|

Financial

Management MGT201

VU

Lesson

21

2-

STOCK PORTFOLIO THEORY, RISK

AND EXPECTED RETURN

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

�

2-Stock

Portfolio Theory

�

Risk

& Expected Return

In

this lecture, we will

continue our discussion on the

risk. One of the easiest way

of calculating risk

using

probability is by understanding the

chance that are embedded in

the game of cards and the

fundamentals

of probability are very

easily understood. We discuss in this

lecture calculation of

risk

using

probability. But first we

recap the previous concepts

formula and

Recap

of Risk Basics:

Risk:

It arises because of Uncertainty,

Volatility, and Spread in possible

out comes. There are

many

possible

outcomes (pi) for Expected

Rate of Returns

(r.i).

It

is measured using Standard Deviation or

Variance.

Risk

= Std Dev = σ

=

√

( r i - <

r i > )2 p i . = "Sigma"

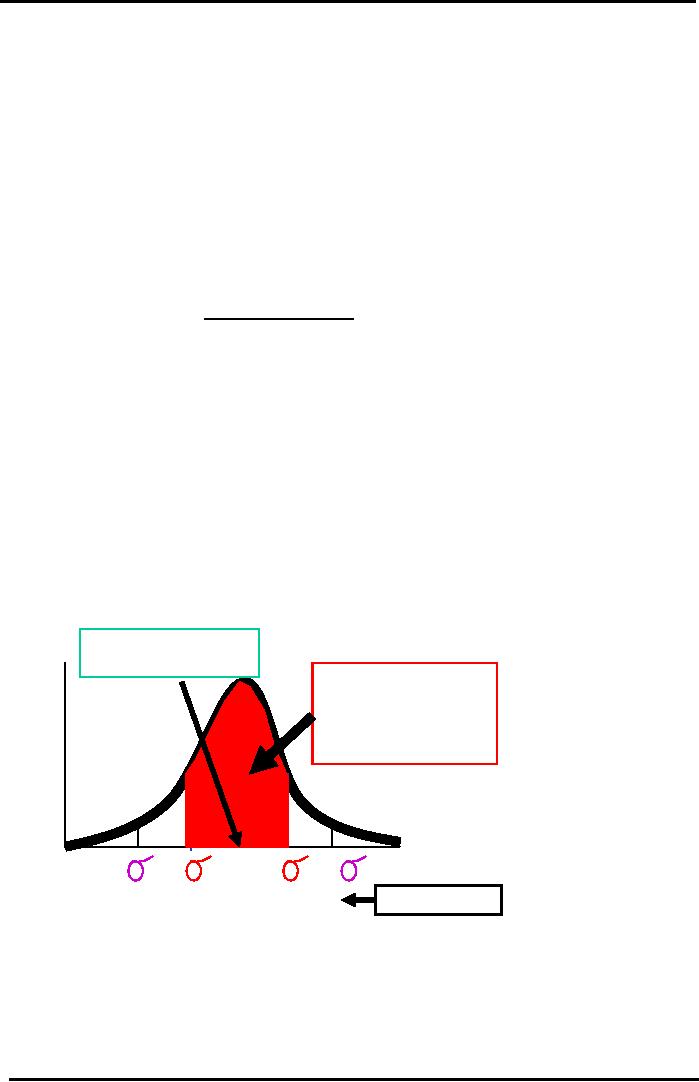

Bell

Curve Assumption: In

this it is assumed that the

forecasted outcome of events will be

distributed

in

the shape of a Normal Probability

Distribution. The advantage we gain

from using this that

after

calculating

the standard deviation for

any particular investment we have an

idea that what the

distribution

or the spread of possible outcomes is

going to be like. If you use

normal distribution that

we

are

sure that 68.26% of the times the

Actual Future Rate of Return

will lie within -1σ

and

+1 σ

range

Coefficient

of Variation: Investment

Comparison Criterion used to

simultaneously account for

Risk &

Return

CV

= σ/ < r

>.

Our

Objective is to minimize Risk &

maximize Return.

<

r > = Exp or Weighted Avg

ROR =

pi

ri

Graphical

Standard Deviation

Expected

(or Mean)

Return

= <r> = 10%

+/-

1 Std Dev covers

Pr

68.26%

of the Area

ob

under

the Normal

ab

Curve

always

ilit

y

(p)

Return

( r ) %

-2

-1

+1

+2

-13.24%

+33.24%

Our

Example

Portfolio

Risk & Return:

Portfolio:

Portfolio

is defined as a Collection of Multiple

Investments. Most organization maintains

large

collection

or portfolio of investments and when we

talk about the risk and

return then we have to

consider

overall risk and return for

the entire portfolio. Portfolios

may have 2 or more stocks, bonds,

other

securities and investments or a mix of all. We

will focus on Stock

Portfolios.

90

Financial

Management MGT201

VU

Risk

is Relative:

The

RISK from investing in Stock

of Company ABC usually

decreases as you make

more

Investments

in other stocks of different

unrelated companies. This is a

logical fact because when

you

talk

about one business which is

earning you Rs 100,000 a

month then you not

look only on this

business

when you are running another

business that is losing you

Rs 200,000 a month,. You have to

look

at all the business and the

overall rate of return you

are generating, Similarly if

you are investing in

the

bonds or stocks then you

are need to look at the

overall risk and return of the

portfolio. The

important

thing to remember is that

risk of particular share of company

ABC will change if you

are

investing

in that share after you have

portfolio of many other

stocks. If you already have

large number

of

investments which you have made and

then if you invest in

particular share in company ABC

will be

different

Diversification:

The

important thing to remember is

that risk of particular

share of company ABC will

change if

you

are investing in that share

after you have portfolio of

many other stocks. If you

already have large

number

of investments and then you invest in

particular share in company ABC

then the risk will be

different.

Investing in many Different

Shares and Bonds and Projects of

Different Companies in

Different

Countries can reduce risk.

Diversified portfolios can

reduce risk. The level of

risk generally

reduces

as the size of the portfolio

increase.

Portfolio

Risk & Return:

What

matters is the Overall Risk &

Return on the entire Portfolio

(or Collection) of Investments.

The

Risk & Return of an Individual

Investment in a Stock or Bond

should be seen in terms of

its

Incremental

Effect on the Overall

Portfolio

Investment

Rule:

Investor

will try to Maximize

Portfolio Return and Minimize

Portfolio Risk. Investor

will NOT

take

on Additional Portfolio Risk

UNLESS compensated with

Additional Portfolio

Return.

Types

of Risks for a

Stock:

Types

of Stock-related Risks which cause

Uncertainty in future possible Returns

& Cash Flows:

Total

Stock Risk = Diversifiable Risk +

Market Risk

Diversifiable

Risk:

It

is known as Company-Specific or Unique or

Non-Systematic Risk. It is associated

with

random

events associated with Each

Company whose stocks you

are investing in i.e.

Winning major

contract,

losing a court case,

successful marketing campaign, losing a

charismatic CEO,...Diversifiable

Risk

can be Reduced using

Diversification. The bad random

events affecting one stock will

offset the

good

random events affecting another stock in

your portfolio

Market

Risk:

It

is known as Non-Diversifiable or Systematic

(Country-wide) or Beta Risk. It is

associated

with

Macroeconomic or Socio-Political or

Global events that

systematically affect Stock investments

in

every

Stock Market in the country

i.e. Inflation, Macro Market

Interest Rates, Recession,

and War.

Market

Risk can NOT be reduced by

Diversification

91

Financial

Management MGT201

VU

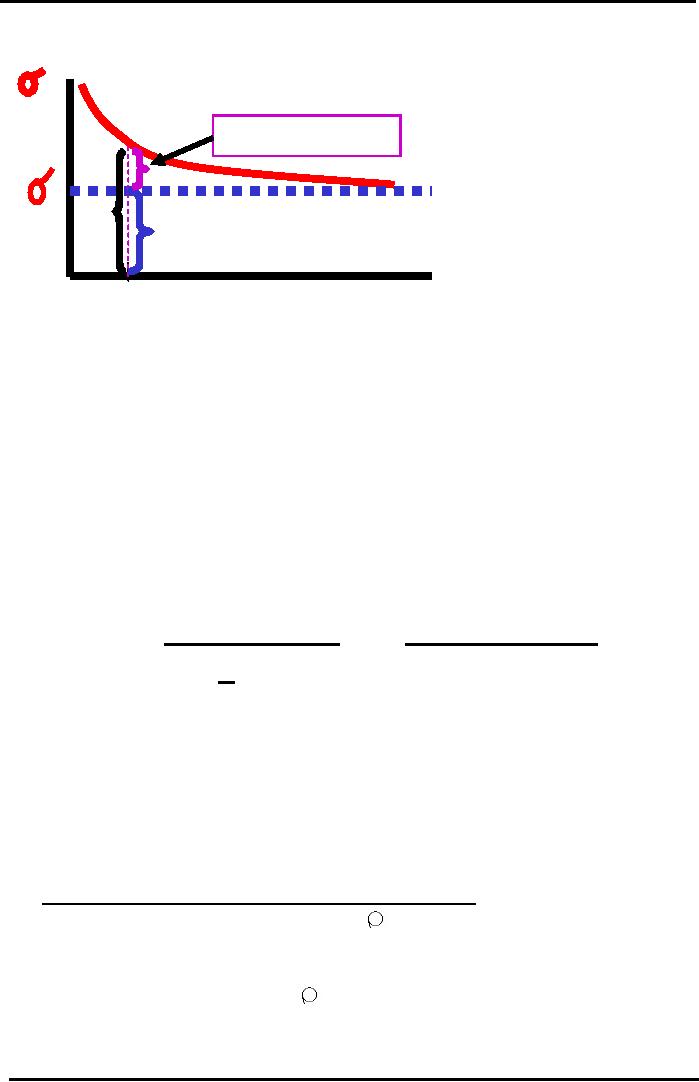

Portfolio

Size vs Risk

Graph

P

Po

Unique

or

Diversifiable

or

rtf

Specific

or Non-Systematic

Risk

oli

To

o

tal

Ri

Ri

M

Market

or Systematic or

Non-

sk

sk

Diversifiable

or Beta

Risk

=

Minimum

Possible Portfolio

Risk

n

7

20

40

Number

of Investments (Stocks) in the

Portfolio

Note:

About

100% of the Diversifiable

Risk (and 50% of the

Total

Risk) can be removed by Diversification

across 40 stocks.

Just

7 carefully chosen Un-Correlated

Stocks might be

enough

to

remove 30% of the Total

Risk.

Portfolio

Rate of Return

Portfolio's

Expected Rate of Return: ( rP

).

It

is the weighted average of the expected returns of

each individual investment in the

portfolio.

Formula

is similar to Expected Return for

Individual Investment but

interpretation is different:

Portfolio

Expected ROR

Formula:

rP

* =

r1

x1

+

r2

x2

+

r3

x3

+ ... +

rn

xn

.

Where

there are "n" different investments (i.e.

Stocks, Bonds, Projects,...) in your

portfolio. r1

represents

the expected return (in % pa) on

Investment No. 1 and

x1

represents

the weight of Investment

No.

1 (fraction of the Rupee value of the

total portfolio that

Investment No. 1

represents).

Example:

Suppose

that you hold a Portfolio of 2

Stock Investments:

Value

of Investment (Rs)

Exp

Individual Return (%)

Stock

A

30

20

Stock

B

70

10

Total

Value =

100

Expected

Portfolio Return

Calculation:

rP

* =

rA

xA

+

rB

xB

=

20% (30/100) + 10 %(

70/100)

=

6%

+

7%

=

13%

2

Stock" Investment Portfolio

Risk

Portfolio

Risk is generally not the

weighted average risk of the

Individual Investments. In fact, it

is

usually

less

Stock

(Investment) Portfolio Risk

Formula:

p

= √

XA2

σ

A 2

+XB2

σ

B 2

+ 2

(XA

XB

σ A

σ

B

AB)

Definition

of Terms:

XA

is Investment A's weight in

the total value of the

Portfolio. σ

A is Investment A's

AB

is the Correlation Coefficient that

measures the

Individual

Risk (or standard

deviation).

correlation

in the returns of the two investments. Last term is a

Covariance term

92

Financial

Management MGT201

VU

Example

Complete

2-Stock Investment Portfolio

Data:

Value

(Rs) Exp Return (%) Risk

(Std Dev)

Stock

A 30

20

20%

10

5%

Stock

B

70

Total

Value = 100

Correlation

Coeff Ro = + 0.6

2-Stock

Portfolio Risk

Calculation:

p

= √

XA2

σ

A

2 +XB2

σ

B

2 + 2 (XA

XB

σ

A

σ

B

AB)

=

{(30/100)2(20%)2

+

(70/100)2(5%)2

+2[(30/100)(70/100)(20%)(5%)(0.6)]}0.5

=

{(0.09)(0.04) + (0.49)(0.0025) + 2[

(0.0021) (0.6) ] } 0.5

=

{0.0036 + 0.001225 + 0.00252}

0.5.

=

{0.004825 + 0.00252} 0.5.

=

{0.007345} 0.5.

=

0.0857=8.57%

XA2

σA2

+ XB2

σB2

+ 2 (XA

XB

σA

σB

AB)

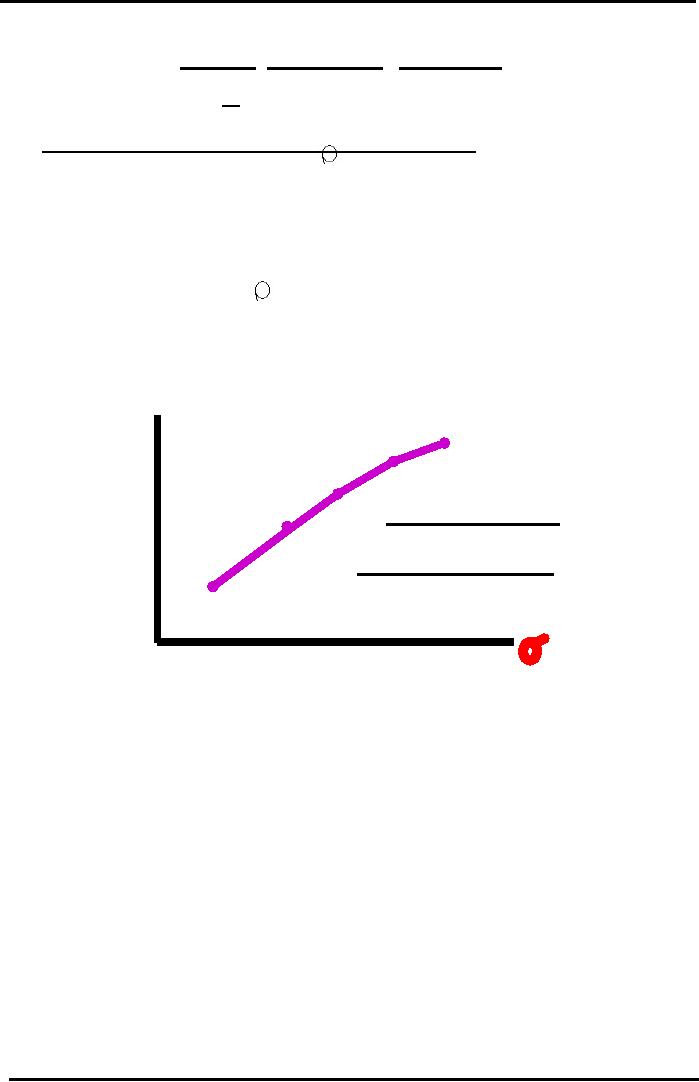

Risk

vs. Return Graph

Example

with 2-Stock Portfolio with

Positive Correlation

rP*

20%

Portfolio

17%

Return

15%

As

Risk INCREASES,

the

Investors' Required

13%

Return

INCREASES

10%

P

5%

9%

12%

15% 20%

Risk

93

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios