|

Financial

Management MGT201

VU

Lesson

20

RISK

FOR A SINGLE STOCK

INVESTMENT, PROBABILITY GRAPHS AND

CO-

EFFICIENT

OF VARIATION

Learning

Objectives:

After

going through this lecture,

you would be able to have an

understanding of the following

topics

�

Risk

for Single Stock

Investment

�

Probability

Graphs and Coefficient of

variation

In

this lecture, we will

continue our discussion on

risk and return. This is

very important area

of

financial

management.

In

previous lecture, we have mentioned an

example for the investment in

share and after

one

year

the share price has 3 possible

outcomes. This uncertainty in

future price of the share

that leads to

the

certain distribution in forecasted

share price and this

distribution is source of the uncertainty

which

allow

us to calculate risk.

3

Possible Outcomes Example

Continued:

Measuring

Stand Alone Risk for

Single Stock

Investment

Std

Dev =

δ

=

√

∑ (r

i - < r i >) 2 p i.

=

(∑(r

i

- < r

i

>) 2

p

i.))

0.5.

=

{[(40-10)2

(0.3)]

+ [(10-10)2

(0.4)]

+ [(-20-10)2

(0.3)]

} 0.5

.

=

{270 + 0 + 270} 0.5

=

{Var}

0.5.

=

{540} 0.5

=

23.24

How

do we interpret this Result for

Risk?

Standard

Deviation Interpretation

What

are the units of Standard

Deviation?

For

our example where Return is

being estimated in % terms, the

units of

Standard

Deviation will also be

%.

It

tells us that if we assume a

Normal Probability Distribution and

symmetric about expected rate of

return,

then we conclude that 68.26% of the

time, the Actual Return will

lie within -1 Standard

Deviation

and +1 Standard Deviation of the Expected (or

Mean) Return.

Expected

(or Mean) Return =

10%

+/-

1 Standard Deviation = 10% +/-

23.24% which means from

(10%

- 23.24%)

to

(10%

+

23.24%) i.e.

from

-13.24% to 33.24%.

There

is a 68.26% chance that the

Actual Return on our Stock

Investment after 1 year will

be

somewhere

between -13.24% and 33.24%. It is

important thing to remember

that in normal

distribution

the

area under the curve from -1

standard deviation to +1 standard

deviation is 68.28%. So, we

can be

sure

that two thirds of the time

the actual value for the return

will be in between -13.68% and +33.24

%.

-13.24%

is not a good sign as it indicates

that we are making loss

but remember that required

rate of

return

is 10%.

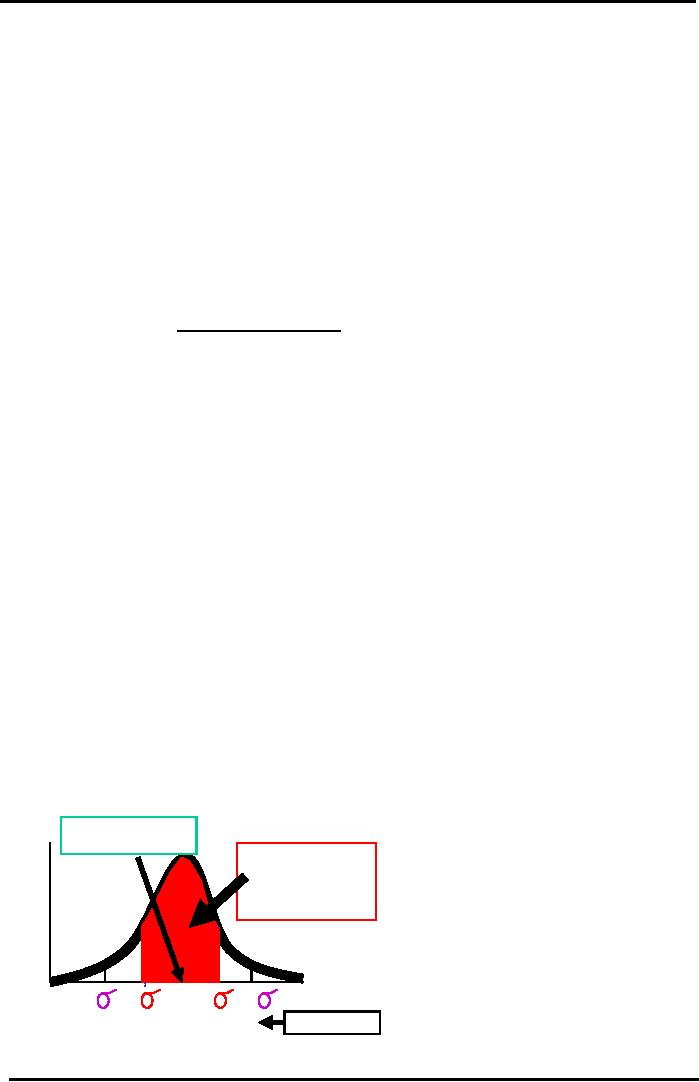

Graphical

Standard Deviation

Expected

(or Mean)

Return

= <r> = 10%

+/-

1 Std Dev covers

68.26%

of the Area

Prob

under

the Normal

abili

Curve

always

ty

(p)

Return

(r) %

-2

-1

+1

+2

-13.24%

+33.24%

Our

Example

87

Financial

Management MGT201

VU

In

the figure the probability is written on

y-axis and the rate of return is

mentioned on the x-axis.

It

shows that higher the

standard deviation the higher the

risk.

Now,

lets take a look another example in

which we raw comparing three

different investments

which

we want to compare in terms of

risk and return.

Example:

Comparison

of 3 Investments in terms of Risk &

Return. Which is the best

Investment?

Risk

(Std Dev)

Expected

Return

Stock

A

23.24%

10%

T-Bill/Bond

B

5%

10%

Project

C

30%

30%

T-Bill

is Least Risky (lowest Std Dev

=5%) and Project C has

Highest Return

(=30%).

Given

2 Investments with Identical Expected

Return, choose the Investment

with the Lower

Risk

(or Spread

or

Volatility

or Standard

Deviation)

Given

2 Investments with Identical Risk,

choose the Investment with the

Higher Expected Return

If

you compare first two

investments, both have the same rate of

return but the T-bills have

less

risk.

Clearly, T-Bill B is a better

investment than Stock A

because their Returns are

identical (10%) but

the

T-Bill is less risky (10%)

than the Stock

(23.24%).

But,

which is better? T-Bill B or Project C?

T-Bill B is Less Risky but

Project C promises

Higher

Return.

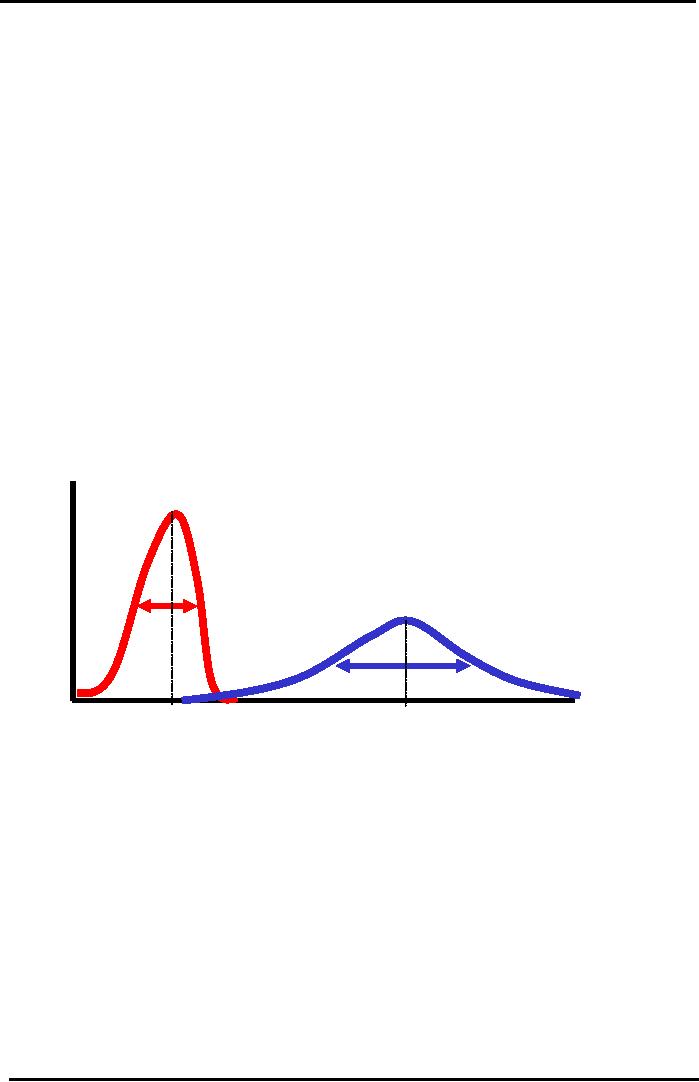

Now,

we conceptually visualize these

two types of investment

Combined

Risk & Return

Graphical

Comparison of Investments

T-Bill

B:

Low

Risk

& Low

Proba

Return

bility

(p)

Project

C:

High

Risk

B

Risk

& High Return

Risk

C

Exp

Return C

Exp

Return B

Rate

of Return (r) %

In

the figure, we are showing

both investments on the same graph.

Left hand shows the

probability

distribution for the T- bills and on

the right hand side shows

the broader and shorter

probability

graph for project C. How to

visualize which project have

higher expected rate of return.

Project

C is on right hand side and therefore it

has higher return as to

project B.The other thing is

that

project

B form a probability distribution

which have a sharp hill or

spread of the curve is much

narrower

as

to project C. The standard

deviation for project B is

much narrower then the

standard deviation

for

project

C .In project B has less

risk whereas Project C has a

higher expected rate return. We have

to

look

at risk and return

simultaneously to answer that

which option is better. We

can derive the answer

with

the help of the coefficient of

variation

Comparison

of Different Investments

Coefficient

of Variation:

Coefficient

of Variation (Risk per unit

Return)

88

Financial

Management MGT201

VU

It

is defined as the CV = Standard Deviation

/ Expected Return. Coefficient

of Variation tells us

about

the Risk per unit Return.

The project which offers

lowest per unit risk is the

best investment. Now

we

calculate the CV for both the

projects.

Compare

the CV's of the Projects:

CV

T-bill = 5% / 10% =

0.5

CV

Project C = 30% / 30% =

1.0

Choose

the Project with the Lowest

CV.

Choose the T-Bill because it

carries the lowest Risk per

unit

Return

Risk

Aversion Assumption

Most

Investors are psychologically Risk

Averse. If

two investments offer the same

Expected

Return,

most Investors would choose

the one with the lower Risk

(or Standard Deviation or

Spread

or

Volatility). In other words, most

Investors are not major

gamblers. Note that gamblers

would

choose

Project C which appeals to

investor greed by offering an upside

return of 30%+10% = 40%

!

Consequences

on Share Price: The

Higher the Risk of a Share, the

Higher its Rate of Return

and the

Lower

its Market Price.

89

Table of Contents:

- INTRODUCTION TO FINANCIAL MANAGEMENT:Corporate Financing & Capital Structure,

- OBJECTIVES OF FINANCIAL MANAGEMENT, FINANCIAL ASSETS AND FINANCIAL MARKETS:Real Assets, Bond

- ANALYSIS OF FINANCIAL STATEMENTS:Basic Financial Statements, Profit & Loss account or Income Statement

- TIME VALUE OF MONEY:Discounting & Net Present Value (NPV), Interest Theory

- FINANCIAL FORECASTING AND FINANCIAL PLANNING:Planning Documents, Drawback of Percent of Sales Method

- PRESENT VALUE AND DISCOUNTING:Interest Rates for Discounting Calculations

- DISCOUNTING CASH FLOW ANALYSIS, ANNUITIES AND PERPETUITIES:Multiple Compounding

- CAPITAL BUDGETING AND CAPITAL BUDGETING TECHNIQUES:Techniques of capital budgeting, Pay back period

- NET PRESENT VALUE (NPV) AND INTERNAL RATE OF RETURN (IRR):RANKING TWO DIFFERENT INVESTMENTS

- PROJECT CASH FLOWS, PROJECT TIMING, COMPARING PROJECTS, AND MODIFIED INTERNAL RATE OF RETURN (MIRR)

- SOME SPECIAL AREAS OF CAPITAL BUDGETING:SOME SPECIAL AREAS OF CAPITAL BUDGETING, SOME SPECIAL AREAS OF CAPITAL BUDGETING

- CAPITAL RATIONING AND INTERPRETATION OF IRR AND NPV WITH LIMITED CAPITAL.:Types of Problems in Capital Rationing

- BONDS AND CLASSIFICATION OF BONDS:Textile Weaving Factory Case Study, Characteristics of bonds, Convertible Bonds

- BONDS’ VALUATION:Long Bond - Risk Theory, Bond Portfolio Theory, Interest Rate Tradeoff

- BONDS VALUATION AND YIELD ON BONDS:Present Value formula for the bond

- INTRODUCTION TO STOCKS AND STOCK VALUATION:Share Concept, Finite Investment

- COMMON STOCK PRICING AND DIVIDEND GROWTH MODELS:Preferred Stock, Perpetual Investment

- COMMON STOCKS – RATE OF RETURN AND EPS PRICING MODEL:Earnings per Share (EPS) Pricing Model

- INTRODUCTION TO RISK, RISK AND RETURN FOR A SINGLE STOCK INVESTMENT:Diversifiable Risk, Diversification

- RISK FOR A SINGLE STOCK INVESTMENT, PROBABILITY GRAPHS AND COEFFICIENT OF VARIATION

- 2- STOCK PORTFOLIO THEORY, RISK AND EXPECTED RETURN:Diversification, Definition of Terms

- PORTFOLIO RISK ANALYSIS AND EFFICIENT PORTFOLIO MAPS

- EFFICIENT PORTFOLIOS, MARKET RISK AND CAPITAL MARKET LINE (CML):Market Risk & Portfolio Theory

- STOCK BETA, PORTFOLIO BETA AND INTRODUCTION TO SECURITY MARKET LINE:MARKET, Calculating Portfolio Beta

- STOCK BETAS &RISK, SML& RETURN AND STOCK PRICES IN EFFICIENT MARKS:Interpretation of Result

- SML GRAPH AND CAPITAL ASSET PRICING MODEL:NPV Calculations & Capital Budgeting

- RISK AND PORTFOLIO THEORY, CAPM, CRITICISM OF CAPM AND APPLICATION OF RISK THEORY:Think Out of the Box

- INTRODUCTION TO DEBT, EFFICIENT MARKETS AND COST OF CAPITAL:Real Assets Markets, Debt vs. Equity

- WEIGHTED AVERAGE COST OF CAPITAL (WACC):Summary of Formulas

- BUSINESS RISK FACED BY FIRM, OPERATING LEVERAGE, BREAK EVEN POINT& RETURN ON EQUITY

- OPERATING LEVERAGE, FINANCIAL LEVERAGE, ROE, BREAK EVEN POINT AND BUSINESS RISK

- FINANCIAL LEVERAGE AND CAPITAL STRUCTURE:Capital Structure Theory

- MODIFICATIONS IN MILLAR MODIGLIANI CAPITAL STRUCTURE THEORY:Modified MM - With Bankruptcy Cost

- APPLICATION OF MILLER MODIGLIANI AND OTHER CAPITAL STRUCTURE THEORIES:Problem of the theory

- NET INCOME AND TAX SHIELD APPROACHES TO WACC:Traditionalists -Real Markets Example

- MANAGEMENT OF CAPITAL STRUCTURE:Practical Capital Structure Management

- DIVIDEND PAYOUT:Other Factors Affecting Dividend Policy, Residual Dividend Model

- APPLICATION OF RESIDUAL DIVIDEND MODEL:Dividend Payout Procedure, Dividend Schemes for Optimizing Share Price

- WORKING CAPITAL MANAGEMENT:Impact of working capital on Firm Value, Monthly Cash Budget

- CASH MANAGEMENT AND WORKING CAPITAL FINANCING:Inventory Management, Accounts Receivables Management:

- SHORT TERM FINANCING, LONG TERM FINANCING AND LEASE FINANCING:

- LEASE FINANCING AND TYPES OF LEASE FINANCING:Sale & Lease-Back, Lease Analyses & Calculations

- MERGERS AND ACQUISITIONS:Leveraged Buy-Outs (LBO’s), Mergers - Good or Bad?

- INTERNATIONAL FINANCE (MULTINATIONAL FINANCE):Major Issues Faced by Multinationals

- FINAL REVIEW OF ENTIRE COURSE ON FINANCIAL MANAGEMENT:Financial Statements and Ratios