|

Financial

Management MGT201

VU

Lesson

24

STOCK

BETA, PORTFOLIO BETA AND

INTRODUCTION TO SECURITY MARKET

LINE

(SML)

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics.

�

Stock

Beta

�

Portfolio

Beta

�

Introduction

to SML (CAPM)

First,

we would recap some of the

concepts which we have studied in the

previous lectures.

It

is mentioned in the efficient capital

markets the investors would take on

extra risk only if they

are

compensated

in the form of extra return.

The market only compensates

the investor to the extent that

he

will

receive extra return for

extra market risk he takes

on by investing in a new stock. However,

the

market

will not pay the investor

any extra return for

taking on unnecessary risk in the

form of

company's

own risk. Therefore, it is

best for investors to act

rationally and to maintain

diversified

portfolios

of many stocks and in this

manner they can eliminate

the company's own risk

and they can

make

investments in stocks at a lower required

rate of return. Market portion of

risk can be

represented

through

the `Beta' coefficient and it is the

corner stone for Capital Asset

Pricing Model (CAMP).

Beta:

It

is a tendency of a Stock to move with the

Market (or Portfolio of all

Stocks in the Stock

Market).it

is the building block of

CAPM.

Total

Risk = Diversifiable Risk +

Market Risk

Total

Stock Return = Dividend

Yield + Capital Gain

Yield

Stock

Risk Vs Stock Beta:

Stock

Risk:

It

is a statistical spread of possible returns

(or Volatility) for that

Stock

Stock

Beta:

It

is a statistical spread of possible returns

(or Volatility) for that

Stock relative to the

market

spread i.e. spread (or

Volatility) of the fully diversified

market portfolio or

index.

Beta

Coefficients of Individual Stocks

are published in "Beta

Books" by Stock Brokerages &

Rating

Agencies

MARKET:

It

is the overall Stock Market.

For Example, Karachi Stock

Exchange. KSE 100 Index

represents Value

of

"Portfolio" of Highest Volume

Stocks but NOT ALL stocks.

Therefore it is not fully

perfect

diversified

portfolio.

Market

carries Risk. It moves up

and down because of macroeconomic factors

(inflation,

general

interest rates) and political

changes. Therefore the market

has some expected rate of

return

which

changes with time because of

this there is possibility of different

outcomes. There are no

fully

diversified

portfolios in reality. The

CAMP based on the promise market Beta to

be Equal to + 1.0. We

can

then look at the different

beta and compare them with

the markets.

Meaning

of Beta for Share ABC in

Karachi Stock Exchange

(KSE):

�

If Share A's Beta = +2.0

then that Share is Twice as

risky (or volatile) as the

KSE Market i.e. If

the

KSE 100 Index moved up

10% in 1 year, then based on

historical data, the Price of Share

B

would

move up 20% in 1

year.

�

If Share B's Beta = +1.0

then that Share is Exactly

as risky (or volatile) as the

KSE Market

�

If Share C's Beta = +0.5

then that Share is only

Half as risky (or volatile)

as the KSE Market

�

If you could find a

Share D with Beta = -1.0

then that share would be

exactly as volatile as

the

KSE

Market BUT in the opposite

way i.e. If the KSE 100

Index moved UP 10% then the

price

of

the Share D would move DOWN

by 10%!

�

The Beta of most Stocks

ranges between + 0.5 and +

1.5

�

The Average Beta for All

Stocks = Beta of Market = + 1.0

Always.

Our

approach for calculating the beta

will be straight forward.

Let us assume that we analyze

he

movements

in KSE index for period of

three years and we also analyze the

price movements for

the

Stock

A in KSE for the same period

of time of three years. We look at the

change in the price of the

103

Financial

Management MGT201

VU

stock

and compare it to the change in

price in the market for each

one of the three years

separately.

And

then we plot those points on

a graph where the expected return on the stock on the

y- axis and

the

expected return on the market on x-axis.

We are using the price of the stock and

value of the

index

as representative measures for the expected

return.

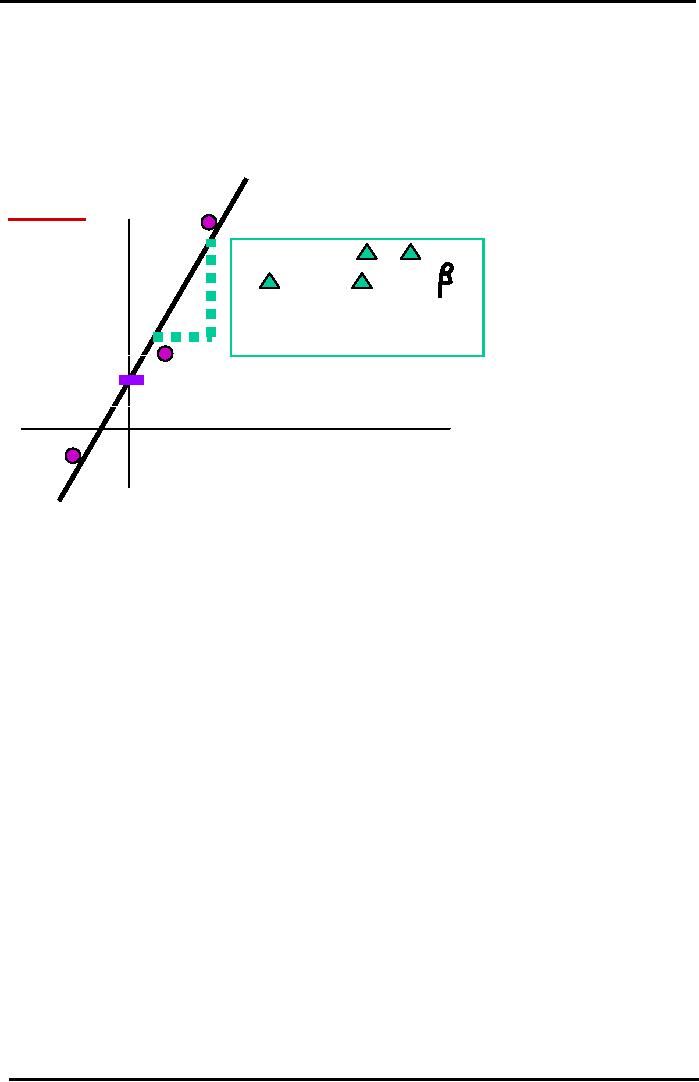

Calculating

Stock Beta

Graphically

Linear

Regression or Least Squares

Fit through

Experimental

Data

Collected for 3 Years

Year

2

Expected

Return

on

Slope

= Beta =

Y / X =

Stock

A

(Historical)

%

%

rA* /

% rM =

A=Risk

Relative to Market =

rA* - rRF

(rA* - rRF)

/ (rM* - rRF)

Y-Intercept

=

Year

1

Alpha

=

Company

Specific Risk

rM* - rRF

Expected

Return on KSE

100 Market Index

Year

3

(Historical)

%

If

you look at the graph, we have

plotted three years of data

for the changes in the

Karachi stock

exchange

100 market index and the expected

return on the stock A. The expected

return on A is on y-

axis

and it is represented by rA*

and the expected

return on stock in KSE 100

market index is

represented

by rM* the

`*'

represented

the expected part of the rate of

return. In both cases the

expected

returns

have been benched marked against the risk

free rate of return. That is

because we pick the

risk

free

rate of return as the starting point

for the changes in the expected return.

Three points are shown

on

the

graph on for each year in

the analysis and after plotting these

points on the graph we can

then do

what

is known as the linear regression of

straight line which best

fit through points. You have

studied

this

concept in the course of "Statistics and

Probability" .The slope of the line

represents the beta

coefficient.

Slope

= Beta = Δ

Y /

Δ

X = %

Δ

rA*

/ % Δ

rM*

=

A

=Risk

Relative to Market =

(rA* -

rRF)

/ (rM* -

rRF)

Beta

represents the risk of stock relative to

the return of the market and in

terms of risk free

rate

of

return we can define the Beta as the

expected rate of return for stock A minus

risk free rate of

return

divided

by the expected rate of return for the

market minus risk free rate of

return. We use

historical

data

of expected rate of return and we graphed it against

changes in the overall market

index

Calculating

Portfolio Beta

(CAPM):

There

are two ways of calculating

portfolio beta

�

Analyze Historical Data for

Portfolio Returns and Market

Index Returns like in the

case of

Stock

Beta, plot Least Squares Fit

Line, and compute Portfolio Line

Slope or Beta directly.

�

Use the Published Data for

Individual

Stock Betas from the "Beta

Book"

Portfolio

beta can be calculated as the

sample weighted average of the stock

beta's in that portfolio.

Portfolio

Beta = β P

=

XA

β A+

XB

β B

+ XC

β C

+.....

In

the formula

βA

represents the Beta (or Market

Risk) of Stock A.

XA represents the Weight of

Stock (fractional value of

investment in A to total

portfolio

value).The simple formula

for calculating the portfolio

beta is as follows.

Portfolio

Beta (or Market Risk)

Formula is a Simple Weighted

Average unlike the portfolio

risk formula

104

Financial

Management MGT201

VU

σP

=

XA2 σ

A

+XB2 σ

+

2 (XA XB σ Aσ

B

ρ

AB

)

2

2

B

Example:

�

Complete 2-Stock Investment

Portfolio Data:

Value

Exp

Return

(r*)

Tot

Risk

Beta

Stock

A

Rs.30

20%

20%

2.0

Stock

B

Rs.70

10%

5%

0.5

Total

Value =Rs 100

Correlation

Coefficient

=

+ 0.6

Portfolio

Mean

Expected Return =

13%

=

rP*

Portfolio

Risk

(Total)

= 8.57%

=

P

(relative to rP*)

Now

we can calculate the portfolio beta

which is measure of the market

portion of portfolio

risk.

Portfolio

Beta

=

XaBa + XbBb = (30/100) (2.0)

+ (70/100) (0.5) = 0.6 +

0.35

=

+0.95

=

β

P

(relative to Market Risk or

Volatility)

It

means that the Portfolio of A & B is

slightly less risky than the

totally diversified KSE

100

Market

Portfolio whose Beta =

+1.0

Effect

of New Stock Investment on

Portfolio:

Now

we will see the case that

what will happen to portfolio

beta if we add another stock to

it.

Suppose,

you add a 3rd Investment

Stock C, to your Old 2-Stock

Portfolio.

Value

Exp

Return (r*)

Beta

Stock

A

Rs.30

20%

2.0

Stock

B

Rs.30

10%

0.5

Stock

C

Rs.40

30%

1.5

Total

Value

Rs.100

3-Stock

Portfolio Beta = β P =

XaBa + XbBb + XcBc

=

(30/100) (2.0) + (30/100)

(0.5) + (40/100)

(1.5)

=

0.6+0.15+0.6 = 1.35

The

effect of adding a stock with a Beta

higher than the Portfolio's is

that it increases the

Portfolio's

Beta

or Risk. In this case we

also increase the beta by

adding new stock but the expected rate of

return

also

increases for the portfolio.

So, the increase rate of

return would compensate the

increase in risk.

Required

Rate of Return (CAPM)

Required

ROR vs. Expected

ROR

Expected

ROR (r*):

The

Most Likely (or Mean) ROR

expected in the future. It is calculated

using Weighted

Average

Formula and

Probabilities (what we have been

calculating so far).It is basically the

weighted

average

or mean of the expected return of the

individual investments in the

portfolio.

Required

ROR (r):

It

is the minimum return that investors

require from the stock to invest in

it. It

varies

from individual to individual. It is

based on

1)

Perceived Risk relative to the Market and

Psychological Risk Profile of

each Investor and

2)

His personal Opportunity Cost of

Capital preference.

We

have mentioned earlier that ROR or

opportunity cost varies from

person to person

because

every

individual have a different preference

for risk taking. Some

people have tendency to be gamblers

whereas

other people put their

money at national saving

schemes.

However,

the ROR can be linked

to

the Beta risk because based on the

portfolio theory and CAPM

where we mentioned there is direct

relationship

between risk and return.

Average

Required ROR for all

rational investors in an Efficient Market

can be estimated using

the

CAPM Theory: Beta and Risk

Free Rate of Return.

Total

Rate of Return (ROR) for

Single Stock = Dividend

Yield + Capital Gain.

GORDON'S

FORMULA

FOR COMMON STOCK PRICING OR VALUATION

USES REQUIRED RETURN r

=

DIV/Po

+ g. In Efficient Markets, Price of

Stocks is based on Market

Risk (or Beta).

We

can formulate the required rate of

return in terms of Beta risk so

how can we use beta

coefficient to

calculate

the required rate of return for the

average investor in the market.

The answer to it is the

105

Financial

Management MGT201

VU

Security

Market line SML. It is the

part of CAPM and it is the most

critical part of CAPM. SML

is

straight

line relationship that contains

all possible combinations of efficient

stocks in the market. If the

combination

of risk and return for any

stock does not lie on the SML

then that stock is not

efficiently

priced.

In other words, it means that

for most of the investors in the market

there ROR for investment in

stock

A is directly proportional to Beta risk

for that stock A. You will

recall that we are not

unfamiliar

with

straight line relationship between

risk and return when we are

talking about the portfolio

when we

calculate

the portfolio risk with a

+ve correlation coefficient we

came up with a continuously

increasing

relationship

between portfolio risk and return. So

that model is similar to

SML.

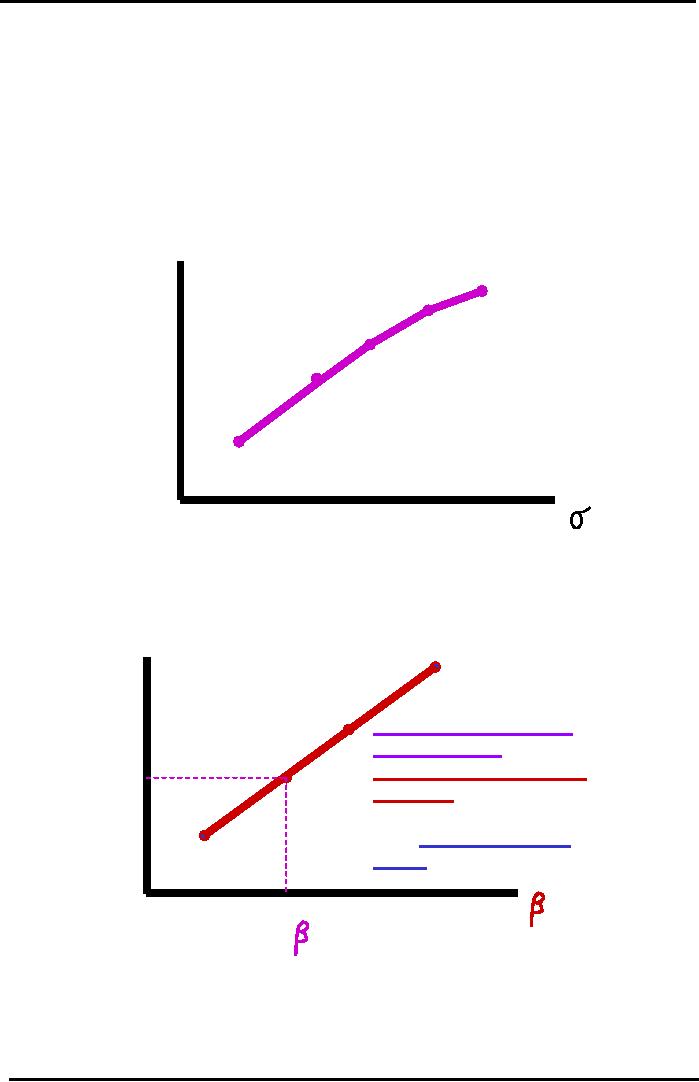

Risk

vs. Return Graph (Risk

Theory)

2-Stock

Portfolio with Positive Correlation

Coefficient

rP*

Non-Efficient

Portfolio

25%

Portfolio

23%

Return

20%

15%

10%

P

5%

9%

12%

15% 20%

Risk

Risk

vs. Return Graph (SML-

CAPM)

EFFICIENT

MARKETS WITH FULLY

DIVERSIFIED

PORTFOLIOS

AND EFFICIENTLY PRICED

STOCKS

r

25%

Required

Return

20%

FULLY

DIVERSIFIED

PORTFOLIOS

AND

EFFICIENTLY

PRICED

15%

STOCKS

IN

EFFICIENT

MARKETS

WILL LIE

ON

10%

THE

STRAIGHT SML

LINE.

P

1.0

0.5

1.5

2.0

Market

Risk

= M

Security

Market Line

(SML):

It

is a Straight Line Model for

Beta Risk and Required Return. It is

Similar to the Relationship

for

the

2-Stock Portfolio with

ρ

>0.

Beta Risk is Directly Proportional to

Required Return. The

Investors

require an extra Return

which exactly compensates them

for the extra Risk of the

Stock

relative

to the Market.

106

Financial

Management MGT201

VU

SML

Linear Equation for the

Required Return of any Stock

A:

rA =

rRF

+ (rM

- rRF

) β A .

In

the above equation

rA =

Return

that Investors Require from

Investment in Stock A.

rRF =

Risk

Free Rate of Return (ie.

T-Bill ROR).

rM =

Return

that Investors Require from

Investment in an Average Stock

(or the Market Portfolio of

All

Stocks

where β M = +

1.0 always). β

A =

Beta for Stock A. (rM

- rRF

)

β

A =

Risk Premium or Additional Return in

Excess of Risk Free ROR to

compensate the Investor

for

the

additional Risk.

107

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios