatility does signify

Risk.

115

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios